One of the reasons why traders are not profitable despite having a well thought out trading plan is because they often apply a trade setup on the wrong market condition. Some traders spam a trend following strategy even though the market is ranging. Others continually use a mean reversal strategy even though the market is trending with strong momentum.

Most seasoned traders use different strategies for different market conditions. Some tweak their strategies a bit so that they could apply the strategy in a different market condition.

Others trade only in a particular market condition wherein their strategy would work best. Some would trade only during ranging markets, while others trade only when the market is clearly trending. This method requires discipline as it is often very tempting to trade setups that are outside of your trade plan. Others find it difficult to identify if they are trading their trading strategy on the right market condition. This presents more problem because trading strategies and trade setups cannot be applied to all market conditions. Trading the same strategy whatever the market condition is would usually affect a trader’s win rate negatively.

Usoho Ichi Trend Forex Trading Strategy is a trend following strategy which incorporates helping traders find the right market condition to trade in and avoid markets that are not trending strong enough.

uSoho Ichi Average Indicator

The uSoho Ichi Average is a trend following indicator which is a modification of the Ichimoku Kinko Hyo indicator.

Both the Ichimoku Kinko Hyo and the uSoho Ichi Average indicator provide trend direction indications that are based on different horizons. Both provide information regarding the short-term, mid-term and long-term trends using modified moving average lines. Both filter out markets that are non-trending using the current price action. Although they are similar in many ways, they differ in the way they compute for the average lines that are being plotted on the price chart. While the Ichimoku Kinko Hyo indicator is mostly based on the median price within a certain period, the uSoho Ichi Average indicator uses modified moving averages, which is much simpler.

The uSoho Ichi Average lines are composed of the MA Tenkan, MA Kijun and MA Senkou lines. MA Tenkan represents the short-term trend and is based on an 8 bar moving average line. MA Kijun represents the mid-term trend and is based on a 24 bar moving average line. MA Senkou is composed of two lines representing the long-term trend and is based on a 48 bar moving average line.

The crossing over of the two MA Senkou lines cause the area of the MA Senkou to change color. If the long-term trend is bullish, the MA Senkou is sandy brown. If the long-term trend is bearish, the MA Senkou is thistle.

The crossing over of the MA Tenkan and MA Kijun lines indicate a trend reversal. If the MA Tenkan line crosses above the MA Kijun line, the market may be starting an uptrend. On the other hand, if the MA Tenkan crosses below the MA Kijun, the market may be starting a downtrend.

The uSoho Ichi Average indicator also plots price action as a line displaced forward represented by a lime line. If the lime line is crossing over the various lines of the uSoho Ichi Average indicator, the market may be too choppy and is not in a trending market condition. Trend following traders should wait for the uSoho Ichi Average lines to be stacked correctly before entering a trade.

Gann HiLo Activato Bars

The Gann HiLo Activator Bars is a short-term trend following indicator which helps traders identify short-term trend and momentum reversals.

This indicator overlays bars on the candlesticks to help traders identify the direction of the short-term trend. These bars change colors depending on the direction of the short-term trend. It plots blue lines to signify a bullish momentum and red bars to indicate a bearish momentum.

Traders usually use this indicator as a short-term trend reversal entry signal. Traders can simply confirm their trade setups and take the trade as soon as the Gann HiLo Activator Bars change color.

Trading Strategy

This trading strategy is a trend following strategy which incorporates identifying trending market conditions systematically and taking trades during retracements in a trending market.

The trend is identified using the uSoho Ichi Average indicator. This is simply based on how the uSoho Ichi Average lines are stacked and whether its lime line is crossing price action or the other lines.

As soon as we identify a trend, we then wait for a trading opportunity during retracements. We wait for price to revisit the area in between the MA Tenkan and MA Kijun lines. This retracement would usually cause the Gann HiLo Activator Bars to temporarily retrace. As soon as the Gann HiLo Activator Bars resume the direction of the trend, we take the trade in the direction of the trend.

Indicators:

- uSoho_Ichi_Average

- Gann HiLo activator bars

Preferred Time Frames: 30-minute, 1-hour, 4-hour and daily charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

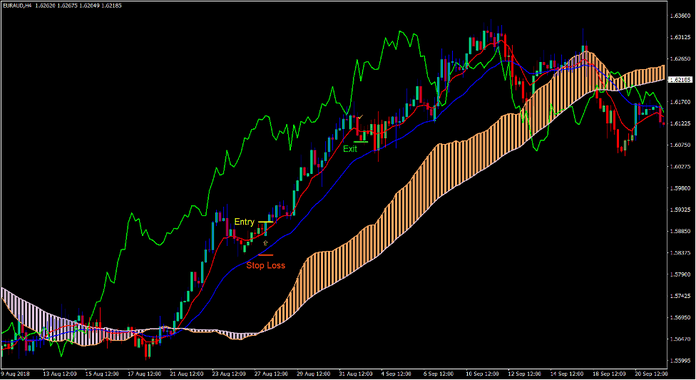

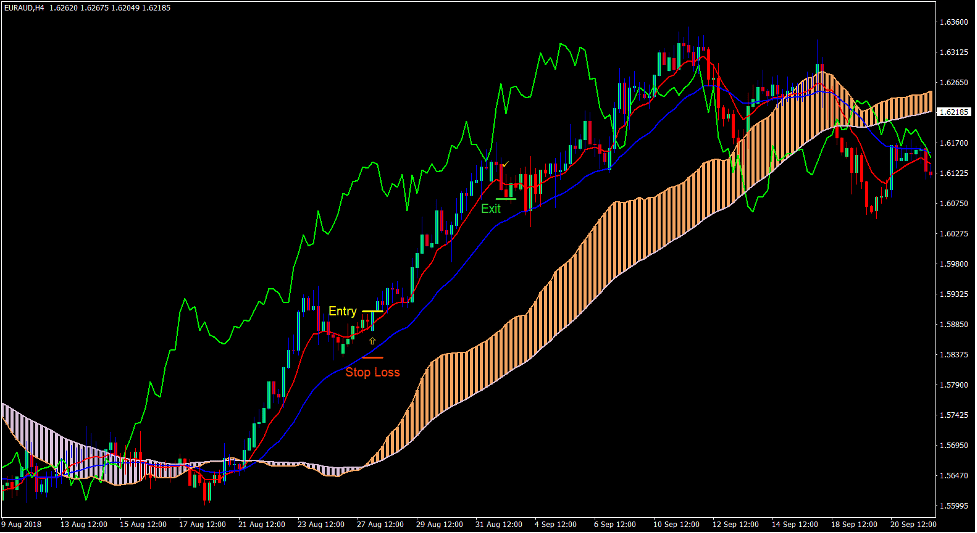

Buy Trade Setup

Entry

- The MA Senkou should be sandy brown.

- The MA Tenkan line should be above the MA Senkou line.

- The lime line of the uSoho Ichi Average should not cross price action or any of the other lines.

- Price should retrace towards the area between the MA Tenkan and MA Senkou line causing the Gann HiLo Activator Bars to temporarily reverse.

- Enter a buy order as soon as the Gann HiLo Activator Bars change to blue.

Stop Loss

- Set the stop loss on the support level below the entry candle.

Exit

- Close the trade as soon as the Gann HiLo Activator Bars change to red.

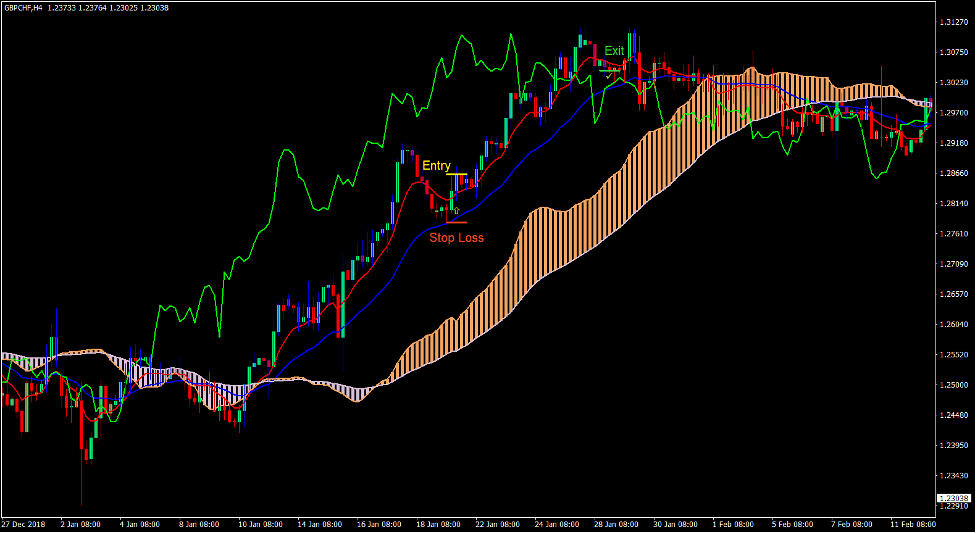

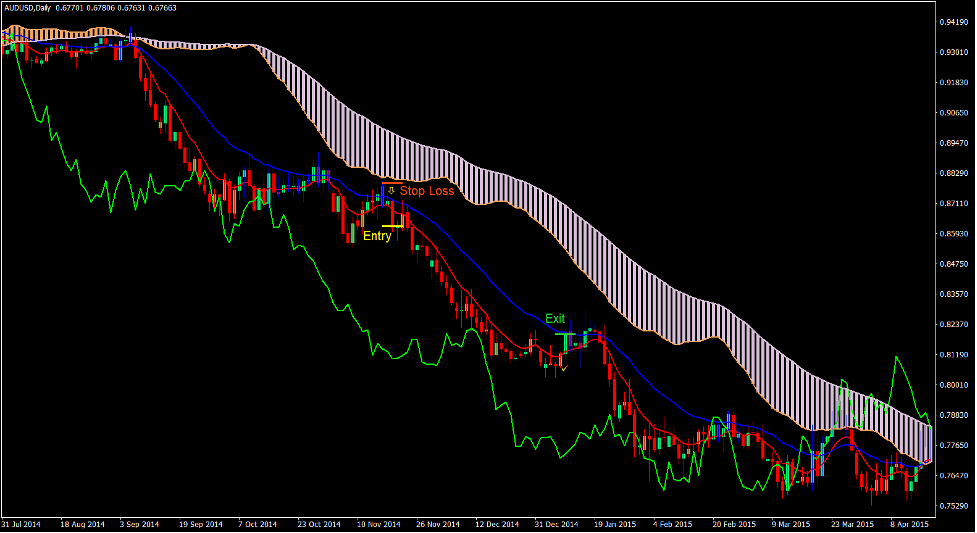

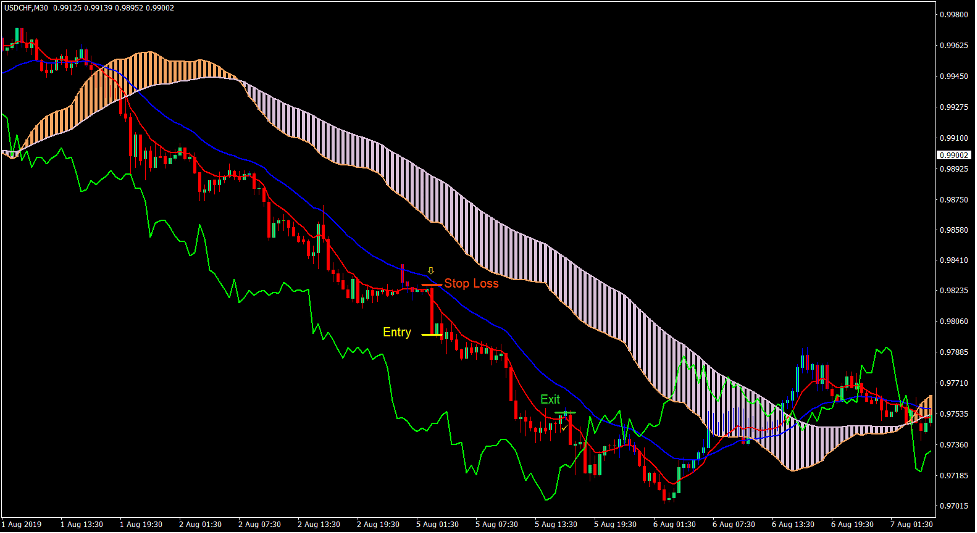

Sell Trade Setup

Entry

- The MA Senkou should be thistle.

- The MA Tenkan line should be below the MA Senkou line.

- The lime line of the uSoho Ichi Average should not cross price action or any of the other lines.

- Price should retrace towards the area between the MA Tenkan and MA Senkou line causing the Gann HiLo Activator Bars to temporarily reverse.

- Enter a sell order as soon as the Gann HiLo Activator Bars change to red.

Stop Loss

- Set the stop loss on the resistance level above the entry candle.

Exit

- Close the trade as soon as the Gann HiLo Activator Bars change to blue.

Conclusion

This trading strategy is a robust trend following strategy. This is because this strategy has a systematic method which allows traders to identify whether the market is trending strong enough or not.

As soon as we identify the right market condition and the trade direction, half the battle is already done. The only thing we should wait for is the exact trade signal coming from the Gann HiLo Activator Bars. These signals would also benefit if combined with price action and price patterns.

If the trader gets these things right and as long as the trader knows how to manage trades well, this strategy should allow traders to consistently profit from the forex markets.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: