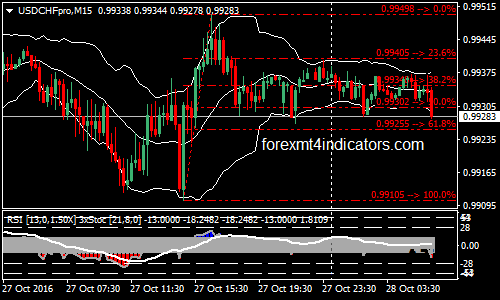

Divergence With Bollinger Bands Binary Options Strategy

Divergence is you will see the price is making higher highs but the indicator is making a lower high. This is if you are bearish. In a bullish trade, you will see the price making lower lows but the indicator is making a higher low.

This system works on a 5-minute timeframe with an expiry time of 60 minutes and 15-minutes with the expiry time of 180 minutes.

Metatrader indicators:

- ATM RSI Histo Triple Stochastic Divergence indicator;

- Fibonacci Retracement: XIT Fib indicator.

The price should be above the upper Bollinger Bands indicator in case of a bearish divergence and in the same manner the price should be below the lower Bollinger Bands indicator in case of a bullish divergence.

Bullish Divergence:

- If it is spotted on a 5-minute timeframe, it is a signal for “CALL” position.

- Call when the red bars of the indicator ATM RSI Histo Triple Stochastic Divergence retrace below the dotted black line.

- Touch points are the Fibonacci Retracement: XIT Fib indicator.

Bearish Divergence:

- If it is spotted on a 5-minute timeframe, it is a signal for “PUT” position.

- Put when the blue bars of the indicator ATM RSI Histo Triple Stochastic Divergence retrace below the dotted black line.

- Touch points are the Fibonacci Retracement: XIT Fib indicator.

This method of trading based on divergence can also be applied to Binary options strategies High / Low but this method of trading is not for beginners.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: