Crude Trap Forex Trading Strategy

Trading the markets is about finding opportunities and exploiting them. I understand we’ve been discussing about forex for quite some time, but there are other opportunities apart from forex. Although this strategy also works well in the forex markets, but I’ve noticed that this strategy does very well with oil lately.

The strategy we will be discussing is all about traps, both bull and bear traps. As I was saying earlier, bull and bear trap strategies have had some great opportunities in oil lately. This is probably due to the fact that oil, although a relatively large market, is not as large as the forex market. It has a few very big players, oil companies and oil producing countries, who when they make decisions, makes a big splash in this market. And they often are either watching each other’s moves or are even making decisions together. In short, they could easily control the market.

One of the things that they’d want is for oil price to stay in a range that they want. Countries don’t want oil prices to go too high because that will cause inflation that ripples to other goods. Oil producing countries on the other hand would want oil price to be somewhat a little higher, so they could have an import-export surplus.

Remember that any good’s price is determined by supply and demand. They can’t control demand. What do they do? They control supply by setting quotas. And the very few big oil companies are glad to go along. Lower cost to extract oil, higher profit margins due to higher prices.

Now, I’m not saying that oil can’t rally. It does rally, but it is usually due to some fundamental factors that affect the supply of oil. Like when the technology for extracting shale oil caused a spike in supply, causing oil prices to dramatically drop, or when wars breakout in the middle east causing oil supplies to run low. But as of now, oil seems a bit rangy, and bull and bear trap strategies work well in rangy market structures.

The Setup: The Crude Trap Strategy

With this strategy, price action and a good eye for identifying highs, lows, supports, resistances, and ranges will be very important. This is one of those strategies wherein we will be using a naked chart.

This also means that a good understanding of reversal candlestick patterns and price rejections would come in handy. This means candles with long wicks, or long candles engulfing the prior candle to signify reversals. For those who have had a significant amount of chart time trying to understand price action and how the market rejects a price area, this will be an advantage to you. For those who are new to trading, this will be a bit advanced, but you could still cope up.

What we will be looking for is a setup where price pierced a prior high, low, support or resistance, which is preferably in a range. These areas which price pierced forming a new high or low would often suck in break out traders, and as most traders do, they set their stop losses in a predictable area. What we will be aiming for is to enter the trade as the big players try to keep oil price in a range and as the other small players stop losses start to get hit. To do this, we will be setting pending entry orders exactly on the area where we know they usually set their stop losses, at the low or high of the breakout candle.

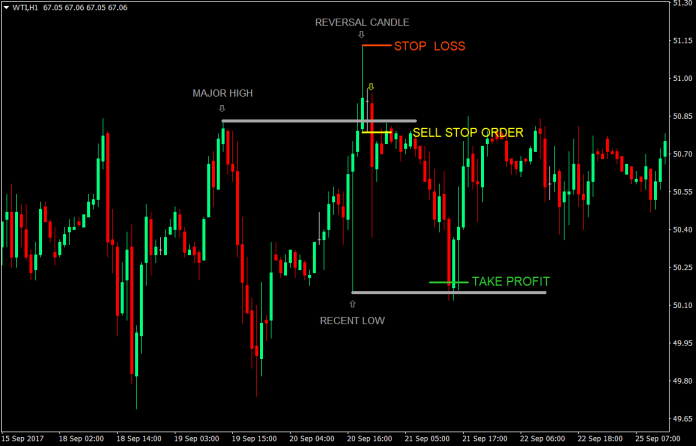

Buy Entry:

- Identify a recent major low in a market structure that is starting to range

- Wait for price to pierce through that low, forming a new low

- Wait for a reversal candle pattern or a candle with a long wick at the bottom

- Set a pending buy stop order at the high of the reversal candle

Stop Loss: Set the stop loss at the low of the reversal candle

Take Profit: Set the take profit a few pips below the most recent high

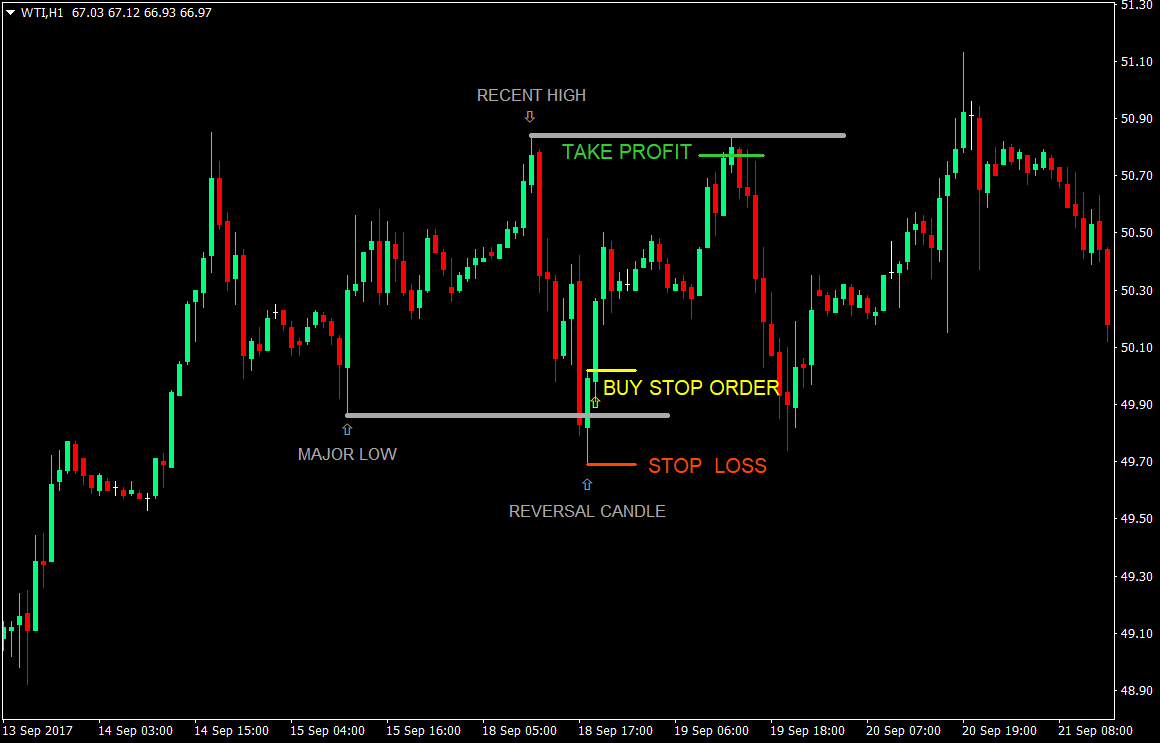

Sell Entry:

- Identify a recent major high in a market structure that is starting to range

- Wait for price to pierce through that high, forming a new high

- Wait for a reversal candle pattern or a candle with a long wick at the top

- Set a pending sell stop order at the low of the reversal candle

Stop Loss: Set the stop loss at the high of the reversal candle

Take Profit: Set the take profit a few pips above the most recent low

Conclusion

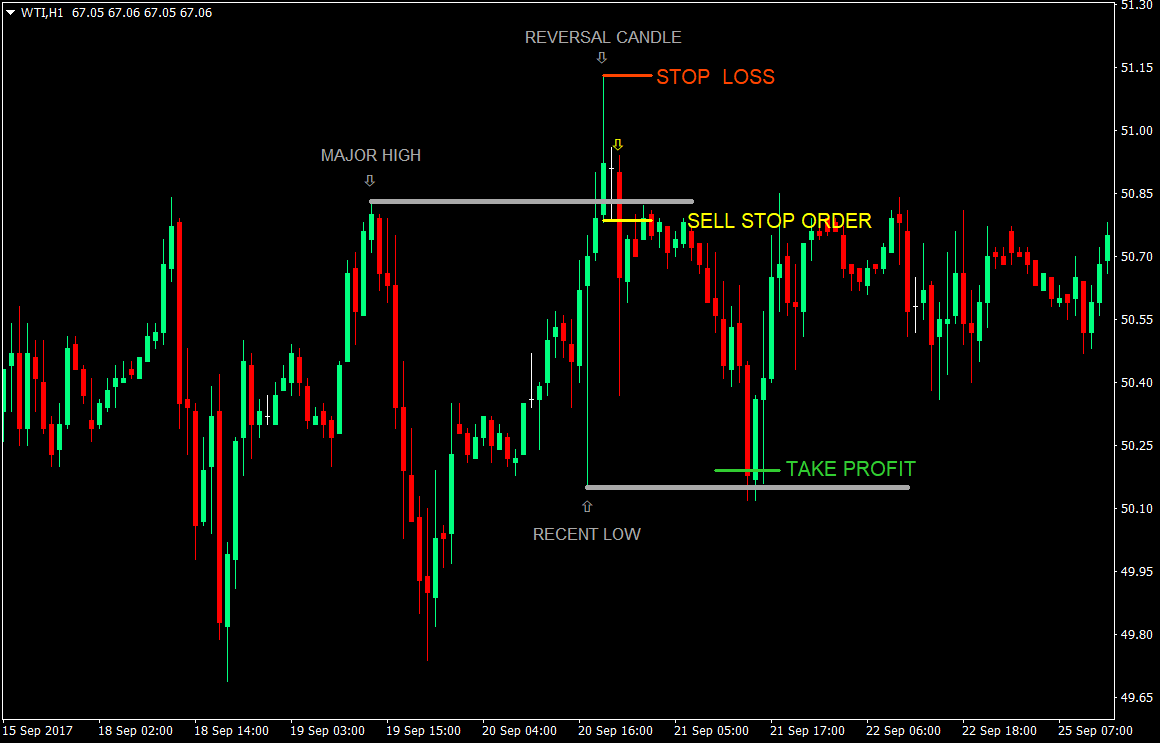

This strategy, the bull trap or bear trap strategy is a common type of strategy with different variations. This setup of the trap strategy leans more on the conservative side. Some traders prefer to enter at the close of the reversal candle. However, since we are banking on a reversal, sometimes momentum would push it further a bit more. Price could hit the stop loss of our prematurely entered trade, before it goes our direction.

If you would notice the setup on our sell trade sample, the candle prior to our reversal candle would also have been a valid entry, but momentum pushed price further forming another reversal candle. If we would have entered at market order, our stop loss would have been prematurely hit. By setting a pending sell stop order, we were able to avoid entering the trade prematurely. Then we were able setup another sell stop order which price did hit.

Notice how when price hits our pending orders, the candle formed is usually quite long. This is because the area of our entry is usually an area where stop losses are placed by breakout traders, which if hit would cause a thrust going our direction.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: