Bressert Signal Forex Strategy

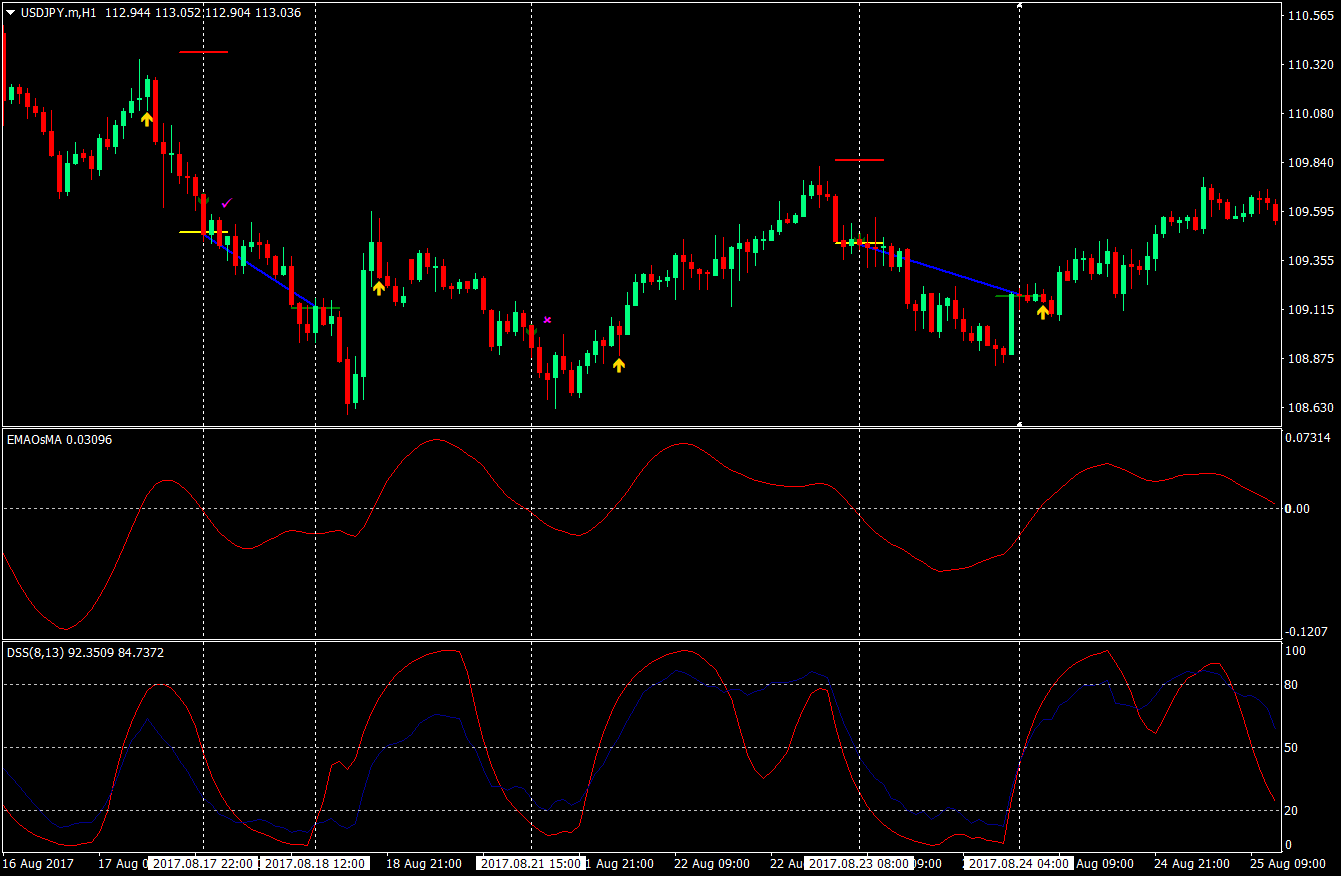

The Bressert signal strategy is a strategy based on two oscillating indicators. One confirms the trend while the other confirms the overbought and oversold territories. By combining these two indicators, the probability of a winning setup is increased.

The DSS Bressert Indicator

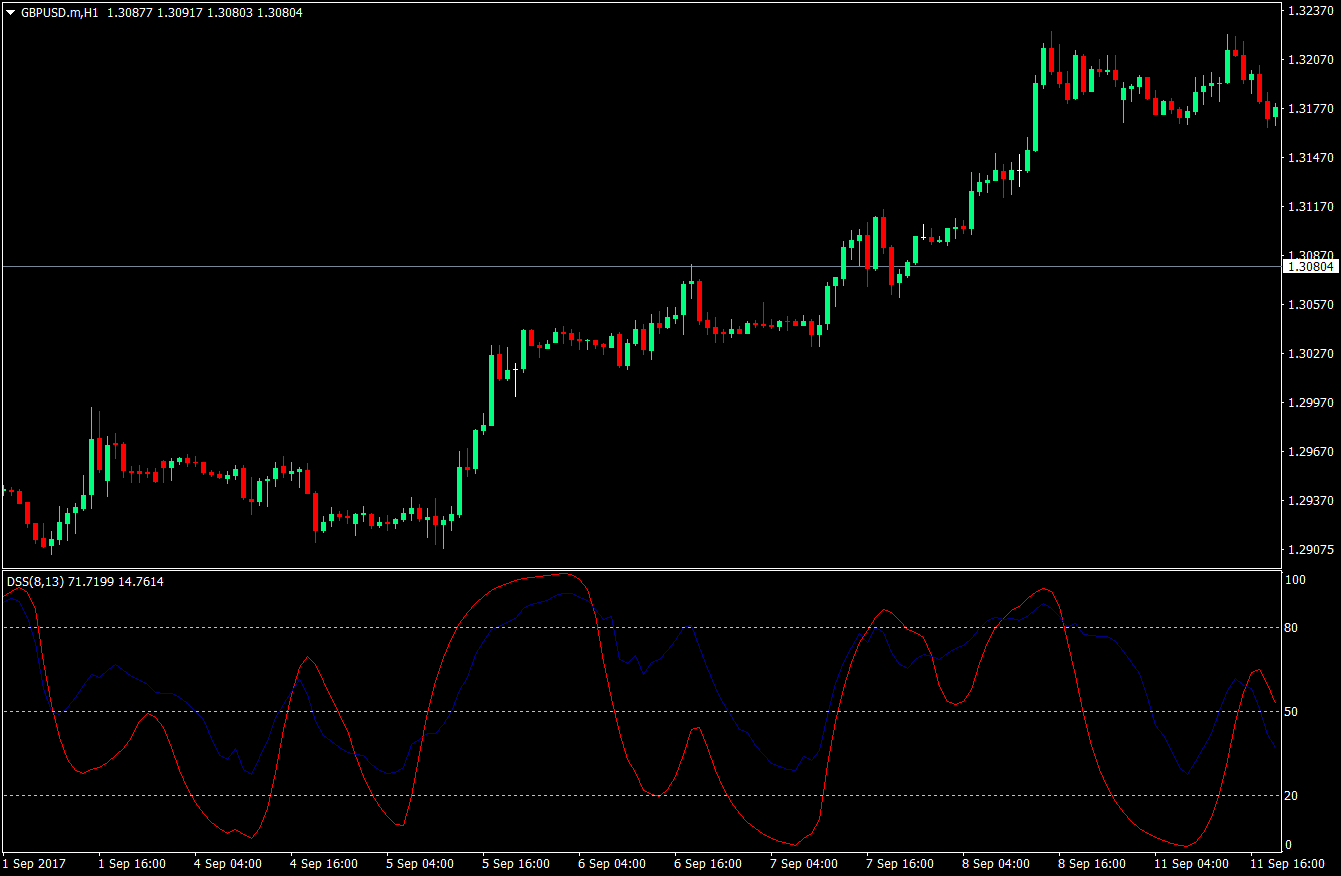

The Bressert indicator is an oscillating indicator with a similar configuration and characteristic as the stochastic oscillators. Just like the stochastic oscillator, it also has the fast and slow lines, and it also has the overbought and oversold areas. Its difference however is its smoothened characteristic. Unlike the stochastic oscillator that plots highly responsive lines, the Bressert indicator is much smoother.

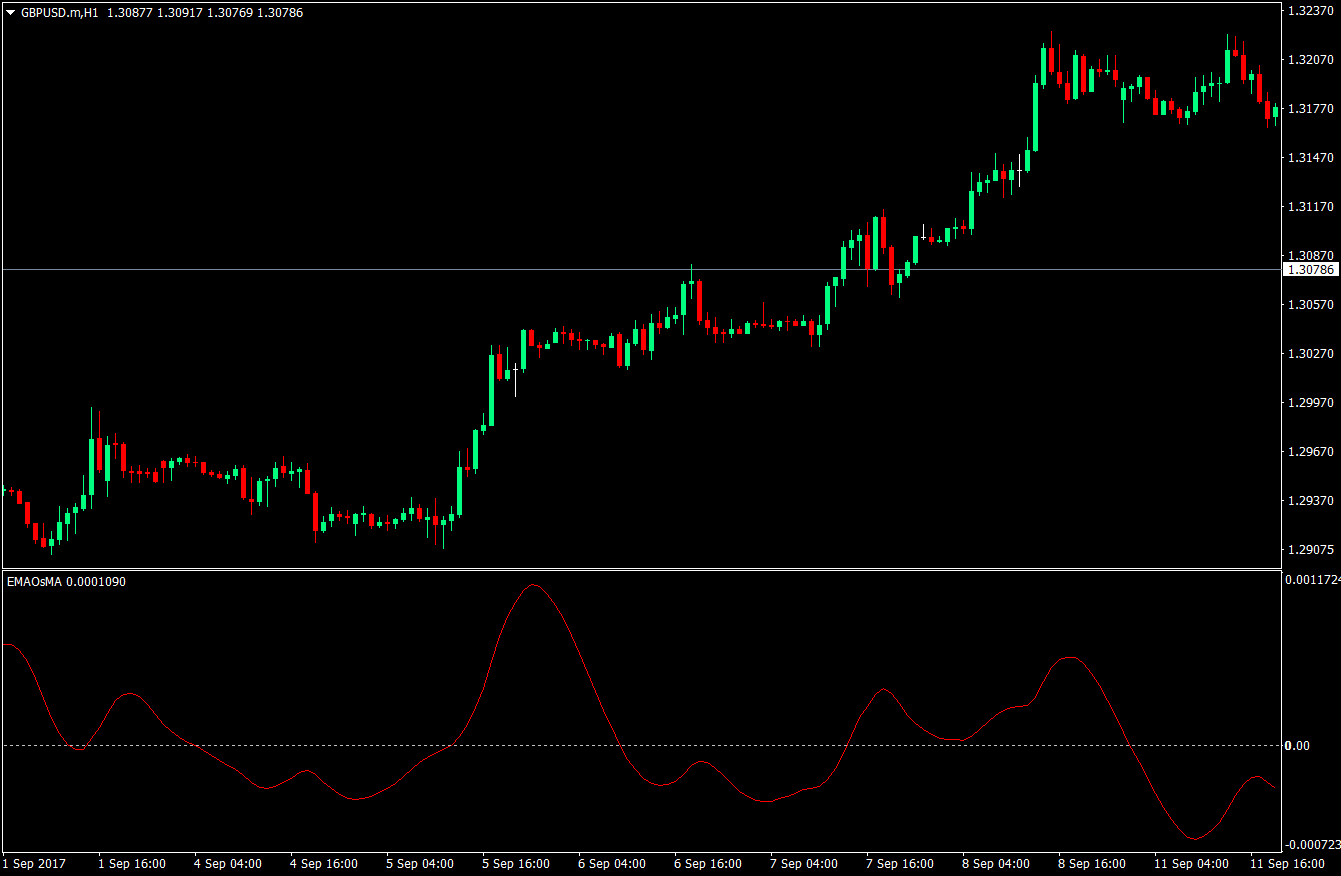

The EMAOsMA Indicator

The EMAOsMA indicator is another oscillating indicator based on moving averages. It has its similarities with the MACD. Its main role in this strategy is to indicate the direction of the trend. Like the MACD, it has a line that oscillates up and down with a midpoint level at zero. If the line is crossing up the zero line, then it indicates that price is being pressured up. If the line is crossing down, then it indicates that price is being pressured down. One of its main advantages is that this custom indicator plots an arrow on the price chart where the indicator crosses the zero line.

The Buy Setup – Entries, Stop Losses & Exits

To initiate buy orders, the following rules must be met:

- The EMAOsMA indicator is crossing up the zero line indicating that price is being pressured up

- Both lines of the Bressert indicator is above the 50-line indicating that the market sentiment is bullish, but is not yet near the overbought territory

- A gold arrow pointing up appears on the price chart indicating the entry candle

Stop Loss: The stop loss should be placed a few pips below the latest minor swing low.

To exit the trade, the trade should be manually closed as the Bressert indicator’s red line crosses the blue line going down. This should indicate that the market’s bullish bias is either losing steam or may soon reverse.

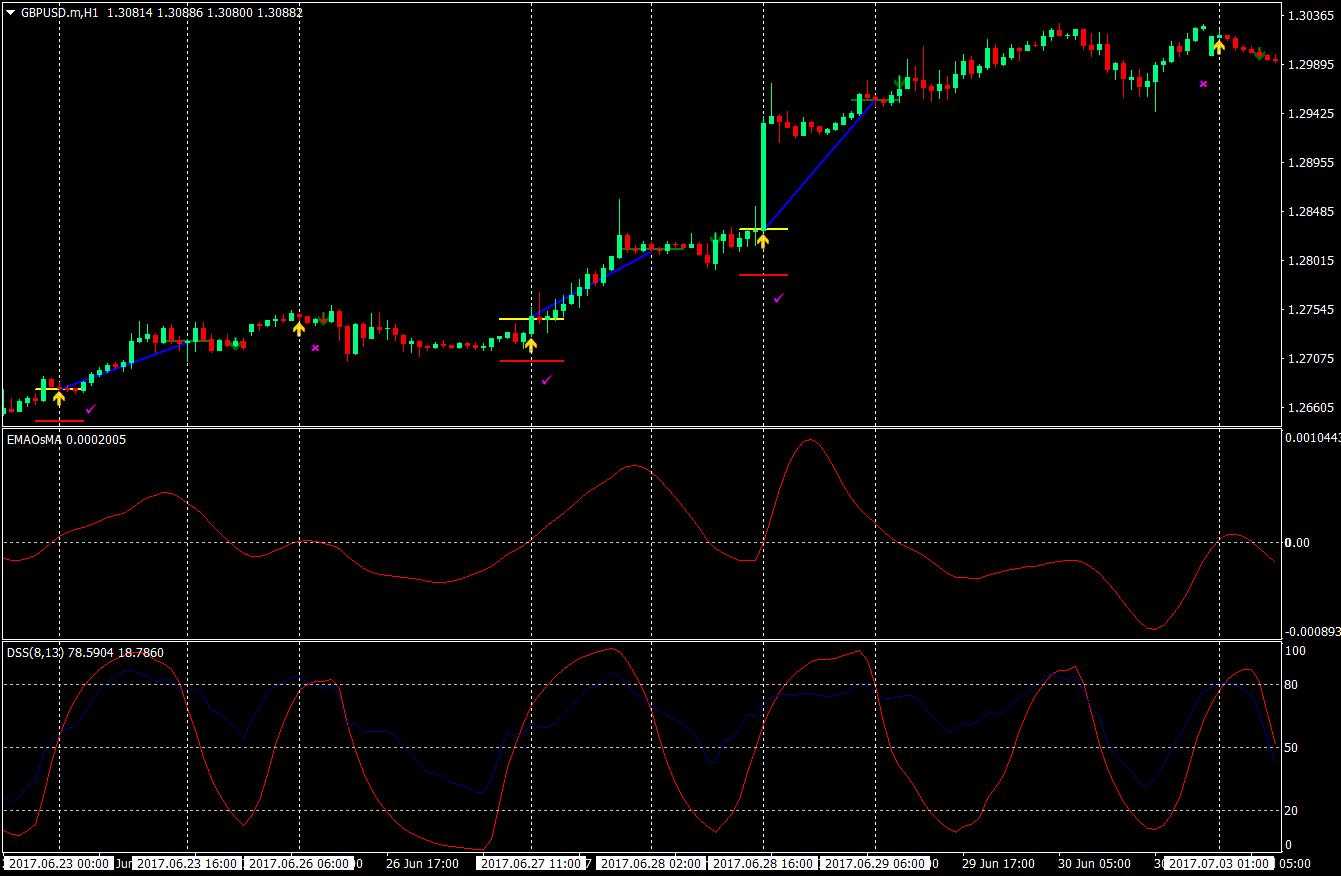

On this chart, five entry signals were spotted. However, two of the three have the Bressert indicator lines near or at the overbought area. Therefore, those trades should not be taken. The other three buy setups did produce a profit. The yellow lines indicate the entry, the red lines indicate the stop loss, and the green lines indicate the exits on profit.

The Sell Setup – Entries, Exits and Stop Losses

To enter a sell trade using this strategy, the following rules should be met:

- The EMAOsMA indicator is crossing down the zero line indicating that price is being pressured down

- Both lines of the Bressert indicator is below the 50-line indicating that the market sentiment is bearish, but is not yet near the oversold territory

- A dark green arrow pointing down appears on the price chart indicating the entry candle

Stop Loss: The stop loss should be placed just a few pips above the most recent minor swing high.

To take profits, the trade should be manually closed as soon as the Bressert indicator’s red line is crossing the blue line.

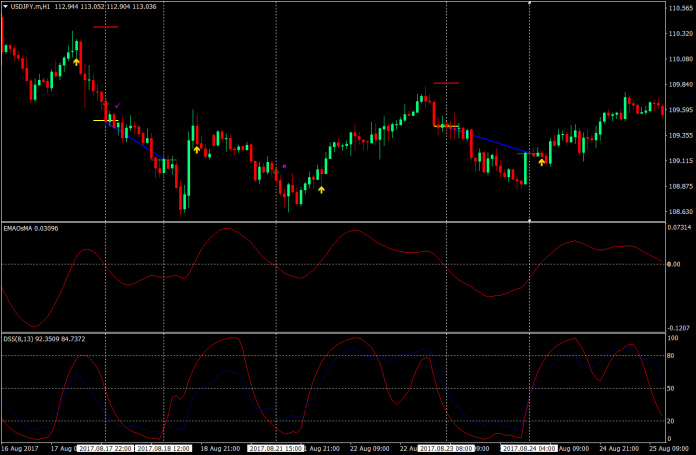

On this chart, three sell signals came up. Of the three, one had its Bressert lines on the oversold area, which indicates that price may reverse. The other two however were in profit. However, since the swing highs were far from the signal candle, the stop losses were a little bit too wide.

Conclusion

The combination of the EMAOsMA indicator and the DSS Bressert indicator is deadly. The EMAOsMA gives the entry signals, however, since it doesn’t take into account the overbought and oversold areas, sometimes the signals are not at an optimal area. This is where the DSS Bressert indicator comes in. The DSS Bressert indicator filter out this problem scenarios by showing which prices are at the overbought and oversold areas.

The setback of this indicator though is that it sometimes gives late signals. The problem with late signals is that using the swing highs and lows as areas for stop losses would cause wide stop losses. These wide stop losses in turn causes a low risk reward ratio. Looking at the sell setups, the two trades that should be taken yielded a risk reward ratio which is less than 1:1. This is not ideal. However, there is no way to know if the trade would yield a good risk reward ratio or not since there is no hard and fixed target take profit. What the trader could do though is assess if the stop loss is quite wide for his liking or not.

This forex strategy’s strength though is its accuracy. With just two custom indicators, quality signals were provided while screening out signals that are not optimal. Having a strategy with a good win ratio allows the trader to risk a little bit more using a good money management system.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: