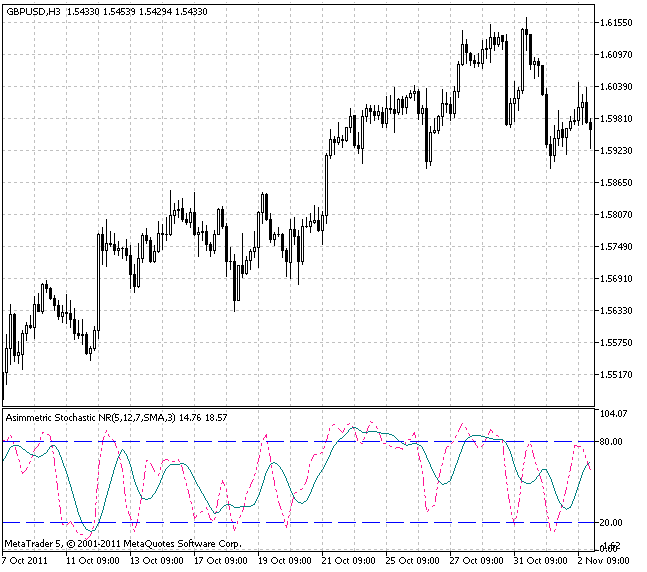

Enhanced version of the stochastic oscillator. As for parameter fields, asymmetric Stochastic has only three differences from the standard one:

-

Kperiod now consists of two values – junior KperiodShort (short) and senior KperiodLong (long).

-

Oversold (OS) and overbought (OB) levels parameters are added. In case Stochastic enters OS/OB areas, Kperiods (lengths of highs/lows searching) are switched over.

-

The third difference (sensitivity limit) is a Sens parameter, which allows to cut off scillations below a certain limit set in points. Thereby, the number of false signals is considerably reduced. The fact is that the standard Stochastic locates the current price between price highs and lows for the number of bars set by %K (Kperiod) parameter. And it does not matter, if extreme points differ from each other by 1 or 100 points. It will still indicate that OS/OB values are reached. Implementation of some limit allows to cut off oscillations that are inconsiderable for a trading system.

Behavior:

In case Stochastic enters OS area, the indicator searches for lows at the bars junior Kperiod (KperiodShort) and for highs – at the senior (KperiodLong) one. In case Stochastic enters OB area, lows are searched for at the long interval, while highs – at the short one.

Interpretation/usage. Entering OS/OB by Stochastic means switching a trend over to the appropriate direction. However, trend switching generally does NOT mean a signal for market entry according to the current trend direction. Position should be opened during a correction, which can be identified by 50% line crossing/touching. If you follow the “turtle” strategy, additions to your position should be made during corrections. When a trend is being switched over, positions should be closed completely or decreased. In the latter case complete closing of a position is carried out during the correction, while a new position in the opposite direction is opened simultaneously. Stop levels are set near the previous (opposite) extreme point with a reasonable setback. But their triggering in the operating mode is unlikely. Stop levels are set there only for force majeure conditions.

This indicator was first implemented in MQL4 and published in Code Base at mql4.com 22.04.2010.

Indicator input parameters:

//+-----------------------------------+ //| Indicator input parameters | //+-----------------------------------+ input uint KperiodShort=5; // %K period input uint KperiodLong=12; // %K period input Smooth_Method DMethod=MODE_SMA; // Signal line smoothing method input uint Dperiod=7; // %D signal line period input int DPhase=15; // Signal line smoothing parameter input uint Slowing=3; // Slowing input ENUM_STO_PRICE PriceField=STO_LOWHIGH; // Prices selection parameter for calculation input uint Sens=7; // Sensitivity in points input uint OverBought=80; // Overbought level, %% input uint OverSold=20; // Oversold level, %% input color LevelsColor=Blue; // Levels color input STYLE Levelstyle=DASH_; // Levels style input WIDTH LevelsWidth=Width_1; // Levels width input int Shift=0; // Horizontal shift of the indicator in bars

This indicator allows to select a smoothing type of the signal line out of ten possible versions:

- SMA – simple moving average;

- EMA – exponential moving average;

- SMMA – smoothed moving average;

- LWMA – linear weighted moving average;

- JJMA – JMA adaptive average;

- JurX – ultralinear smoothing;

- ParMA – parabolic smoothing;

- T3 – Tillson’s multiple exponential smoothing;

- VIDYA – smoothing with the use of Tushar Chande’s algorithm;

- AMA – smoothing with the use of Perry Kaufman’s algorithm.

It should be noted that Phase type parameters for different smoothing algorithms have completely different meaning. For JMA it is an external Phase variable changing from -100 to +100. For T3 it is a smoothing ratio multiplied by 100 for better visualization, for VIDYA it is a CMO oscillator period and for AMA it is a slow EMA period. In other algorithms these parameters do not affect smoothing. For AMA fast EMA period is a fixed value and is equal to 2 by default. The ratio of raising to the power is also equal to 2 for AMA.

The indicator uses SmoothAlgorithms.mqh library classes (must be copied to the terminal_data_folder\MQL5\Include). The use of the classes was thoroughly described in the article “Averaging Price Series for Intermediate Calculations Without Using Additional Buffers”.

Recommended MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

(Free MT5 Indicators Download)

Click here below to download: