Momentum trading strategies are viable trading strategies that many seasoned traders use. Price usually continues after a strong price movement because of momentum. This presents a trading opportunity that many momentum traders take advantage of. This strategy shows us how we can trade with the momentum in confluence with the direction of the trend.

Adaptive ATR Keltner Channel

The Adaptive ATR Keltner Channel is a technical indicator based on the Keltner Channel indicator, which was first introduced by Chester Keltner in the 1960s. It is a trend following technical indicator that draws a band or channel-like structure that follows the movements of price action.

The Keltner Channel is very similar to the widely used Bollinger Bands. The difference is that while the Bollinger Bands uses standard deviations to determine the distance of the outer lines from the middle line, the Keltner Channel uses a multiple of the Average True Range (ATR) to measure the distance of the outer lines from the middle line.

There are two commonly used variations of the Keltner Channel. One variation uses a Simple Moving Average (SMA) to determine its middle line, while the other uses an Exponential Moving Average (EMA) to draw its middle line. This variation of the Keltner Channel however uses an Adaptive Simple Moving Average to calculate for its middle line. This incorporates the use of the Efficiency Ratio which Perry Kauffman used in developing the Kauffman Adaptive Moving Average (KAMA).

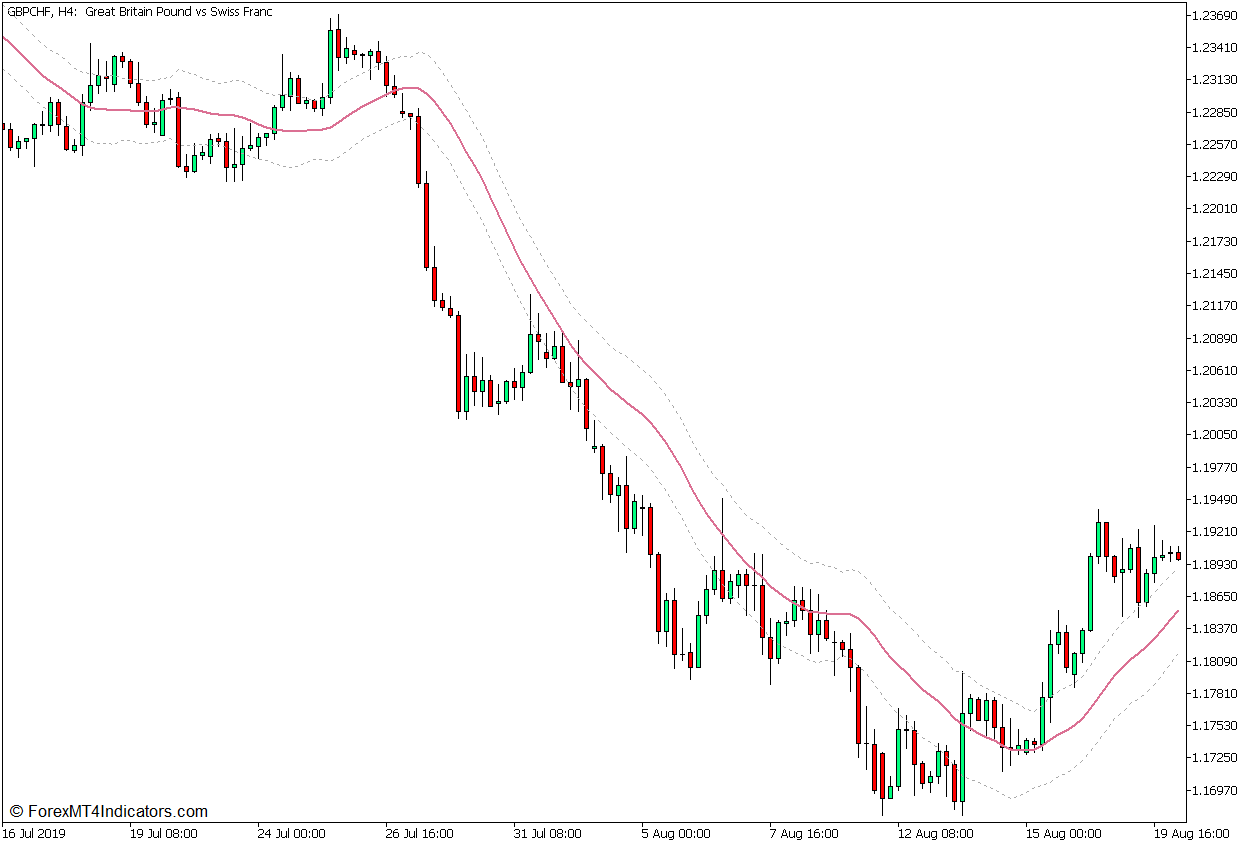

This version of the Keltner Channel is preset to use the Typical Price to calculate its middle line instead of the usual Close Price. This is represented by the solid pale violet-red line. The outer lines are drawn as a dashed dark gray line. The distance of the outer lines is preset at 1x the ATR from the middle line. However, these presets may be modified within the indicator settings.

Since the middle line is a moving average line, traders can use this indicator as a trend direction indicator. This is based on the general location of price action about the middle line, as well as the slope of the line.

It can also be effectively used as a momentum indicator. Traders may observe strong momentum candles closing outside the channel after a bounce from the area around its middle line.

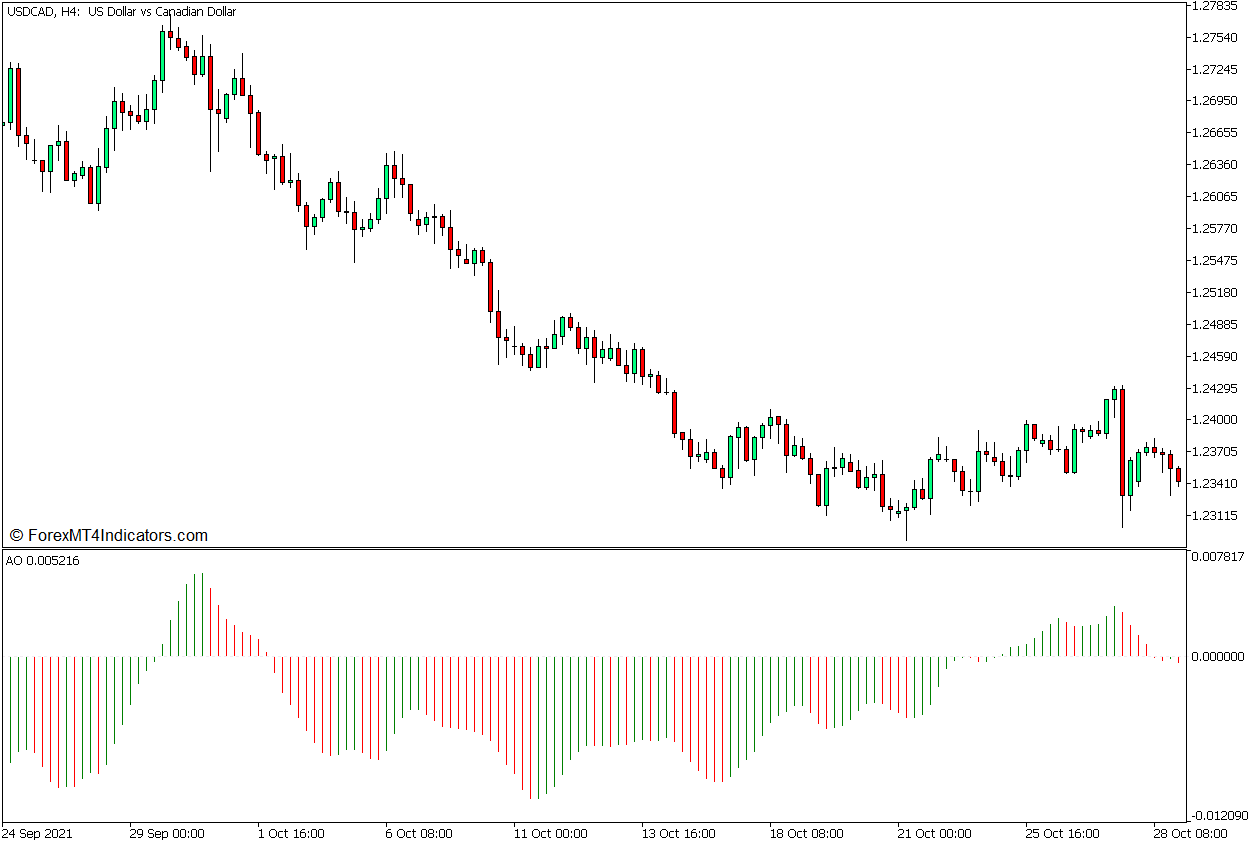

Awesome Oscillator

The Awesome Oscillator (AO) is a technical indicator used to objectively measure and assess the direction of the market’s momentum. It does this using a pair of Simple Moving Average (SMA) lines, which are usually preset as the 5-bar SMA and the 34-bar SMA. The indicator calculates the difference between the 5 SMA and 34 SMA values and then uses the resulting values to plot histogram bars making an oscillator.

Trend and momentum direction is indicated by whether the bars are generally positive or negative. Trend strength on the other hand is indicated by the increase or decrease of the values of the bars. This version of the Awesome Oscillator conveniently plots green bars to indicate increasing bar values and red bars to indicate decreasing bar values. Positive green bars indicate a strengthening bullish trend direction, while positive red bars indicate a weakening bullish trend direction. Inversely, negative red bars indicate a strengthening bearish trend direction, while negative green bars indicate a weakening bearish trend direction.

Traders often use the values of the bars to identify the direction of the trend and filter trades based on the trend direction. Some traders also use the changing of the color of the bars to confirm a trade entry in the direction of the trend. As an oscillator, the AO can also be used to identify divergences, which are high-probability trend reversal indications.

Trading Strategy Concept

This trading strategy is a trend continuation strategy that trades on momentum signals based on the confluence of the Awesome Oscillator and the Adaptive ATR Keltner Channel indicator.

The Awesome Oscillator is primarily used to identify the direction of the trend. This is based on whether the AO is generally plotting positive or negative bars. Traders should then isolate their trades only in the direction of the trend as indicated by the AO.

After identifying the direction of the trend, traders may then use the Adaptive ATR Keltner Channel indicator to identify shallow pullbacks towards its middle line. Price action should then bounce off the middle line and form a momentum candle that would close outside the Adaptive ATR Keltner Channel. Traders may then use this momentum signal as an entry signal for the trade.

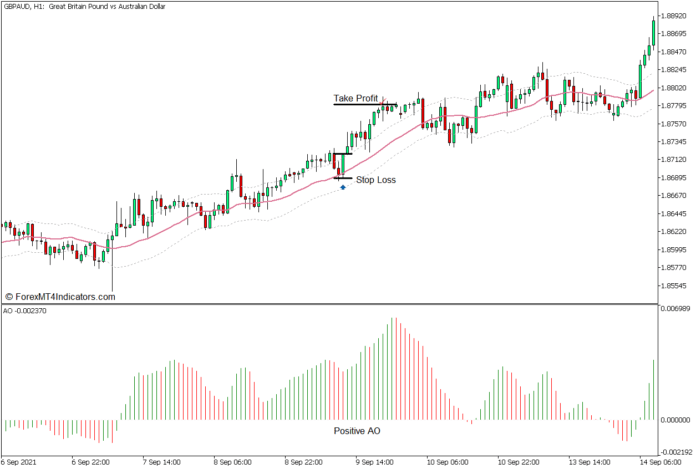

Buy Trade Setup

Entry

- The Awesome Oscillator bars should generally be positive.

- Price action should pull back towards the middle line of the Adaptive ATR Keltner Channel indicator.

- Open a buy order as soon as price action shows signs of price rejection on the area of the middle line and a bullish momentum candle closes above the upper line of the Adaptive ATR Keltner Channel.

Stop Loss

- Set the stop loss below the bullish momentum candle.

Exit

- Set the take profit target at 2x the size of the stop loss in pips and allow the price to reach the target.

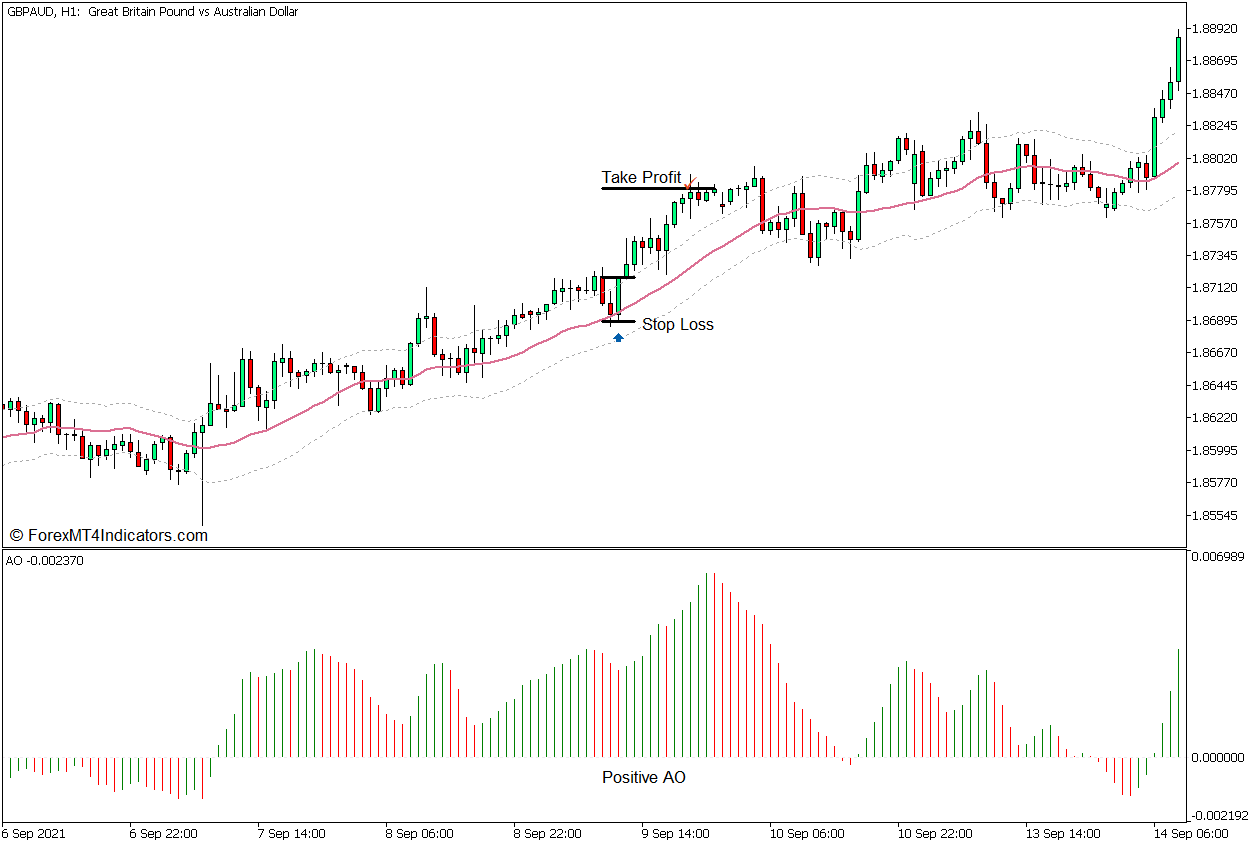

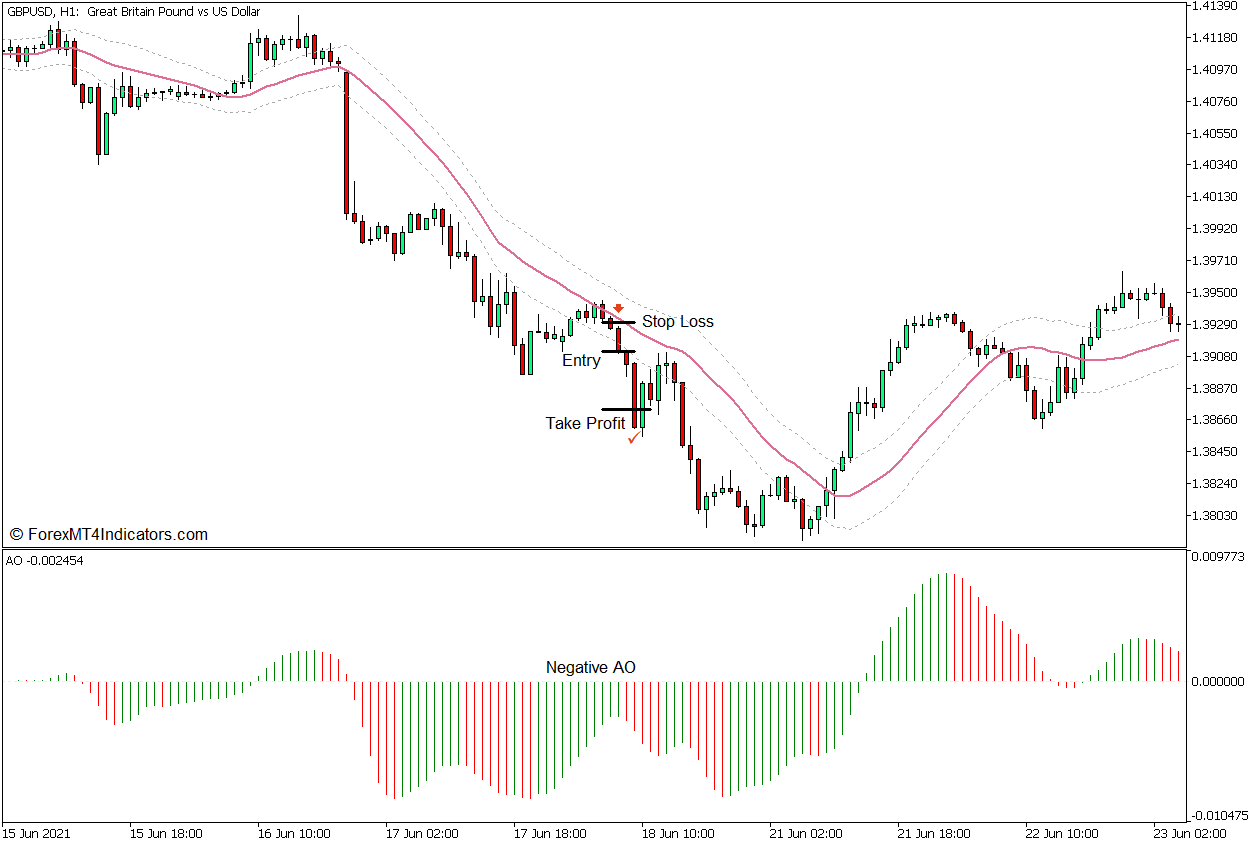

Sell Trade Setup

Entry

- The Awesome Oscillator bars should generally be negative.

- Price action should pull back towards the middle line of the Adaptive ATR Keltner Channel indicator.

- Open a sell order as soon as price action shows signs of price rejection on the area of the middle line and a bearish momentum candle closes below the lower line of the Adaptive ATR Keltner Channel.

Stop Loss

- Set the stop loss above the bearish momentum candle.

Exit

- Set the take profit target at 2x the size of the stop loss in pips and allow the price to reach the target.

Conclusion

This trading strategy is a viable momentum trading strategy that traders can use. It allows traders to objectively filter out trades that are not viable based on the set of rules used. However, there are also situations wherein the succeeding price movement is not strong enough to reach the target. There are also situations wherein trade opportunities form at the end of the trend, which traders should avoid. Traders should still use sound judgment when deciding whether to take a valid trade or not.

Recommended MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: