Intraday Channel Breakout MT5 Indicator comes into play, offering a helping hand in navigating the intraday price action. This article delves deep into the world of the Intraday Channel Breakout MT5 Indicator, acting as your comprehensive guide. We’ll explore its inner workings, unveil its strengths and limitations, and equip you with the knowledge to integrate it seamlessly into your trading strategy. So, buckle up, and get ready to conquer the market’s momentum with confidence!

What are Intraday Channel Breakouts?

Imagine the price of a currency pair fluctuating throughout the trading day. Often, these fluctuations create a “channel” on the price chart, with the price bouncing between an upper and lower boundary. This channel represents a period of consolidation, where buyers and sellers are temporarily in a tug-of-war.

Intraday channel breakouts occur when the price decisively breaks above the channel’s upper limit (bullish breakout) or below its lower limit (bearish breakout). These breakouts signal a potential shift in market sentiment, suggesting a trend continuation or reversal.

Understanding Metatrader 5 and Its Functionality

MetaTrader 5, or MT5 for short, is a powerful and versatile trading platform widely used by forex traders. It boasts a plethora of features, including:

- Advanced charting tools: MT5 allows in-depth price analysis with a variety of chart types, technical indicators, and drawing tools.

- Automated trading capabilities: Develop and deploy custom trading robots (Expert Advisors) to automate your trading strategies.

- Market data and news feed: Stay updated with real-time market data, news events, and economic indicators that can impact price movements.

How Intraday Channel Breakouts and MT5 Intersect

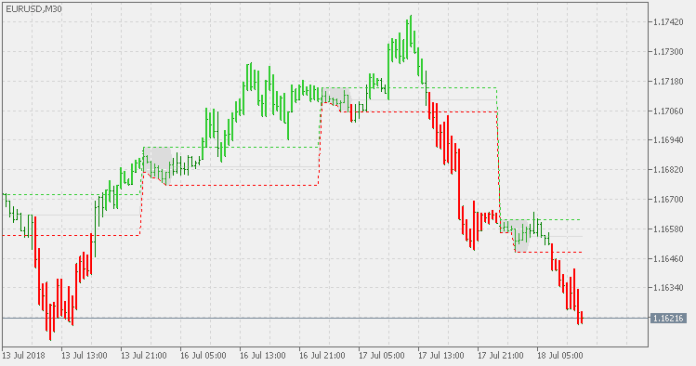

The Intraday Channel Breakout MT5 Indicator leverages the capabilities of the MT5 platform to identify potential breakouts within intraday channels. It analyzes price data and automatically plots the channel on your chart, along with visual cues to signal breakouts. This allows you to quickly identify these breakout opportunities and make informed trading decisions.

Components Of The Indicator: Channels, Breakouts, And Signals

- Channels: The indicator displays the channel on your chart as two horizontal lines, representing the upper and lower boundaries of the price movement within the chosen timeframe.

- Breakouts: When the price decisively breaks above the upper channel line (bullish breakout) or below the lower channel line (bearish breakout), the indicator generates a visual signal on the chart. This signal can be an arrow, a change in line color, or a pop-up notification, depending on the indicator’s settings.

- Signals: These visual cues help you identify potential trading opportunities based on the identified breakouts.

Risk Management Techniques Alongside the Indicator

Remember, no indicator is a crystal ball. Always incorporate proper risk management techniques alongside the Intraday Channel Breakout MT5 Indicator:

- Stop-Loss Orders: Place stop-loss orders below the channel for long positions (bought) and above the channel for short positions (sold) to limit potential losses.

- Position Sizing: Manage your risk by allocating a sensible percentage of your capital to each trade based on your risk tolerance and account size.

- Money Management: Develop a sound money management strategy that dictates your entry and exit points and protects your capital over the long run.

Potential Benefits of the Indicator for Traders

- Simplified Breakout Identification: The indicator automates channel detection and breakout notification, saving you valuable time and effort.

- Early Entry Opportunities: By identifying potential breakouts early, you can potentially position yourself to capture profitable trends.

- Enhanced Market Awareness: The indicator can heighten your awareness of potential trend shifts within the intraday timeframe.

Combining the Indicator with Price Action Confirmation

Remember, the success of these strategies hinges on confirmation from price action. Look for bullish or bearish candlestick patterns following the breakout to increase your confidence before entering a trade.

Understanding The Limitations Of Backtesting Results

It’s crucial to understand that backtesting results are not a guarantee of future success. Market conditions are constantly evolving, and historical performance may not always translate to the future.

Support and Resistance Levels

Price often finds temporary pauses or reversals at established support and resistance levels. A breakout that coincides with a known support level for long positions (indicating a potential break higher) or a resistance level for short positions (indicating a potential break lower) holds more weight than a breakout in isolation. Overlay support and resistance zones on your chart alongside the channel breakout indicator for a more comprehensive picture.

Market Volatility

Volatility plays a crucial role in breakouts. High volatility can amplify breakouts, leading to larger price movements. Conversely, low volatility breakouts might be less forceful and more prone to false signals. Consider the current market volatility when interpreting the indicator’s signals. Look for breakouts accompanied by a surge in volume, which can be a sign of increased market participation and potentially stronger breakouts.

Volume Analysis

Volume is the lifeblood of the market. A breakout accompanied by healthy volume suggests greater conviction behind the price movement, strengthening the breakout’s validity. Conversely, a breakout with low volume might be a weaker signal and more susceptible to reversal. The Intraday Channel Breakout MT5 Indicator might not inherently show volume, so you’ll need to utilize MT5’s built-in volume bars or a separate volume indicator alongside it.

Price Action Confirmation

As mentioned earlier, relying solely on the indicator’s breakout signals can be risky. Look for confirmation from price action patterns like bullish/bearish candlesticks following the breakout to increase your confidence before entering a trade.

How to Trade with Intraday Channel Breakout Indicator

Buy Entry

- Trigger: Price decisively breaks above the upper channel line.

- Confirmation: Look for bullish candlestick patterns following the breakout, such as:

- Pin Bars: Pin bars with long tails protruding upwards signal potential buying pressure.

- Engulfing Bars: A bullish engulfing bar occurs when a bullish candlestick completely engulfs the previous bearish candlestick, indicating a shift in momentum.

- Breakout Bars: The breakout candlestick itself can be a confirmation signal, especially if it closes well above the channel line with significant volume.

- Stop-Loss: Place a stop-loss order below the lower channel line to limit losses if the price reverses.

- Take-Profit: Target your profits based on technical analysis tools like:

Sell Entry

- Trigger: Price decisively breaks below the lower channel line.

- Confirmation: Look for bearish candlestick patterns following the breakout, such as:

- Shooting Stars: Shooting stars with long upper wicks indicate potential selling pressure and possible trend reversal.

- Bearish Engulfing Bars: A bearish engulfing bar occurs when a bearish candlestick completely engulfs the previous bullish candlestick, indicating a shift in momentum.

- Breakdown Bars: The breakdown candlestick itself can be a confirmation signal, especially if it closes well below the channel line with significant volume.

- Stop-Loss: Place a stop-loss order above the upper channel line to limit losses if the price reverses.

- Take-Profit: Target your profits based on technical analysis tools like:

Conclusion

Intraday Channel Breakout MT5 Indicator can be a valuable asset in your trading toolbox. It streamlines the process of identifying potential breakout opportunities within intraday channels. However, remember that it’s just one piece of the puzzle. By understanding its functionalities, and limitations, and effectively integrating it with other technical analysis tools and risk management strategies, you can leverage the indicator to make more informed trading decisions and potentially capture profitable breakout opportunities.

Recommended MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

(Free MT5 Indicators Download)

Click here below to download: