Traders are like hunters. Forex traders would stalk the forex pairs in their watchlist waiting for the perfect timing. Often, they would be looking at a forex pair for hours, days or even weeks. They would be looking at certain levels, waiting for price to reach that certain level and react to it according to their trade plan.

Hunters wait for their prey at a certain spot. They often do not go chasing their prey around and spook them. Instead, they would stay in a hunting hide and wait for their prey. As soon as their prey would be in the vicinity they would aim at their prey and wait for their prey to be at the center of their crosshairs. That is when they squeeze the trigger and shoot.

Traders should also do the same. Traders should have certain levels or zones where they would wait for price to enter. Traders should not chase price as that is usually the worst mistake traders could make. As soon as price enters the zone, they should wait for price to react to that zone and confirm it with either price action or an indicator.

Pinpoint Supply and Demand Forex Trading Strategy is a trading strategy that applies this concept. It waits for price at certain supply or demand zones and confirms the entry using an entry trigger based on a technical indicator.

Supply and Demand

Supply and Demand is a concept in trading wherein traders would identify supply and demand zones based on price previously moving away from a certain level with strong momentum. These moves would often create swing lows and swing highs. Traders would then extend the congestion zone of the swing high or swing low to create the supply and demand zone.

Supply and Demand indicator simplifies this process by automatically marking the supply and demand zones. Traders simply must observe price as it revisits and retests these areas.

This indicator marks the demand zone with a dark blue box extended to the right It also marks the supply zone with a maroon box extended to the right. The boxes are nullified whenever price is able cross the zone with strong momentum.

Heiken Ashi Candlesticks

Regular Japanese candlesticks are currently the norm. It is the most commonly used charting method amongst traders. However, there is a new method of charting which is also developed by the Japanese.

Heiken Ashi literally means “average bars” in Japanese. It is an indicator which modifies how a candlestick is plotted. It would plot the same highs and lows of a bar. However, it would modify the open and close of the candle based on the average movements of price. The result are candles which would show the highs and lows of the candle, which is very useful for price action analysis. The modified open and close of a candle would cause the candle to change color only when the short-term trend has reversed.

The Heiken Ashi Candlesticks could be used as a charting method and as a short-term momentum indicator. Traders could use it as an entry or exit signal based on the changing of the color of the bars.

Trading Strategy

This trading strategy is a basic supply and demand strategy that attempts to take trades off bounces from a supply or demand zone.

It uses the Supply Demand indicator to automatically plot viable supply and demand zones. Traders should then wait for price to revisit and retest the area in anticipation of a price bounce.

This strategy uses the Heiken Ashi Candlestick indicator as a charting method in order to identify probable short-term momentum shifts. These short-term momentum reversals could be used to identify probable bounces off the supply or demand zone.

If price is showing signs of bouncing off the supply or demand zone accompanied by the changing of the color of the Heiken Ashi Candlesticks, a pending stop entry order would be placed on the high or low of the Heiken Ashi Candlestick. If price breaches the high or low of the candle, then the momentum shift is confirmed.

Take profit targets are placed on a recent swing high or swing low prior to the bounce, which is a logical take profit target.

Indicators:

- Heiken Ashi

- SupDem

Preferred Time Frames: 1-hour, 4-hour and daily charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

Buy Trade Setup

Entry

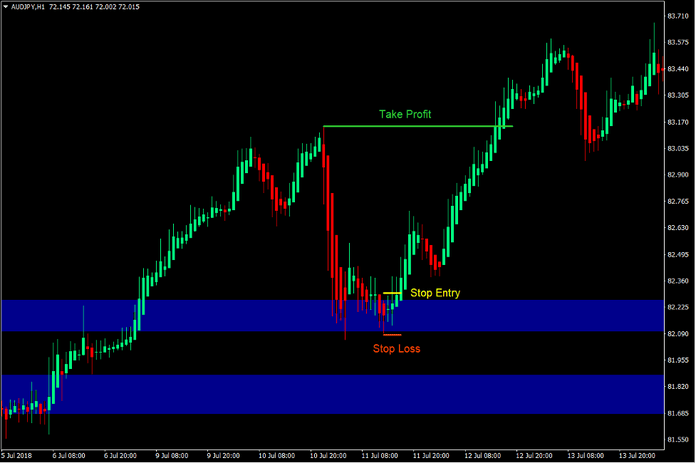

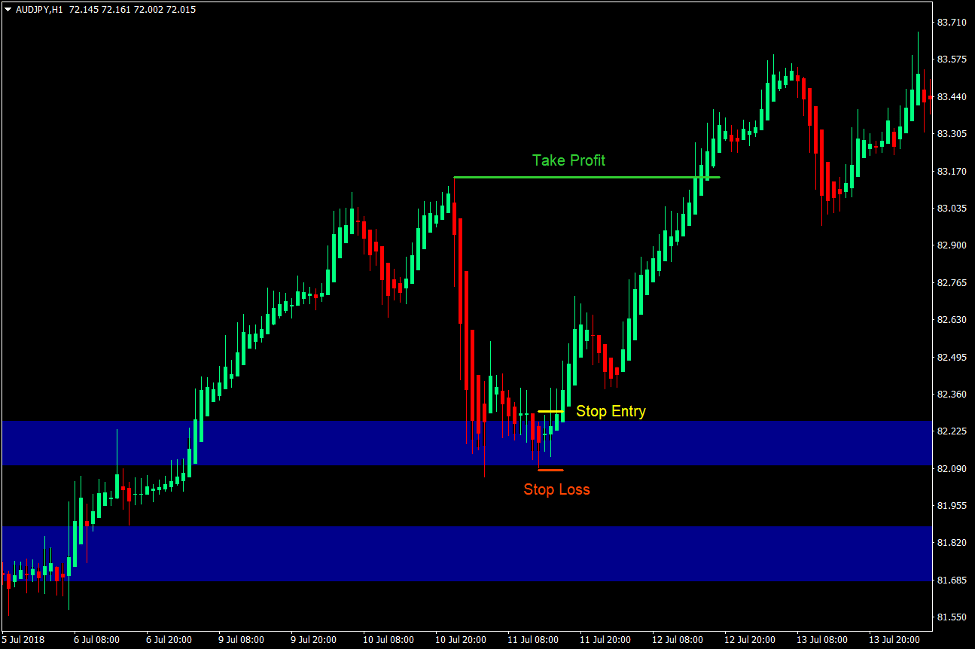

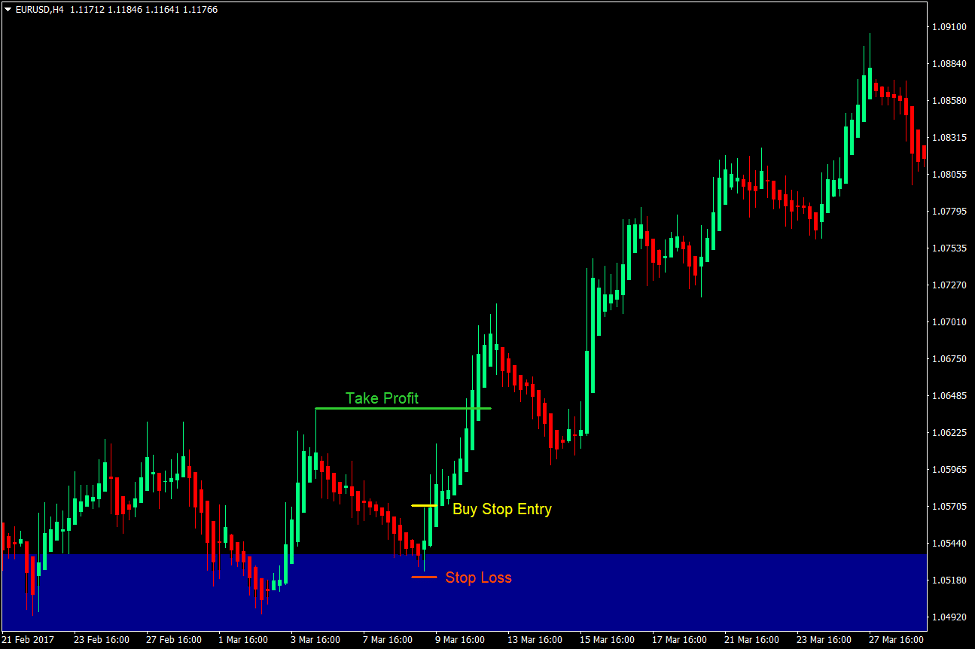

- The Supply Demand indicator should plot a dark blue box indicating a demand zone.

- Price should retest and bounce off the demand zone.

- The Heiken Ashi Candlesticks should change to spring green.

- Place a buy stop entry order on the high of the candlestick.

Stop Loss

- Set the stop loss on the fractal below the entry candle.

Exit

- Set the take profit target at the swing high prior to the demand zone bounce.

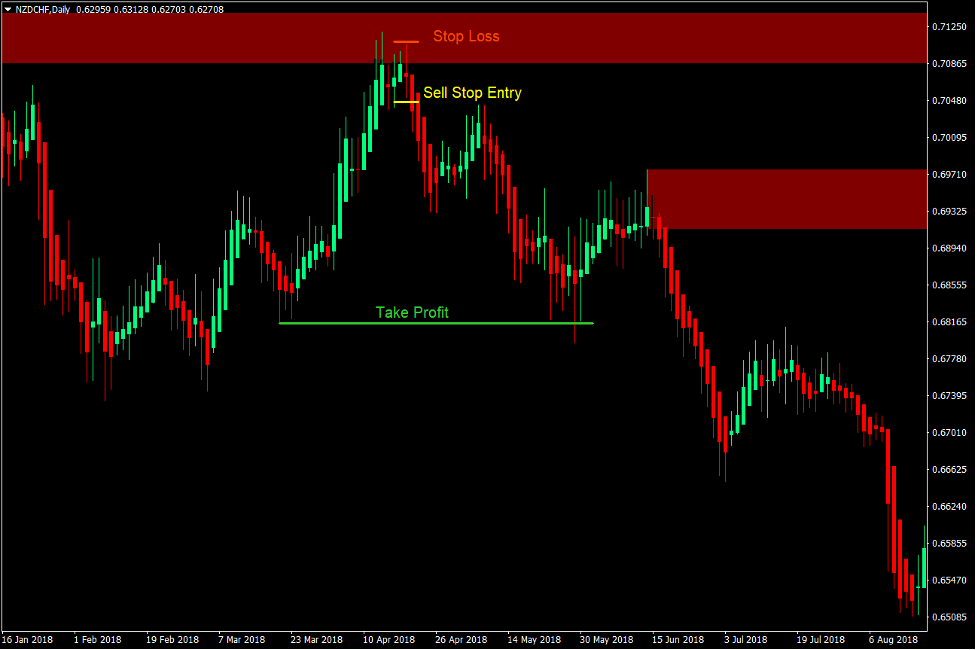

Sell Trade Setup

Entry

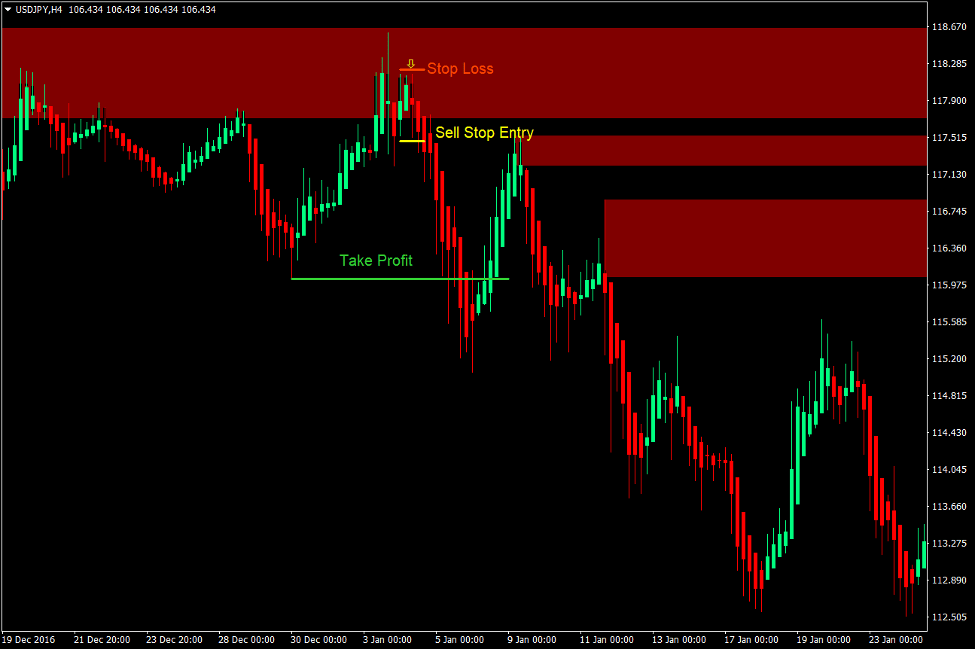

- The Supply Demand indicator should plot a maroon box indicating a supply zone.

- Price should retest and bounce off the supply zone.

- The Heiken Ashi Candlesticks should change to red.

- Place a sell stop entry order on the low of the candlestick.

Stop Loss

- Set the stop loss on the fractal above the entry candle.

Exit

- Set the take profit target at the swing low prior to the supply zone bounce.

Conclusion

Supply and Demand strategies are one of the most popular trading strategies used by professional traders. Most profitable professional traders incorporate Supply and Demand into their trading or other variations of it.

The problem with Supply and Demand strategies is that it requires a lot of practice to properly identify viable supply and demand zones. Some even take years to master it.

This strategy simplifies the process by pre plotting the zones. It also validates bounces off the zones based on the Heiken Ashi Candlesticks.

This creates a strategy that should be complex friendlier to new traders.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: