Trend reversal and trend following strategies are very popular among many traders. This is because traders are often attracted to charts that are moving in one direction, either from the bottom left of the chart to the upper right corner of the chart, or from the upper left corner of the chart to the bottom left corner, depending on the direction of the trade. These types of chart is typical of a trending market and these types of market could mean that traders who entered the market at the start of the trend could be earning so much as long as they are able to hold the trade until the end of the trend.

However, this is easier said than done. Catching big trending market moves is very difficult.

One of the best ways to catch such types of market moves is by looking for confluences of signals that indicate price might be moving in a certain direction. This could come from a variety of indicators or a confluence of price action and some technical indicators.

Another factor that could indicate the possible start of a trend is the presence of momentum. Momentum is a scenario wherein price would move strongly in one direction and often within a short period. This means that the market moved in one direction with volume and speed. This makes momentum very difficult to go against with. Often, it also results in a new market trend developing.

Trend Envelopes

The Trend Envelopes indicator is a custom trend following indicator which is based on the Envelopes indicator.

The classic Envelopes indicator is an indicator developed from moving averages. It plots two lines which are derived from a moving average line. These lines are shifted above and below the original moving average line based on a preset percentage deviation. These lines are mainly used to identify momentum. A bullish momentum is perceived whenever price breaks strongly above the upper line, and a bearish momentum is perceived whenever price drops strongly below the lower line. Trends are identified whenever price hugs either of the two lines for a longer period.

Trend Envelopes is based on this concept. The difference is that it retains only the line opposite of the current trend or momentum detected. This allows traders to more easily identify the direction of the trend, while the line acts as a dynamic support or resistance line.

The lines also change color depending on the direction of the trend. Light blue lines indicate a bullish trend, while orange lines indicate a bearish trend.

Awesome Oscillator

The Awesome Oscillator (AO) is a widely used trend following indicator which is a part of the oscillator family of technical indicators.

The AO is computed by subtracting a 34-period Simple Moving Average (SMA) from a 5-period Simple Moving Average (SMA). However, instead of using the closing price which most moving averages use, the AO uses the median of each candle. The result is then plotted as histogram bars of an oscillator.

Positive green bars indicate a bullish trend with strengthening momentum, while positive red bars indicate a bullish trend with weakening momentum. Negative red bars indicate a bearish trend with strengthening momentum, while negative green bars indicate a bearish trend with weakening momentum.

Given the nature of how the AO is computed, the AO can be considered as a trend following indicator which is based on moving average crossovers. Trend reversal signals can be identified whenever the histogram bars shift either to positive or negative.

William %R

The William %R indicator is a classic technical indicator which is a momentum oscillator.

It is computed by dividing the result of the difference from the highest high and close to the difference of the highest high and the lowest low.

The result is then plotted as a line that oscillates from 0 to -100, with -50 as the midpoint. It also has markers at level -20 and -80.

The William %R indicator is mainly used to identify overbought and oversold market conditions. The market is overbought if the line is above -20 and oversold if the line is below -80. These conditions are prime for short-term trend reversals.

Trading Strategy

Envelope Momentum Forex Trading Strategy aims to capture trending market moves that are initiated by strong momentum. To identify these scenarios, we will be using the confluences of the above indicators as a basis for our trade setups.

The shifting of the Trend Envelopes is the primary and initial indication of a shift in the direction of the momentum.

This is then confirmed by the AO based on the direction and color of the histogram bars.

Finally, instead of being an overbought and oversold indicator, the William %R indicator will be used to confirm momentum. Strong momentum breaches beyond the -80 to -20 range would be interpreted as a momentum breakout indication.

Indicators:

- TrendEnvelopes_v1

- Awesome Oscillator

- Williams’ Percent Range

- Period: 28

Preferred Time Frames: 1-hour, 4-hour and daily range

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

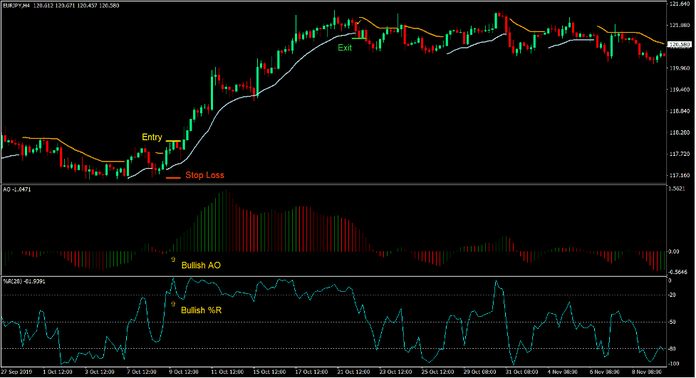

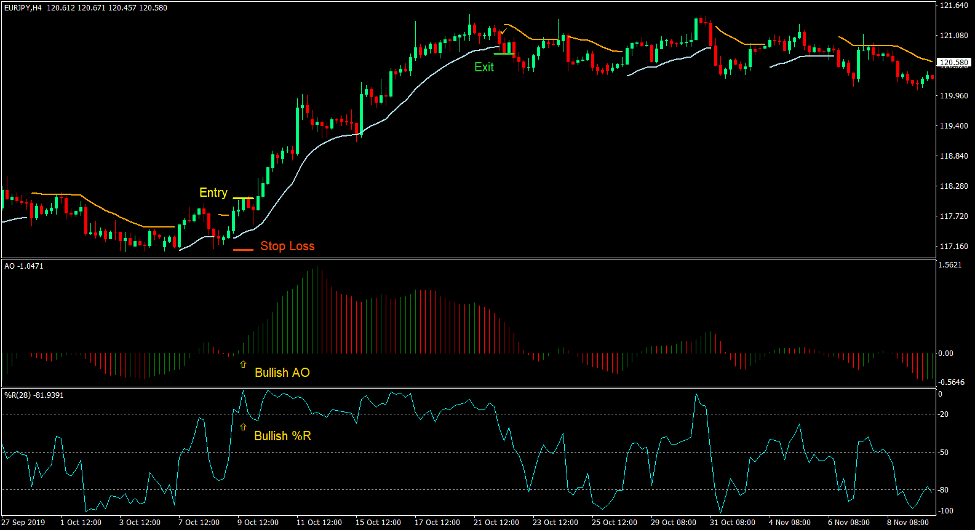

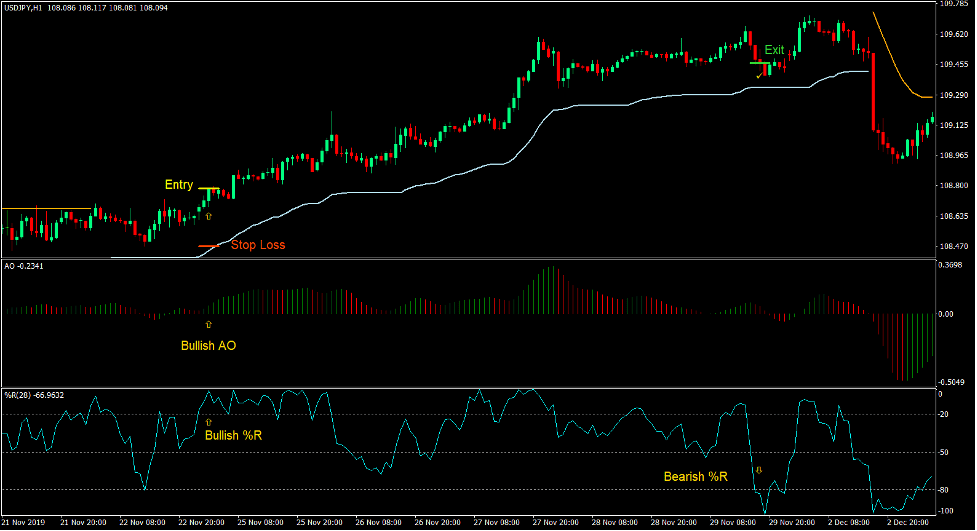

Buy Trade Setup

Entry

- The Trend Envelopes line should shift below price action and should change to light blue.

- The AO bar should cross above zero and should be positive green.

- The Williams %R line should break strongly above -20.

- Enter a buy order on the confirmation of these conditions.

Stop Loss

- Set the stop loss on the support below the entry candle.

Exit

- Close the trade as soon as the Williams %R line drops below -80.

- Close the trade as soon as the Trend Envelopes line shifts above price action and changes to orange.

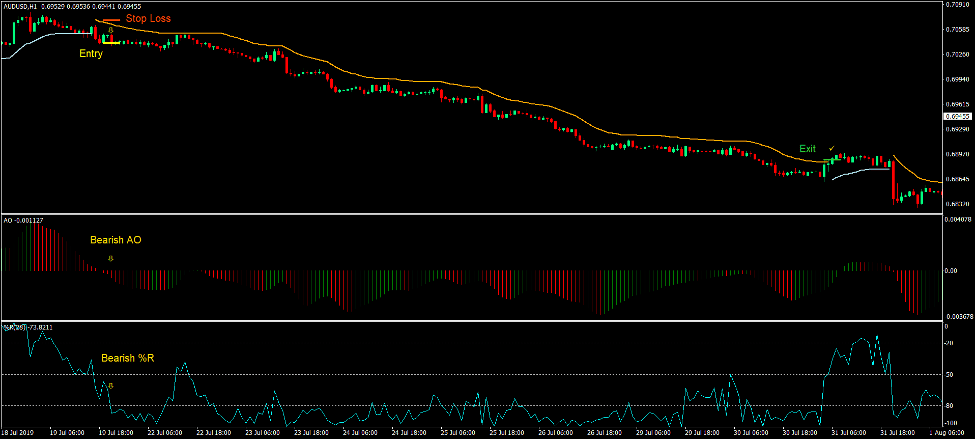

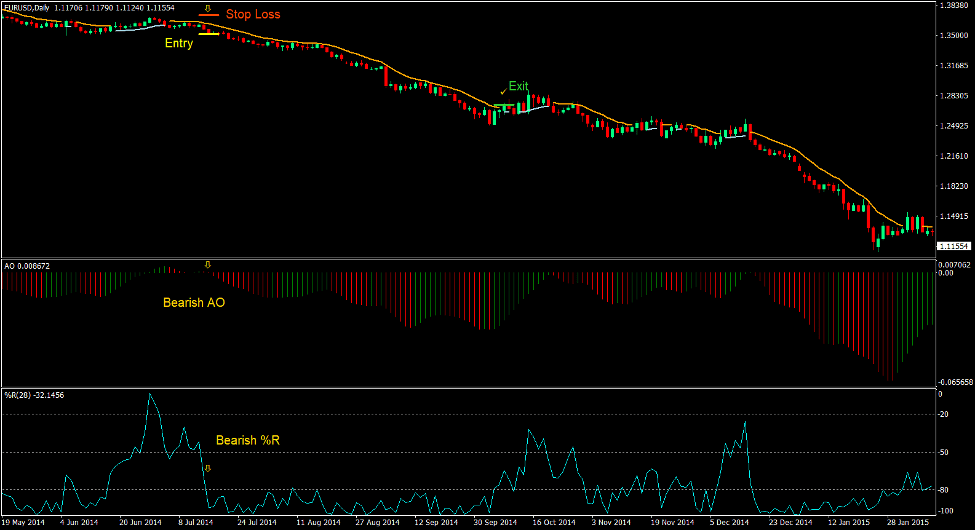

Sell Trade Setup

Entry

- The Trend Envelopes line should shift above price action and should change to orange.

- The AO bar should cross below zero and should be negative red.

- The Williams %R line should break strongly below -80.

- Enter a sell order on the confirmation of these conditions.

Stop Loss

- Set the stop loss on the resistance above the entry candle.

Exit

- Close the trade as soon as the Williams %R line breaches above -20.

- Close the trade as soon as the Trend Envelopes line shifts below price action and changes to light blue.

Conclusion

Trending markets are some of the most lucrative types of market conditions which allow traders to earn unlimited income from the forex markets. Momentum breakouts are conditions which could often lead to a trending market.

Envelope Momentum Forex Trading Strategy is a simple momentum breakout strategy which aims to capture huge market trends using a confluence of different momentum and trend signals.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: