Trend Reversals are one of the most lucrative types of trading strategies used by traders, whether be it in stocks, futures, options or forex. It is the type of trading strategy wherein, although it is quite difficult to catch a trade as the trend reverses, trades that work out would usually result in very high yields. It is not uncommon for trend reversal trades to result in yields which are four times the risk placed on a trade. This is because trend reversal trades are often taken near the start of a trend and is usually exited just before the trend reverses. This allows traders to catch a very big chunk of the price movement resulting from the new trend.

Now, trend reversal strategies are not for everybody. It is for those who are willing to take risks in order to gain high rewards. If you are the type of trader who aims to catch these big moves, then this strategy might be for you.

RSI MA TRADE SIST Indicator

The RSI MA TRADE SIST indicator is an excellent momentum-based trend following indicator. This indicator works well in identifying trend direction based on the mid- and short-term trends.

This indicator is based on the confluence of a Relative Strength Index (RSI) indicator and a crossover of two moving averages. When used correctly, confluences between the two indicators does tend to result in strong price movements.

The Relative Strength Index (RSI) is a momentum indicator used to determine trend direction based on the strength of price movements compared to the previous period. It is traditionally displayed as an oscillator that moves from 0 to 100. RSI below 30 is considered oversold while RSI above 70 is considered overbought. On the other hand, trend direction is usually based on where the RSI is in relation to the midline. The trend is considered bullish whenever the RSI is above 50 and bearish whenever it is below 50.

Moving Average crossovers are also used to determine trend reversals. In fact, this is the most common trade entry strategy used by many traders.

This indicator makes use of both RSI and a moving average crossover. It has moving average lines drawn on the price chart and it also indicates momentum-based trend reversals based on the RSI by placing arrows on the price chart.

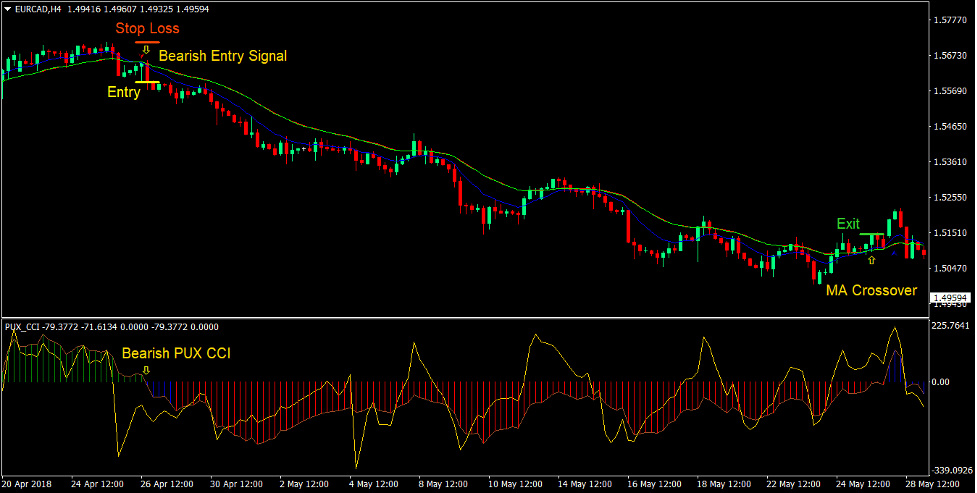

PUX CCI

The PUX CCI indicator is a custom momentum indicator based on the Commodity Channel Index (CCI) indicator. It is presented as an oscillator with histogram bars indicating the trend direction. Positive bars indicate a bullish trend condition while negative bars indicate a bearish trend direction. The histogram bars also change colors depending on the direction of the trend. Bars that have just crossed over the midline are colored blue, bars that have been above the midline for quite some time are colored green, and bars that have been below the midline for a while are colored red.

It also consists of two lines. One line is more reactive to price movements while another line tends to be more subdued. The slower line is connected to the histogram bars and is colored sienna while the faster line is not and is colored gold.

Trading Strategy

The RSI CCI Trend Reversal Forex Trading Strategy provides trade signals based on the signals provided by the RSI MA TRADE SIST indicator and the PUX CCI indicator.

Trades are taken whenever there is a confluence between the crossing over of the RSI MA TRADE SIST moving averages, an entry signal based on the arrows placed by the RSI MA TRADE SIST indicator, and the crossing over of the sienna line of the PUX CCI indicator over the midline.

Trade signals that are in confluence with each other and are closely aligned have a strong tendency to result in a trend. This is because these conditions only become closely aligned whenever there is a strong momentum shift. This could be observed on the chart as a momentum candle or an engulfing candlestick pattern.

Indicators:

- rsi_ma_trade_sist_chart

- Fast EMA: 10

- Slow EMA: 24

- RSI Period: 42

- PUX_CCI (default setting)

Preferred Timeframe: 1-hour, 4-hour and daily charts

Currency Pairs: major and minor pairs

Trading Session: Tokyo, London and New York session

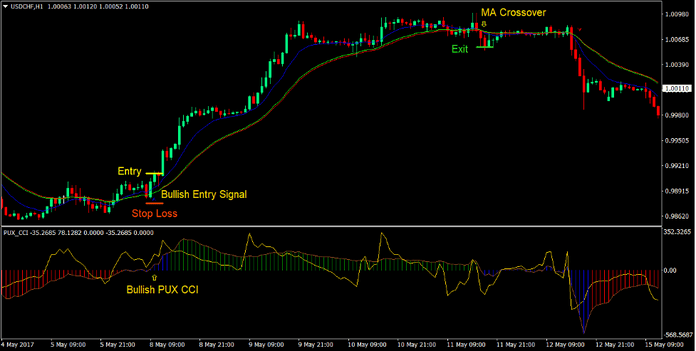

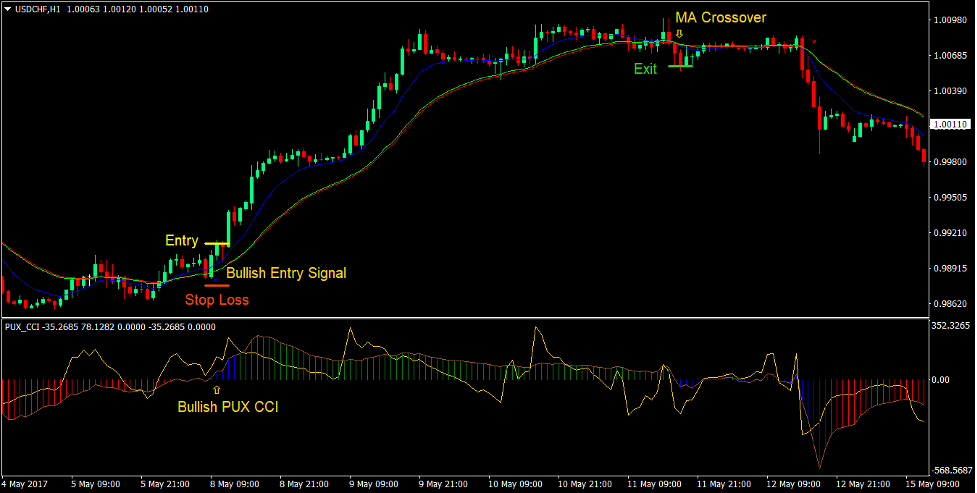

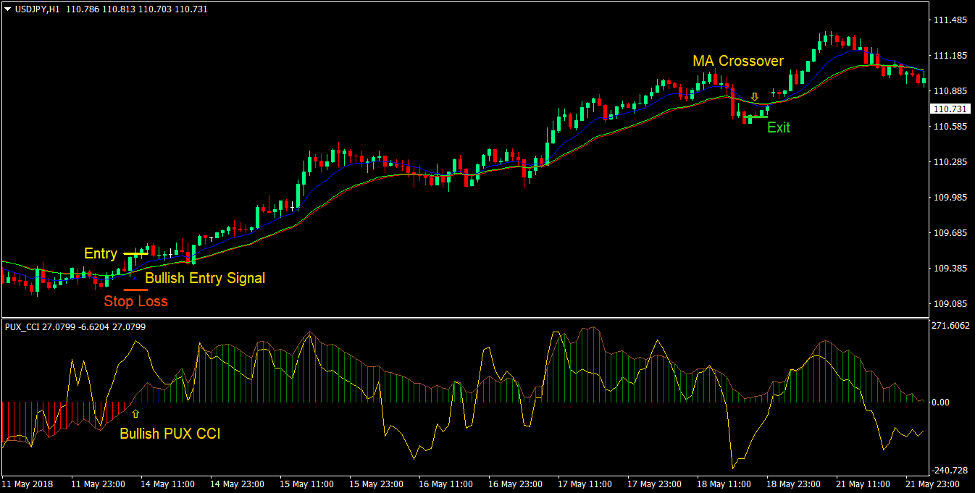

Buy Trade Setup

Entry

- Price should cross above the moving average lines.

- The blue moving average line of the RSI MA TRADE SIST indicator should cross above the lime moving average line indicating a bullish trend reversal.

- A bullish momentum candle or a bullish engulfing pattern should be visible on the chart.

- An arrow pointing up should be printed by the RSI MA TRADE SIST indicator indicating a bullish entry signal.

- The sienna line of the PUX CCI indicator should cross above the midline indicating a bullish trend reversal.

- These bullish signals should be closely aligned.

- Enter a buy order on the confluence of the above conditions.

Stop Loss

- Set the stop loss on the support level below the entry candle.

Exit

- Close the trade as soon as the blue moving average line of the RSI MA TRADE SIST indicator crosses below the lime moving average line.

- Close the trade as soon as an arrow pointing down is printed by the RSI MA TRADE SIST indicator.

- Close the trade as soon as the sienna line of the PUX CCI indicator crosses below the midline.

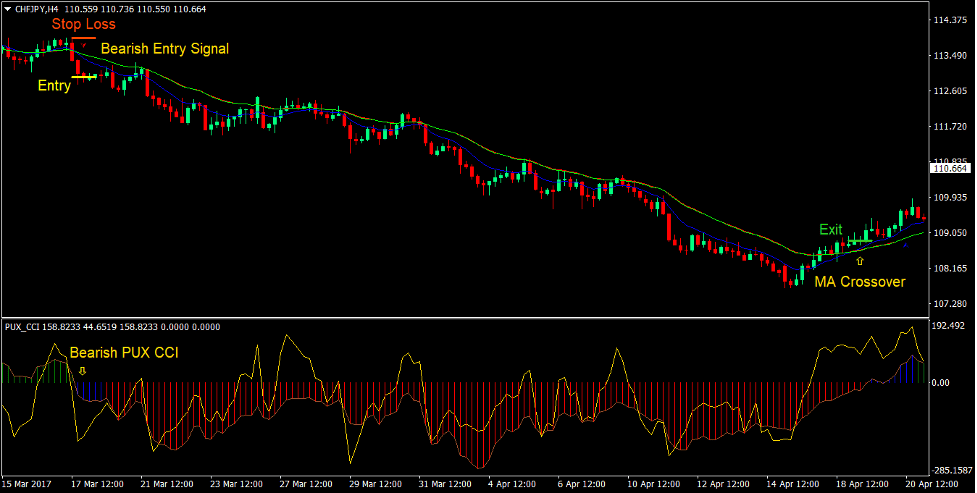

Sell Trade Setup

Entry

- Price should cross below the moving average lines.

- The blue moving average line of the RSI MA TRADE SIST indicator should cross below the lime moving average line indicating a bearish trend reversal.

- A bearish momentum candle or a bearish engulfing pattern should be visible on the chart.

- An arrow pointing down should be printed by the RSI MA TRADE SIST indicator indicating a bearish entry signal.

- The sienna line of the PUX CCI indicator should cross below the midline indicating a bearish trend reversal.

- These bearish signals should be closely aligned.

- Enter a sell order on the confluence of the above conditions.

Stop Loss

- Set the stop loss on the resistance level above the entry candle.

Exit

- Close the trade as soon as the blue moving average line of the RSI MA TRADE SIST indicator crosses above the lime moving average line.

- Close the trade as soon as an arrow pointing up is printed by the RSI MA TRADE SIST indicator.

- Close the trade as soon as the sienna line of the PUX CCI indicator crosses above the midline.

Conclusion

This strategy is one which allows traders to catch huge price movements resulting from a fresh trend. Trades entered using this strategy could be opened right near the start of a trend and is usually closed as the trend ends. This allows the strategy to provide trades that have a high reward-risk ratio.

However, not all entry signals would result in a trend. Trades that are taken haphazardly during a ranging market could result in a failed trade. It is best to use this strategy in conjunction with price action and breakouts from a congestion area.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: