There are two strategies that are at the opposite sides of the spectrum – trend following strategies and mean reversal strategies.

The two strategies seem like exact opposites. Trend following pertains to looking for markets that are trending in a certain direction and trading in the direction of the trend. Mean reversal strategies on the other hand is about looking for markets that are either overbought or oversold and trading against the current direction with the belief that price would soon revert back to its mean.

Trend following strategies tend to produce high probability trade setups because traders are often taking trades in the direction of the trend. Mean reversal strategies also tend to produce high probability setups because price does usually revert back to its average price whenever it is already overbought or oversold. Combining both strategies could produce trade setups that have a very high probability of producing a winning trade since individually both strategies are already high probability strategies.

So, how do we combine two strategies that are at the opposite sides of the spectrum?

Deep retracements present this kind of opportunity. Deep retracements that occur during a strong trend can cause price to be mathematically overbought or oversold yet still maintain the direction of the trend. Traders could then take advantage of these opportunities since price would usually continue the direction of the trend quite strongly after a deep retracement.

Ichimoku Kinko Hyo – Kumo

The Ichimoku Kinko Hyo is a unique type of technical indicator because it is a combination of multiple indicators that interact as one system. This provides traders a birds eye view of what the market is doing, from the long-term trend, mid-term trend, short-term trend up to the current price action.

The Ichimoku Kinko Hyo is a set of multiple lines that are based on the median of price based on varying periods.

Chikou Span or lagging span represents the price action plotted 26 periods back.

Tenkan-sen or conversion line represents the short-term trend based on the median of price over the past nine periods.

Kijun-sen or base line represents the mid-term trend and is calculated based on the median of the last 26 periods.

Senkou Span A and B or Leading Span A and B form the Kumo or clould, which represents the long-term trend. Senkou Span A is calculated based on the median of Tenkan-sen and Kijun-sen plotted 26 periods ahead. Senkou Span B is calculated as the median of the last 52 periods then plotted 26 periods ahead.

The Kumo is a good indication of the long-term trend because it is not as susceptible to other long-term moving averages since it is composed of two lines. It clearly indicates trend direction making it very useful for trend following traders.

Stochastic Oscillator

The Stochastic Oscillator is a classic momentum indicator which is one of the most widely used oscillator type of indicator.

The Stochastic Oscillator indicates momentum direction based on the closing price of a tradeable instrument over a period of time. The indicator is preset to identify short-term trends, but its sensitivity can be adjusted by tweaking the time period which the indicator would compute from.

The indicator then plots two lines that oscillate within the range of 0 to 100. Momentum direction and reversal is typically identified based on the crossing over of the two lines. A bullish momentum is indicated if the faster line is above the slower line, while a bearish momentum is indicated if the faster line is below the slower line.

The range of the oscillator also has markers at level 20 and 80. These levels indicate oversold and overbought prices. Lines dropping below 20 indicate and oversold market, while lines breaching above 80 indicate and overbought market. Crossovers occurring on these areas tend to have a higher probability because it could indicate a probable mean reversal.

Trading Strategy

Kumo Dip Forex Trading Strategy is a combination between a mean reversal strategy and a long-term trend following strategy.

The Ichimoku Kinko Hyo indicator is modified to display only the Kumo. A sandy brown Kumo indicates a bullish long-term trend, while a thistle Kumo indicates a bearish long-term trend. Trend direction is also confirmed based on the characteristics of price action as well as the location of price action in relation to the Kumo.

Price would typically retrace even on a trending market condition. Deep retracements should cause the Stochastic Oscillator to either be oversold or overbought.

Trade setups are generated whenever the Stochastic Oscillator lines crossover while either overbought or oversold in the direction of the trend.

The take profit target is placed on the swing high or swing low. If the risk-reward ratio is positive, then the trade setup is a viable trade.

Indicators:

- Ichimoku Kinko Hyo

- Stochastic Oscillator

Preferred Time Frames: 30-minute, 1-hour or 4-hour charts

Currency Pairs: FX majors, minors or crosses

Trading Sessions: Tokyo, London and New York Sessions

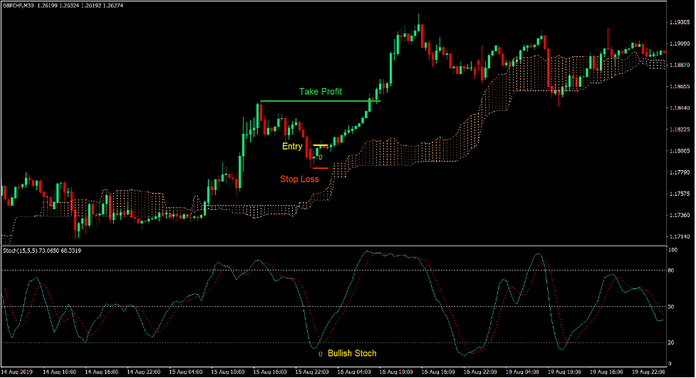

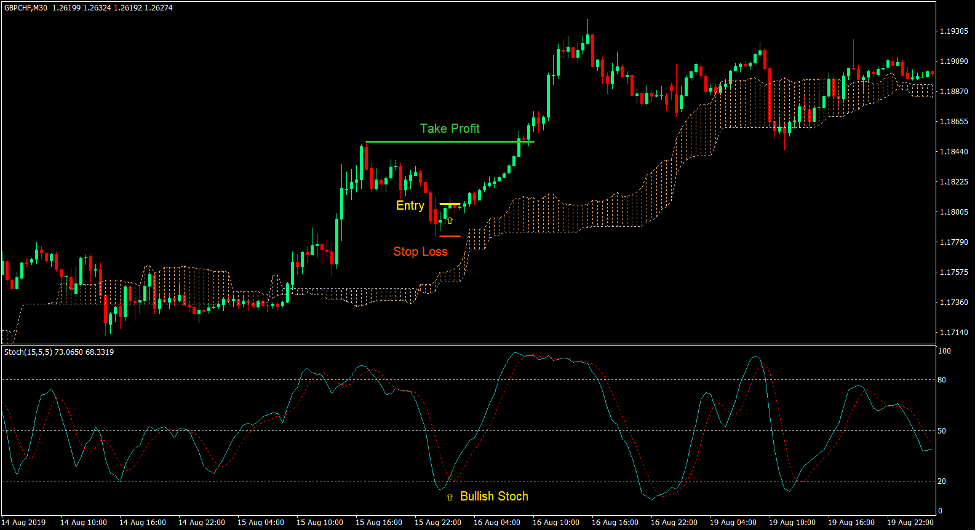

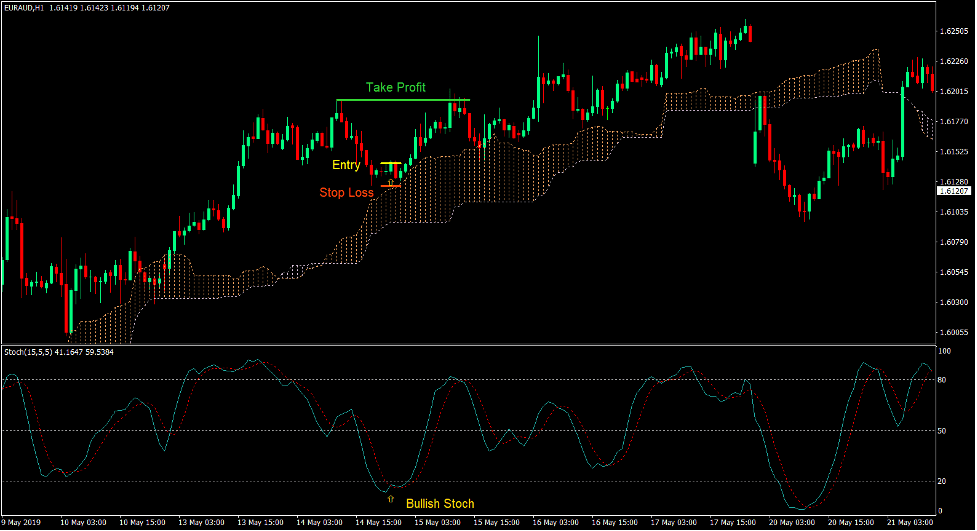

Buy Trade Setup

Entry

- Price action should be above the Kumo.

- The Kumo should be sandy brown.

- Price should temporarily retrace causing the Stochastic Oscillator to be oversold.

- Enter a buy order as soon as the faster Stochastic Oscillator line crosses above the slower line.

Stop Loss

- Set the stop loss on the support below the entry candle.

Exit

- Set the take profit target on the recent swing high.

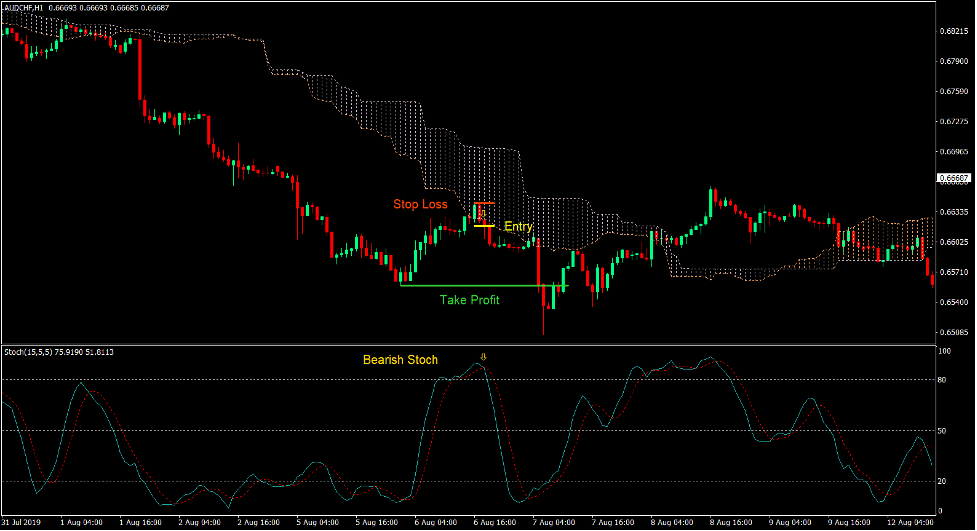

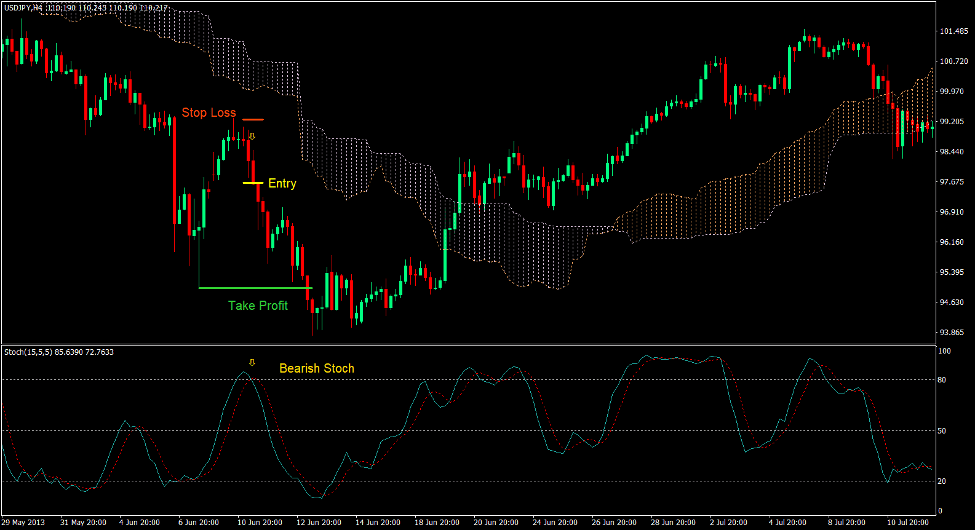

Sell Trade Setup

Entry

- Price action should be below the Kumo.

- The Kumo should be thistle.

- Price should temporarily retrace causing the Stochastic Oscillator to be overbought.

- Enter a sell order as soon as the faster Stochastic Oscillator line crosses below the slower line.

Stop Loss

- Set the stop loss on the resistance above the entry candle.

Exit

- Set the take profit target on the recent swing low.

Conclusion

This simple trading strategy, which is a combination of a mean reversal and trend following strategy, is a high probability trading strategy.

Both mean reversal and trend following strategies are individually high probability trading strategies. Combining both strategies together creates a strategy with a very high probability.

The key to trading this strategy successfully is in looking for trade setups which have a decent risk-reward ratio. Trades that have a risk-reward ratio of at least 1.5 would be a decent for this type of strategy.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: