In the world of forex trading, having the right tools at your disposal can make all the difference between success and failure. One such tool that has gained popularity among traders is the ROC MT4 Indicator. In this article, we will delve into the details of this indicator, explaining what it is, how it works, and why it’s a valuable addition to your trading arsenal.

Understanding ROC

What is ROC?

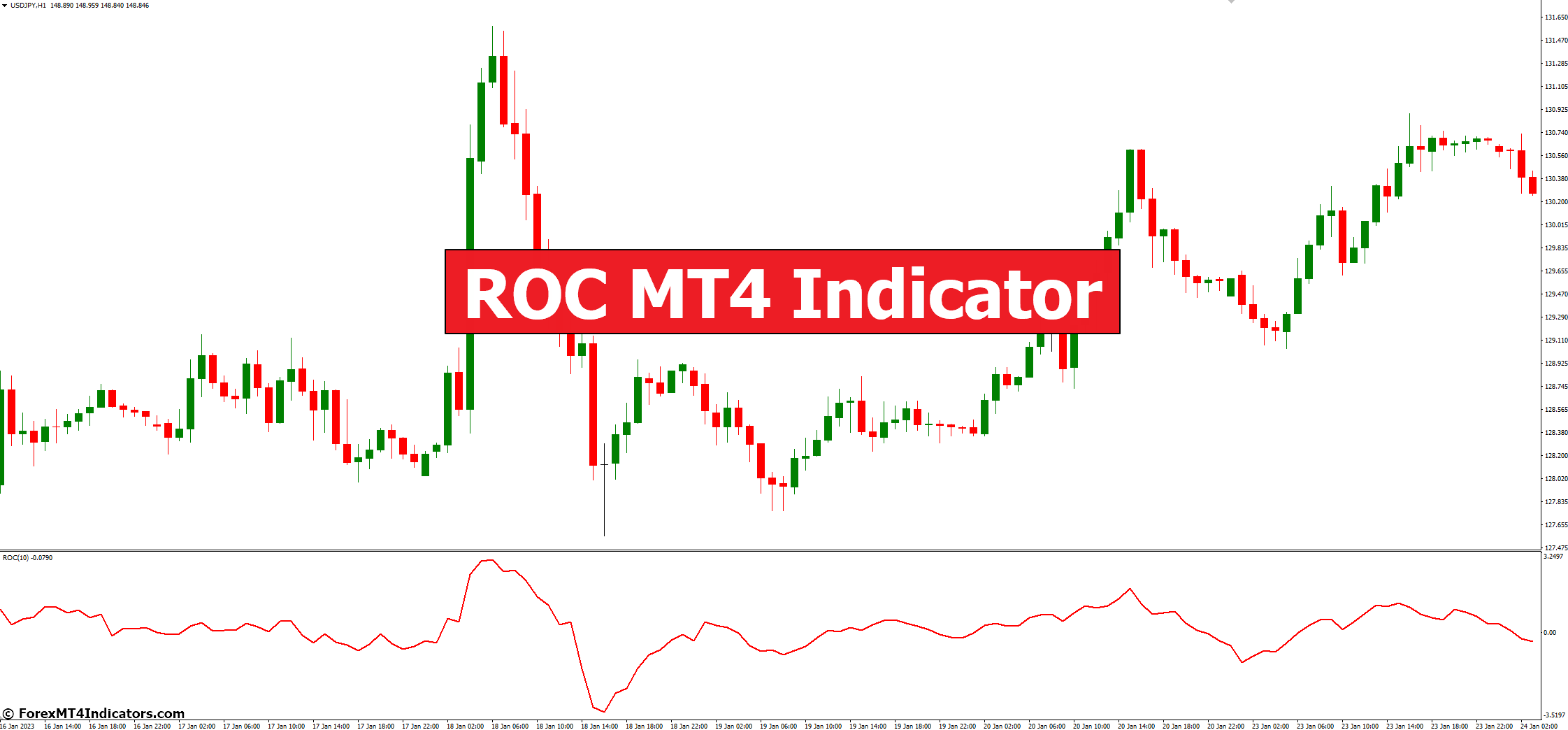

ROC stands for Rate of Change, and in the context of forex trading, it’s an essential technical indicator. ROC measures the percentage change in price between the current closing price and the closing price “n” periods ago. It helps traders identify the momentum of a currency pair, giving insights into whether it’s overbought or oversold.

How Does ROC Work?

The ROC MT4 Indicator calculates the rate of change by comparing the current closing price to the closing price of a specific number of periods ago. It’s expressed as a percentage. A positive ROC indicates that the current price is higher than it was “n” periods ago, suggesting bullish momentum. Conversely, a negative ROC suggests bearish momentum.

Using ROC in Your Trading

Identifying Trends

One of the primary uses of the ROC MT4 Indicator is to identify trends. When the ROC is positive and rising, it indicates a strong bullish trend, signaling that it might be a good time to buy. Conversely, a negative ROC that’s decreasing suggests a bearish trend, indicating a potential selling opportunity.

Divergence

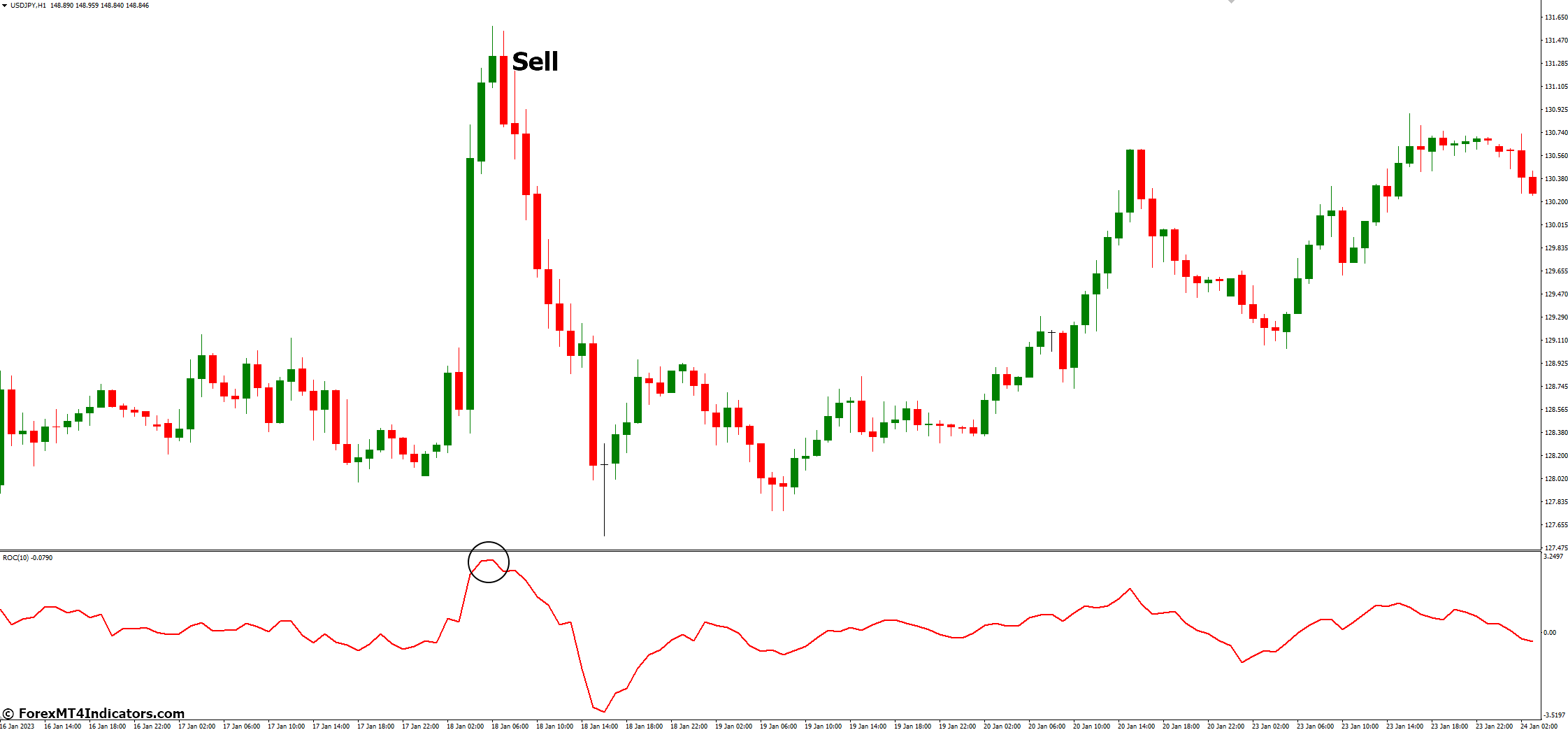

ROC can also be used to spot divergence between the indicator and the price chart. Divergence occurs when the price is moving in one direction, but the ROC is moving in the opposite direction. This can be a signal that a trend is losing steam and might reverse soon.

Overbought and Oversold Conditions

ROC can help identify overbought and oversold conditions. When the ROC reaches extremely high levels, it suggests that the asset may be overbought, and a price correction could be imminent. On the other hand, when the ROC reaches extremely low levels, it indicates that the asset may be oversold, and a price rebound could be on the horizon.

How to Trade with ROC MT4 Indicator

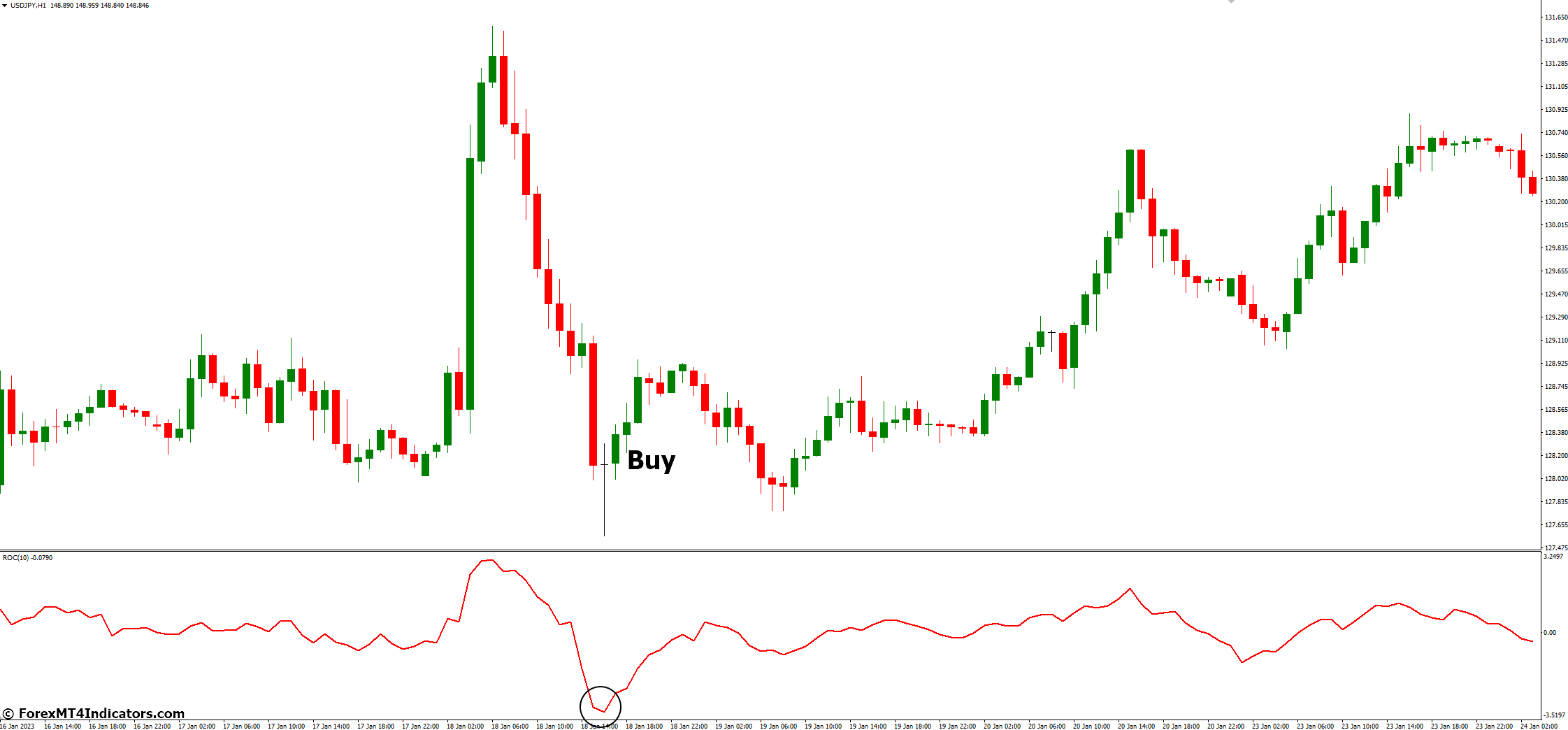

Buy Entry

- Look for a strong positive ROC value.

- ROC measures the percentage change in price over a specified period. A rising ROC indicates bullish momentum.

- Consider a buy entry when ROC crosses above zero or a significant resistance level.

- Combine ROC with other indicators or price analysis to confirm the buy signal.

- Use a trailing stop or other risk management techniques to protect your position.

Sell Entry

- Focus on a significant negative ROC value.

- A falling ROC indicates bearish momentum in the market.

- Consider a sell entry when ROC crosses below zero or a significant support level.

- Always confirm the sell signal with additional technical analysis or indicators.

- Implement risk management strategies to limit potential losses.

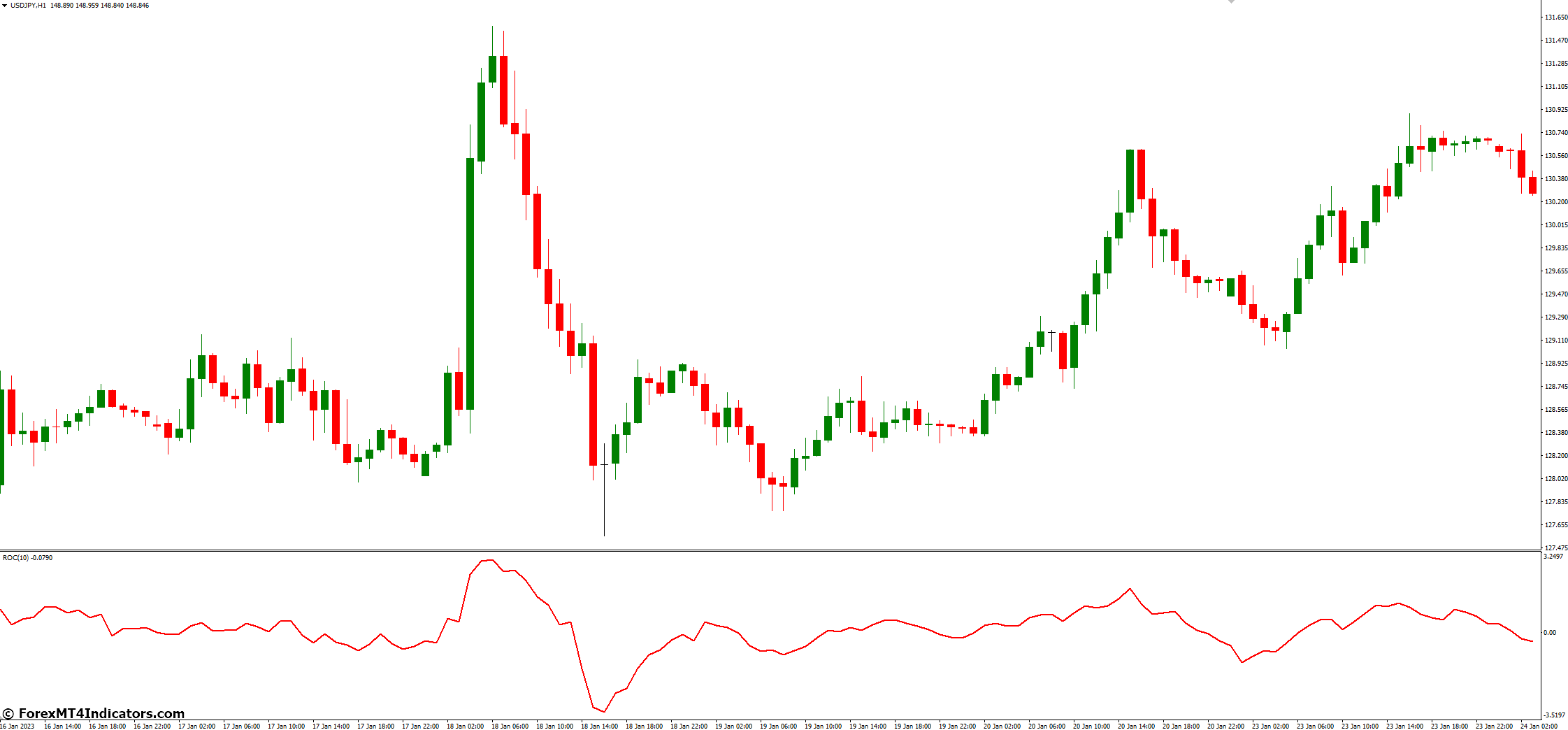

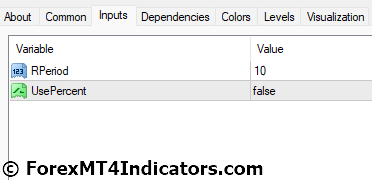

ROC MT4 Indicator Settings

Conclusion

In the fast-paced world of forex trading, having the right tools can significantly impact your success. The ROC MT4 Indicator is a valuable tool that helps traders identify trends, divergence, and overbought/oversold conditions. By understanding how to use this indicator, you can make more informed trading decisions and increase your chances of success.

Frequently Asked Questions

- Is the ROC MT4 Indicator suitable for both beginners and experienced traders?

Yes, the ROC MT4 Indicator can be used by traders of all levels. It provides valuable insights into market momentum and trend direction. - What is the ideal number of periods to use with the ROC indicator?

The ideal number of periods to use with the ROC indicator may vary depending on your trading strategy and the timeframe you’re trading. Experiment with different settings to find what works best for you. - Can the ROC indicator be used in conjunction with other technical indicators?

Absolutely. Many traders use the ROC indicator in combination with other indicators like moving averages and RSI to confirm trading signals. - How often should I check the ROC indicator when trading?

The frequency of checking the ROC indicator depends on your trading strategy and the timeframe you’re using. Some traders monitor it on a daily basis, while others may check it multiple times a day for shorter-term trades.

Recommended MT4/MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

(Free MT4 Indicators Download)

Click here below to download: