Most traders would want to trade at points where the market reverses. Doing so means more profits for the least amount of risk. Traders who are able to catch price as it reverses tend to squeeze the most profit out of a price movement. However, doing so is very difficult to accomplish.

So, how do we catch price at a reversal point? One of the telltale signs of a possible reversal are price rejections. Price rejection is not an actual term in trading. However I would describe it as a point on the price chart where price was quickly turned back by the market after reaching a certain level. In other words the market quickly rejected that price level as it was reached. This is identified by candlesticks with long wicks. This is because long wicks indicate that price quickly reversed after reaching a certain point. The reversals are so quick that price reversed within one candle period. The most notable price rejection candlestick pattern is a pin bar pattern. The long wick and short body signify that price indeed was reversed quick enough.

Price rejections are very effective when they are observed in key areas on a price chart. These are support and resistance levels, dynamic areas of supports and resistances, pivot points, supply and demand areas, etc.

In this strategy, we will be looking at how the Bollinger Bands can be used to identify possible reversals based on price rejection.

Bollinger Bands

The Bollinger Bands is a widely used momentum indicator which can provide so much information for various traders. It can be used to identify trend direction, volatility, overbought or oversold mean reversal signals and momentum breakout signals.

The Bollinger Bands is plotted with three lines that form a channel like structure. The middle line is basically a 20-period Simple Moving Average (SMA) line. As such, the middle line can be used to identify trend direction. This is based on the general location of price action in relation to the middle line, as well as the slope of the middle line. The middle line could also act as a support or resistance level where price could bounce off from in a trending market condition.

The outer bands are basically standard deviations plotted above and below the middle line. Being based on standard deviations, the outer lines can be used to identify volatility. A Bollinger Band that is contracted signify a forex pair in a market contraction phase, while a Bollinger Band that is expanding signify a forex pair in an expansion phase.

The outer lines can also be used to identify momentum breakouts, which typically occur after a market contraction phase. Momentum candles strongly closing outside of the Bollinger Bands indicate a momentum breakout in the direction where the candle broke out from.

Inversely, the same outer lines can be used as a basis for a potential mean reversal signal. This is based on price action indicating that it is rejecting the price level near the outer lines of a Bollinger Band. This is because the area below the lower line marks an oversold level, while the area above the upper line marks an overbought level. Both conditions are prime for mean reversals.

BB Alert Arrows

The BB Alert Arrows indicator is a custom technical indicator which acts as a reversal signal. The signals it produces are based on key areas on the Bollinger Bands.

The BB Alert Arrows indicator detect mean reversal signals based on price action quickly reversing from the outer lines of the Bollinger Bands. It also detects bounces from the middle line while it acts as a dynamic support or resistance level.

In both scenarios, the indicator simply plots an arrow pointing the direction of the reversal. Traders can simply use these signals to make trade decisions.

Trading Strategy

This trading strategy is a reversal trading strategy which is initiated by a mean reversal coming from an overbought or oversold market condition.

First, we identify the long-term trend using the 200 Exponential Moving Average (EMA) line. Trend direction is based on the general location of price action in relation to the 200 EMA line, as well as the slope of the said line.

Then, we make use of the Bollinger Bands to identify overbought or oversold market conditions. This is based on price action showing signs of price rejection on the outer lines of the Bollinger Bands. The BB Alert Arrows should then confirm such price rejection by plotting an arrow pointing the direction of the reversal. This would serve as a valid trade signal.

Indicators:

- BBalert_Arrows

- Bollinger Bands

- 200 EMA

Preferred Time Frames: 30-minute, 1-hour, 4-hour and daily charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

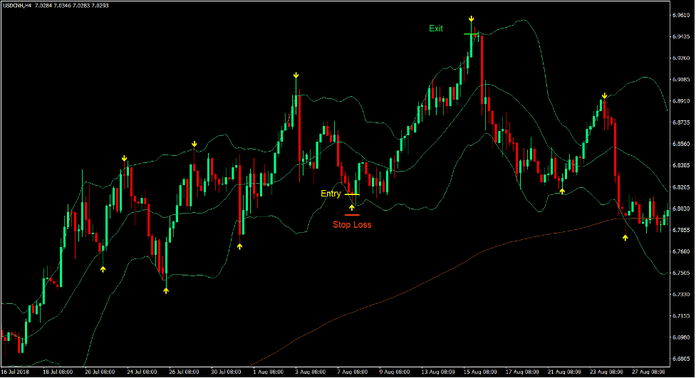

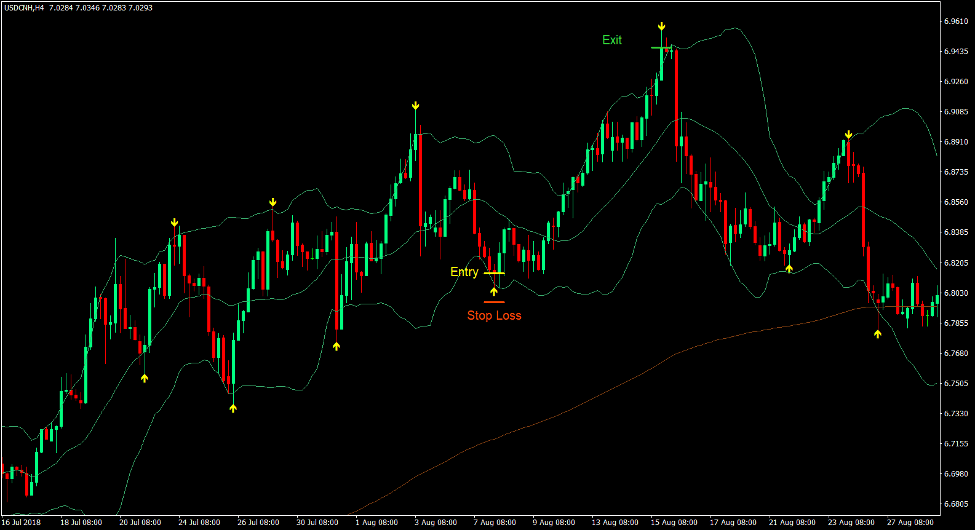

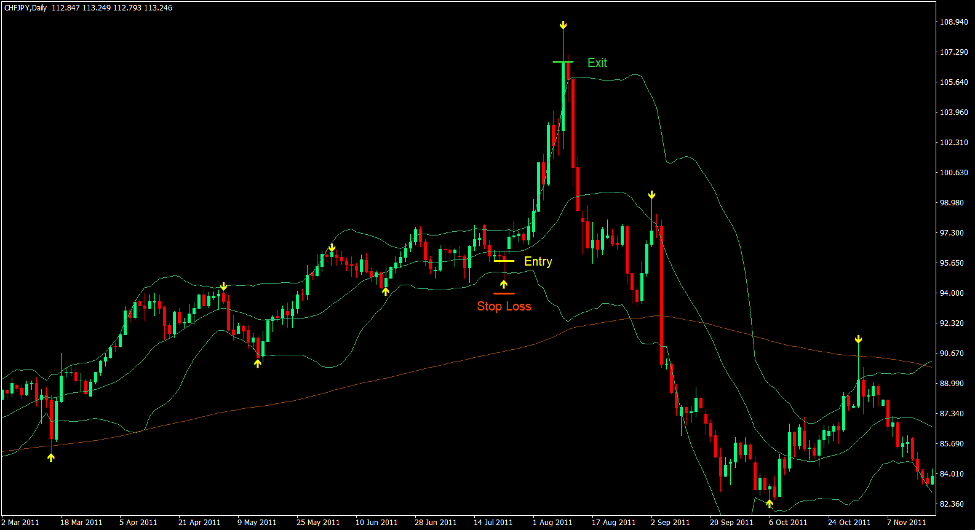

Buy Trade Setup

Entry

- Price action should be above the 200 EMA line.

- The 200 EMA line should slope up.

- Price action should show signs of price rejection on the area touching the lower outer Bollinger Band.

- The BB Alert Arrows should plot an arrow pointing up.

- Enter a buy order on the confirmation of these conditions.

Stop Loss

- Set the stop loss below the arrow.

Exit

- Close the trade as soon as the BB Alert Arrows plot an arrow pointing down.

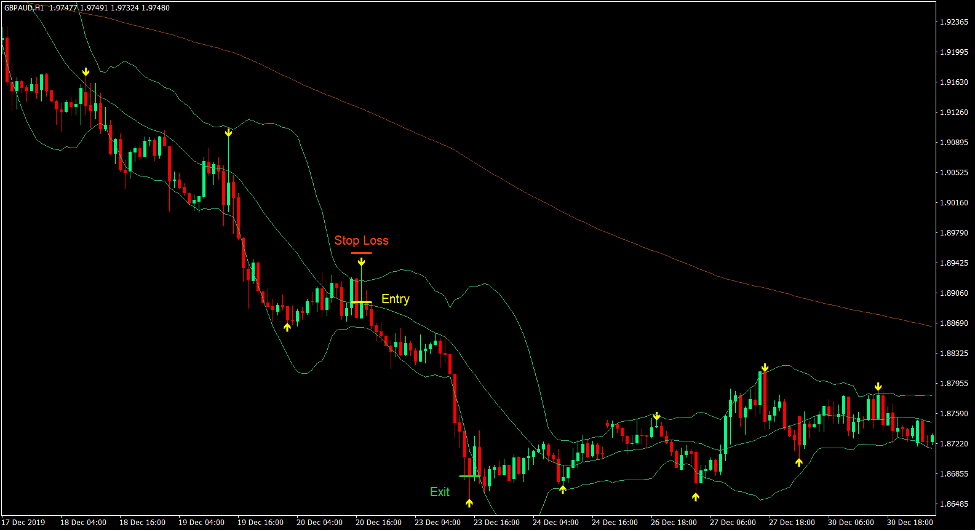

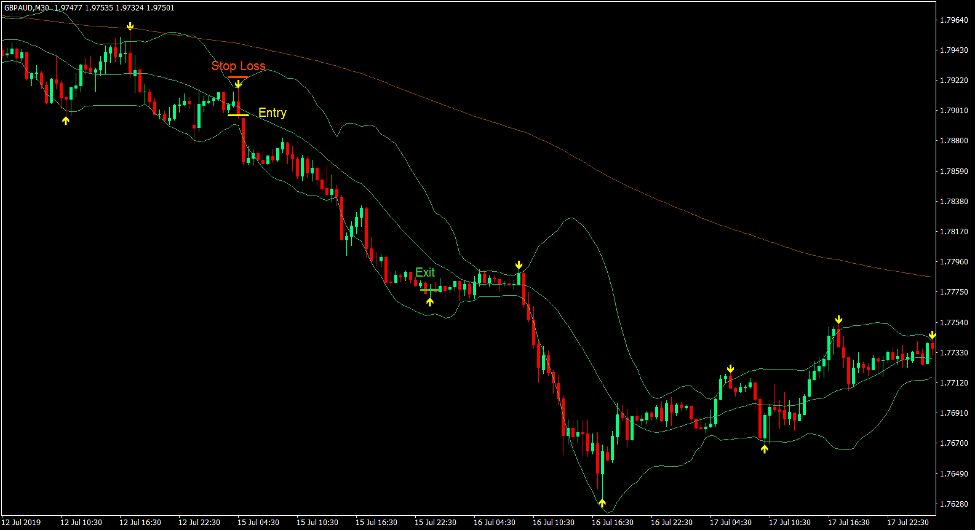

Sell Trade Setup

Entry

- Price action should be below the 200 EMA line.

- The 200 EMA line should slope down.

- Price action should show signs of price rejection on the area touching the upper outer Bollinger Band.

- The BB Alert Arrows should plot an arrow pointing down.

- Enter a sell order on the confirmation of these conditions.

Stop Loss

- Set the stop loss above the arrow.

Exit

- Close the trade as soon as the BB Alert Arrows plot an arrow pointing up.

Conclusion

Mean reversal signals which could turn into potential full-blown trend reversals are great trading opportunities. However, spotting these reversal points are very difficult to accomplish.

The use of Bollinger Bands as a means of identifying potential reversal points is popular among many traders. In fact, many profitable traders use this method. Most use their knowledge of candlestick patterns are their gutfeel to make decisions. However, new traders still do not have this skill.

This strategy allows new traders to systematically identify such reversal points making it easier for them to trade.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: