Are you a trader in the Forex market, constantly seeking ways to improve your trading strategies? If so, you’re in the right place. In this article, we’ll delve into the fascinating world of the Pin Bar MT4 indicator, exploring its significance, functionality, and how you can effectively incorporate it into your trading toolkit. So, let’s dive in and unravel the secrets behind this powerful tool.

Anatomy of a Pin Bar

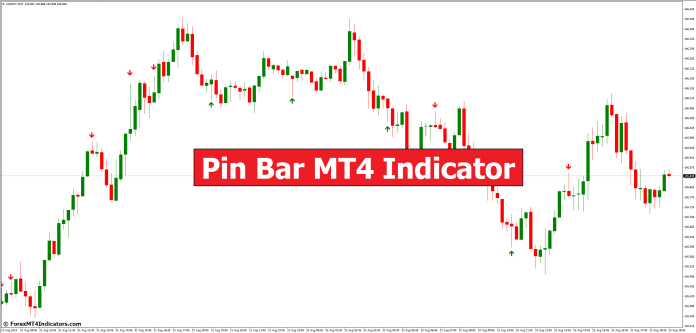

A Pin Bar, also known as a “Pinocchio Bar,” comprises a single candlestick with a small body and a long wick on one side. The small body represents a brief consolidation of price, while the elongated wick indicates a rejection of higher or lower levels. This rejection can be a pivotal point for traders, as it suggests a potential shift in market sentiment.

Identifying Pin Bars on MT4

Identifying Pin Bars on the MT4 platform involves recognizing the candlestick pattern and interpreting it within the context of the prevailing market conditions. The wick should be at least two times longer than the body of the candlestick, making it stand out visually.

Pin Bar Patterns and Their Interpretations

Bullish Pin Bar

A Bullish Pin Bar forms when the candlestick’s body is at the bottom, indicating a reversal from a downtrend to an uptrend. It implies that buyers are gaining control and might push prices higher.

Bearish Pin Bar

Conversely, a Bearish Pin Bar develops when the candlestick’s body is at the top. This signals a potential reversal from an uptrend to a downtrend, suggesting that sellers could take over.

Advantages of Using Pin Bar MT4 Indicator

The Pin Bar MT4 indicator offers several advantages:

- Simplicity: Its straightforward pattern makes it accessible to traders of all experience levels.

- Versatility: It can be used in conjunction with other indicators and strategies.

- High Probability: Pin Bars appearing at key support or resistance levels tend to have higher accuracy.

Pin Bar Strategies for Effective Trading

Pin Bar with Support and Resistance

Combining Pin Bars with support and resistance levels enhances the likelihood of accurate predictions. A Pin Bar bouncing off a significant level strengthens the signal’s validity.

Pin Bar with Trendlines

Pin Bars intersecting with trendlines provide valuable insights. If a Bullish Pin Bar aligns with an upward trendline, it amplifies the potential for an uptrend continuation.

Pin Bar with Fibonacci Retracement

Incorporating Pin Bars with Fibonacci retracement levels can help pinpoint potential reversal zones, leading to well-timed trades.

Common Mistakes to Avoid

- Overtrading based solely on Pin Bars.

- Ignoring the broader market context.

- Neglecting proper risk management.

Pin Bar Indicator vs Other Price Action Tools

Compared to other price action tools, the Pin Bar indicator stands out due to its simplicity and clear entry and exit signals.

A Real-world Example

Consider a scenario where a Bearish Pin Bar forms after a prolonged uptrend. This could be an early sign of a trend reversal, prompting traders to consider short positions.

Tips for Novice Traders

- Practice identifying Pin Bars on historical data.

- Start with higher timeframes for more reliable signals.

- Combine Pin Bars with other technical tools for confirmation.

Expert Insights

Experienced traders often use Pin Bars as part of a larger strategy, taking into account the overall market conditions and other indicators.

Pin Bar Indicator on Different Timeframes

Pin Bars can offer valuable insights on various timeframes, from short-term scalping to long-term investing. Adapting your strategy to different timeframes is key.

Backtesting Your Strategy with Pin Bar Indicator

Backtesting your trading strategy using historical data and Pin Bar signals helps validate its effectiveness before risking real capital.

How to Trade with Pin Bar MT4 Indicator

Buy Entry

- Look for a bullish pin bar formation on the chart. A bullish pin bar has a long lower tail (wick) and a small upper body, indicating a potential reversal from a downtrend to an uptrend.

- Once a bullish pin bar is identified, consider waiting for confirmation before entering a buy trade. Confirmation could come from a subsequent bullish candlestick, a break above the high of the pin bar, or other supporting indicators.

- Place a buy entry order above the high of the bullish pin bar or the confirming candlestick.

- Set a stop-loss order below the low of the pin bar to protect your trade from potential losses.

- Consider setting a take-profit order at a reasonable target level, such as a recent resistance level or a predetermined risk-to-reward ratio.

Sell Entry

- Search for a bearish pin bar formation on the chart. A bearish pin bar has a long upper tail (wick) and a small lower body, suggesting a potential reversal from an uptrend to a downtrend.

- As with buying entries, it’s advisable to wait for confirmation before entering a sell trade. Confirmation could come from a subsequent bearish candlestick, a break below the low of the pin bar, or other supporting indicators.

- Place a sell entry order below the low of the bearish pin bar or the confirming candlestick.

- Set a stop-loss order above the high of the pin bar to manage risk.

- Determine a suitable take-profit level, such as a recent support level or a predetermined risk-to-reward ratio.

Conclusion

Incorporating the Pin Bar MT4 indicator into your trading arsenal can elevate your decision-making process and improve your trading outcomes. Remember that like any tool, it’s most effective when used in conjunction with a comprehensive trading strategy and risk management plan.

FAQs

Q1: Can the Pin Bar indicator be used for day trading?

A: Yes, the Pin Bar indicator can be utilized effectively for day trading. However, it’s crucial to combine it with other technical tools and consider the broader market context to enhance its accuracy.

Q3: What’s the recommended risk-to-reward ratio when trading Pin Bars?

A: It’s recommended to aim for a risk-to-reward ratio of at least 1:2 when trading Pin Bars. This means that your potential profit should be at least twice the amount you’re willing to risk on a trade.

Q4: How do I filter out false Pin Bar signals?

A: To filter out false Pin Bar signals, consider using additional confirmation indicators or techniques. Look for confluence with other technical tools such as support and resistance levels, trendlines, and oscillators to increase the validity of the signal.

Recommended MT4/MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

(Free MT4 Indicators Download)

Click here below to download: