There are two psychological factors that play with a trader’s mind whenever they are trading the forex market. One is greed and the other is fear. While most traders blame greed for causing them to lose money when trading, fear is also just as damaging to a trader’s account.

Seasoned traders know that wins and losses are a given when trading the market. Often, traders lose money out of greed, which often causes them to get out of their game plan. However, disciplined traders lose money not because of greed but purely because the market is the market and it does whatever it wants to do. It is all part of the statistics of his or her strategy. However, at times traders cannot recuperate from their losses, which is a part of the statistics, because they are afraid to take trades that could have potentially earned them profits. This is all because of fear.

One of the clear opportunities that traders often miss out on is when the market starts to trend. Many traders drool when they see the market trending, wishing that they were able to take the trade at the start of the trend. However, out of fear that the trend may soon end, they would rather not take any risk.

Trending markets have so much potential. Traders just need to know how to enter a trending market without trying to chase price.

Ichimoku Kinko Hyo

Ichimoku Kinko Hyo is one of the few technical indicators which can claim to be a complete trading system all by itself. This is possible because this indicator provides traders a bird’s eye view of what the market is doing, from the long-term trend down to the short-term trend and immediate price action.

The Ichimoku Kinko Hyo is composed of several modified moving average lines, which are mostly based on the median of price within a certain period.

The Tenkan-sen or conversion line is computed as the median of price within the last nine periods. This line represents the short-term trend. This line is usually used to confirm short-term trend reversals along with the Kijun-sen line.

The Kijun-sen or base line is based on the median of price over the last 26 periods. This line represents the short- to mid-term trend. This line can be used as a trailing stop loss point since this could be an early warning of a possible trend reversal.

Senkou Span A or leading span A is derived from the median of the Tenkan-sen and Kijun-sen plotted 26 periods ahead.

Senkou Span B or leading span B is the median of price over the past 52 periods plotted 26 periods ahead.

The Senkou Span A and B form the Kumo or cloud. The Kumo represents the direction of the long-term trend. The long-term trend is bullish if the Senkou Span A is above Senkou Span B. On the other hand, the long-term trend is bearish if the Senkou Span A is below Senkou Span B.

Chikou Span or lagging span is the current periods closing price plotted 26 periods back. This line can be used to determine the characteristics of price action. It can also be used to identify potential support or resistance levels based on its swing points.

FBS Fisher

FBS Fisher is an oscillator type of technical indicator which is based on the concept of a Gaussian normal distribution. This indicator derives its computation from the historical movements of price action and converts the figures into a Gaussian normal distribution. This normalizes price movements within an oscillator range, which in turn helps traders identify potential oversold or overbought markets that could reverse.

The resulting figures are plotted as histogram bars that could either be positive or negative. This indicator also modifies the color of the bars to indicate a potentially strengthening or weakening momentum.

Positive gold bars indicate a strengthening bullish trend, while negative gold bars indicate a strengthening bearish trend. Positive red bars indicate a weakening bullish trend, while negative lime bars indicate a weakening bearish trend.

Trading Strategy

Ichimoku Fisher Forex Trading Strategy can be used as a long-term trend following strategy or a trend re-entry strategy.

The Kumo is used to identify the direction of the long-term trend based on how the Senkou Span A and B overlap, as well as the color shaded on the area inside the Kumo.

Pullbacks would cause the Tenkan-sen and Kijun-sen to temporarily reverse. It should also cause the FBS Fisher bars to temporarily reverse.

The market is considered to be continuing its trend direction if the Tenkan-sen crosses over the Kijun-sen towards the direction of the trend and the FBS Fisher crosses over the midline and plots gold bars indicating the direction of the trend. This would constitute a valid trade setup.

Indicators:

- Ichimoku Kinko Hyo

- FBS Fisher

Preferred Time Frames: 1-hour and 4-hour charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

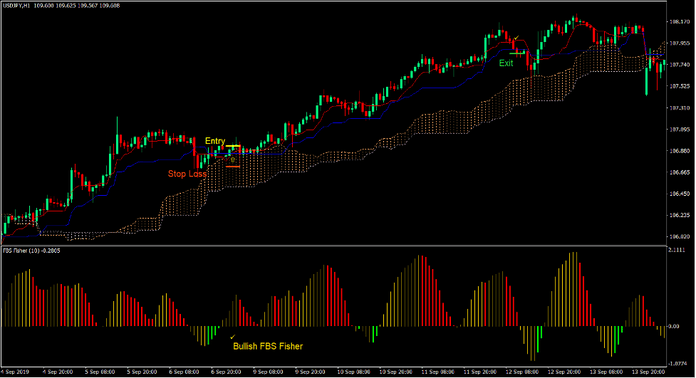

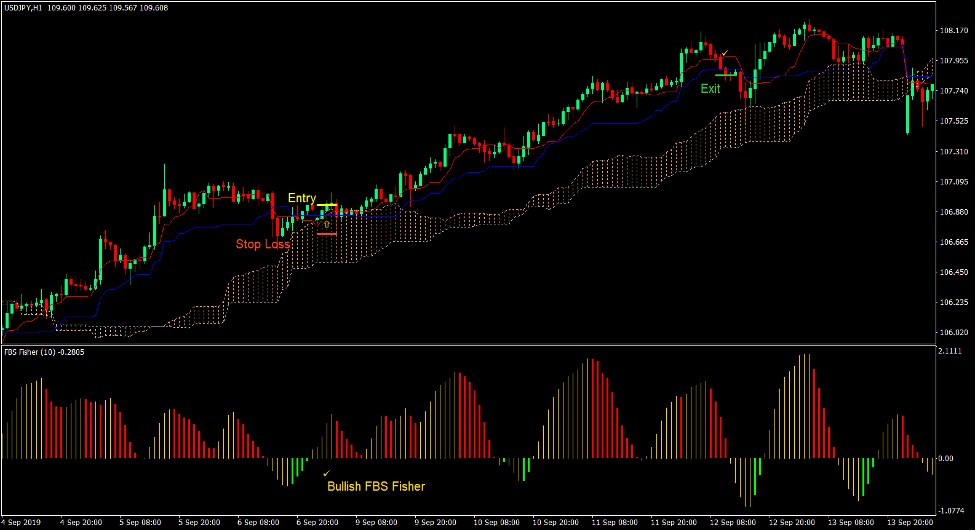

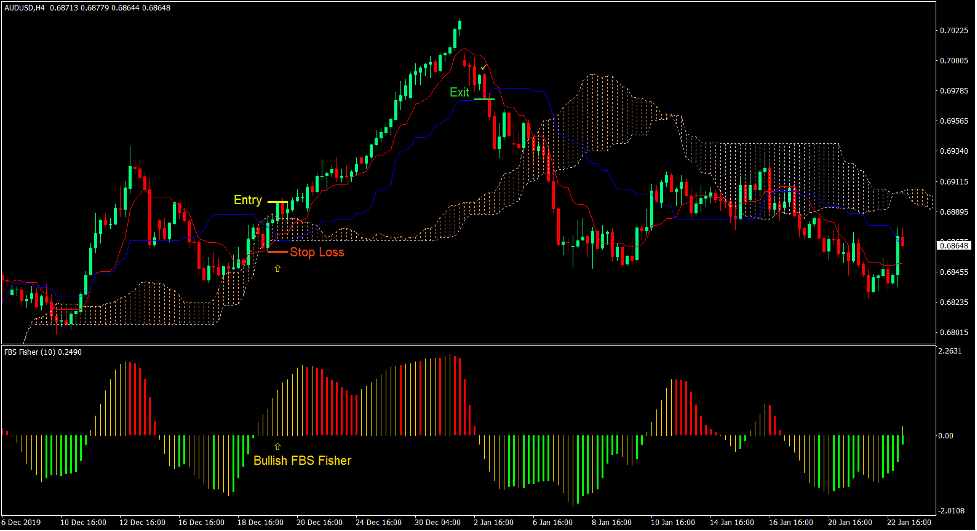

Buy Trade Setup

Entry

- The Senkou Span A should be above the Senkou Span B and the Kumo should be sandy brown.

- Price action should be trending up.

- Price should pull back towards the Kumo causing the Tenkan-sen to temporarily cross below the Kijun-sen and the FBS Fisher bars to be negative.

- Enter a buy order as soon as the FBS Fisher plots a positive gold bar and the Tenkan-sen crosses above the Kijun-sen.

Stop Loss

- Set the stop loss on the support below the entry candle.

Exit

- Close the trade as soon as price closes below the Kijun-sen.

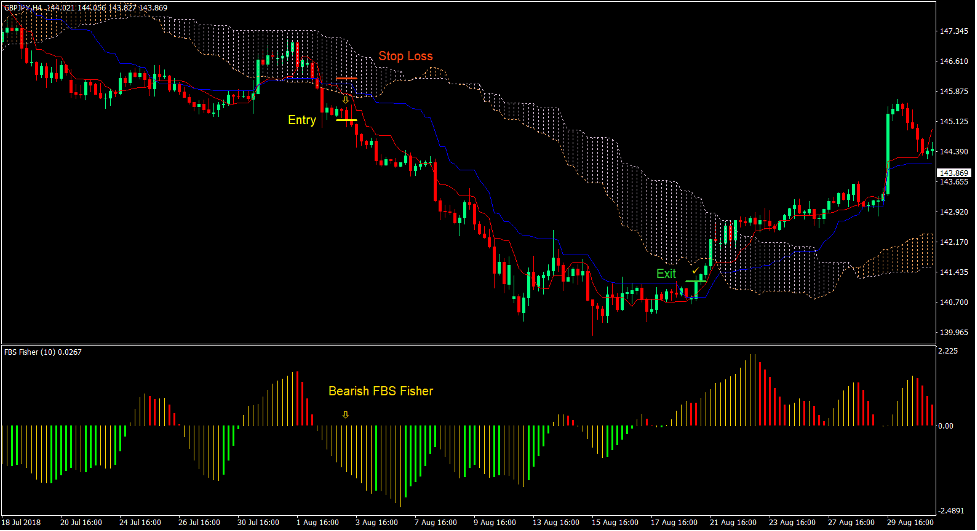

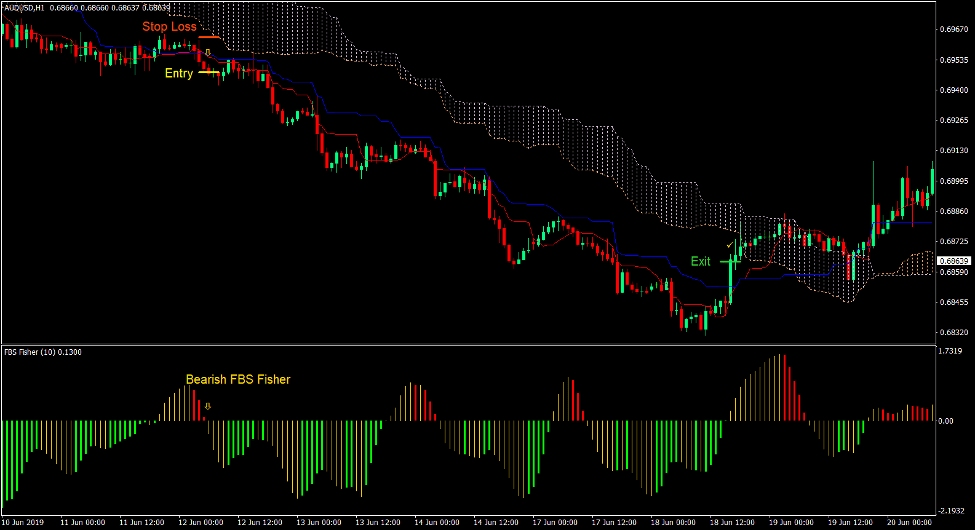

Sell Trade Setup

Entry

- The Senkou Span A should be below the Senkou Span B and the Kumo should be thistle.

- Price action should be trending down.

- Price should pull back towards the Kumo causing the Tenkan-sen to temporarily cross above the Kijun-sen and the FBS Fisher bars to be positive.

- Enter a sell order as soon as the FBS Fisher plots a negative gold bar and the Tenkan-sen crosses below the Kijun-sen.

Stop Loss

- Set the stop loss on the resistance above the entry candle.

Exit

- Close the trade as soon as price closes above the Kijun-sen.

Conclusion

The Ichimoku Kinko Hyo indicator is an indicator which can be a complete trading system all by itself. In fact, crossovers between the Tenkan-sen and Kijun-sen while being aligned with Kumo is considered a common Ichimoku Kinko Hyo strategy.

The FBS Fisher serves as an additional layer of confirmation which traders can use to improve on their win probability. However, traders can also opt to use the shifting of the FBS Fisher bars to serve as an entry trigger. This would be a more aggressive method but it can also mean an earlier entry which should allow traders to squeeze out a bit more profits.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: