Simple Trend Retracement Forex Trading Strategy

“Trade with the trend!”, “The trend is your friend!” You may have heard this age-old maxim that traders love to say. This is so true, and I can’t stress it even more. This is the cornerstone of most of my trading strategies. I usually want to trade with the trend. Sure, there are setups that could be done to trade ranging markets, but I find it much easier to trade with the trend.

However, though trading with the trend is supposed to be easier, sometimes trading with the trend, especially momentum trades, leave you being caught right at the peak of a short rally. This often causes traders to be stopped out or panic as price starts to turn down. Little did they know, it could just be one of the many short retracements and thrusts that price does as it rallies upward.

So, how do we get around this. Should we just enter the trade anywhere we want as long as it is in the direction of the trend? Many momentum traders do this, and it seems to work for them. But it also carries its own risks. It could be that these short retracements could cause your stop losses to be hit more often than not. Should we just not put a stop loss and wait for price to return to profit then? Sure. Many traders do that too, and it works for them. But you’d have to be mindful of your position sizes. This leaves you no choice but to have very small lots relative to your account balance. But what if you’d want to be able to scale your position sizes? You’d then have to have a stop loss to limit your risk.

We may be left in a conundrum here. How do we scale our position sizes, limit our risk, and at the same time profit on a trending market? The answer? Sound entry setups. This is the usual weakness of trending and momentum strategies. These type of strategies sometimes just forgo logical entries and start chasing prices. By disregarding the importance of sound entries, we end up buying high and hoping it gets higher. We also end up not knowing where it could stop if it decides to turn against us. If ever we do have an idea where it would stop, it is often far from our entry price. This leaves us with a wide stop loss. Which leaves us no room to scale our position sizes.

Now the question is, where should our entries be? Retracement. This is where we are to place our entries – at retracement. This allows us to enter when price has come back to a level that is not too expensive or too cheap (for sell setups). This also gives us an idea that price would more likely turn towards the direction we want to trade, since it is just a retracement.

Now, what I’m gonna show you is not perfect. But it is a logical strategy. Buy relatively cheaper in a bullish trending market, or vice versa for bearish markets.

The Setup: How to Trade Retracements Using Moving Averages

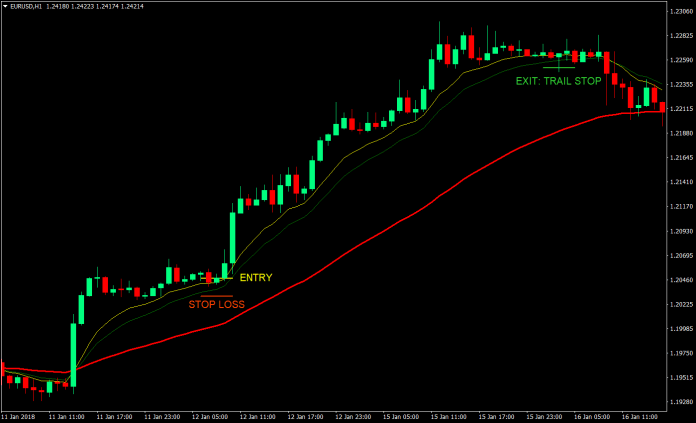

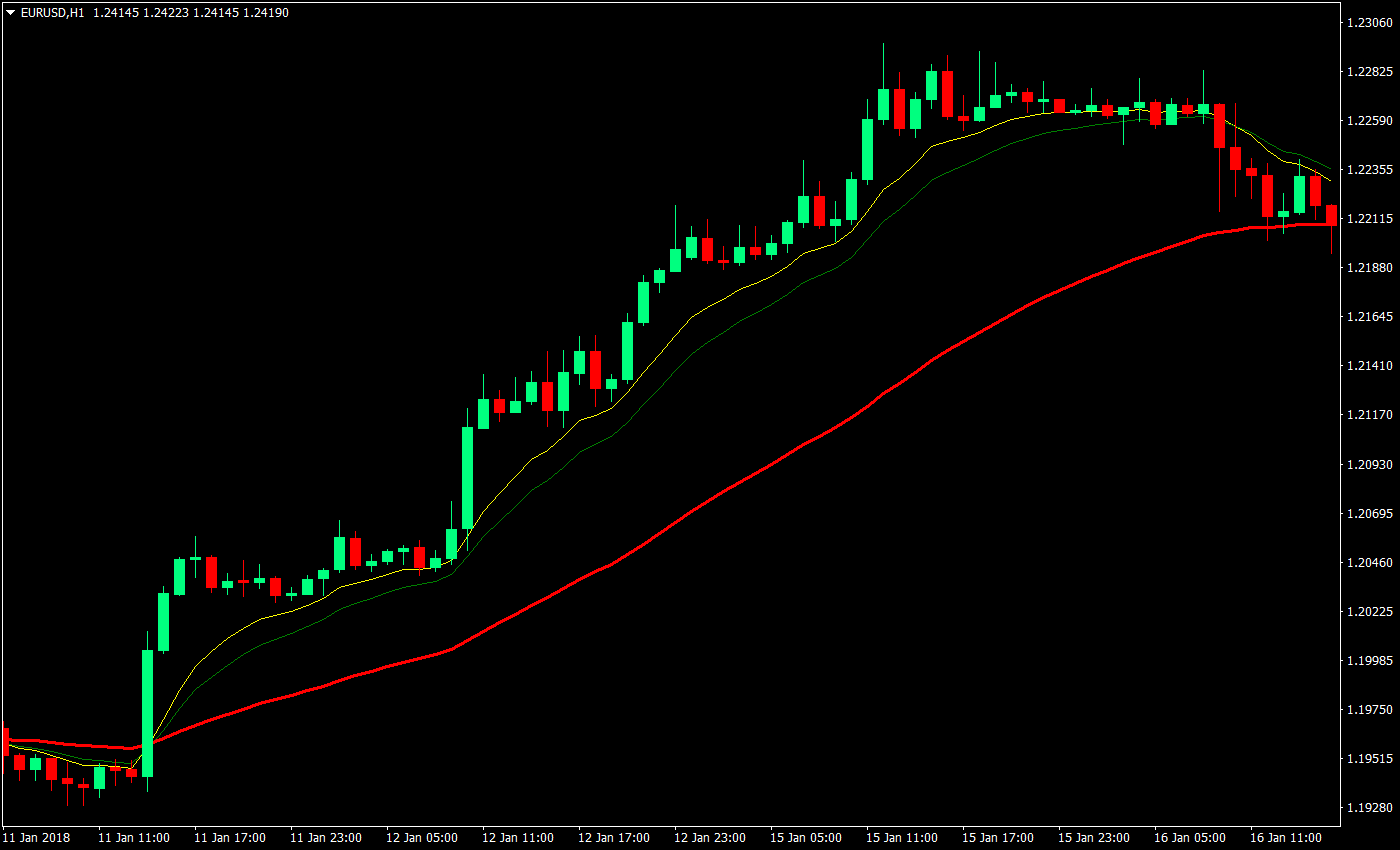

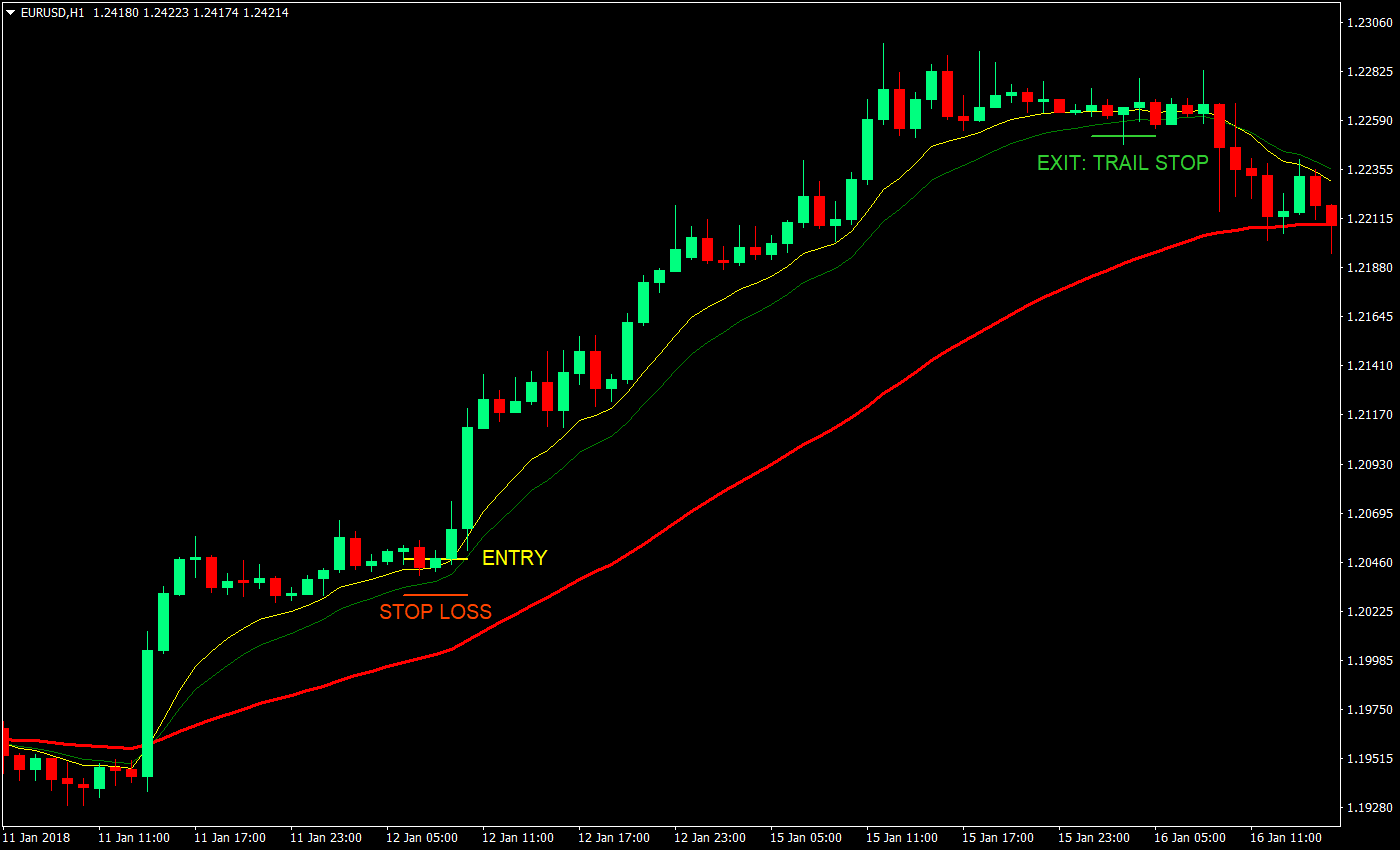

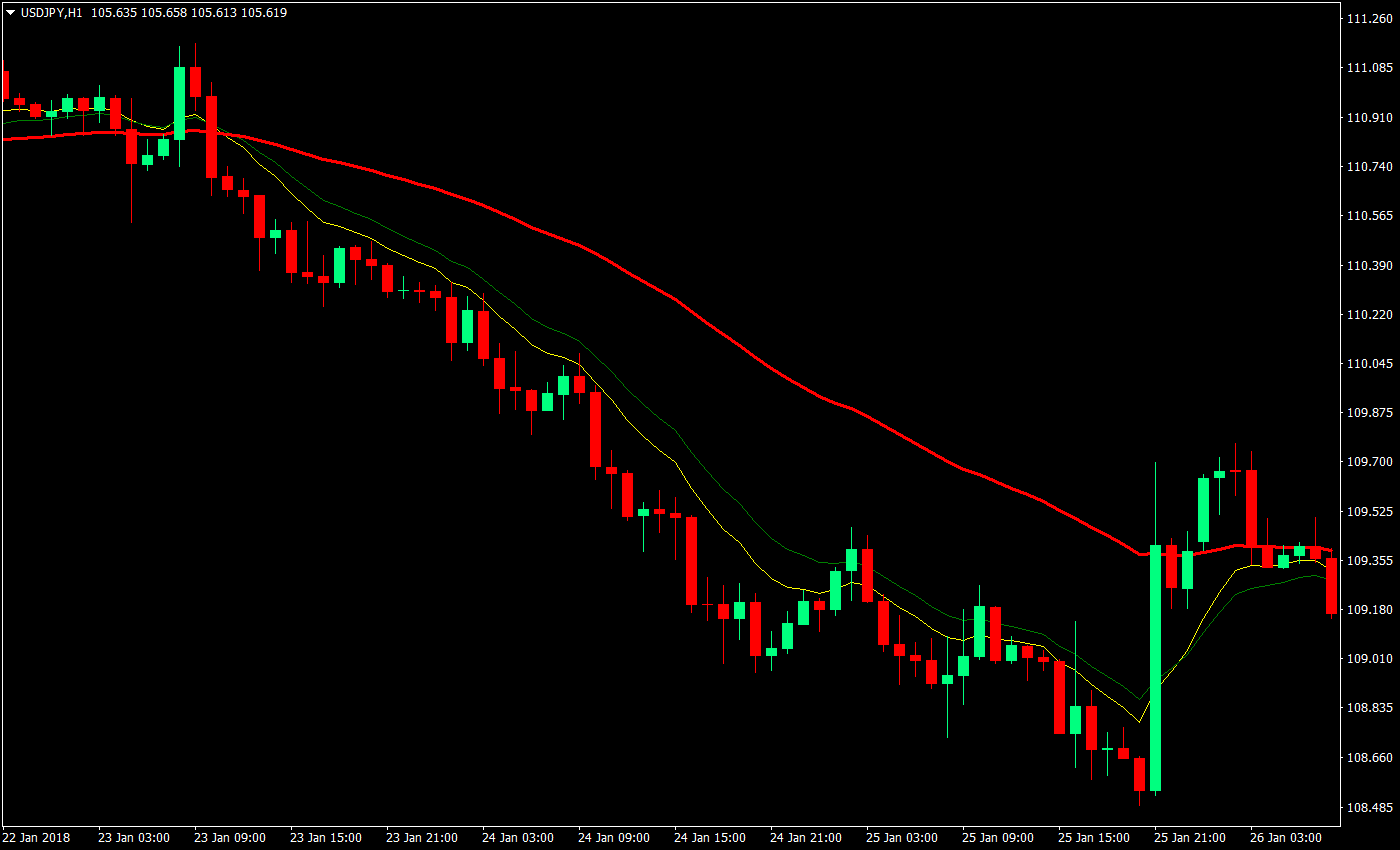

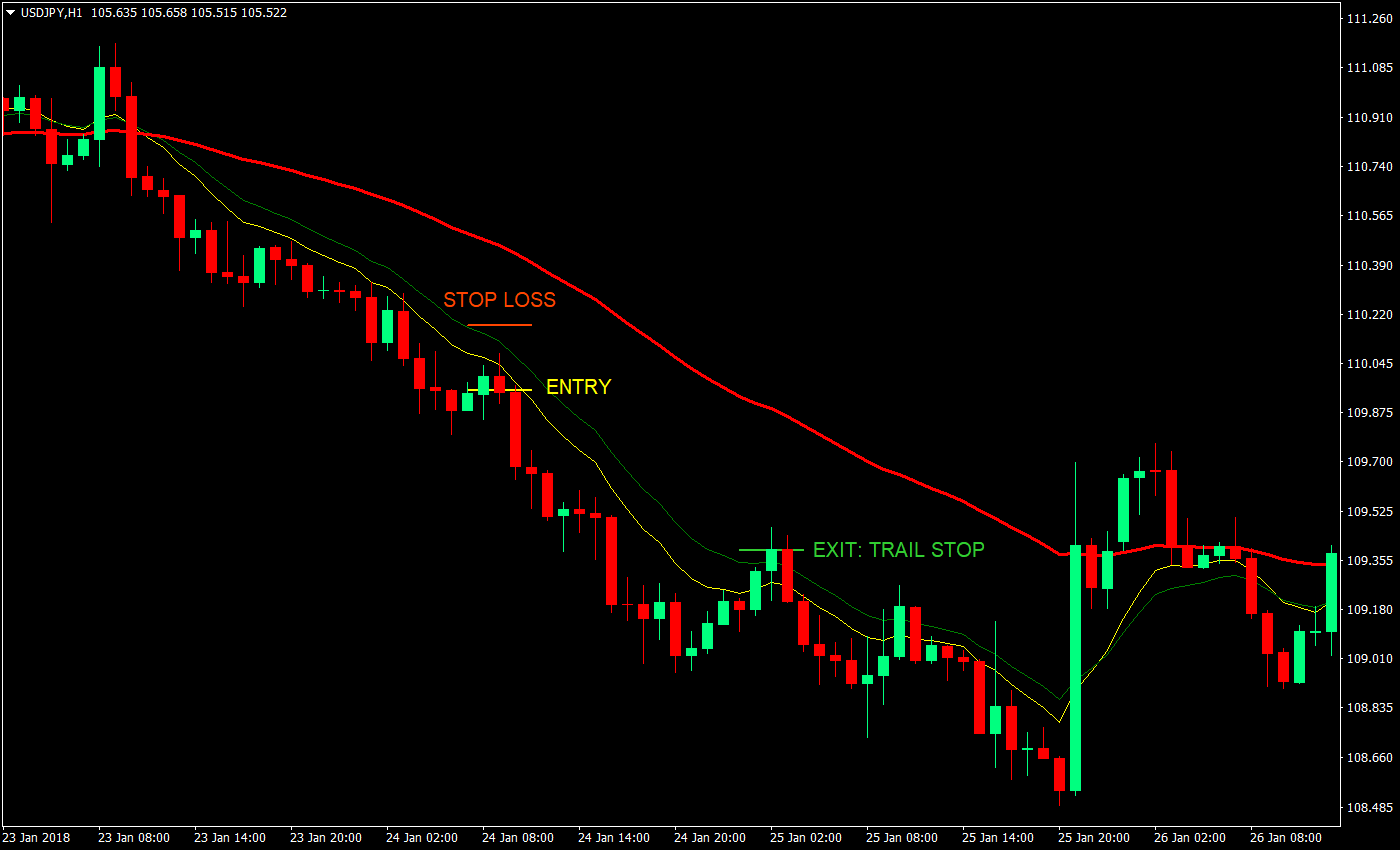

Yes, we will be using moving averages to identify these retracements. More specifically, we will be using the 10, 15, and 50 Exponential Moving Average (EMA). The 10 and 15 EMA would be our signal EMAs, while the 50 EMA will mainly be a filter for directional bias.

For our charts, the EMAs will be as follows:

- 10 EMA: yellow line

- 15 EMA: green line

- 50 EMA: red line

Now, on to our setups.

Buy Entry:

- Yellow and green lines should be above the red line.

- Yellow line should be above the green line.

- Price should be above the yellow line.

- Then allow price to retrace back in between the 10 and 15 EMA but not closing below it.

- Wait for price to close back above the 10 EMA.

- As soon as price closes above the 10 EMA, enter a buy market order.

Stop Loss: A few pips below the 15 EMA.

Exit: Trail the stop loss a few pips below the 15 EMA as the trade starts to profit.

Sell Entry:

- Yellow and green lines should be below the red line.

- Yellow line should be below the green line.

- Price should be below the yellow line.

- Then allow price to retrace back in between the 10 and 15 EMA but not closing above it.

- Wait for price to close back below the 10 EMA.

- As soon as price closes below the 10 EMA, enter a sell market order.

Stop Loss: A few pips above the 15 EMA.

Exit: Trail the stop loss a few pips above the 15 EMA as the trade starts to profit.

Conclusion

This strategy is something that would really be effective in trending situations. It won’t be perfect, but what it gives you is the ability to have tight stop losses due to the narrow 10-15 EMA area, giving you a good Risk-Reward Ratio. This also streamlines your trade helping you avoid choppy markets, which usually means trouble.

However, as said earlier, this strategy works best on trending markets. This would not work for ranging choppy markets. Also, try to avoid taking trades that are already towards the end of the trend. You would know this by looking one timeframe higher and seeing if the trend is already overextended. Also, trends usually don’t last too long since markets range more than it trends. So, if you are seeing a chart that already has more than four thrusts going the direction of the trend, try looking at the higher timeframe, it might already be overextended. Also, avoid taking trades on charts that already shows signs of reverse pressure. You would notice that towards the end of these charts, price has been closing below the 15 EMA, and even challenging 50 EMA. These are signs that the trend might be ending and could either start to range, or even reverse.

As always, study the strategy, and even develop it further if you’d want to.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: