Forex RSI Strategy Introduction:

What is RSI?

[toc]RSI is the short version of Relative Strength Index. A momentum oscillator which measures the speed and changes of the market price. The indicator was developed by Welles Wilder. He also developed other famous indicators such as Parabolic SAR, Average Directional Index etc. End of the RSI background story.

So, what’s inside this report?

In this post, you’ll discover the 2 methods for using RSI effectively. This short and to the point blog post will help to understand and learn how to use RSI effectively.

Here is the basic knowledge you can understand with RSI:

Trend

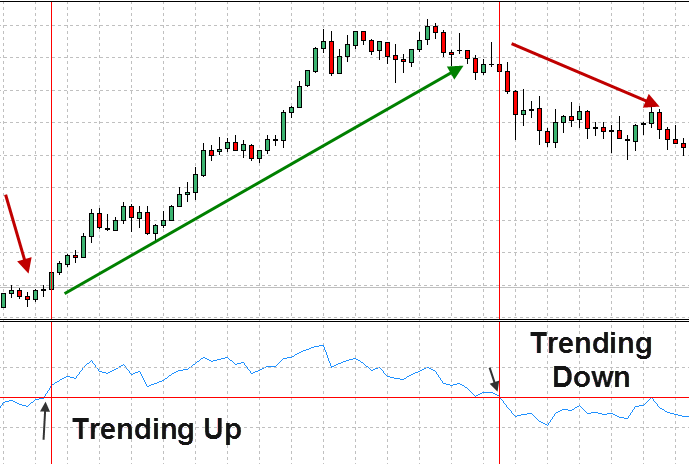

You can find the trend by knowing the direction of the RSI line.

The middle line on the RSI window is 50

If the RSI line is above 50, then trend is up.

If the RSI line is below 50, then the trend is down.

However, this is not the main method you’re going to discover.

The Forex RSI Strategy Method:

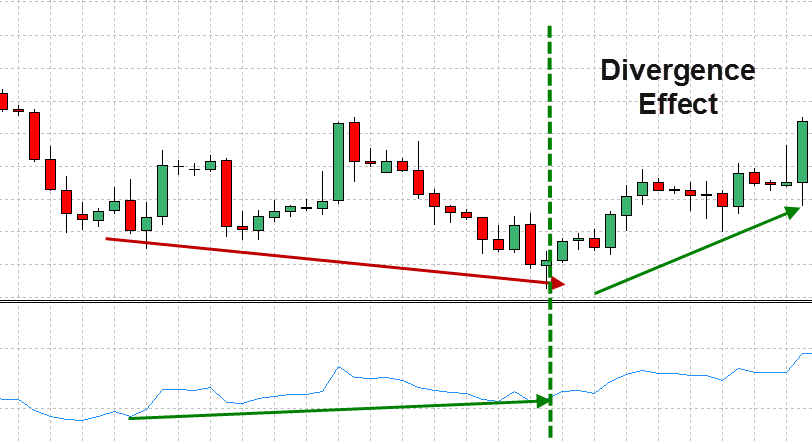

Forex RSI Strategy Method 1: Divergence

RSI also can be used to find divergence signal. Divergence happens when the price of the market is not aligns with the RSI direction.

For example, the EUR/USD price is trending up while RSI is trending down, notice the direction of market is not align with trend so this is called divergence. In this case, this is called buy divergence.

Divergence is indeed effective for finding accurate and early reversal signal.

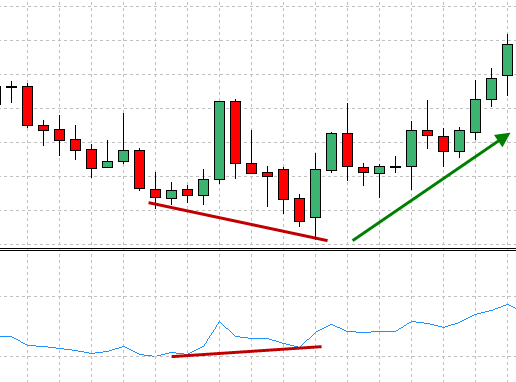

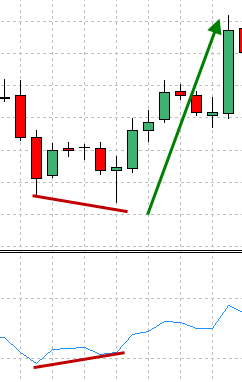

Buy Signal:

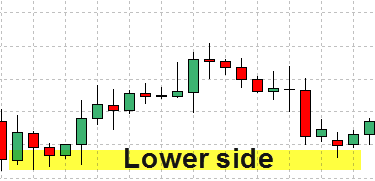

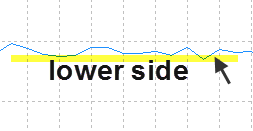

Lower Side of price and RSI

Lower Side of price and RSI

– The buy/positive divergence happens on the lower side of the price and RSI (notice I don’t use lower high or etc because I want to keep it simple to understand for most traders)

RSI divergence in action: Example 1

Example 2

Example 3:

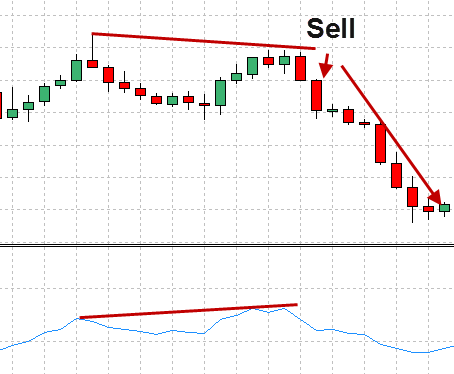

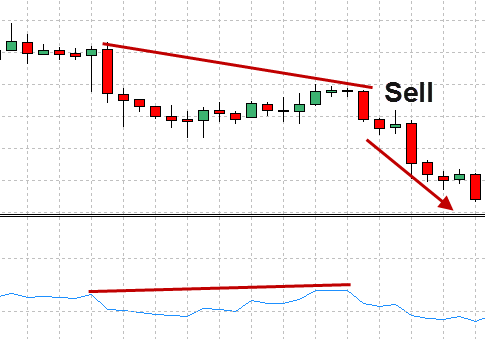

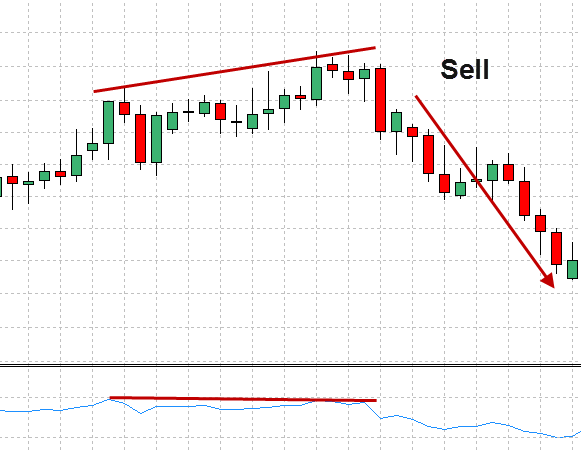

Sell Signal:

– The sell/negative divergence happens on the upper side of the RSI and the price.

See RSI divergence in action:

Example 1

Example 2

Example 3:

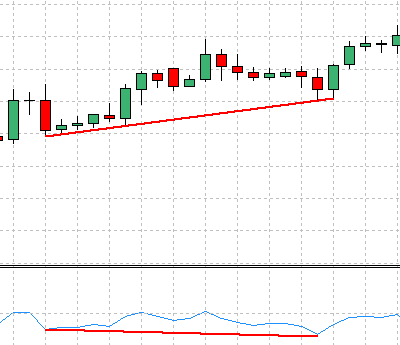

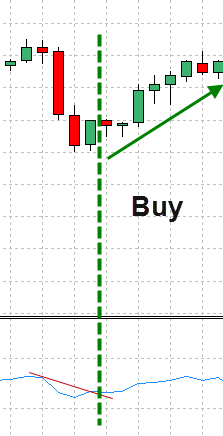

Forex RSI Strategy Method 2: RSI Trend lines breakout

We can also use trend lines on the RSI to identify the turning point of the trend.

Buy signal: Enter on the next candle after the break of the trend line on RSI.

Example:

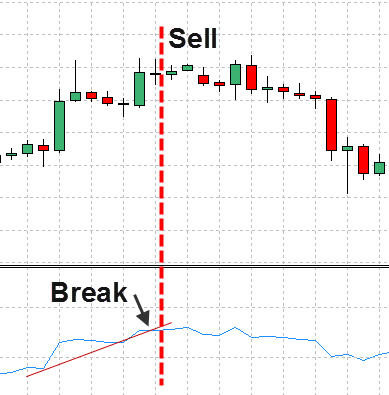

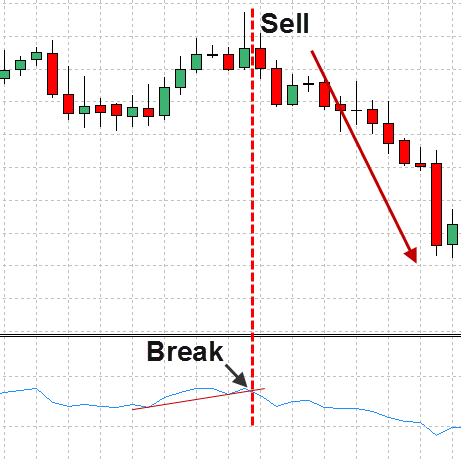

Sell signal: Enter on the next candle after the break of the trend line on RSI.

Example 1:

Example 2:

The Forex RSI Strategy Method In A Nutshell:

So, here is a basic outline of what you’ll be doing with these methods:

1. Method 1: Upper divergence for sell, Lower divergence for buy signal.

2. Method 2: Use trendline breakout to determine the turning point of the market.

***Tip: Combine the methods with candlestick pattern will significantly boost the confirmation.

I hope you enjoyed reading this short, simple blog post on an easy way to dominate RSI. I wish you the best success in your trading! Do share this post if you find it useful 🙂

Best,

Tim Morris

admin @ ForexMT4Indicators.com

Recommended Forex Trading Broker

- Free $30 To Start Trading Instantly

- No Deposit Required

- Automatically Credited To Your Account

- No Hidden Terms

Lower Side of price and RSI

Lower Side of price and RSI

Hi Tim, Thanks for the great sharing. It is very useful for my trading 🙂

Thanks! I’m glad that you like it. I will do my best to share more forex trading tips and strategies 🙂

i cannot loaddown

Hi Yam, there is no download for this. It’s a post about RSI Strategy.

– Admin

Download Link please?

Hi shofiurbwh, There’s no download link for this strategy. All theory are on this site.

Thanks,

Tim

thanks so much you made forex simpler by detailed explanation of key components