Bowel Bounce Forex Trading Strategy

To trade the markets effectively, a trader must have an idea how the market moves, more specifically, how price moves.

So, how does price really move? Price moves in a manner in which it bounces off certain price points. This is what traders call supports and resistances. There are many ways to determine supports and resistances among traders. Some use trendlines, others pivot points, while others prefer moving averages. But of course, all these to some extent works, because all of these are either based on average prices or certain notable price points in a chart.

Today, we will be discussing a certain manner in which we could decipher how price bounces off certain price points. Think of price as a pin ball bouncing back and forth. The only difference is that it is bouncing off tight spaces. Now, imagine dropping the pinball inside a pipe that bends up and down, left and right, and all over the place. That is how price moves. As you can imagine it, price would certainly bounce back and forth in a very unpredictable manner.

But there is a technique to somehow intelligently guess where price is bouncing off.

The Setup: Bowel Bounce Strategy

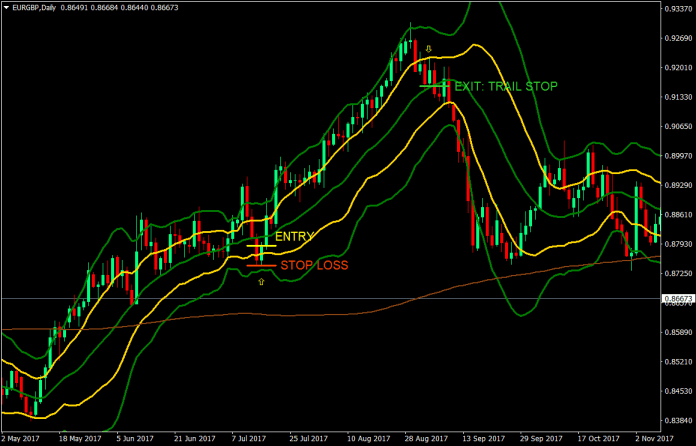

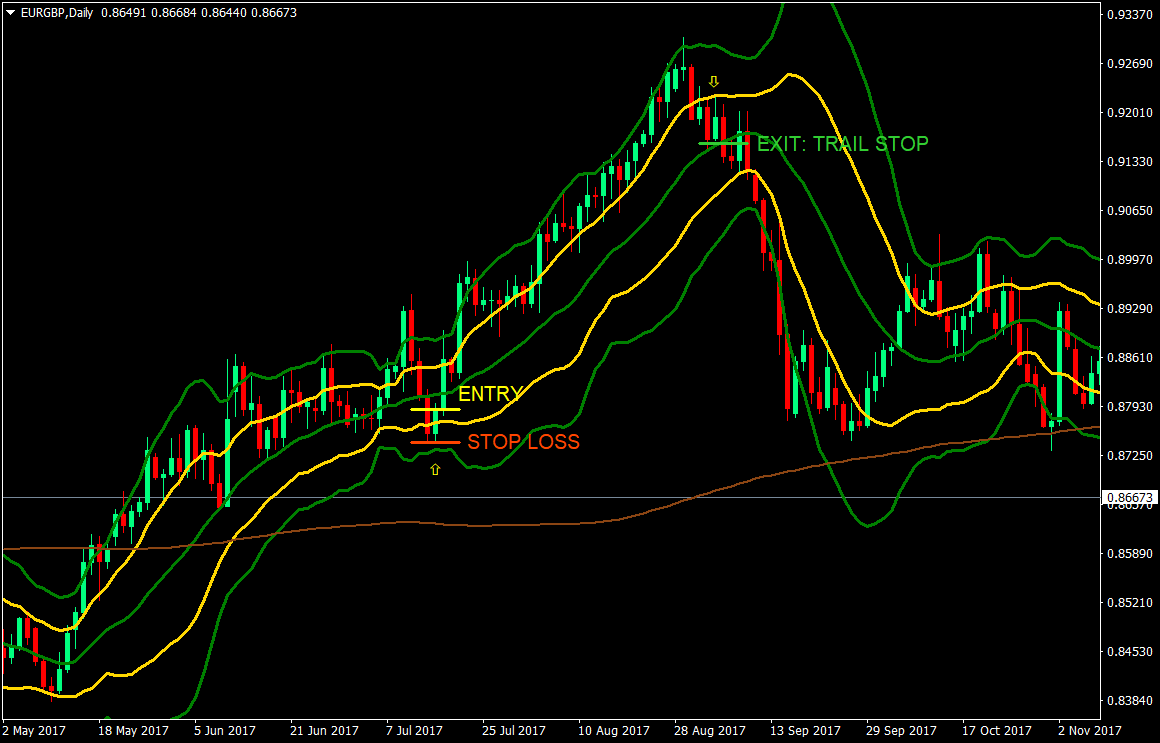

To determine if price is starting to bounce off a certain area, we will be using two Bollinger Bands with settings of 20 SMA, 1 standard deviation (gold), and 2 standard deviations (green). The reason why we are calling it Bowel Bounce Strategy, is because instead of looking like a pipe, the Bollinger Bands resemble our intestines more. Plus, the fact that market volatility does make our bowels turn upside down.

So, the way that this strategy works is that we will be looking for bounces off the Bollinger Bands with a standard deviation of 1. This will be determined by price closing beyond the gold outer bands, then closing back in the Bollinger Band.

The green Bollinger Band with a standard deviation of 2 is just an additional confirmation and a confidence booster. If ever we see price bouncing off the green Bollinger Band, and closing inside the gold Bollinger Band, we would could consider that a higher probability trade.

But of course, we wouldn’t want to be taking every available trade presented. We would want to have higher probability trades. One way to do this is to trade with the trend. To ensure we are trading with the trend, we will be using the 200 Exponential Moving Average (EMA). This is a long-term moving average that many traders look at. We would want to trade with the sentiment of the bulk of the market, instead of against them. If price is above the 200 EMA, we will only be considering long trades. If price is below the 200 EMA, then we will only be looking to short the pair.

Buy Entry:

- Price should be above the 200 EMA

- Coming from above, price should close below the lower band of the gold Bollinger Band

- Price should then close above the lower band of the gold Bollinger Band

- Enter a buy market order on the close above the lower band of the gold Bollinger Band

Stop Loss: Set the stop loss at the low fractal formed by the bounce

Exit: Trail the stop loss on the middle line of the Bollinger Band, which is a 20 Simple Moving Average (SMA)

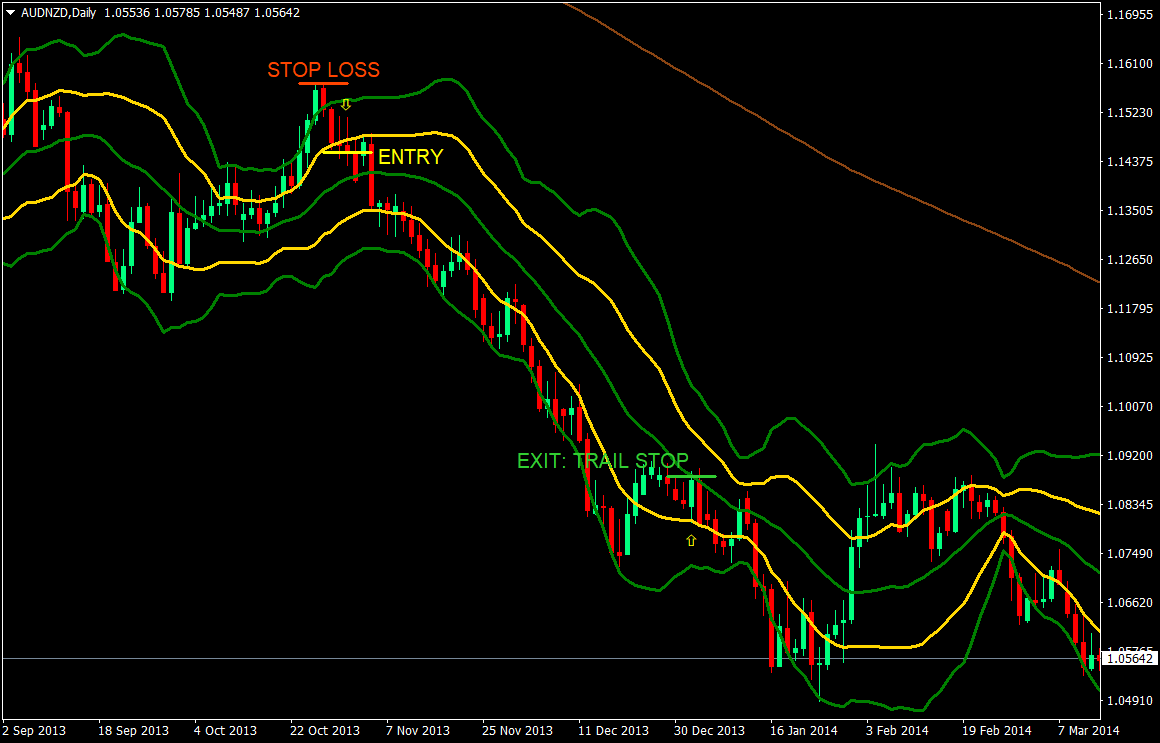

Sell Entry:

- Price should be below the 200 EMA

- Coming from below, price should close above the upper band of the gold Bollinger Band

- Price should then close below the upper band of the gold Bollinger Band

- Enter a sell market order on the close below the upper band of the gold Bollinger Band

Stop Loss: Set the stop loss at the high fractal formed by the bounce

Exit: Trail the stop loss on the middle line of the Bollinger Band, which is a 20 Simple Moving Average (SMA)

Conclusion

This strategy is a simple strategy which is a derivative of how most traders use the Bollinger Bands. Many traders do trade bounces off of the outer bands of the Bollinger Band, but with different parameters. One of the most common is the 2 standard deviation Bollinger Band with a 20 SMA middle line. This is the reason why our green Bollinger Band has a higher probability, because of the fact that many traders look at it. However, what I find lacking in the use of that parameter alone is the lack of a confirmation. Using the 1 standard deviation Bollinger Band is somehow more of a confirmation of a reversal, since it is much closer to the mean, which is the middle line.

If you would see on our sell sample, this is a classic example of a bounce off of the 2 standard deviation Bollinger Band, with a trade entered on the confirmation, which is a close below the upper gold band. After that cross was a good sell off which would have been for a handsome profit.

The pros of this strategy is that it takes into consideration overbought and oversold market conditions with the outer band of the Bollinger bands, which is also somewhat a mean reversion entry, then it also takes into account the long-term trend with the 200 EMA, and finally, the exit is based on the reversal of the short-term trend, which is the middle line of the Bollinger Bands.

There will be instances however when signals will be generated that won’t result to a profit. This is the reason why we should have a stop loss. However, we shouldn’t stop taking these signals as what we are trying to do is to catch the big moves. Looking back at our sell sample, prior to the big move which is our trade, a signal was generated on the same direction, which didn’t result in a profit. By continuing taking the trades that fit the rules, we caught the big one.

This strategy does work in a trending market, however, on ranging market, or a market that chops up and down, this strategy would result to several losing trades. It is best to learn to identify if the market is ready for this type of strategy prior to using it.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download:

Nice Strategy. Thank you

Very Nice