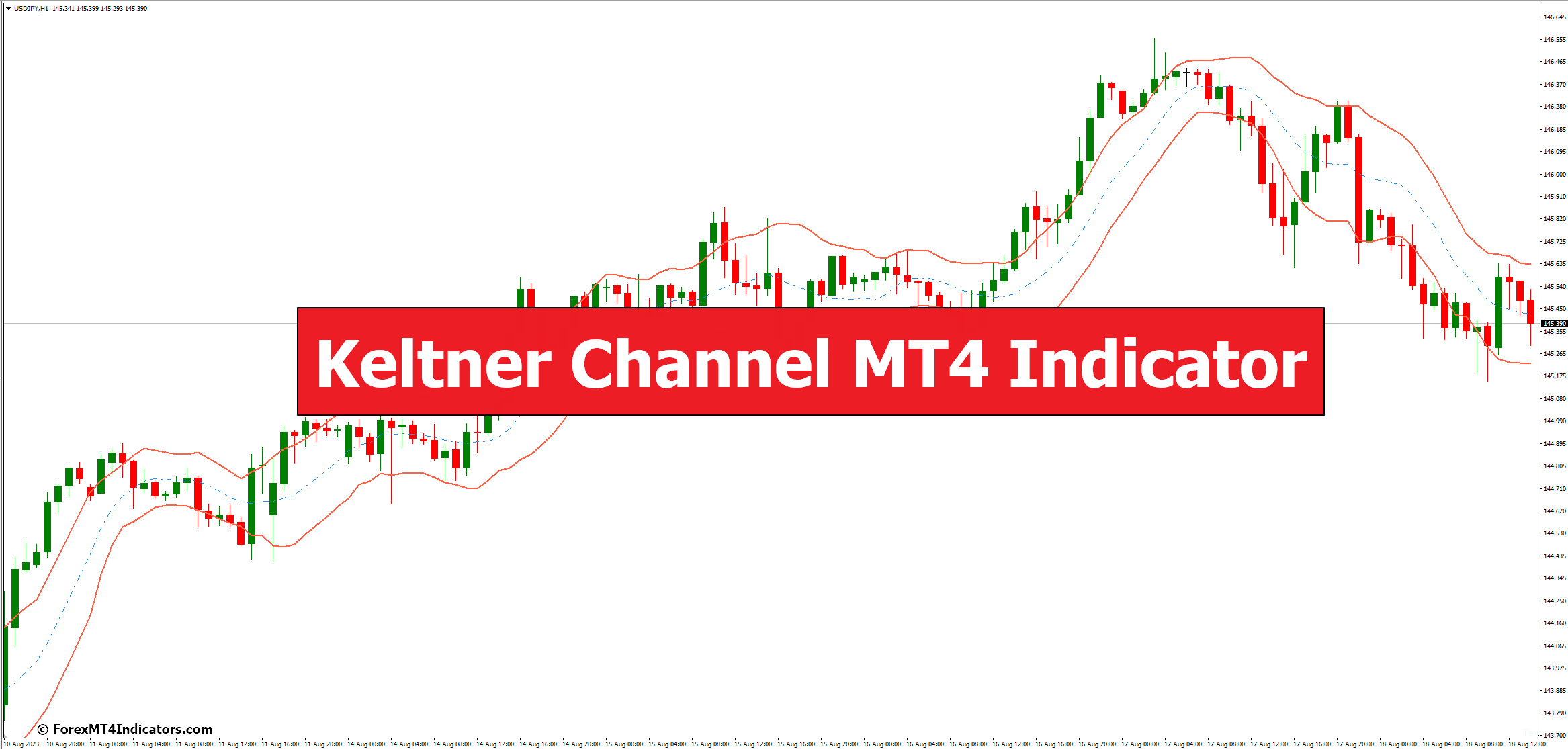

In the fast-paced world of financial trading, having the right tools at your disposal can make a significant difference in your success. One such tool that has gained popularity among traders is the Keltner Channel MT4 indicator. In this article, we’ll delve into what the Keltner Channel is, how it works, and how you can effectively use it in your trading strategy.

Understanding the Components of the Keltner Channel

The Middle Line: Exponential Moving Average (EMA)

At the core of the Keltner Channel is the Exponential Moving Average (EMA). This moving average provides insight into the average price of an asset over a specific period, helping traders identify the prevailing trend.

Upper and Lower Bands: Average True Range (ATR)

The upper and lower bands of the Keltner Channel are determined by the Average True Range (ATR). ATR measures market volatility and is used to set the width of the bands. During periods of high volatility, the bands widen, while they narrow during lower volatility periods.

Interpreting Keltner Channel Signals

Volatility Assessment

One of the primary applications of the Keltner Channel is assessing market volatility. When the price moves outside the bands, it suggests increased volatility and potential trading opportunities.

Identifying Overbought and Oversold Conditions

The Keltner Channel’s upper and lower bands also help identify overbought and oversold conditions. When the price reaches the upper band, the asset may be overbought, signaling a potential reversal. Conversely, when it reaches the lower band, it may be oversold.

Integrating the Keltner Channel into Your Trading Strategy

Trend Following Strategies

Traders often use the Keltner Channel to identify trends. A strong trend is indicated when the price consistently stays above the EMA and within the bands.

Reversal Strategies

Conversely, traders also use the Keltner Channel for reversal strategies. Reversals are suggested when the price moves beyond the bands, indicating potential trend shifts.

Tips for Maximizing the Effectiveness of the Keltner Channel

Period and Multiplier Selection

Choosing appropriate EMA and ATR values is crucial. Shorter periods lead to more sensitive indicators, while longer periods offer more stable signals.

Confirming Signals with Other Indicators

To enhance accuracy, consider confirming Keltner Channel signals with other indicators like RSI or MACD.

Advantages and Limitations of the Keltner Channel

Advantages

- Versatility: Suitable for various market conditions.

- Clear Signals: Easily understandable overbought and oversold signals.

- Volatility Awareness: Effective in volatile markets.

Limitations

- False Signals: Like any indicator, it can generate false signals during choppy markets.

- Lagging Indicator: Reacts to price movements, not predicting them.

The Future of Keltner Channel and Technical Indicators

As trading technologies advance, indicators like the Keltner Channel will likely evolve. Traders should stay informed about the latest developments and adapt their strategies accordingly.

How to Trade with Keltner Channel MT4 Indicator

Buy Entry

- In uptrend, wait for price to break above upper Keltner Channel line.

- Buy during strong uptrend when price retraces to middle or lower line.

- Seek confluence with support levels for better risk-reward.

Sell Entry

- In downtrend, wait for price to break below lower Keltner Channel line.

- Sell during strong downtrend when price bounces off middle or upper line.

- Identify resistance levels aligning with Keltner Channel lines.

- Watch for divergence between price and Keltner Channel for potential reversals.

Keltner Channel MT4 Indicator Settings

Conclusion

Incorporating the Keltner Channel MT4 indicator into your trading toolkit can provide valuable insights into market trends, volatility, and potential trading opportunities. By understanding its components and interpreting its signals, you can enhance your trading strategy and make more informed decisions.

FAQs

- Q: Is the Keltner Channel suitable for day trading?

A: Yes, the Keltner Channel can be effective for day trading due to its ability to assess intraday volatility. - Q: Can I use the Keltner Channel alone?

A: While possible, confirming Keltner Channel signals with other indicators can enhance accuracy. - Q: What’s the recommended period setting for EMA?

A: The period setting for EMA depends on your trading style and the asset you’re trading. Experiment to find the optimal setting.

Recommended MT4/MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

(Free MT4 Indicators Download)

Click here below to download: