Trading strategies are usually classified into two types – Mean Reversal Strategies and Momentum Strategies. These two types are technically opposites of each other.

Mean Reversal Strategies assume that whenever price would start to get overextended, meaning it is either overbought or oversold, price would reverse more often than not. This is logically correct. If you would come to think of it, if you knew the price range of a certain item, and you know that it is at an all time high, you would tend not to buy it. This behavior is what brings prices back down. The inverse is true when price is at an all time low. You would think of it as a discount and buy as soon as possible, thereby brining prices up.

Momentum Strategies on the other hand, assumes that prices would continue its current trajectory more often than not. In many cases, this is also true. If you badly need something and you new that prices are going up, chances are you would buy that product immediately to avoid buying at a higher price. The same is true on the opposite side of the transaction. If sellers believe that prices are going down, many tend to panic and start selling right away to avoid losing more.

The concepts mentioned above also applies to trading. In fact, these types of behaviors are what drives the price movement that you see on your chart. The only difference is that in trading, what you see is a chart with candlesticks, bars or whatnot.

RSI and Arrows Forex Trading Strategy is a type of strategy that makes use of both concepts, Mean Reversal and Momentum. It combines these two opposing ideas and combines them into one strategy.

Relative Strength Index

Relative Strength Index or RSI was first introduced by J. Welles Wilder in his book, “New Concepts in Technical Trading,” published in 1978.

RSI is an oscillating indicator which attempts to mirror price action on a separate window. It is a bounded oscillating indicator that oscillates within the range zero to 100. This allows traders to interpret RSI either as a momentum indicator or a mean reversal indicator.

As a momentum indicator, traders would typically look at the crossing over of level 50 to indicate the shift of momentum. Whenever the RSI line crosses 50 some traders would take a trade in the direction of the crossover.

As a mean reversal indicator, traders typically use 30 and 70 as an indication of probable reversal conditions. Whenever the RSI goes over these levels, price is considered either oversold or overbought. Traders who trade this method would expect price to reverse.

Arrows and Curves Indicator

Arrows and Curves is a custom indicator which is plotted on the price chart itself. It is composed of two outer bands. These bands could be interpreted as dynamic supports and resistances.

This could mean different things to different traders. Mean Reversion traders would consider these areas as points where price could bounce off. On the other hand, Momentum traders would consider a close beyond these lines as a breakout, which could indicate a possible start of a trending market move.

This custom indicator also conveniently prints an arrow indicating the direction of the trend whenever it detects a shift in momentum.

Trading Strategy

The RSI and Arrows Forex Trading Strategy is a trading strategy which combines both mean reversion and momentum strategies by using two complimentary indicators.

With this strategy, mean reversion will be observed using the RSI line. Whenever the RSI line goes below 30 or over 70, the market will be considered either oversold or overbought. This should give us an indication that a possible reversal could occur.

However, we would only be taking the reversal trade setup only when momentum is confirmed. To do this, we will be using the Arrows and Curves indicator. We will be waiting for price to go beyond the outer bands, which we will consider as breakouts. This should also be accompanied by arrows indicating the entry signals.

Indicators:

- ArrowsAndCurves

- SSP: 36

- Relative Strength Index

Timeframe: 1-hour, 4-hour and daily charts

Currency Pairs: major and minor pairs

Trading Session: Tokyo, London and New York sessions

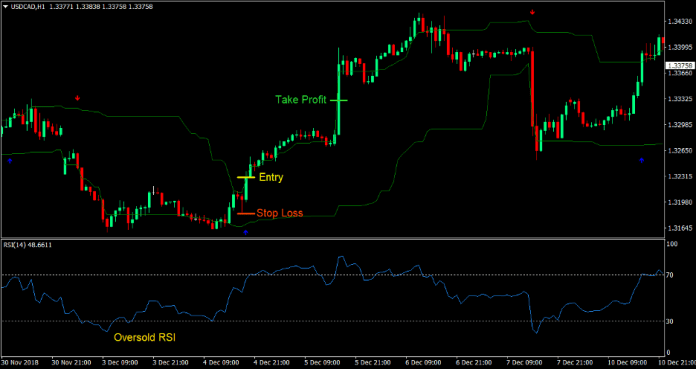

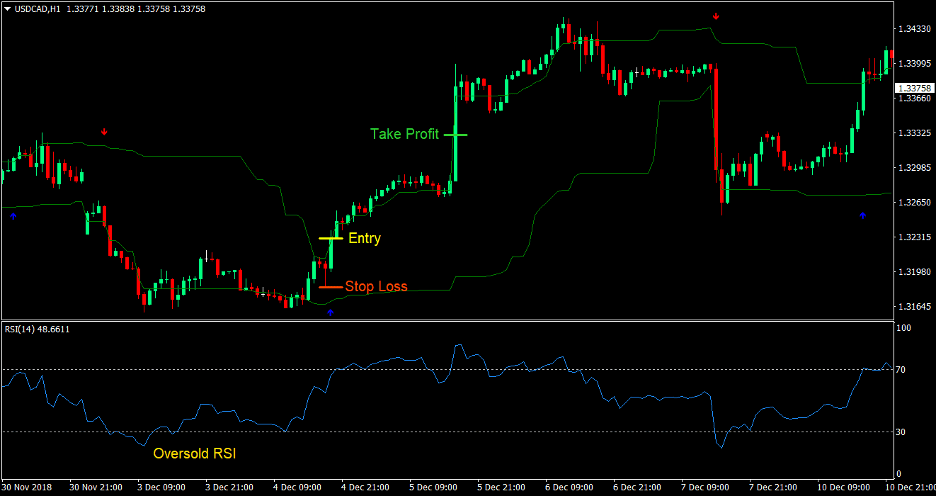

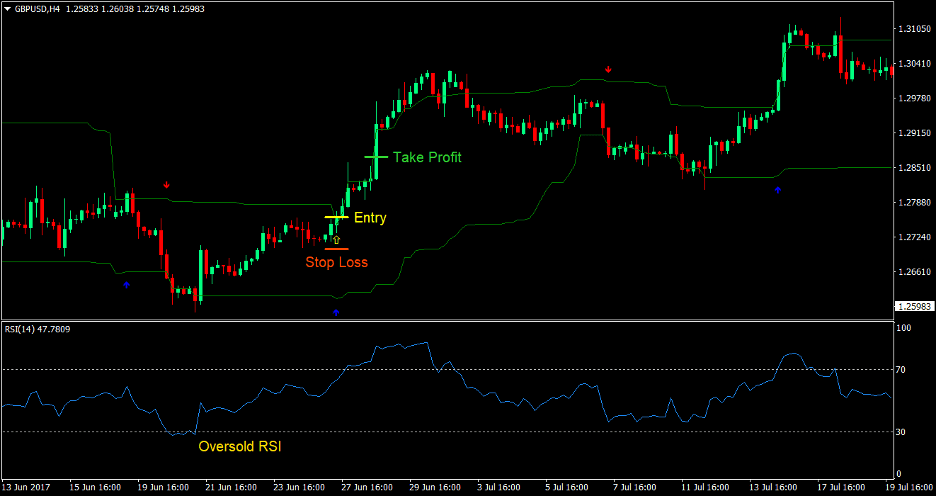

Buy Trade Setup

Entry

- The RSI line should go below 30 indicating an oversold market condition

- Allow price to reverse

- Wait for price to close above the upper band of the Arrows and Curves indicator

- Enter a buy order as soon as an arrow pointing up is printed by the Arrows and Curves indicator

Stop Loss

- Set the stop loss at the support level below the entry candle

Take Profit

- Set the take profit target 2x the risk on the stop loss

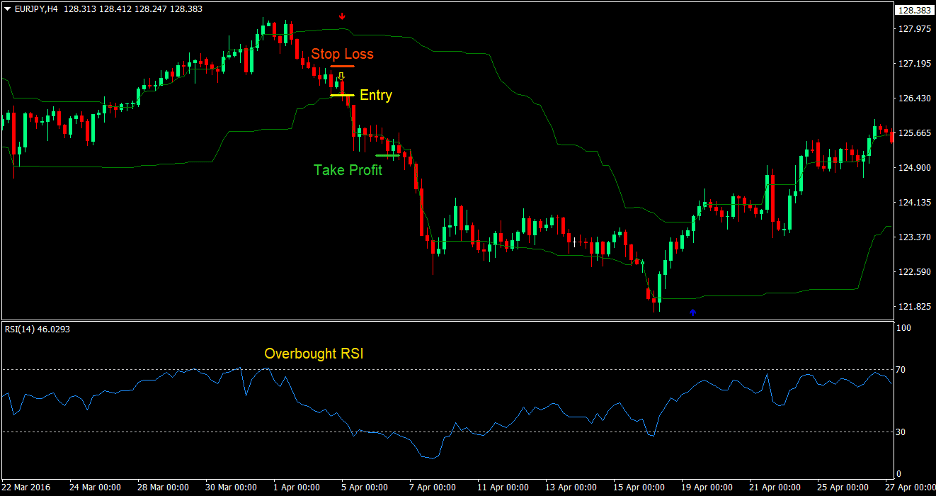

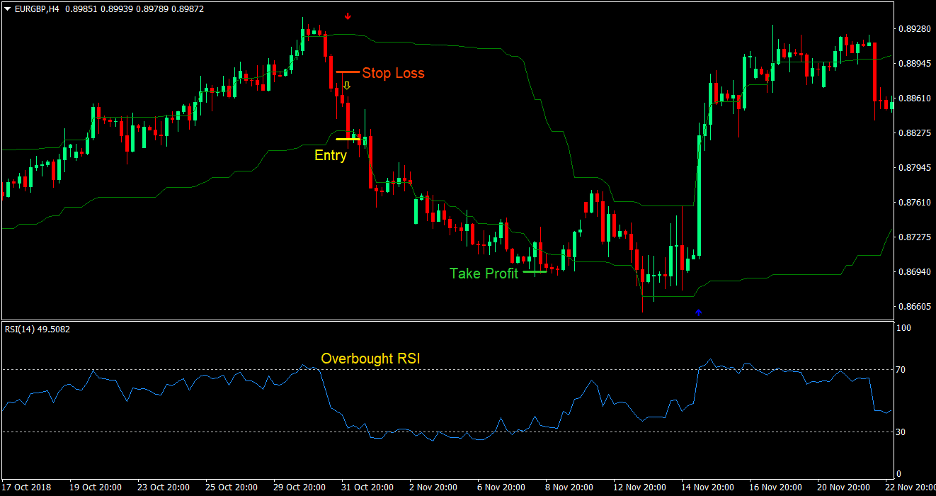

Sell Trade Setup

Entry

- The RSI line should go above 70 indicating an overbought market condition

- Allow price to reverse

- Wait for price to close below the lower band of the Arrows and Curves indicator

- Enter a sell order as soon as an arrow pointing down is printed by the Arrows and Curves indicator

Stop Loss

- Set the stop loss at the resistance level above the entry candle

Take Profit

- Set the take profit target 2x the risk on the stop loss

Conclusion

This trading strategy is one which allows traders to profit on sudden momentum shifts. The momentum shifts should start from an overbought or oversold market condition. Then, as price goes over the outer bands of the Arrows and Curves indicator, we take the trade on the direction of the trade signal. This usually results in price moving in the direction of the trend with strong momentum.

Traders could use a different reward-risk ratio depending on risk appetite. A lower ratio should allow for a better win rate but with a lower yield on winning trades.

Traders should also move the stop loss to breakeven as soon as possible if the trade is already in profit. However, it should not be too early which would cause the stop loss to be hit prematurely.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: