Dual Stochastics Forex Day Forex Trading Strategy

Most traders are learners. People attracted to trading are usually those who they think they can learn something complicated quickly through sheer grit and tenacity, and they usually exhibit this by the countless hours they spend learning about the markets.

Learning about the markets is a good thing, however it could also be a trap for many. How can this be? Often, when new traders get into the markets, their appetite for learning causes them to study the markets voraciously. Every now and then they learn something new. Trendlines, support and resistance, price patterns, this indicator, that moving average, etc. Then, before you know it, their charts become cluttered with all the squiggly lines that covers the whole palette of the rainbow. They think they’ve got it all figured out with everything they’ve learned. Then, all those squiggly lines start to point them to ten different directions. They either freeze up and not make a decision or they end up making erratic decisions without any stable and concrete rationale for such trade. This is called noise. Even if you shut yourself out of any other noise from the news, too much information on your screen could be your source of noise. Now, don’t get me wrong. I’m all about learning but choose wisely which techniques and indicators you include in your trading strategy.

One way of avoiding this trap is to streamline your technical indicators. Choose one, two, maybe three at most and maximize its potential as you master it.

The Stochastic Oscillator

The stochastic oscillator is one of the oldest and most basic technical indicators available for traders, yet many have overlooked it due to its simplicity.

The stochastic oscillator is a type of oscillating indicator which compares the current market price to the trading instrument’s range of historical prices. By doing so, the stochastic oscillator tends to follow closely the price movement on the price chart.

One advantage of the stochastic oscillator is its overextended areas. By using the stochastic oscillator, a trader could mathematically identify if the market is overbought or oversold, which puts pressure on price to reverse.

However, the same overbought or oversold areas could also be interpreted differently. The oscillator’s lines could be staying on an overextended area for quite some time and not reverse. This could mean that the market is starting to trend.

Trading Strategy Concept

Earlier, we’ve talked about how having too many technical indicators could cause too much noise. With this strategy we will be streamlining our strategy to stochastic indicators and one moving average, while at the same time maximizing the potential of the stochastic indicator.

Since the stochastic oscillator could be used to indicate if the market is due for a reversal or is starting to trend, we will be using these two concepts at the same time. We will be doing this by having two stochastic oscillators, one with a fast setting and the other with a slow setting.

The slow stochastic oscillator will be used to determine if the longer-term outlook of the market is starting to trend. If the oscillator moves from one extreme to the other and starts to linger at the opposite extreme, we could say that the market has reversed and is starting to trend. So, the slow stochastic must be crossing from oversold to overbought and linger at the overbought territory to warrant a buy trade setup. Flip it over to have a sell trade setup. This will be our trade direction.

As for the actual entry, we will be using the faster stochastic oscillator and the 20-period Exponential Moving Average (EMA). What we will be looking for is for price to retrace to the 20 EMA. This should be accompanied by the fast stochastic crossing from one extreme to the other, then resume its initial direction. On a bullish trending environment, the fast stochastic should retrace to the oversold territory as price retraces to the 20 EMA. Then, as the stochastic oscillator crosses back up, we enter a buy trade.

Indicators:

- 20-period Exponential Moving Average (green)

- Slow Stochastic Oscillator

- %K period: 21

- %D period: 4

- Slowing: 10

- Fast Stochastic Oscillator

- %K period: 5

- %D period: 2

- Slowing: 2

Preferred Timeframe: 1-hour chart

Currency Pair: any

Trading Session: any

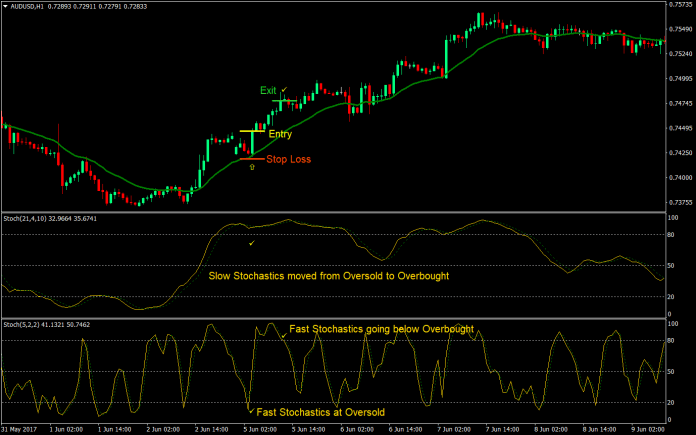

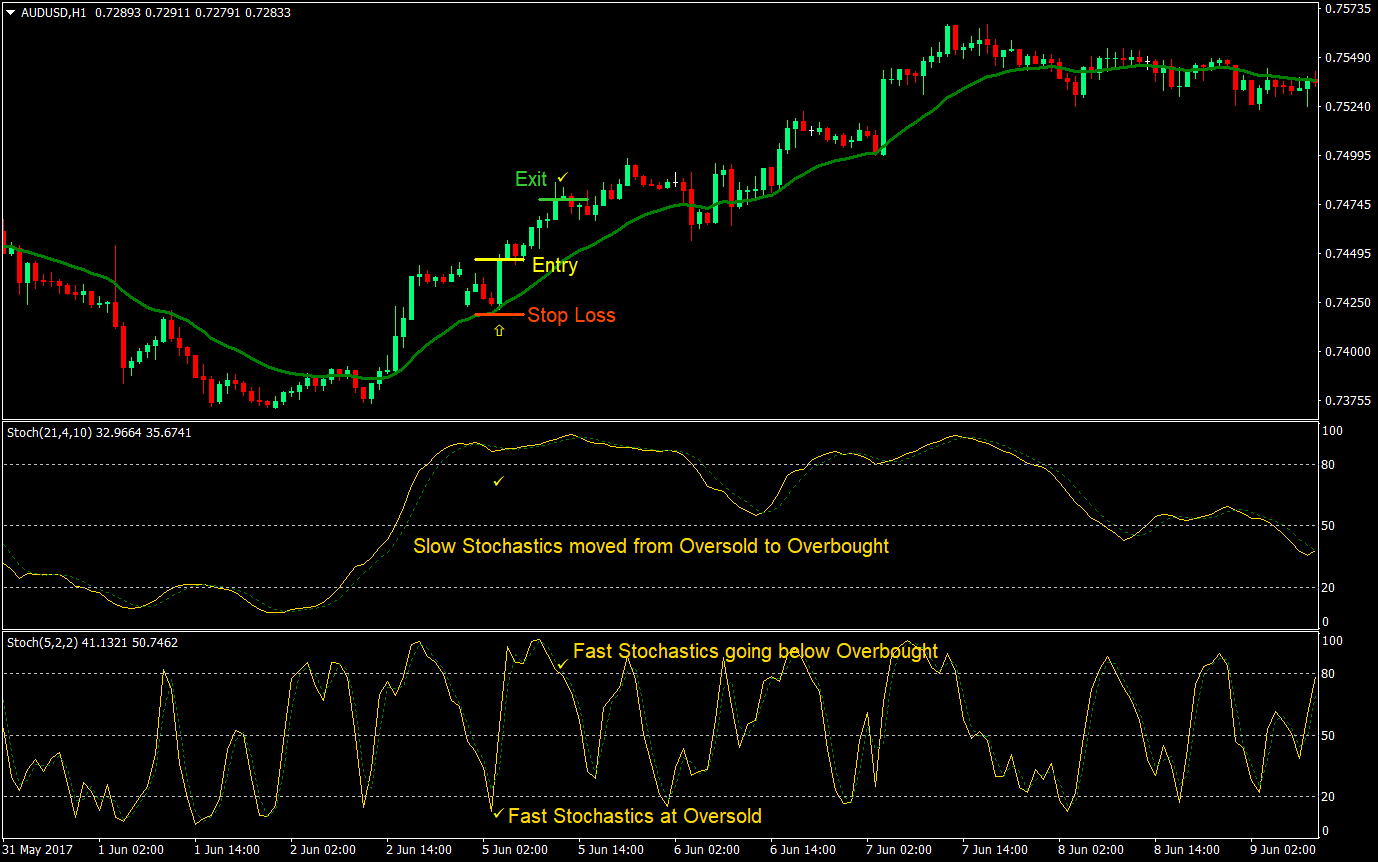

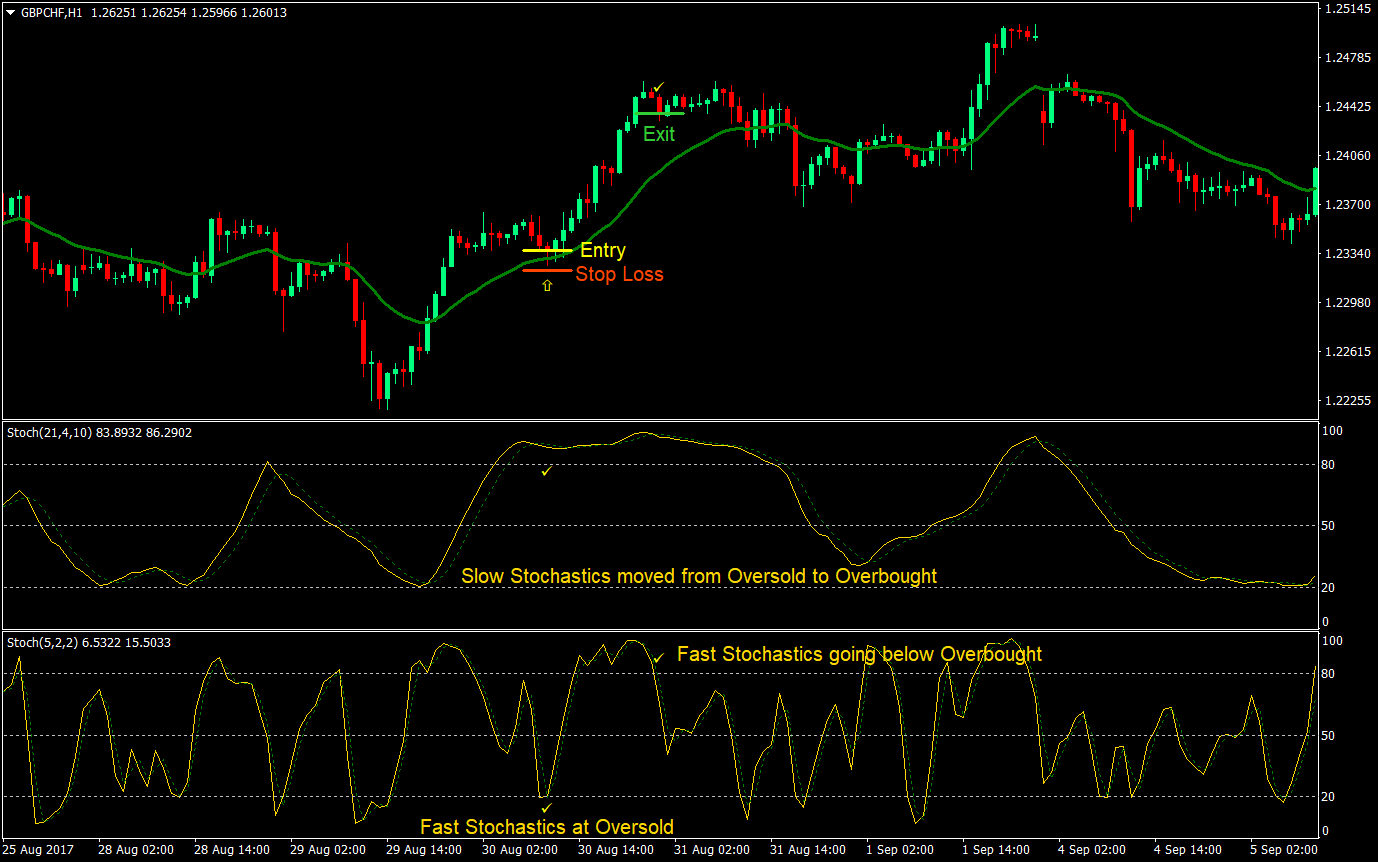

Buy (Long) Trade Setup

Entry

- The Slow Stochastic should move from the Oversold area to Overbought indicating that the momentum is shifting and is starting to trend up

- Price should retrace near the 20 EMA

- The Fast Stochastic should touch or cross the 20 level indicating that the market is Oversold at the short-term

- Enter a buy order as the Fast Stochastics cross back above 20

Stop Loss

- Set the stop loss below the entry candle

Exit

- Allow the Fast Stochastic to cross to the Overbought area then close the trade as it crosses back below 80

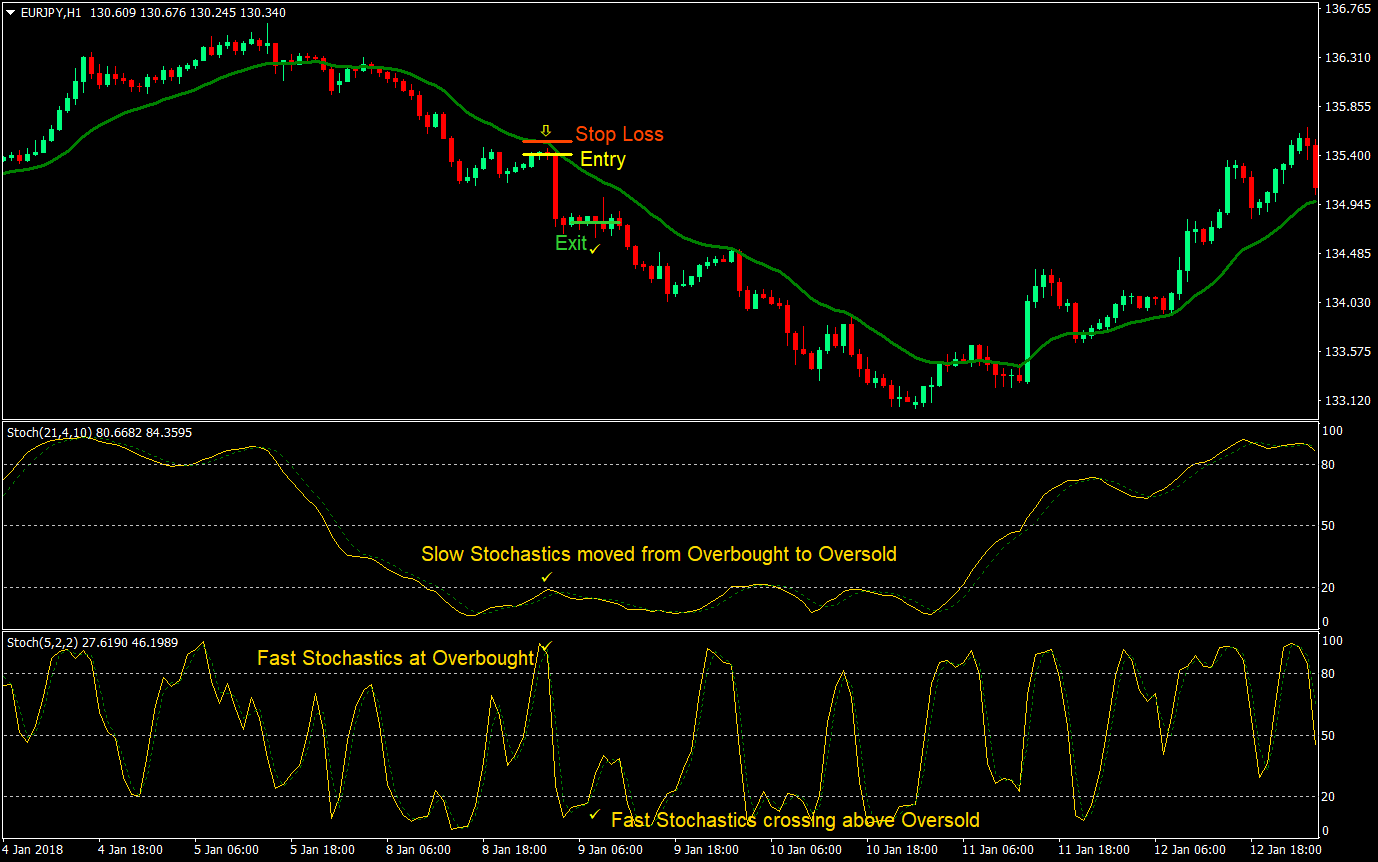

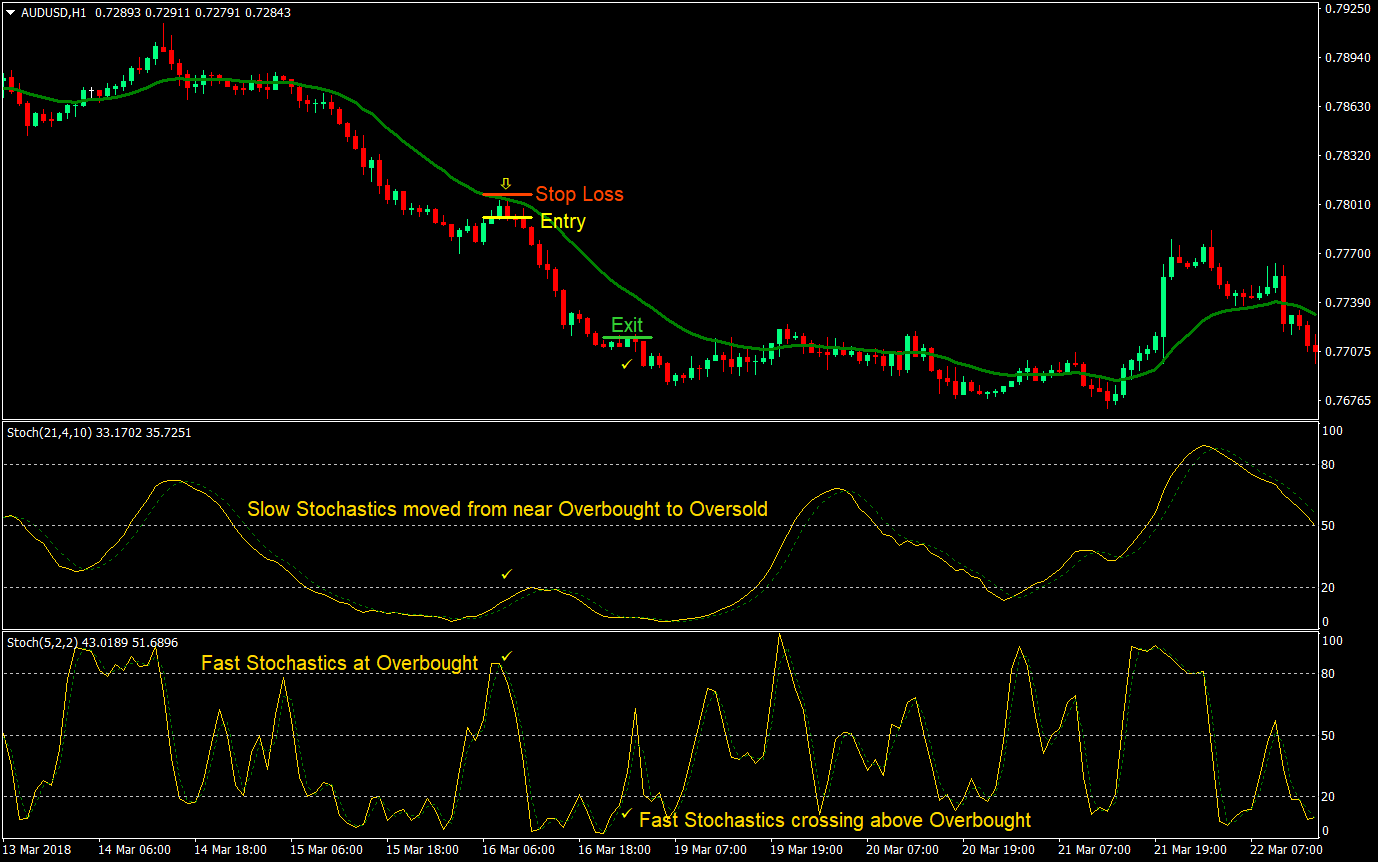

Sell (Short) Trade Setup

Entry

- The Slow Stochastic should move from the Overbought area to Oversold indicating that the momentum is shifting and is starting to trend down

- Price should retrace near the 20 EMA

- The Fast Stochastic should touch or cross the 80 level indicating that the market is Overbought at the short-term

- Enter a sell order as the Fast Stochastics cross back below 80

Stop Loss

- Set the stop loss above the entry candle

Exit

- Allow the Fast Stochastic to cross to the Oversold area then close the trade as it crosses back above 20

Conclusion

This strategy is a type of trend following strategy that takes trades as price retraces to the mean. Taking trades as price retraces to a 20-period moving average is a common trend following strategy. However, it is often difficult to identify if the market is trending or not. Even more difficult is timing the entry as price retraces to the mean.

By using the two parameters for the Stochastic Oscillator, we not only get to identify if the market is starting to trend, we also have a better probability of timing the entry correctly.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: