Traders are always on the prowl looking for an edge to improve their trading. Anything that would give them even the slightest advantage would be great.

One of the most common tools that traders look for in order to gain an advantage is with technical indicators. Indicators make things a whole lot easier for traders. Price charts that used to make no sense could immediately seem very predictable when used with the right technical indicator. However, most indicators have a common disadvantage. Indicators are naturally lagging. Indicators follow price movements, not the other way around. Because indicators follow price movements, it is just natural that indicators would lag price movements. What most developers do however is to try to decrease the lag as much as possible in order for the indicator to be more responsive to price movements.

Indicators should be used just as the name suggests – indicators. It is wise to avoid using indicators as the final basis for a buy or sell decision. Instead, traders should look for indicators that are very responsive and could be a step ahead prior to major price movements. Traders could then use it as an indication of a “possible” trade setup. If price action confirms the setup, then a trader could take action of such setup.

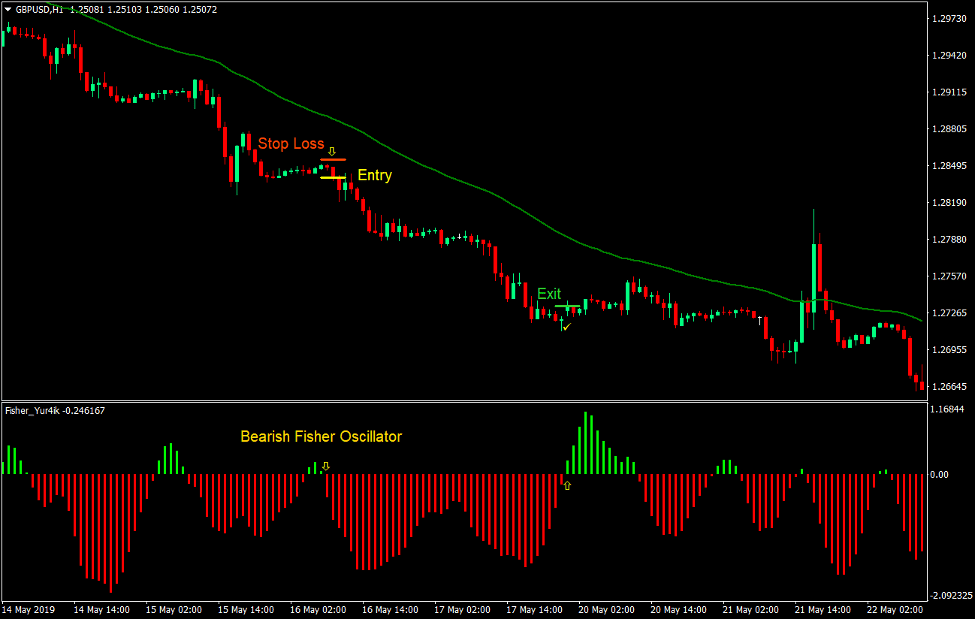

Fisher Retrace Forex Trading Strategy is an example of a strategy that uses an indicator as an indication of a trade setup. It is used on trending market conditions and provides trade setups right after a retracement.

Fisher Indicator

The Fisher indicator is an oscillating technical indicator which attempts to predict the cyclical movements of the short-term trend. The concept behind this indicator is that it converts price movements into a Gaussian normal distribution. This allows the indicator to identify when prices have moved to an extreme price point in relation to the historical price points. Coming from an extreme price point, the indicator would then be very susceptible to indicate a reversal even prior to major price movements.

This setup of the Fisher indicator is displayed as a histogram. Bars are plotted on a free range. It could be plotted as positive or negative. Positive bars indicate a bullish trend while negative bars indicate a bearish trend. The bars also change color depending on whether the bars are bullish or bearish. Bullish bars are lime while bearish bars are red.

Trading Strategy

This strategy trades on trending market conditions right after a retracement. It uses the Fisher indicator to identify possible reversal points. Trades are then taken based on momentum or reversal candlestick patterns which occur near a Fisher indicator reversal.

To identify trend direction, we will be using the 50-period Exponential Moving Average (EMA). Trend direction is based on the location of price in relation to the 50 EMA line, as well as the slope of the 50 EMA line. Price action should also generally stay on one side of the 50 EMA line in the direction of the trend. It should also be trending visually based on a rising or falling swing point pattern.

Then, we wait for price to retrace towards the 50 EMA line. This would cause the Fisher indicator to temporarily reverse. We then wait for the Fisher indicator to indicate a resumption of trend direction.

Trade setups are generated as soon as a reversal or momentum candlestick pattern is generated. It could be a pin bar, engulfing, morning or evening star, tweezer tops or bottoms, or any high probability candlestick pattern.

Indicators:

- 50 EMA (Green)

- Fisher_Yur4ik (default setup)

Currency Pairs: major and minor pairs

Preferred Time Frames: major and minor pairs

Trading Sessions: Tokyo, London and New York sessions

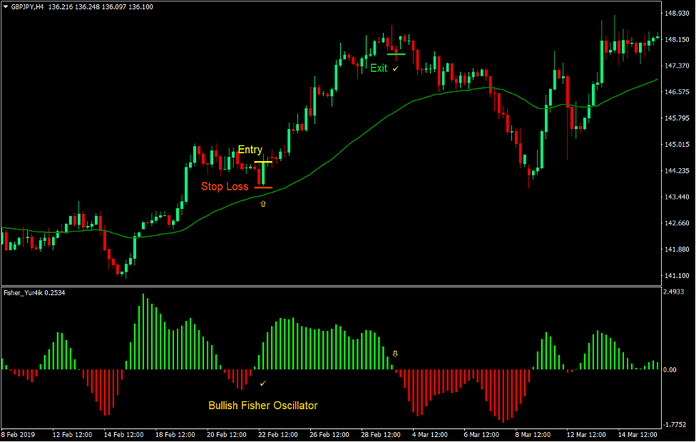

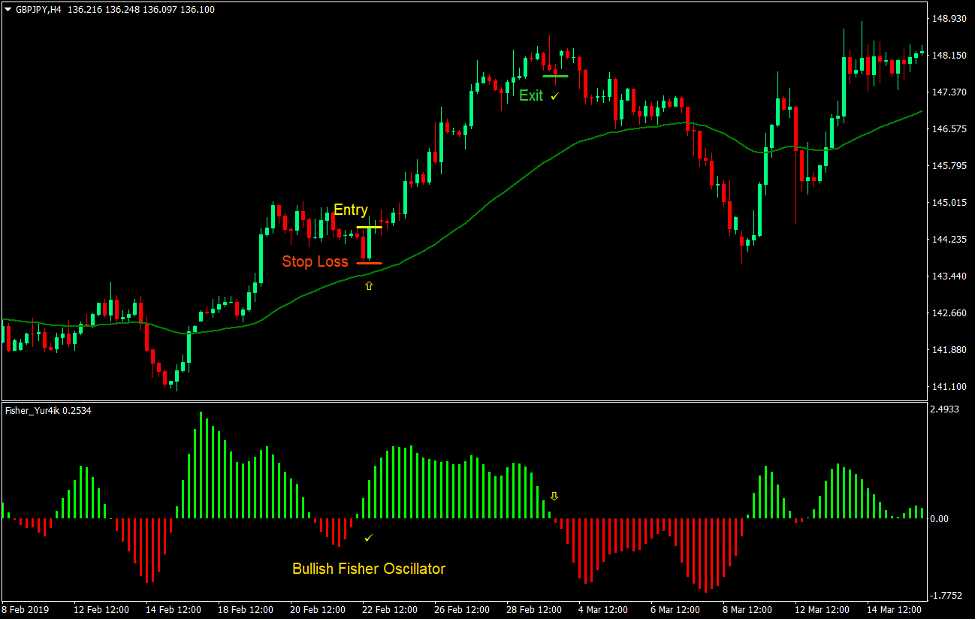

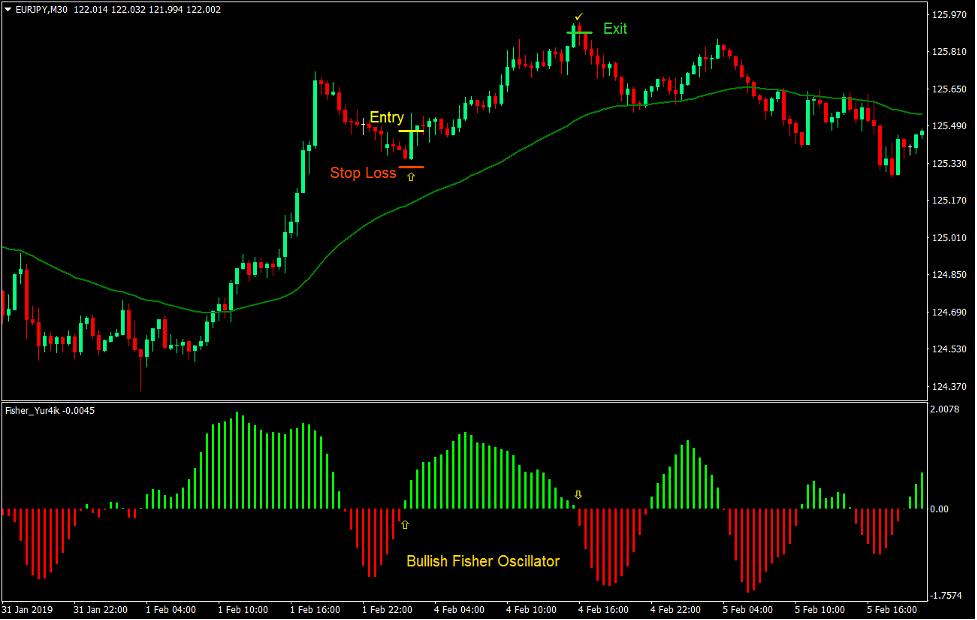

Buy Trade Setup

Entry

- Price should be above the 50 EMA line.

- The 50 EMA line should be sloping up.

- Price action should be making higher swing highs and swing lows.

- Price should retrace near the 50 EMA line.

- The Fisher indicator should temporarily change to red.

- The Fisher indicator should change to lime indicating the resumption of the trend.

- Enter a buy order as soon as a high probability candlestick pattern is observed.

Stop Loss

- Set the stop loss on the fractal below the entry candle.

Exit

- Close the trade as soon as the Fisher indicator changes to red.

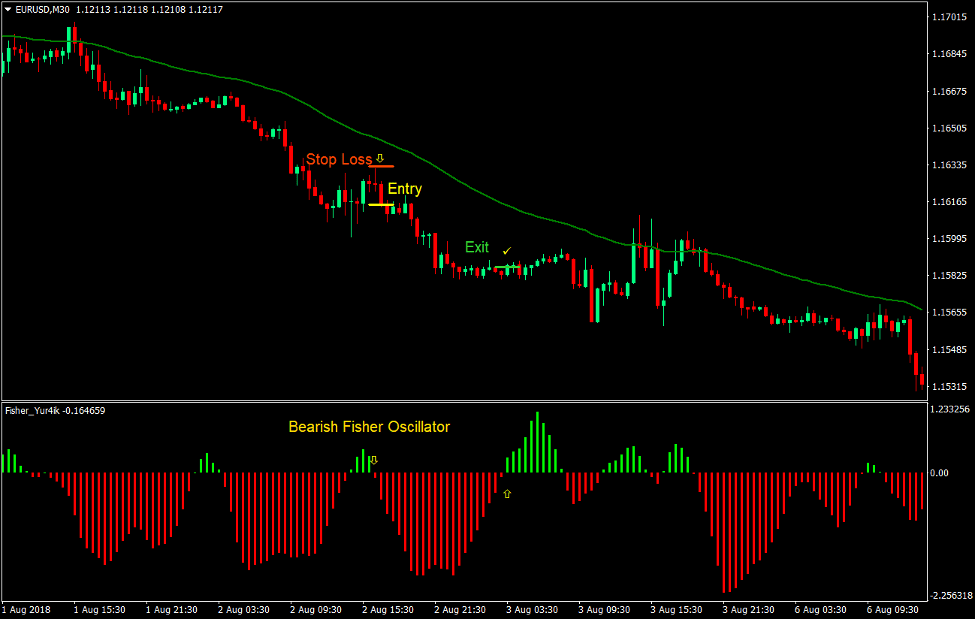

Sell Trade Setup

Entry

- Price should be below the 50 EMA line.

- The 50 EMA line should be sloping down.

- Price action should be making lower swing highs and swing lows.

- Price should retrace near the 50 EMA line.

- The Fisher indicator should temporarily change to lime.

- The Fisher indicator should change to red indicating the resumption of the trend.

- Enter a sell order as soon as a high probability candlestick pattern is observed.

Stop Loss

- Set the stop loss on the fractal above the entry candle.

Exit

- Close the trade as soon as the Fisher indicator changes to lime.

Conclusion

This trading strategy works particularly well in trending market conditions. It could produce high probability trade setups with decent reward-risk ratios.

To successfully implement this type of strategy, traders should be adept to identifying high probability trend reversal candlestick patterns. This is because entry triggers are not based on the reversal of an indicator. Instead, entry triggers are developed based on candlestick patterns. Learn and practice trading on candlestick patterns and you could use this strategy successfully.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: