Momentum breakout strategies are good starting points for new traders. This is because strong momentum often causes price action to continue further in its direction as it carries volume along with it. This provides traders an excellent short-term opportunity which may provide huge profits even in just a few period bars. The challenge is in how we could spot such momentum-based trading opportunity.

The strategy shown below is an example of a momentum-based strategy which uses technical indicators to confirm momentum.

Smoothed Repulse 2 Indicator

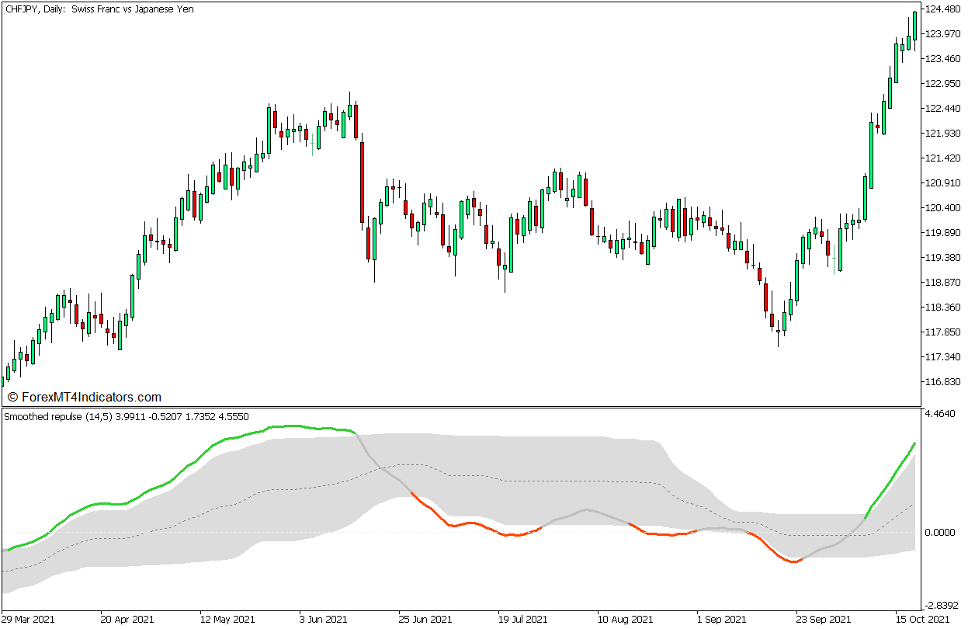

The Smoothed Repulse Indicator is a momentum-based trend following technical indicator which was developed to provide traders valuable insight into how the markets are moving, which may give traders the additional confidence regarding how they are reading the markets directional bias.

This indicator is an oscillator type of technical indicator which plots two lines that oscillate around a midline, which is zero, and plots a band or channel-like structure around one of the lines. This indicator is based on moving averages. It uses its underlying moving average values as a basis for plotting its two lines. The slower moving line, which is the dashed line, acts as a signal line and as the median of the outer bands. The outer line acts as its main line which provides traders the indications with regards to the trend and momentum direction.

There are several ways to interpret this indicator. One method is to identify the main trend bias based on whether the lines are above or below zero. The second is to use the crossovers between the solid line and the dashed line as a basis for identifying short-term trend reversals and direction. The third method is to use the slope of the solid line as a basis for identifying the short-term momentum direction or trajectory. Lastly, traders can also use the breach of the solid line above the upper edge of the band as a bullish momentum confirmation, or the drop of the solid line below the lower edge of the band as a bearish momentum confirmation.

The solid line also has a feature wherein it changes color whenever the solid line breaches the range of the band-like structure, which makes it easier to confirm momentum breakouts. However, this feature can also be modified wherein the line changes color whenever the solid line crosses over the dashed line or whenever the slope of the solid line changes.

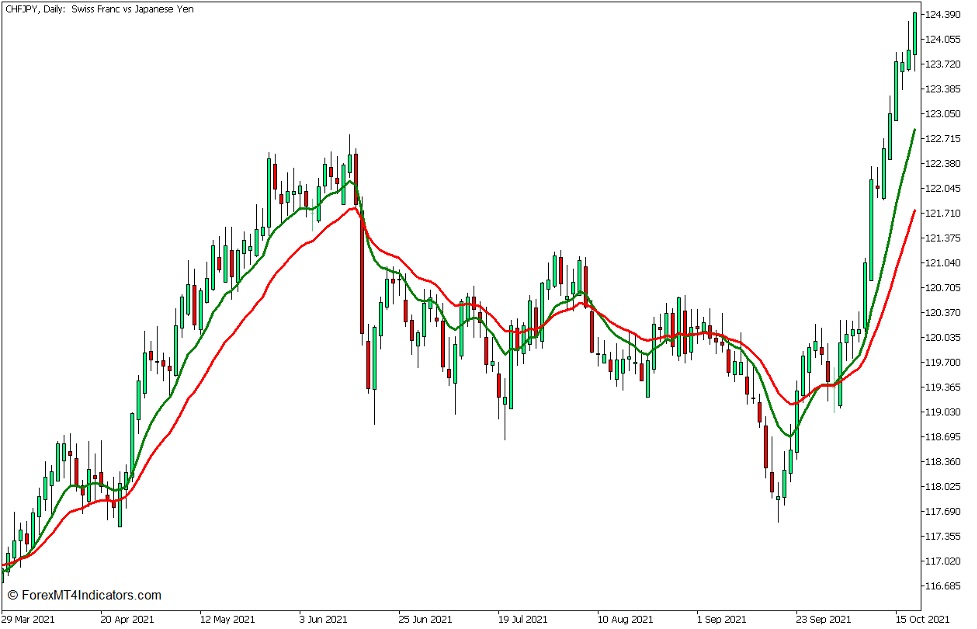

10 EMA and 20 EMA Trend Direction

Moving averages are excellent tools for identifying trend direction effectively. One of the methods used by traders to identify trend direction using moving average lines is by looking at a pair of moving average lines and observing how the two lines interact with each other. Traders may identify a bullish trend direction if a faster moving average line is above a slower moving average line. Inversely, a bearish trend direction is also indicated if the faster moving average line is below the slower moving average line.

The Exponential Moving Average (EMA) is an excellent tool for identifying trend direction. This is because EMA lines were developed to place more weight on recent price movements. This causes the moving average line to be more responsive to price action. However, it also retains its smoothness which makes it less susceptible to market noise such as price spikes.

The 10-bar EMA and 20-bar EMA is a good moving average pair for identifying short-term trend directions. It is responsive to tend reversals yet provides a clear indication of the direction of the trend.

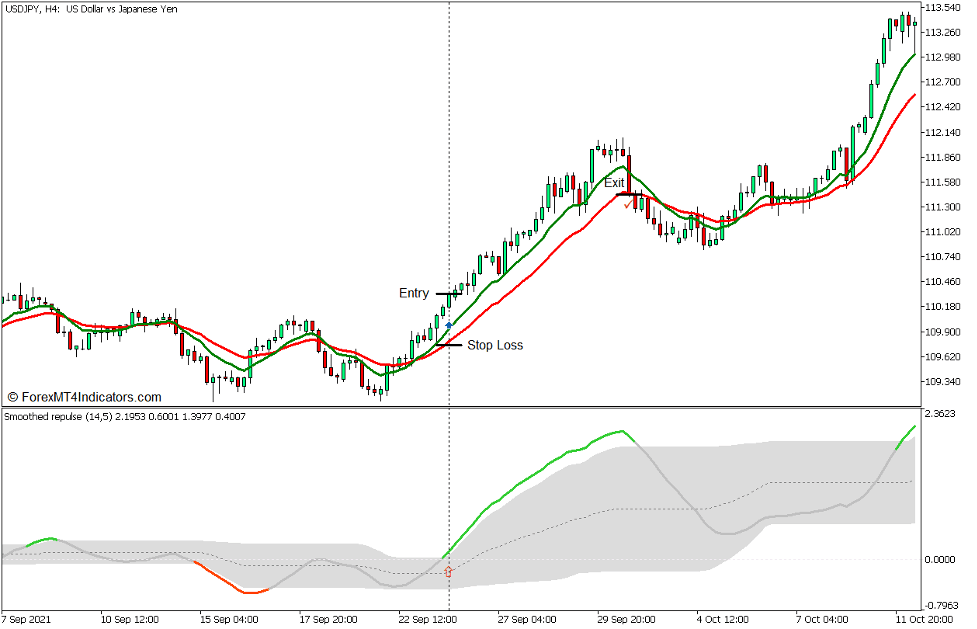

Trading Strategy Concept

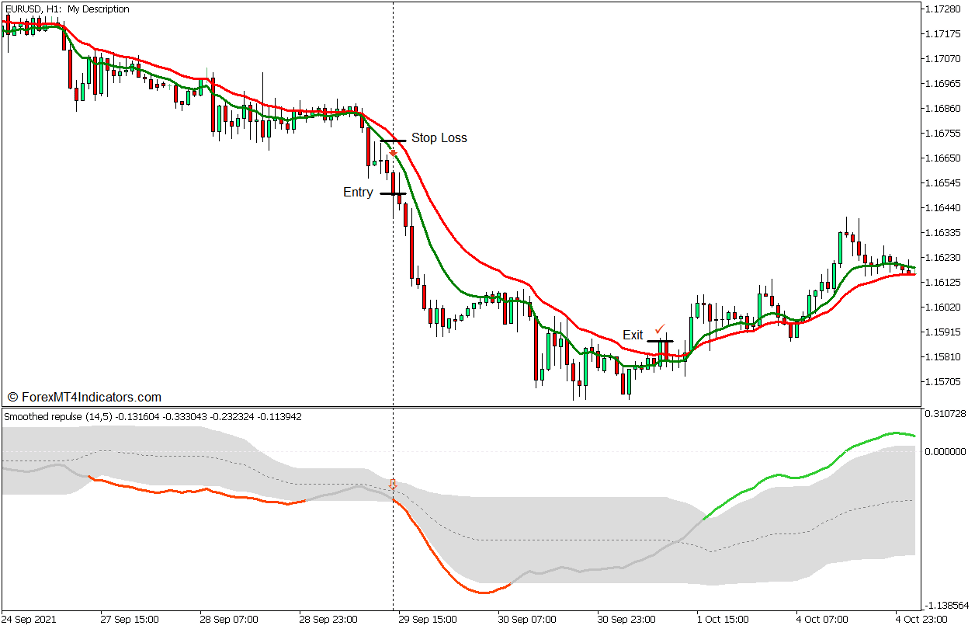

Smoothed Repulse Momentum Breakout Forex Trading Strategy for MT5 is a momentum-based strategy which uses the 10 EMA, 20 EMA, and the Smoothed Repulse 2 oscillator to identify and confirm momentum-based trade setups.

The 10 EMA and 20 EMA lines are mainly used to identify and confirm the trend direction. This is based on the location of the 10 EMA line in relation to the 20 EMA line.

As soon as the trend direction is confirmed, we could then observe and wait for momentum breakouts and its confirmation.

Breakouts should be observed on price action. This is based on price breaching a swing high resistance or swing low support with momentum.

The Smoothed Repulse 2 oscillator is used to confirm the momentum breakout based on the changing of the color of the solid line as breaches the range of the bands.

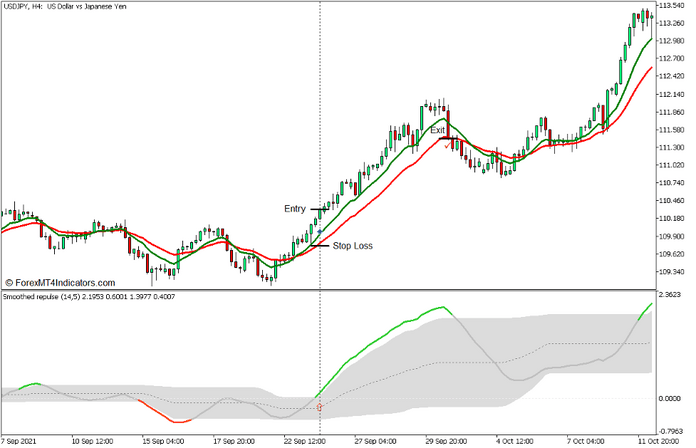

Buy Trade Setup

Entry

- The 10 EMA line (green) should be above the 20 EMA line (red) indicating a bullish trend.

- Price should break above a visible swing high.

- Open a buy order as soon as the Smoothed Repulse 2 solid line changes to lime green as it breaches above the upper band edge confirming the bullish momentum.

Stop Loss

- Set the stop loss on a fractal below the entry candle.

Exit

- Close the trade as soon as price closes below the 20 EMA line.

Sell Trade Setup

Entry

- The 10 EMA line (green) should be below the 20 EMA line (red) indicating a bearish trend.

- Price should drop below a visible swing low.

- Open a sell order as soon as the Smoothed Repulse 2 solid line changes to orange red as it drops below the lower band edge confirming the bearish momentum.

Stop Loss

- Set the stop loss on a fractal above the entry candle.

Exit

- Close the trade as soon as price closes above the 20 EMA line.

Conclusion

Momentum breakout strategies can be excellent trading opportunities. However, spotting momentum is often very difficult for new traders. At times traders would misjudge price candles as momentum, making them open trades at the top or bottom of a minor market fluctuation. Other times it only becomes obvious when the market has already had too much of a run. Beginners would often chase such momentum breakouts which might already be about to reverse. Traders who do not have a concrete and objective method for identifying and confirming momentum often lose money as they chase price. This strategy simply provides a confirmation of two factors which are important to momentum breakouts, which are the short-term trend and an objective momentum signal. This strategy is not perfect. Traders should still learn to observe price action and how momentum breakouts develop to be proficient in trading momentum breakouts.

Recommended MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: