London Open Scalping Forex Trading Strategy

Scalping is notoriously known to be a very difficult type of trading strategy. Some would even go as far to say that scalping isn’t profitable. But it is. I love to scalp the markets. Its quick, money is fast. You get in early in the move, you get much out of the move.

The difficulty lies in the cost to scalp. Often, what causes traders to lose money scalping the markets is the cost. This pertains to the spread and commission from the broker. When scalping, you get a move of just a few pips. Take into account the cost which could be at around 2 pips or more depending on the broker, even if you have a strategy that has a bit of an edge, that 2 pips could spell the difference. So, before you try scalping, first find a broker that has low spreads and commission.

Pin Bar – One of the More Effective Candlestick Patterns

Not all candlestick patterns perform equally. Some are good, some just doesn’t perform as well. Of all the candlestick patterns, the pin bar is one of my personal favorites. Although it isn’t perfect, it has a very high probability. Not only that, it is also often the start of a huge move.

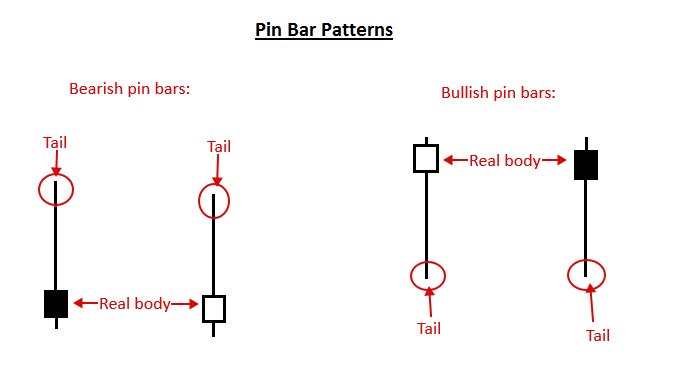

A pin bar is basically a candlestick pattern with a long wick on one end, a very small body, and a very small wick on the other end.

Every time you see that, get excited because it could be an opportunity for profits, given that it occurs in a condition when the market is prime for a reversal.

The logic behind a pin bar is that of a very quick market sentiment. Imagine, the market has been on an uptrend and is pushing up. Then, suddenly bears started to push price back down and have managed to reverse the gains in one candle. The good thing with the pin bar is that it is also a signal of a start of a move. Price could still have been pushed lower if time didn’t run out for that candle. But, that move would usually continue on to the next few candles.

Stochastic – An Indicator for Reversals

Stochastics are probably one of the more popular indicators. This probably mainly due to its simplicity and effectivity.

The Stochastic Oscillator is basically an oscillating indicator that provides information regarding the short thrusts of the market. It does this by printing two lines, a faster and a slower stochastic line. These lines also provide a signal by crossing over each other.

Another very important feature of the Stochastic Oscillator is its overbought and oversold markers. These markers objectively identify if the market is overbought or oversold and could be prime for a reversal.

Trading Strategy Concept

This strategy is a mean reversion strategy mainly used during the London market open. During this time, a sudden burst of volume and volatility occurs, making the market conducive for scalping.

With this strategy, we will be using the Stochastic Oscillator as our trade direction filter. We will be looking to take trades only when the oscillators are on an overextended area, meaning the market is prime for a reversal. If the stochastics are on the oversold area, then the market might be reversing to the upside soon. If they are on the overbought area, then the market might reverse to the downside. We will only be taking trades if the stochastic oscillators are in these areas.

Then, we wait for our entry signal. We will be using the Pinbar custom indicator. It is a custom indicator that would alert us if ever a pin bar candlestick pattern appears. If a pin bar pattern appears when the market is in an overextended market condition, then we take our reversal trade setup.

Indicators:

- Pinbar

- Stochastic Oscillator: (21, 3, 3)

Timeframe: 1-minute chart only

Currency Pair: EURUSD and GBPUSD only

Trading Session: first two hours of the London open

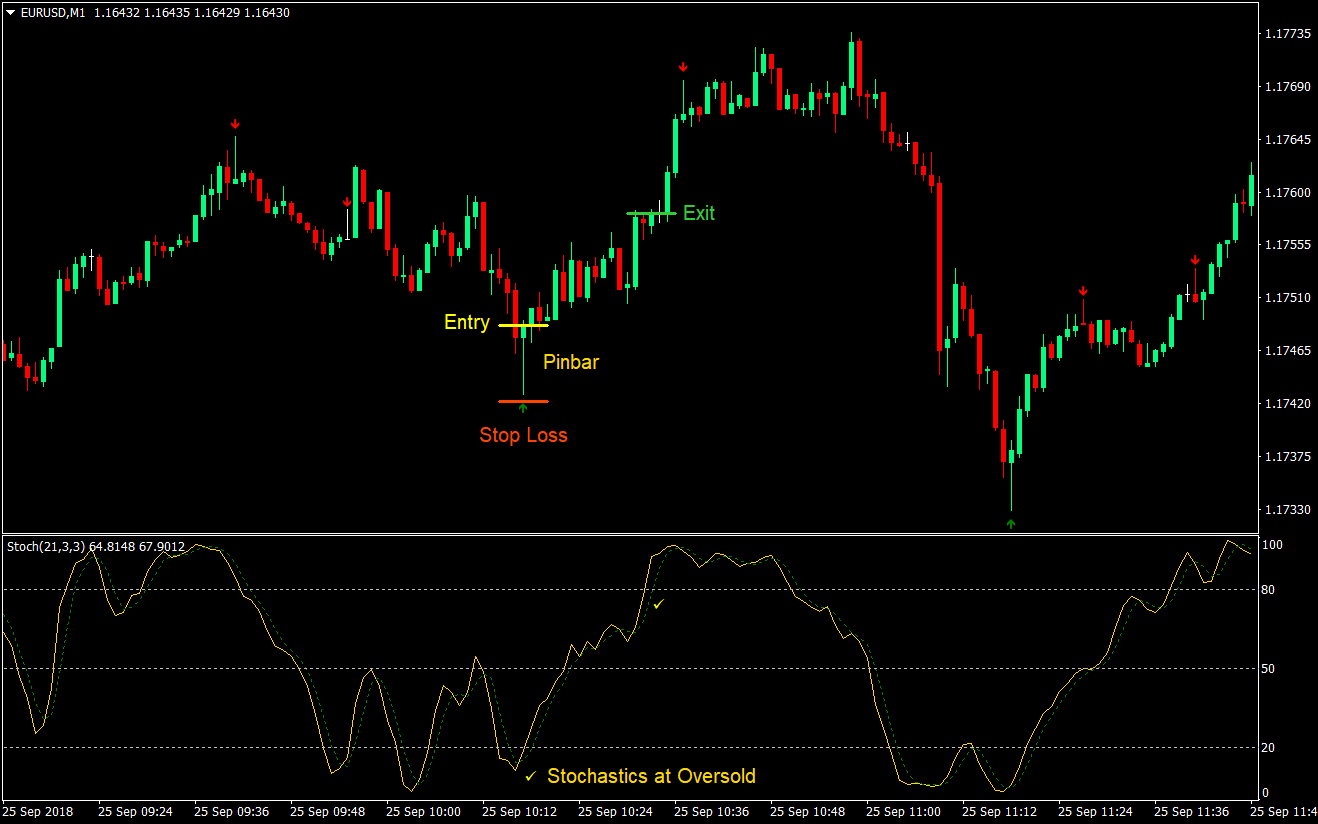

Buy (Long) Trade Setup

Entry

- Both stochastic oscillator lines should be on the oversold area (below 20)

- A bullish pin bar pattern should appear

- Take a buy market order as soon as the bullish pin bar candle closes

Stop Loss

- Set the stop loss below the entry candle

Exit

- Close the trade as soon as the stochastic oscillator reaches the opposite side

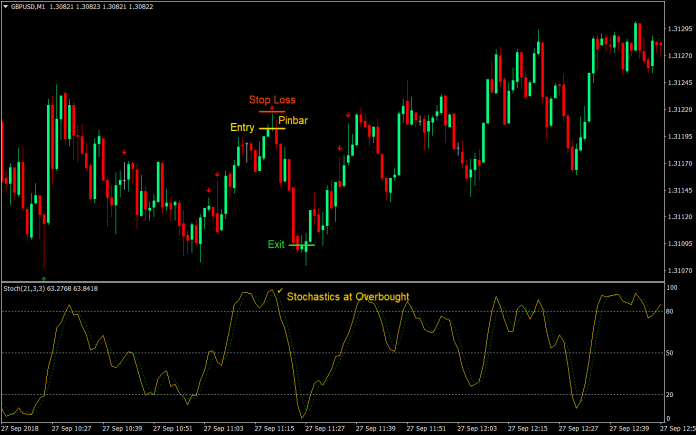

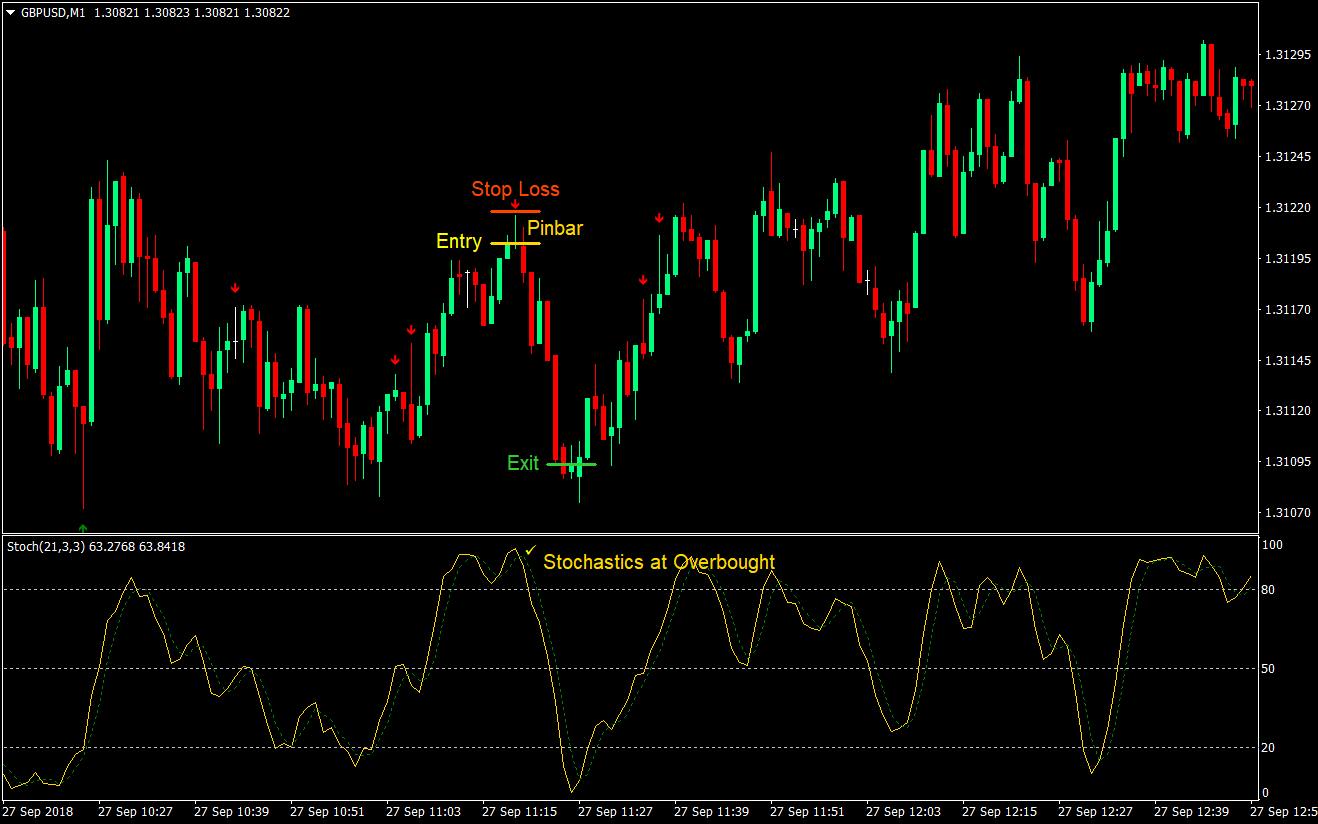

Sell (Short) Trade Setup

Entry

- Both stochastic oscillator lines should be on the overbought area (above 80)

- A bearish pin bar pattern should appear

- Take a sell market order as soon as the bearish pin bar candle closes

Stop Loss

- Set the stop loss above the entry candle

Exit

- Close the trade as soon as the stochastic oscillator reaches the opposite side

Conclusion

This is a commonly recurring theme on the 1-minute chart, especially during range bound market conditions. However, this could also occur on an overextended trending market.

I find the pin bar pattern to be very effective on the 1-minute chart as compared to higher timeframe day trading charts. This might probably be because on the lower timeframe, the pin bar candle signals the start of a probably reversal, while on the 5-minute chart and above, price have already moved by several pips. Although many traders have also been profitable on the 5-minute, 15-minute and even higher day trading timeframes.

This strategy could also work intraday during the London session, even after the two-hour window for volatility spike. However, often times, volatility fizzles out making it difficult to scalp. This strategy could also work on the New York open. The key is that volatility is high to allow us to easily scalp the market.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: