Trend following strategies are one of the most powerful strategies available to traders. It allows traders the opportunity to take trades that have the potential to earn the high returns. If used with the right filters, taking into account the long-term trend, using exit strategies that allow profitable trades to run, and making use of precise, high probability entries, trend following strategies could actually yield big profits.

The Trend Cloud Forex Trading Strategy is a trend following strategy that tries to tick all the boxes mentioned above. It takes trades aligned with the long-term trend, allows profitable trades to run, and makes use of high probability entries. It does by making use of a combination of custom indicators that accomplishes these requirements.

iTrend Manager Indicator

The iTrend Manager indicator is a custom indicator which acts as a zone marker. Visually, those familiar with the Ichimoku Cloud indicator would notice its similarity to the Ichimoku’s cloud feature.

It basically looks like a cloud that changes colors whenever the trend changes. Blue shading represents a bullish market condition, while red shading represents a bearish market condition.

The iTrend Manager indicator also acts as a support and resistance. Price would tend to bounce off whenever it visits the area around it. Since the Trend Manager indicator represents the mid-term trend, the trend tends to reverse whenever price pierces through and breaks through it.

FX Trend Power Indicator

FX Trend Power is a custom indicator that attempts to predict the trend and conveniently shows traders the general mid-term trend direction. It does this by drawing a colored line on the window below the price chart. If the market is bullish, the indicator paints a blue line. On the other hand, if the market is bearish, it paints a gold line.

Trading Strategy Concept

The iTrend Cloud Forex Trading Strategy is a trend following strategy that aligns with the long-term trend while at the same time makes use of precise entries. By doing so, the strategy allows traders to have an improved probability as compared to most trend following strategies.

In order to align trades with the long-term trend, the strategy makes use of the 200-period Exponential Moving Average (EMA). This moving average is commonly used among professional traders as a tool to determine the long-term trend. To determine the trend using the 200 EMA, we will be identifying the location of price in relation to it. If price is generally above the 200 EMA, then the market is said to be bullish, while if price is generally below it, then the market is said to be bearish. Although the 200 EMA is a long-term trend and usually does not change directions too steeply, it is still important to note the slope of the 200 EMA. Trends tend to be stronger when the 200 EMA is sloping. As such, only trade setups with a considerable slope should be traded, while flatter 200 EMAs should be avoided since it may indicate that the trend is not as strong.

The entries are based on the two custom indicators, the iTrend Manager indicator and the FX Trend Power indicator. Individually, these two indicators seem to produce decent trade signals, however, when used in tandem, the trade signals generated seem to have better win rates. The FX Trend Power indicator would usually respond earlier than the iTrend Manager indicator. As such, we would be looking at it to determine possible entry signals. Then, we wait for the Trend Manager indicator to agree with the Forex Trend Power indicator. Trades would be taken as soon as these two indicators align, together with the direction of the 200 EMA.

The iTrend Manager is not just an entry signal. It also acts as a support and resistance zone. Trades are usually invalidated whenever price pierces through it. As such, we will be placing our stop losses on the other side of the Trend Manager indicator and allow the trade to run until stopped out. This ensures that we get to stay with the trade until the trend dies out.

Indicators

- iTrendManager

- 200 EMA (gold)

- fxtrendpower

Timeframe: 1-hour, 4-hour and daily charts

Currency Pair: major and minor pairs

Trading Session: Tokyo, London and New York sessions

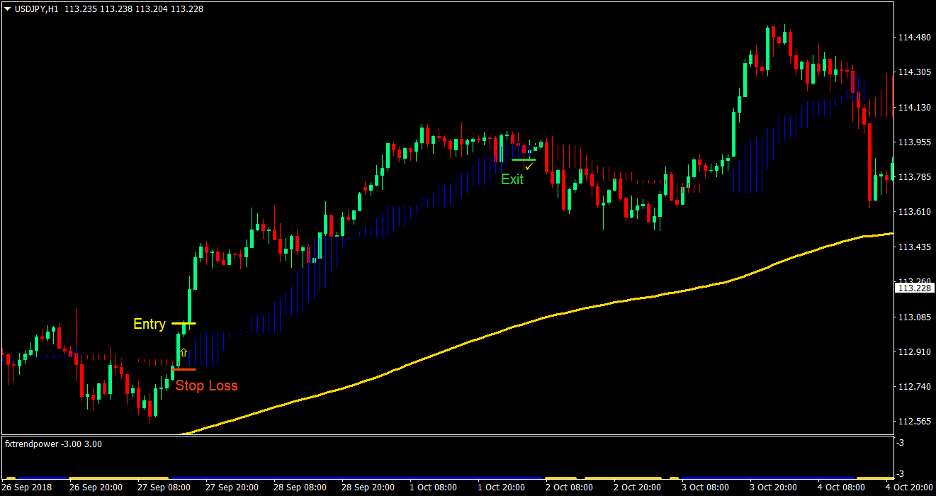

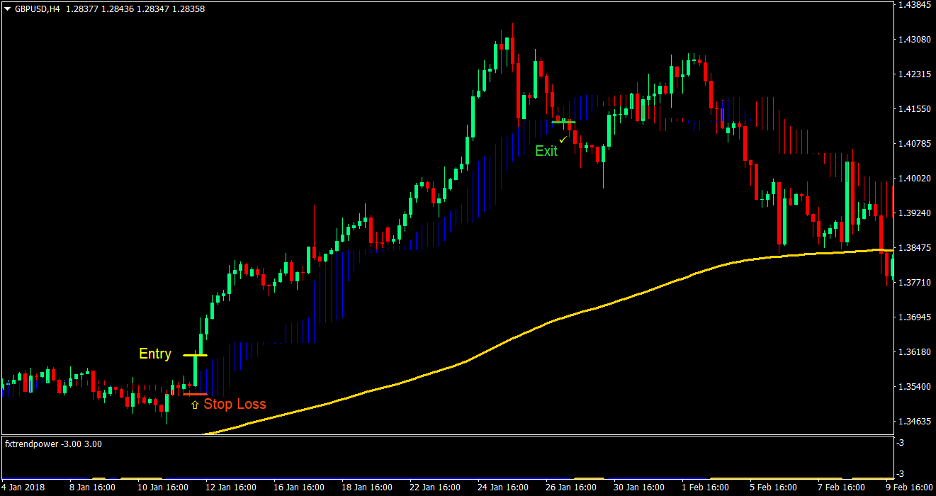

Buy (Long) Trade Setup

Entry

- Price should be above the 200 EMA indicating a bullish long-term trend

- The Trend Manager indicator should be above the 200 EMA

- The FX Trend Power indicator should print a blue line indicating a bullish mid-term trend

- Enter a buy order as soon as the Trend Manager indicator changes to blue confirming the start of the bullish mid-term trend

Stop Loss

- Set the Stop Loss below the Trend Manager indicator

Exit

- Trail the stop loss below the Trend Manager indicator until stopped out

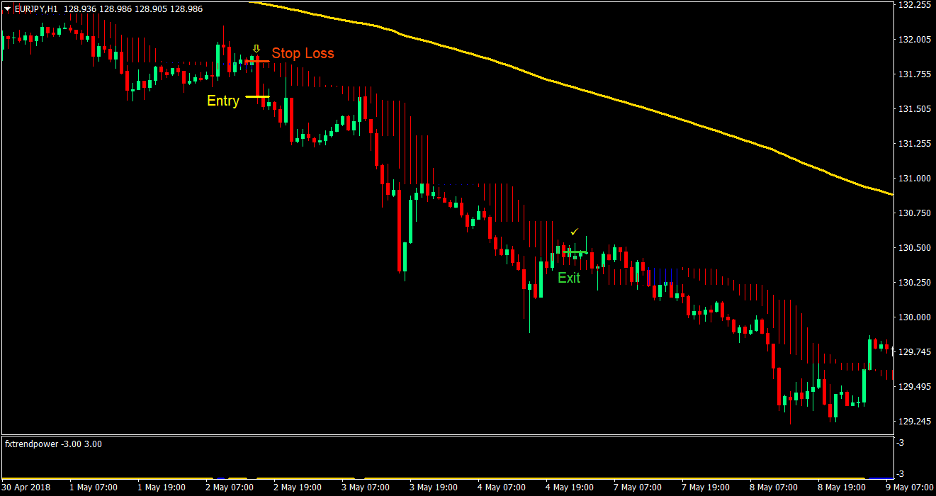

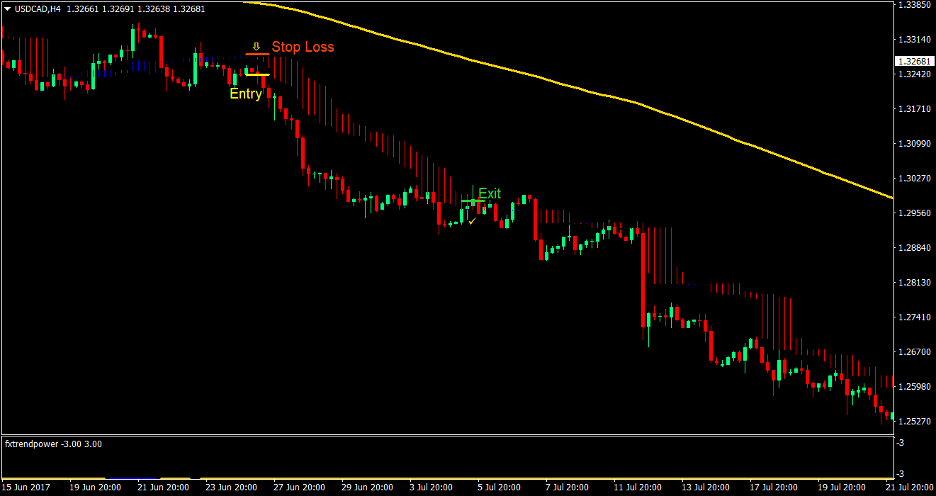

Sell (Short) Trade Setup

Entry

- Price should be below the 200 EMA indicating a bearish long-term trend

- The Trend Manager indicator should be below the 200 EMA

- The FX Trend Power indicator should print a gold line indicating a bearish mid-term trend

- Enter a sell order as soon as the Trend Manager indicator changes to red confirming the start of the bearish mid-term trend

Stop Loss

- Set the Stop Loss above the Trend Manager indicator

Exit

- Trail the stop loss above the Trend Manager indicator until stopped out

Conclusion

This strategy is a trend following strategy with a decent win ratio and a high reward-risk ratio. Most trend following strategies tend to have a low win ratio. This is probably because most trend following strategies take trades in any direction without regard for the long-term trend. Trend following strategies only get to be profitable because it usually has a good reward-risk ratio.

The iTrend Cloud Forex Trading Strategy however has a better win ratio than most trend following strategies while still having a very good reward risk ratio. It usually yields returns of 4:1 and above.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: