Mean reversal strategies are often used in a non-trending market condition. This is because price action would typically swing back and forth the average range as price becomes temporarily oversold or overbought on the short-term. However, price can still be mathematically overbought or oversold even in a trending market against the direction of the trend.

This strategy is an example of how mean reversal strategies can be traded in a market with a long-term trend bias using the 200 SMA line and the Engulfing Stochastic Indicator.

200 SMA Line

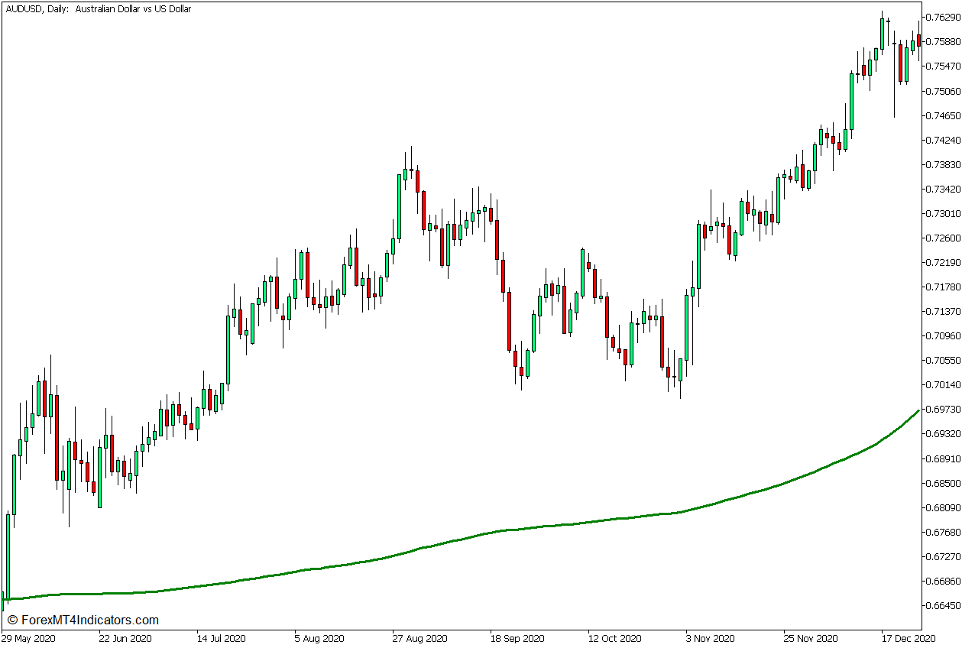

The 200-period Simple Moving Average (SMA) is a widely accepted long-term trend line which could also act as a dynamic support or resistance line.

As a long-term trend direction indicator, traders would identify trend direction based on where price action generally is in relation to the 200 SMA line. The slope of the 200 SMA line also gradually follows the direction of the trend.

In an uptrend, price action is typically above the 200 SMA line while the 200 SMA line slopes up. In a downtrend, price action would usually be below the 200 SMA line while the line slopes down.

As mentioned above, the 200 SMA line can also act as a dynamic support or resistance level. It is common to see scenarios wherein price would keep bouncing off the 200 SMA line as if it was a support or resistance level.

Engulfing Pattern

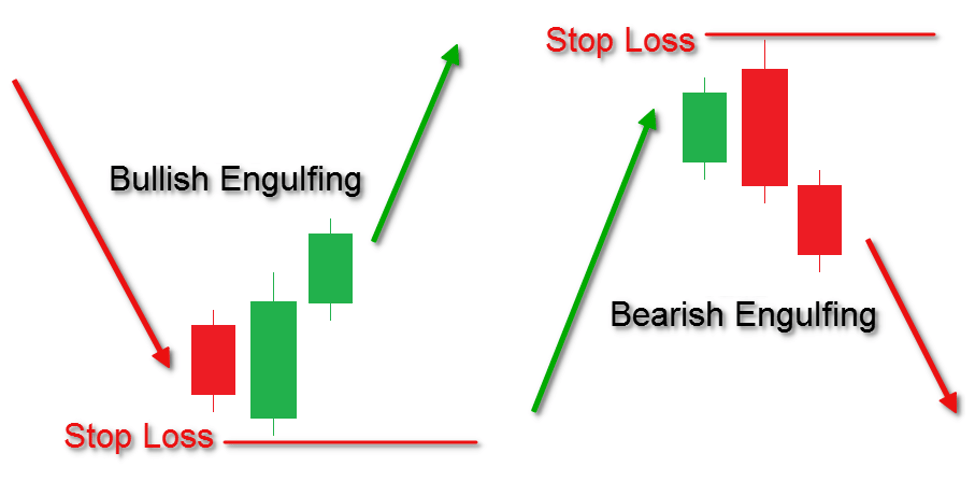

The Engulfing Pattern is a high probability reversal candlestick pattern.

This pattern is formed by two candles, with the second candle reversing against the first candle that its body completely engulfs the body of the first candle.

A bullish engulfing pattern has the first candle as a bearish candle, while the second candle is a bullish candle that closes above the open of the first candle.

A bearish engulfing pattern on the other hand has a bullish first candle, and its second candle is a bearish candle which closes below the opening price of the first candle.

This pattern is a good indication of a possible reversal because it tells us that momentum has shifted drastically that price would completely reverse on a prior period.

Stochastic Oscillator and the Engulfing Stochastic

The Stochastic Oscillator (SO) is a widely used momentum-based indicator which is widely used to identify overbought and oversold market conditions.

The SO plots two lines that oscillate within the range of zero to 100. Momentum direction and momentum reversals are usually based on how the two lines interact and crossover. The direction of the reversal is based on which direction the faster line is crossing the slower line.

The SO range also has markers at level 20 and 80. SO lines below 20 are indicative of an oversold market condition, while SO lines above 80 are indicative of an overbought market condition. Crossovers occurring on these areas tend to be high probability mean reversal signals.

The Engulfing Stochastic is a custom technical indicator which is based on the Stochastic Oscillator and the Engulfing Pattern. This indicator identifies engulfing patterns which are formed while the Stochastic Oscillator lines are overbought or oversold. It plots an arrow pointing up to indicate a bullish engulfing pattern, and an arrow pointing down to indicate a bearish engulfing pattern.

Bullish signals that develop while the Stochastic Oscillator lines are above 80 indicate a possible bullish momentum continuation, while bearish signals that develop while the Stochastic Oscillator lines are below 20 indicate a possible bearish momentum continuation.

On the other hand, bullish signals that develop while the Stochastic Oscillator lines are below 20 indicate a possible bullish mean reversal, while bearish signals that develop while the Stochastic Oscillator lines are above 80 indicate a possible bearish mean reversal.

Trading Strategy Concept

This strategy is a mean reversal trading strategy which trades in the direction of the long-term trend using the 200 SMA line and the Engulfing Stochastic Indicator.

We will use the 200 SMA line first as a long-term trend direction filter taking signals that agree with the long-term trend direction indicated by the 200 SMA line. Secondly, we will also use the 200 SMA line as an area of dynamic support or resistance, allowing price to pull back near the 200 SMA line before we consider a possible mean reversal signal.

As for the Engulfing Stochastic Indicator, we will be using the mean reversal signals identified by this indicator as our trade entry signal, as long as the trade direction is in confluence with the 200 SMA line.

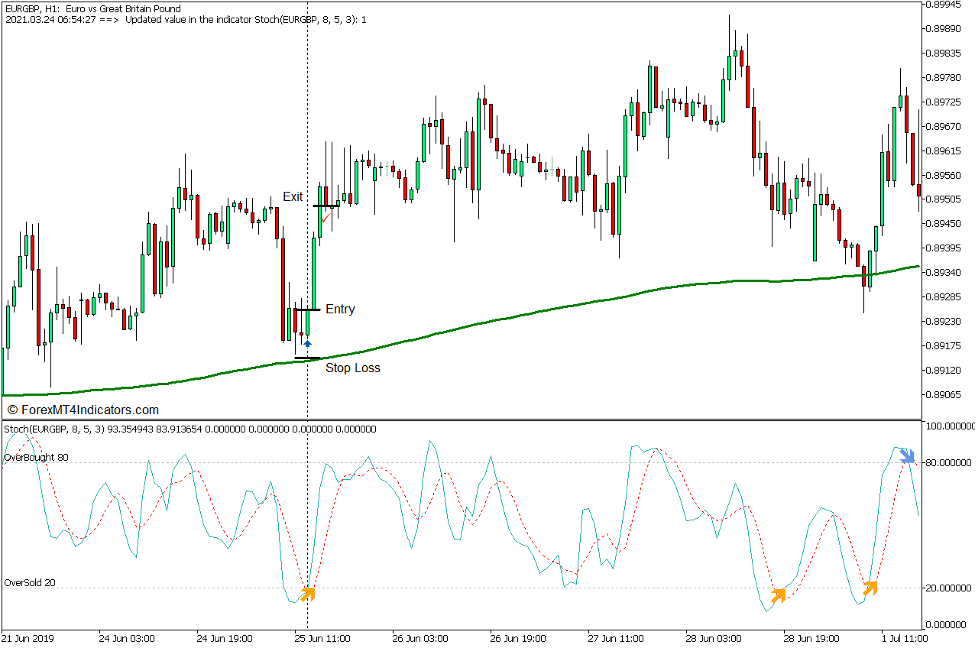

Buy Trade Setup

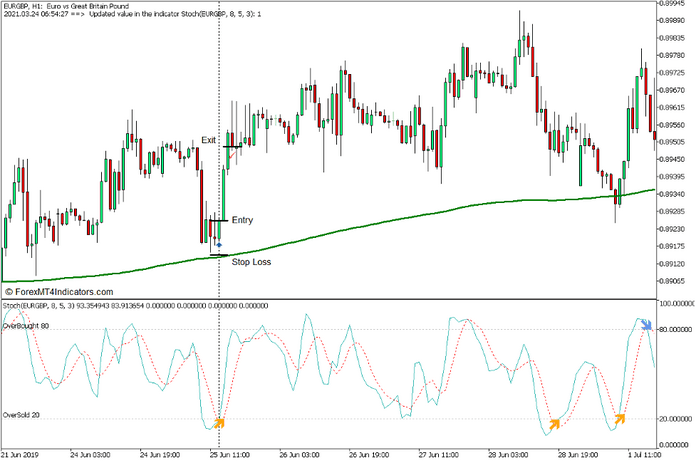

Entry

- Price action should generally be above the 200 SMA line.

- Price action should retrace towards the 200 SMA line.

- The Stochastic Oscillator lines should be below 20 as price action retraces near the 200 SMA line.

- Enter a buy order as soon as a bullish engulfing pattern forms and the Engulfing Stochastic plots an arrow pointing up while oversold.

Stop Loss

- Set the stop loss at the support below the entry candle.

Exit

- Close the trade as soon as price action shows signs indicating the end of the bullish momentum.

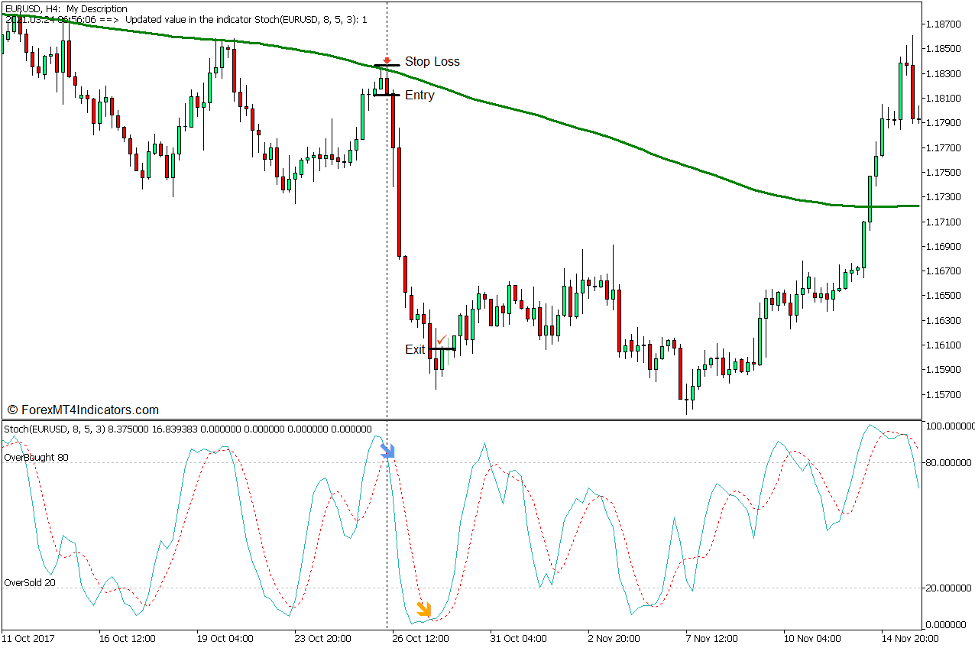

Sell Trade Setup

Entry

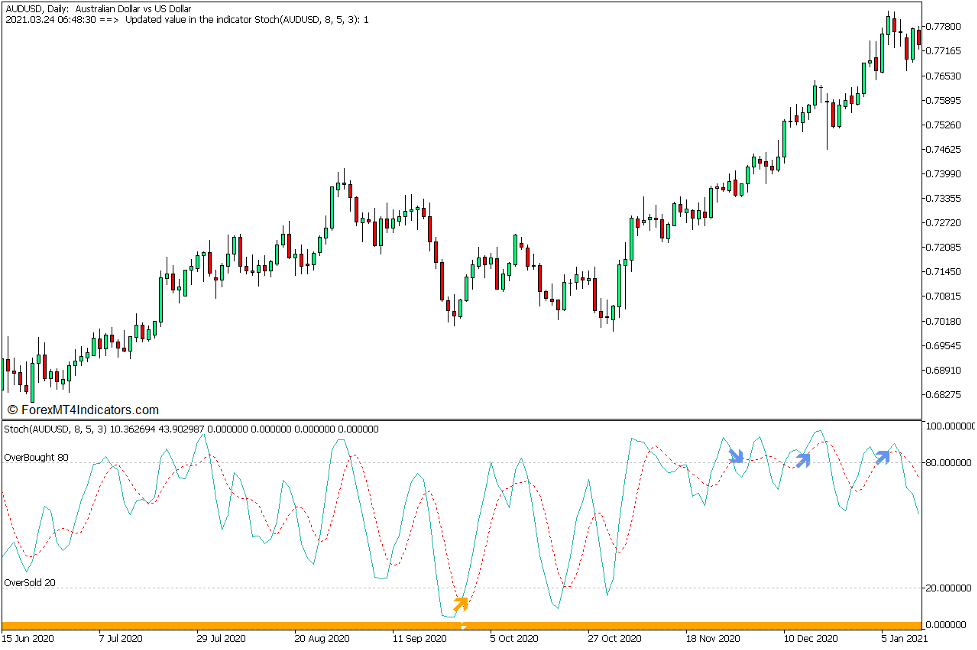

- Price action should generally be below the 200 SMA line.

- Price action should retrace towards the 200 SMA line.

- The Stochastic Oscillator lines should be above 80 as price action retraces near the 200 SMA line.

- Enter a sell order as soon as a bearish engulfing pattern forms and the Engulfing Stochastic plots an arrow pointing down while overbought.

Stop Loss

- Set the stop loss at the resistance above the entry candle.

Exit

Close the trade as soon as price action shows signs indicating the end of the bearish momentum.

Conclusion

This type of mean reversal strategy contradicts other mean reversal strategies. This is because some mean reversal strategies trade on reversals towards the moving average line. This approach would be good if the market were totally flat and ranging. However, if the market has a slight long-term trend bias, mean reversal setups tend to have a shorter travel distance making it less efficient as a trade setup. This strategy on the other hand takes a different approach. It trades mean reversals assuming that there is still a long-term trend bias and trades taken in that direction allow for possible high yielding trades.

Recommended MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: