Momentum trading is one of the staple types of trading strategies that many successful traders use. Momentum strategies often provide high probability trades that could push price in the same direction after the momentum signal develops. This allows traders to profit as price tends to push further in the same direction after a strong momentum price movement.

However, although momentum trading is very effective, it is often very confusing for new traders to identify which momentum candle is a valid momentum entry. Price might seem to be a very good momentum candle but might not be sufficiently strong enough when compared to previous price candles. This is because price is dynamic. Price ranges could vary one moment to another. A candle may range for 50 pips one moment, then in the next few hours candles could range to more than a hundred. This sometimes makes identifying possible momentum entries a bit tricky.

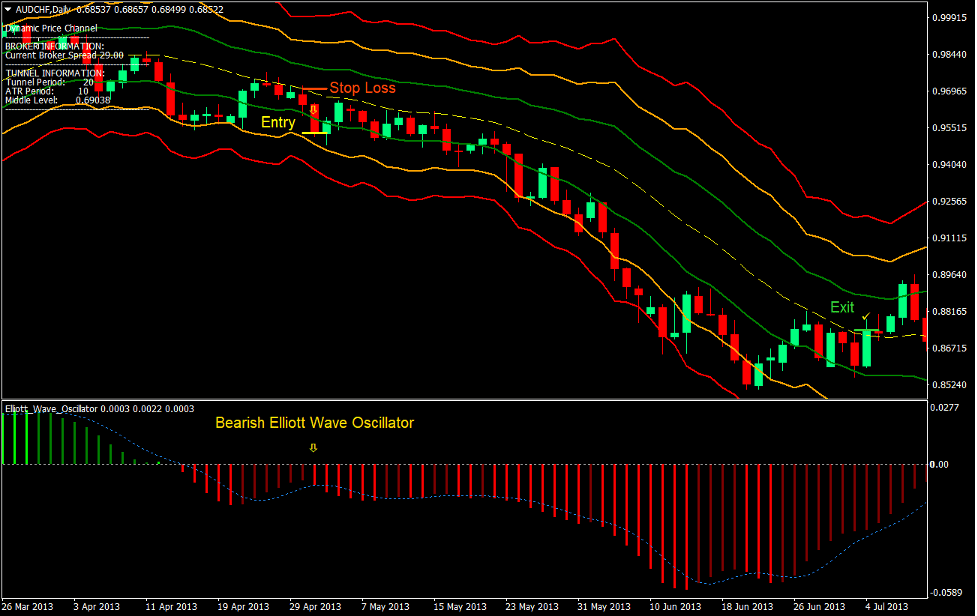

Dynamic Price Channel Forex Trading Strategy is a momentum strategy that helps traders identify possible momentum-based trade entries. It provides traders a clear rule-based system that would help traders qualify momentum candle signals. On top of this, it also uses another technical indicator that would help identify if the trend has already reversed in the direction of the momentum candle. This combination of a momentum signal and a trend confirmation is an excellent trade entry strategy that could help traders profit from the forex market.

Dynamic Price Channel

The Dynamic Price Channel indicator is a custom technical indicator which helps traders identify momentum and trend.

It is a band or channel type of indicator which could be used in a variety of ways. It could identify momentum, trend, overbought or oversold prices, and volatility.

Dynamic Price Channel is based on the classic moving averages and the Average True Range (ATR). The middle line is a basic moving average which could be modified depending on the preference of the trader. It could be a Simple Moving Average (SMA), an Exponential Moving Average (EMA), a Smoothed Moving Average (SMMA), or a Linear Weighted Moving Average (LWMA).

The indicator then plots three pairs of lines above and below the moving average. These lines are plotted away from the middle line based on the ATR. The trader could modify the multipliers of each pair of lines to adjust its distance from the midline.

As a momentum indicator, traders could identify momentum price movements based on candles closing at a certain level away from the middle line. As a trend indicator, traders could identify the trend based on the slope of the middle line and the location of price in relation to the middle line. Volatility could also be identified based on the expansion and contraction of the channels. Overbought and oversold price conditions could also be identified based on reversal price candles occurring on levels away from the middle line.

Elliott Wave Oscillator

The Elliott Wave Oscillator (EWO) is a trend-following indicator. It is an oscillating indictor which indicates the direction of the trend by plotting histogram bars.

The Elliott Wave Oscillator is computed as the difference between a 5-period Simple Moving Average (SMA) and a 35-period Simple Moving Average (SMA) based on the close of each bar. The resulting difference is then plotted as a histogram bar. Positive histogram bars indicate a bullish trend bias, while negative histogram bars indicate a bearish trend bias.

It plots lime bars to indicate a strengthening bullish trend and green bars to indicate a weakening bullish trend. It plots red bars to indicate a strengthening bearish trend and maroon bars to indicate a weakening bearish trend.

Given the basis for the histogram bars, this indicator is basically a simple trend-following indicator based on the concept of a moving average crossover. The difference is that the indications of a trend reversal is plotted on a separate indicator window. This allows traders to place another indicator on the price chart, which could also be valuable for a trading strategy.

Trading Strategy

This strategy is a momentum-based strategy based on the Dynamic Price Channel. It also makes use of the trend reversal and trend strength indication of the Elliott Wave Oscillator.

First, we look at the Elliott Wave Oscillator indicator to identify the direction of the trend and whether the trend is strengthening or not. Trend direction will be based on whether the bars are positive or negative, while trend strength will be based on the color of the bars.

Then, we wait for price to gather momentum based on the Dynamic Price Channel. This will be based on a momentum candle closing beyond the green lines, which are the first levels of the Dynamic Price Channel.

If the market is indeed developing a trend based on momentum, then the price candles will start to push on the orange and red lines. If the trend weakens or starts to reverse, then price will close on the opposite side of the middle line.

Indicators:

- Dynamic_Price_Channel (default settings)

- Elliott_Wave_Oscillator (default settings)

Preferred Time Frames: 30-minute, 1-hour, 4-hour and daily charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

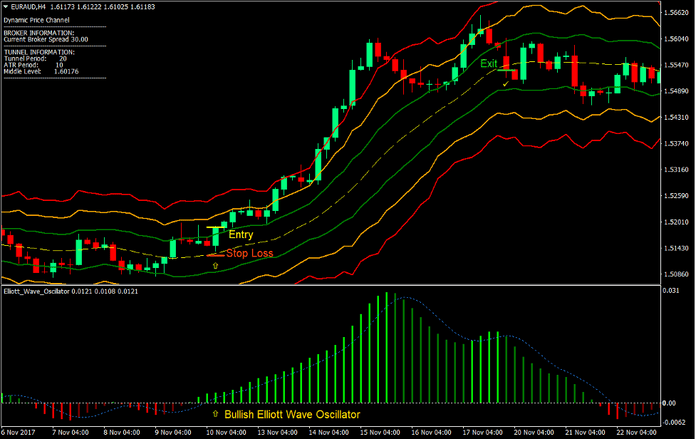

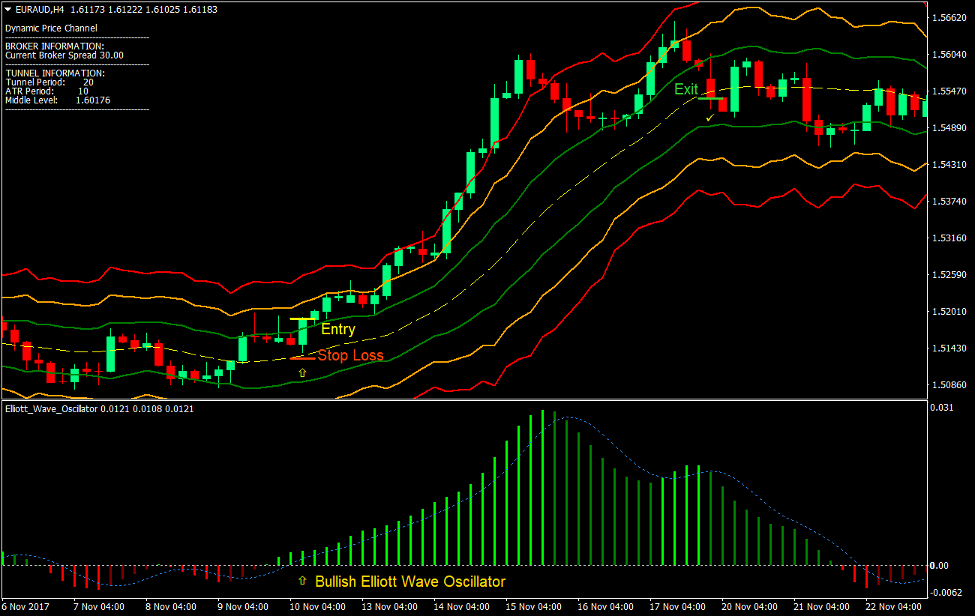

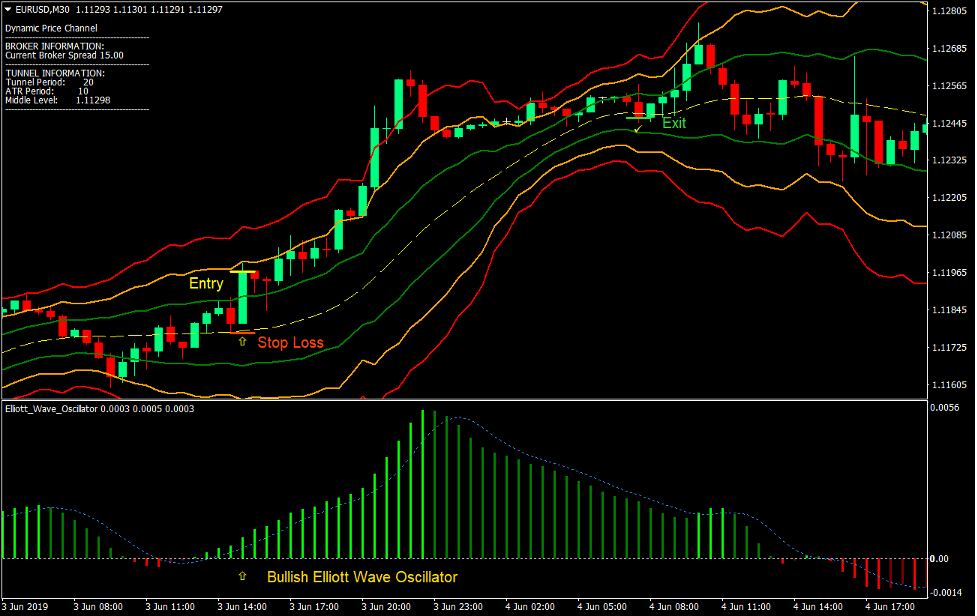

Buy Trade Setup

Entry

- The Elliott Wave Oscillator should be plotting positive lime bars.

- A bullish engulfing or momentum candle should close above the upper green line of the Dynamic Price Channel indicator.

- Enter a buy order on the confluence of the conditions above.

Stop Loss

- Set the stop loss below the midline of the Dynamic Price Channel indicator.

Exit

- Close the trade as soon as price closes below the midline of the Dynamic Price Channel indicator.

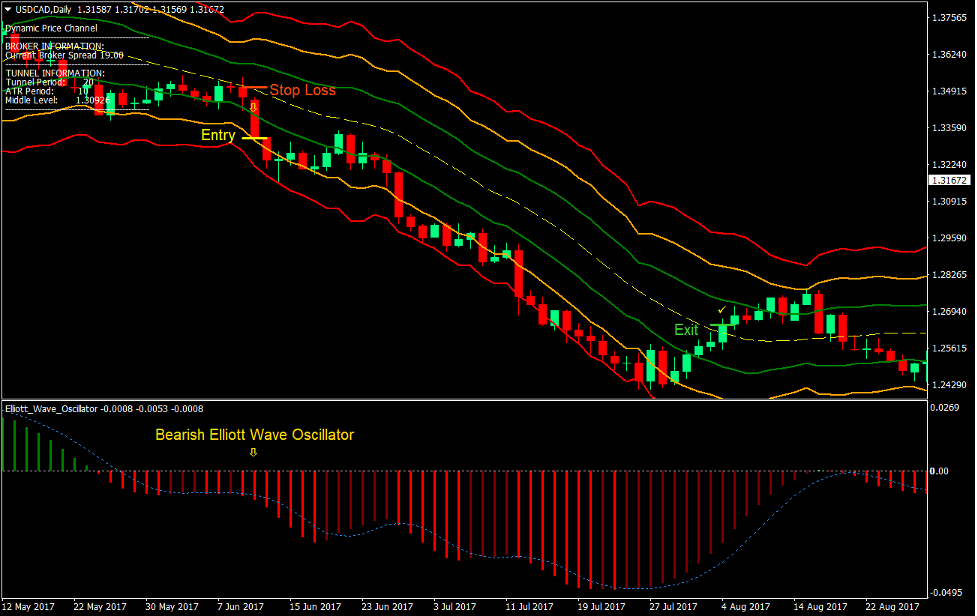

Sell Trade Setup

Entry

- The Elliott Wave Oscillator should be plotting negative red bars.

- A bearish engulfing or momentum candle should close below the lower green line of the Dynamic Price Channel indicator.

- Enter a sell order on the confluence of the conditions above.

Stop Loss

- Set the stop loss above the midline of the Dynamic Price Channel indicator.

Exit

- Close the trade as soon as price closes above the midline of the Dynamic Price Channel indicator.

Conclusion

This momentum strategy works very well most of the time. Price would usually push in the direction of the trend right after the momentum candle. At times, price may retrace a bit towards the area of the green line, then continue its initial momentum move.

The hurdle is usually the duration or the intensity of the continuation move after the entry. At times, price could reverse right away after moving in the direction of the trend a bit. It is best to move the stop loss to breakeven whenever possible. Another option would be to close the trade as soon as price action shows signs of indecision or reversal based on candlestick patterns.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: