The Double Bottom Forex Swing Trading Strategy

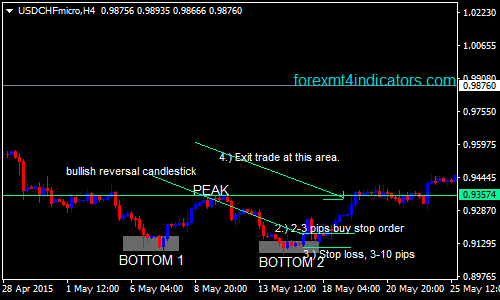

This system is the opposite of the double top chart pattern. This is considered as a bullish reversal chart pattern and is made up of two bottoms that are equal with a peak in between.

The double bottom chart patterns can form when there is an existing downtrend. Price finds support and stops the downtrend move. Price then will rally to a new high forming a resistance point. The sellers then get in and push down the price but when it reaches the previous low, which is the bottom, price finds support and rallies back up.

The two bottoms or lows are now forming a strong resistance level. This pattern is confirmed when price breaks out the above resistance.

Trading Rules:

There are 2 ways to trade using this pattern and these are aggressive and conservative entry.

Aggressive Entry:

- The second bottom must form then watch for a bullish reversal candlestick formation.

- Place a buy stop order just 3-5 pips above the high of the bullish reversal candlestick pattern.

- Place your stop loss at leat 5-10 pips below the low of the bullish reversal candlestick. You can also place it a little bit outside of both bottom 1 and 2 around 5-20 pips.

- You can use the peak as your take profit target level

Conservative Entry:

- The price has to break the above peak. The candlestick must break the peak but must close above it.

- Then place a buy stop order 3-5 pips above that breakout candlestick’s high.

- Stop loss must be placed about 3-10 pips below the peak or below the low of the breakout candlestick.

- Calculate the distance in pips between the peak and the 1st bottom (or the second bottom.

ADVANTAGES:

- No need for indicators, because this strategy will only be using price actions.

- It is easy to identify.

- There can be a high probability of success and can be achieved using bullish reversal candlesticks for trading confirmation.

- There can be low-risk trade entries.

DISADVANTAGES:

- The double bottom formation can’t appear most of the time. The price will just break through the support level.

- The distance from the first bottom to the 2nd bottom is a factor in how the market responds to the double bottom chart formation pattern. It won’t be identified if it’s too far and can be insignificant if it’s too close.

Open a USDCHF daily chart for the template.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: