Classic Bull Trap Swing Forex Trading Strategy

The market is a vicious world. It is a place where many build their fortunes and many also lose a lot of money. It is a place where traders fight for every last pips and bps just to get ahead of the others. And although this is not always true, to some extent, it is a place where some make money at the demise of other traders.

Bull Trap

A classic example of a situation where some traders are making money while others are in deep losses is the bull trap.

The bull trap is a scenario wherein a breakout signal was generated yet that signal turns out to be a false signal. After a spike above a resistance level, usually occurring intraday, many breakout traders would take notice. Some traders have rules that would prevent them from entering prior to a confirmation. Some may trade at end of day, others would wait for a retracement, others would wait for a break above the high of the day, etc. Others on the other hand can’t resist the temptation of chasing a breakout instead of waiting for a confirmation. These traders take a trade as soon as they see that price is above the resistance. However, price doesn’t stop at exact resistances. Sometimes price would peak above a resistance, only to dive back below it within the day. Impatient bulls who took the trade right away find themselves trapped in a long trade when price has actually bounced off a resistance. Some would cut losses, while others would hold on to the losing trade until the pain is enough to make them close the trade at a massive loss, others wipe out their accounts on a single errant trade. That is the viciousness of a bull trap scenario.

Trading Strategy Concept

While the bull trap could be painful for some traders, it could mean money for those who would trade against the trapped bulls. This is because as more of the bulls gets squeezed out of the trade, many would either get stopped out, manually close their buy trade, or would be margin called, all of which are effectively sell transactions which would push price further down. This is where some traders make money, by selling right before price pushes further down.

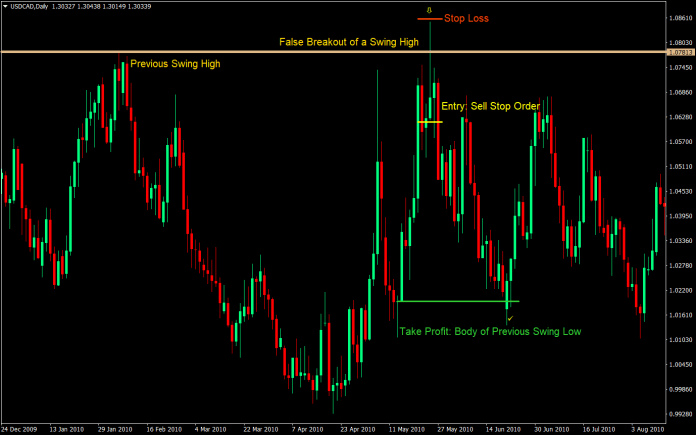

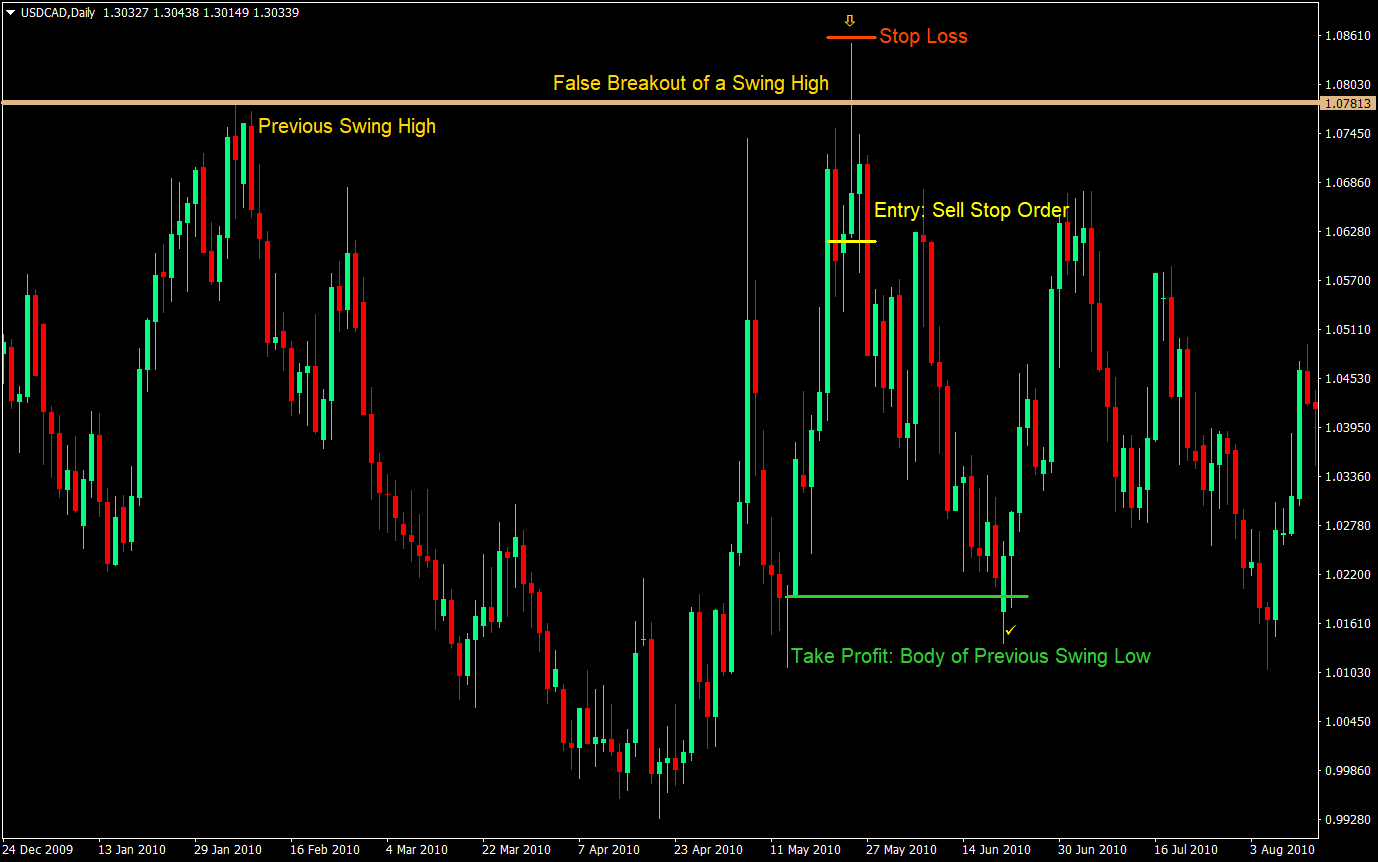

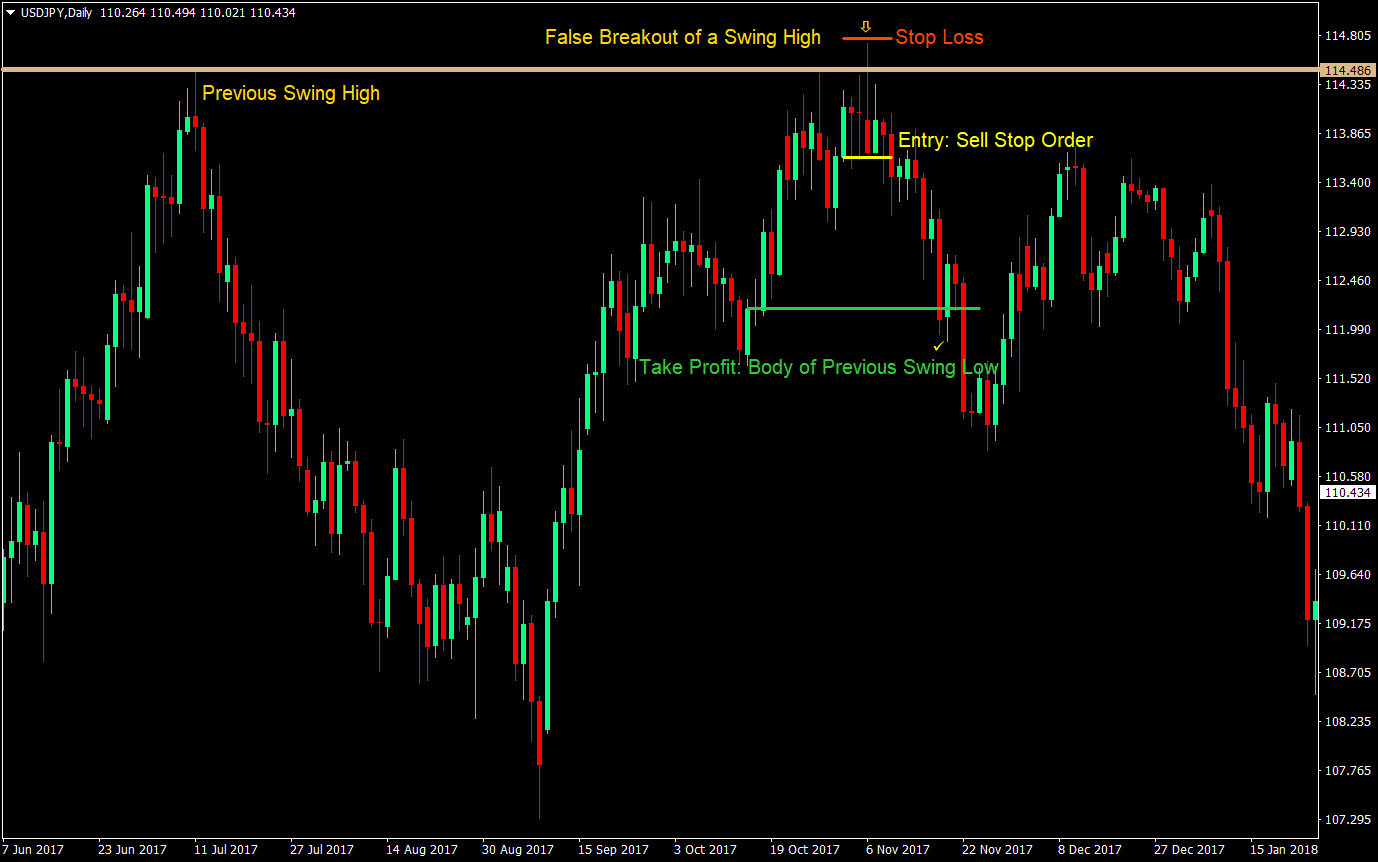

To do this, we should first identify a resistance level by identifying a major swing high or an actual resistance line. Then, we observe how price behaves as it visits that level. At times, price would bounce off the resistance level prior to the actual touch of the line. Sometimes, it would poke above the resistance level before diving back below it. This price action on a single candle would form a shooting star or a bearish pin bar pattern. The key is to find these kinds of candlestick patterns or candles with long wicks above the resistance level and closing below it. As the candle closes, we then set out sell stop orders at the low of that candle. Often, as the sell transactions come in, our order would get triggered as price heads down.

Currency Pair: any

Timeframe: daily chart

Sell (Short) Trade Setup

Entry

- Identify a horizontal resistance level by determining swing highs or actual horizontal resistance levels with multiple touches

- Wait for price to revisit the area of the resistance level

- Wait for price to poke above the resistance level and closing back below the resistance level before the candle closes

- The candle should form a shooting star, a bearish pin bar pattern or a candlestick with a long wick above the body of the candle

- Set a sell stop order below the low of the candle

Stop Loss

- Set the stop loss above the high of the candle

Take Profit

- Set the take profit at the body of the previous swing low

Conclusion

The bull trap trade setup is a commonly traded setup among many traders, whether in forex, commodities, stocks, or other trading instrument. This is because this is a recurring market scenario. Traders have the same psychological weaknesses, whatever the market may be, greed and impatience. Greed and impatience are the key factor as to why these scenarios occur.

The key to this trading strategy is trading when their bulls trapped in a trade. This is because this setup’s success is highly dependent on whether the bulls would panic and get out of the trade as they are squeezed.

The reason why we are using the daily chart for this is because it is a timeframe which is enough to have day trading bulls trapped in a trade. The more trapped bulls there are, the more powerful the setup becomes. It doesn’t mean that you can’t trade this setup on the lower timeframes. It is just that this setup tends to be more powerful on the higher timeframes.

We are also aiming for the previous swing low’s body because bounces off of a resistance could sometimes lead to a ranging market scenario. However, there are times when price just wouldn’t touch the bottom of the range. To remedy this, you could employ trail your stop loss based on a lower timeframe, moving the stop loss on further profit until stopped out as price forms lower and lower swing lows.

Trade wisely.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: