When I first got into trading, I read everything about forex that I could scour from the internet, like any newbie trader would. I learned something about almost anything trading and forex. One of the most interesting things that caught my attention when I first learned about trading strategies was breakouts.

Breakouts are very interesting because the possibilities are endless. Technical traders know that price would often bounce off support or resistance lines. Once broken, price would often move towards the next support or resistance line. These spaces where price could move are called pockets.

Breakouts however, if it is the last support or resistance line near the vicinity of the current price, have an endless room for price to run. This often allows price to trend strongly in one direction. Traders who can catch such trades could grow their accounts exponentially.

However, trading breakouts is a double-edged sword. While breakout traders look for price to breach such levels, supply and demand traders, as well as reversal traders look for bounces off these levels. Trading breakouts is tricky. However, there are ways to greatly increase the probability of a win.

Zone Momentum Breakout Forex Trading Strategy allows traders to take trades on momentum breakouts with a relatively high success rate. It uses indicators that help traders identify breakout zones and hold trades until the momentum or trend generated on the breakout has fizzled out.

SDX Zone Breakout

SDX Zone Breakout is a custom indicator which helps traders identify the range of a currency pair during a given trading session. It then marks the range with support and resistance lines creating supply and demand zones.

Although this indicator plots supply and demand zones quite differently, it also does work quite well as a basis for support and resistance line breakouts.

Traders could use this indicator in two ways. Reversal traders who expect price to range could trade on bounces from the support or resistance line. Breakout traders on the other hand could trade on strong momentum breakouts from the support or resistance zone and ride the momentum after the breakout.

Slope Direction Line

Moving averages are one of the most basic indicators available to technical traders. In fact, most indicators have an element of a moving average incorporated in it.

Moving averages are primarily used to identify trend direction and trend reversals. One of the most popular ways to identify trend direction using moving averages is by looking at its slope. A moving average that is sloping up indicates an uptrend, while a moving average that is sloping down indicates a downtrend.

The Slope Direction Line is basically a modified moving average line that could help traders identify the direction of the trend based on how it is sloped. This indicator simplifies this by changing the color of its line depending on the direction of the trend.

In this setup, the Slope Direction Line is colored light blue during an uptrend and tomato during a downtrend.

Trading Strategy

This trading strategy is a basic momentum breakout strategy using the SDX Zone Breakout indicator.

To trade this strategy, traders simply wait for a momentum candle to breakout from the support or resistance lines. We will be using the topmost and bottom most lines to identify the support and resistance levels.

A break beyond the outermost lines would alert us that a possible momentum breakout could occur. However, we should not be taking the trade right away. Instead, we wait for price to retest the support or resistance zone.

Retest simply means price action would revisit the area of the support or resistance line and show signs of price rejection of the area. Some traders call it a confirmation, and rightfully so. It would indicate that price is creating higher swing highs and lows after a bullish breakout, or a lower high and low after a bearish breakout. As many professional traders would say, “Confirmation is key.”

Trades are then held if the Slope Direction Line color agrees with the direction of the momentum breakout. Trades are then closed as soon as the Slope Direction Line color changes, indicating that the momentum has fizzled out and price might soon reverse.

Indicators:

- SDX-ZoneBreakout (default setting)

- Slope Direction Line (default setting)

Preferred Time Frames: 5-minute and 15-minute chart only

Currency Pairs: major and minor pairs

Trading Sessions: Tokyo, London and New York sessions

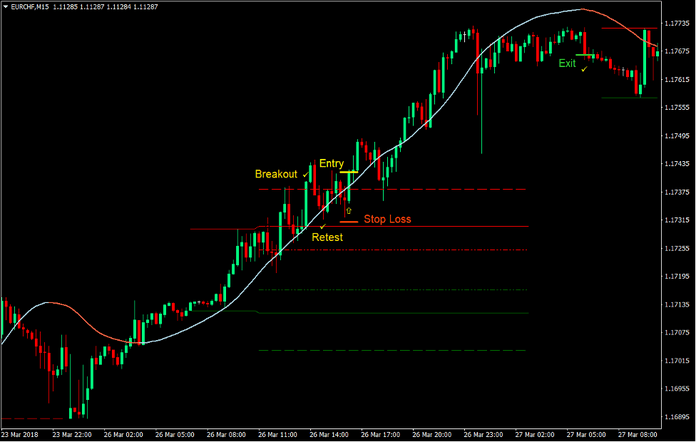

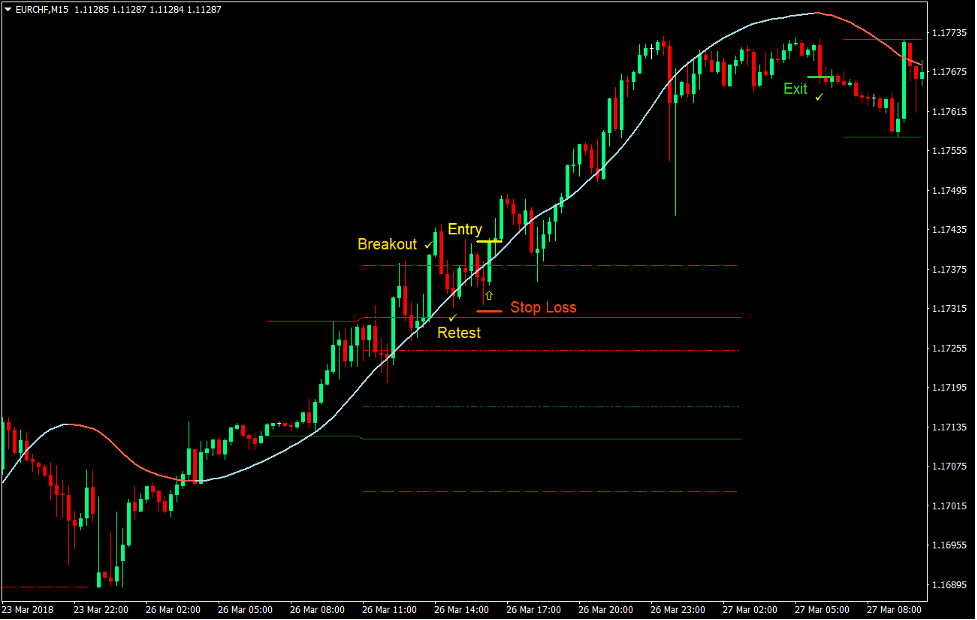

Buy Trade Setup

Entry

- A bullish momentum candle should break above the upper most resistance line.

- The Slope Direction Line should be color light blue.

- Price should retest the resistance lines.

- Price should show signs of price rejection on the area of the resistance line.

- Enter a buy order as soon as price action resumes its bullish pattern.

Stop Loss

- Set the stop loss on the fractal below the entry candle.

Exit

- Close the trade as soon as the Slope Direction Line changes to tomato.

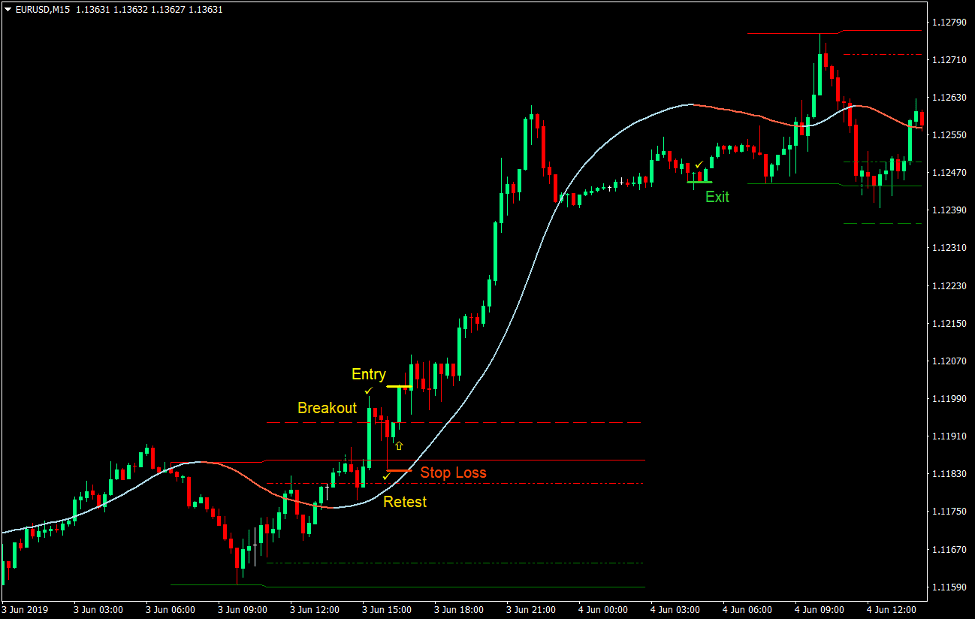

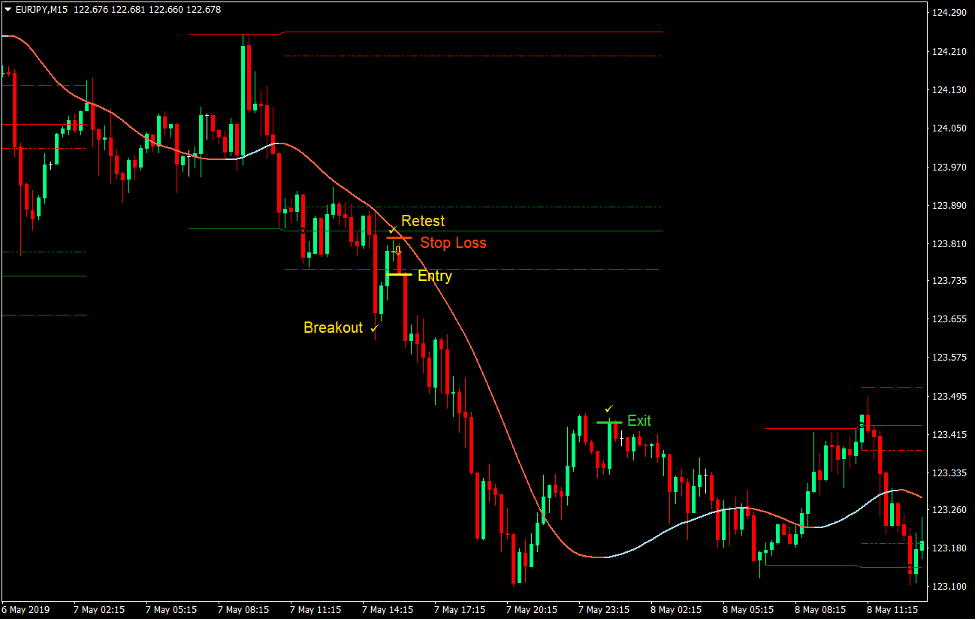

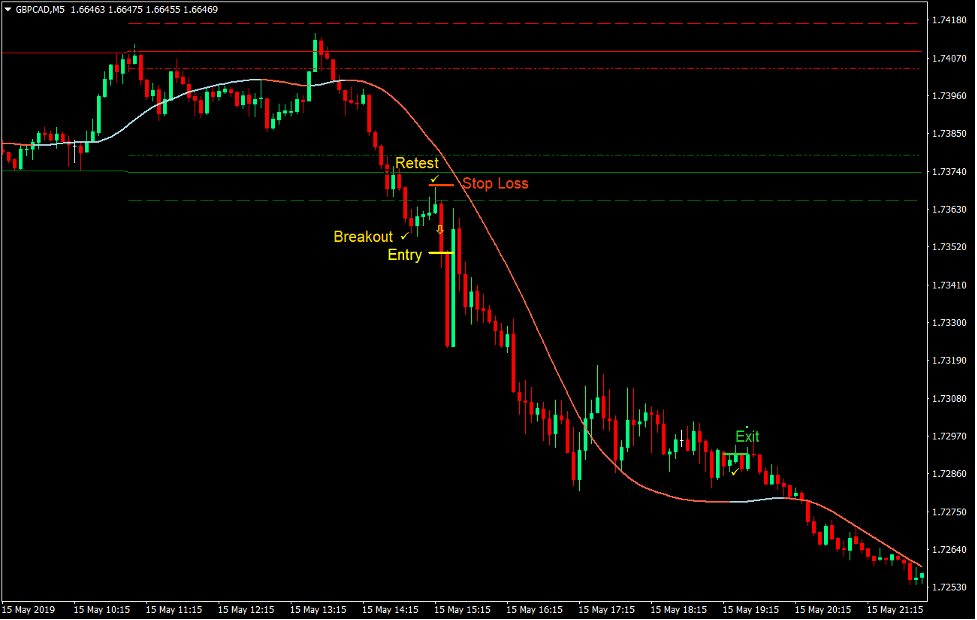

Sell Trade Setup

Entry

- A bearish momentum candle should break below the lower most support line.

- The Slope Direction Line should be color tomato.

- Price should retest the support lines.

- Price should show signs of price rejection on the area of the support line.

- Enter a sell order as soon as price action resumes its bearish pattern.

Stop Loss

- Set the stop loss on the fractal above the entry candle.

Exit

- Close the trade as soon as the Slope Direction Line changes to light blue.

Conclusion

This strategy is a classic price action based breakout strategy. It provides trade signals on momentum breakouts from support or resistance lines.

Not all classic breakout strategies employ taking trades after the retest. However, breakout strategies that do this tend to have better win rates.

This strategy differs only because it uses a technical indicator to plot the support or resistance lines. This could be helpful for newbie traders. However, seasoned traders might be able to plot more accurate support and resistance lines.

It also simplifies the exit strategy by using the Slope Direction Line. Most breakout traders do not have a systematic method of exiting the trade. Instead, they would opt to set fixed take profit targets. Using the Slope Direction Line allows traders to hold on to a trade as long as the trend is still in place.

This strategy could work well in many trade setups. Traders who could identify the right trade setups could profit much using this type of strategy.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: