Trigger Lines MT5 Indicator steps in, offering a sharper, more responsive tool for discerning traders. This in-depth guide will equip you with everything you need to master the Trigger Lines indicator in MT5. We’ll delve into its core principles, explore configuration options, and unlock its potential for generating high-probability trading signals. Whether you’re a seasoned trader or just starting your forex journey, this comprehensive exploration will empower you to make informed decisions and potentially elevate your trading game.

What are Trigger Lines in MT5?

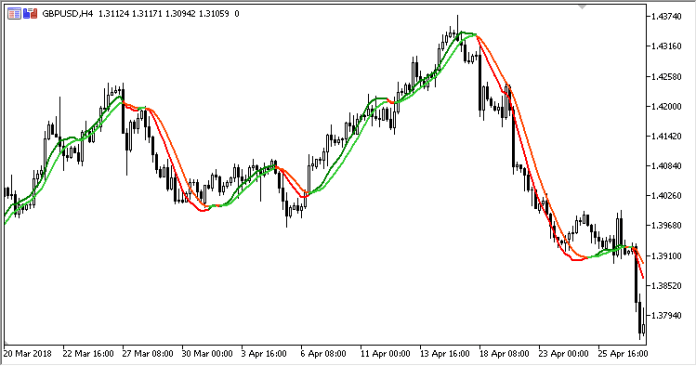

At its core, the Trigger Lines indicator for MT5 is a trend-following tool that utilizes two moving averages to depict the prevailing market direction. However, unlike traditional moving averages that simply average past price data over a set period, Trigger Lines employs a more sophisticated filtering mechanism. This filtering process reduces the impact of price extremes, resulting in a smoother and more responsive trend representation.

Unveiling the Logic Behind Trigger Lines

The magic behind Trigger Lines lies in their two-pronged approach. Here’s a breakdown of the key components:

- The First Moving Average: This line serves as the foundation, calculated using a user-defined period (e.g., 20 periods).

- The Second Moving Average (Smoothing Line): This line acts as a filter, calculated with a shorter period (e.g., 5 periods) based on the first moving average. This shorter period helps to smooth out the first line by giving less weight to extreme price fluctuations.

Contrasting Trigger Lines with Traditional Moving Averages

While both moving averages and Trigger Lines aim to identify trends, they differ in their responsiveness and susceptibility to market noise. Traditional moving averages, due to their reliance on a single period for averaging, can be slow to react to changing market conditions. Additionally, they can be overly influenced by short-term price spikes, generating misleading signals.

Trigger Lines, on the other hand, address these shortcomings by incorporating a filtering mechanism. The shorter smoothing period helps to reduce the impact of price extremes, leading to a more responsive and less noisy trend representation. This translates to potentially more accurate signals, particularly in volatile market environments.

Think of it this way: Traditional moving averages are like a slow-moving train, lagging behind price action. Trigger Lines, in contrast, are like a nimble sports car, able to react swiftly to changing market dynamics.

Demystifying Trigger Lines Configuration in MT5

Now that you’ve grasped the essence of Trigger Lines, let’s delve into the nitty-gritty of configuring them within your MT5 platform. The Trigger Lines indicator boasts three critical configuration parameters that influence its behavior:

Period

This setting determines the length of the first moving average used to establish the baseline trend. A longer period (e.g., 50) translates to a smoother line but might be less responsive to recent price movements. Conversely, a shorter period (e.g., 20) offers a more agile line but could be more susceptible to short-term volatility.

Smoothing

This parameter governs the length of the second moving average, also known as the smoothing line. As mentioned earlier, this line acts as a filter, reducing the influence of price extremes on the overall trend representation. A longer smoothing period (e.g., 10) will result in a smoother but potentially less responsive indicator. Conversely, a shorter smoothing period (e.g., 5) will yield a more reactive indicator but with potentially increased noise.

Applied Price

This setting allows you to specify the price data used for calculating the Trigger Lines. Common options include the typical price (average of high, low, close, and open), the closing price, or even the median price. The choice often depends on your trading style and preferences. For instance, focusing on the closing price might be suitable for day trading strategies, while the typical price could be useful for longer-term swing trading approaches.

Optimizing Trigger Lines for Your Trading Strategy

The beauty of Trigger Lines lies in their adaptability. There’s no one-size-fits-all configuration, and the optimal settings will depend on your specific trading style, timeframe, and market conditions. Here are some general guidelines to get you started:

For Scalping and Day Trading

Opt for shorter periods (e.g., 20-30) and a shorter smoothing period (e.g., 5-7) to capture faster price movements. However, be mindful of potential increased noise with these settings.

For Swing Trading and Position Trading

Consider longer periods (e.g., 50-100) and a moderate smoothing period (e.g., 10-15) to identify more established trends. This configuration prioritizes filtering out short-term volatility for a clearer long-term trend view.

Interpreting the Trend Direction with Trigger Lines

The core function of Trigger Lines lies in their ability to portray the underlying trend. Here’s how to interpret their positioning:

Upward Trend

When the first moving average (thicker line) is consistently above the smoothing line (thinner line), it suggests a potential uptrend. This scenario indicates that the overall price movement is trending higher, with the smoothing line acting as a dynamic support level.

Downward Trend

Conversely, if the first moving average remains consistently below the smoothing line, it hints at a possible downtrend. This positioning suggests that the price is generally declining, with the smoothing line acting as a dynamic resistance level.

How to Trade with Trigger Lines Indicator

Buy Entry

- Entry: Open a long (buy) position when the thicker moving average (first moving average) crosses above the thinner moving average (smoothing line) from below.

- Stop-Loss: Place a stop-loss order below the recent swing low (consider using the low of the previous bar for tighter stops or the low of the past few bars for looser stops based on your risk tolerance).

- Take-Profit: Consider profit targets based on historical price movements or by utilizing other technical indicators like Fibonacci retracement levels. Aim for a risk-reward ratio of at least 1:2 (potential profit is at least twice the potential loss).

Sell Entry

- Entry: Open a short (sell) position when the thicker moving average (first moving average) crosses below the thinner moving average (smoothing line) from above.

- Stop-Loss: Place a stop-loss order above the recent swing high (consider using the high of the previous bar for tighter stops or the high of the past few bars for looser stops based on your risk tolerance).

- Take-Profit: Utilize profit targets based on historical price movements or technical indicators like Fibonacci retracement levels. Aim for a minimum 1:2 risk-reward ratio.

Conclusion

Trigger Lines MT5 indicator offers a valuable tool for discerning traders seeking to navigate the ever-changing forex landscape. Its ability to depict trends with greater clarity and responsiveness compared to traditional moving averages can empower you to identify potential trading opportunities.

Recommended MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

(Free MT5 Indicators Download)

Click here below to download: