Price movements are what makes trading virtually an unlimited source of income. That is if you know what you are doing. Every pip that the market makes is an opportunity to make money. Every candle formed means that thousands of traders around the world could have made money out of it, although thousands could have also lost money from it.

This is even made more pronounce with forex trading. Although forex trading technically is moving by a small fraction of a cent, because of the sheer volume that traders could trade, the forex market is probably one of the most volatile markets. Add to it the fact that you are trading with traders from around the world, which means that volume is always available. Chances are that any time you click that button to buy or sell a currency pair, there will always be sufficient volume for you to be filled.

Price movements is what makes traders earn or lose profits. Trading the forex market successfully entails that a trader knows how to take advantage of these price movements.

Rads MACD Optimized Forex Trading Strategy is a strategy that entails taking advantage of price movements right before it starts a possible fresh trend. These trends could potentially result in huge yields if you time the market right. It makes use of two simple yet effective indicators to help you as a trader identify these potential strong market moves and trade in the right direction.

Rads MACD Indicator

The Rads MACD indicator is a trend following technical indicator used by traders to identify the direction of the trend and its possible reversals.

It is based on the popular Moving Average Convergence and Divergence (MACD). The MACD is an oscillating indicator that plots the difference between two moving average lines. It then plots the difference as a line which oscillates from negative to positive and vice versa. It also plots a second line which is called the signal line. The signal line is basically a moving average line derived from the MACD line. Trend direction is identified based on how the two oscillating lines overlap and whether it is positive or negative. A crossover between the two lines could indicate a probable trend reversal.

Rads MACD is a modified version of the MACD. Instead of displaying the two lines, it displays a histogram bar representing the difference between the MACD line and the signal line. It also uses a modified moving average and is preset to create smooth trend indications.

Positive bars indicate a bullish trend and negative bars indicate a bearish trend. A crossover from negative to positive would indicate a bullish trend reversal, while a crossover from positive to negative would indicate a bearish trend reversal.

The bars also change colors to indicate the strength of the trend. Positive lime bars indicate a strengthening bullish trend, while positive red bars indicate a weakening bearish trend. On the flip side, negative red bars indicate a strengthening bearish trend, while negative lime bars indicate a weakening bearish trend.

AMA Optimized

AMA Optimized indicator is a trend following indicator displayed as a moving average line. It is based on the Adaptive Moving Average (AMA), which is a reliable moving average line.

Moving averages are effective technical indicators. However, it is often plagued with false signals whenever the market starts to become choppy or noisy.

The Adaptive Moving Average was developed in order to address the issue of noise being incorporated in the signal of a moving average line. The AMA line adjusts for market noise by closely following price action whenever the market has low noise and widening away from price action whenever it detects that the market is starting to become noisy.

AMA Optimized is plotted as a moving average line just like the Adaptive Moving Average. It is also modified to produce trade signals based on trend direction. It overlays blue dots on the line whenever it detects that a bullish trend is gaining momentum. It also overlays red dots on the line whenever it detects that a bearish trend is gaining momentum. This indicator could be used as an entry signal based on the changing of the color of the dots it overlays.

Trading Strategy

This trading strategy is a simple trend reversal strategy based on the confluence of the Rads MACD indicator and the AMA Optimized indicator.

Both indicators would be used to identify probable trend reversals.

The trend reversal signal from the Rads MACD indicator would simply be the shifting of the histograms from negative to positive or vice versa.

On the AMA Optimized indicator, trend reversals will be interpreted based on the changing of the color of the dots being plotted on the line.

Trade signals are considered whenever there is a confluence of trend reversal signals coming from the two indicators.

Indicators:

- Rads_MACD (default setting)

- AMA_optimized

- Period AMA: 14

Preferred Time Frames: 1-hour, 4-hour and daily charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

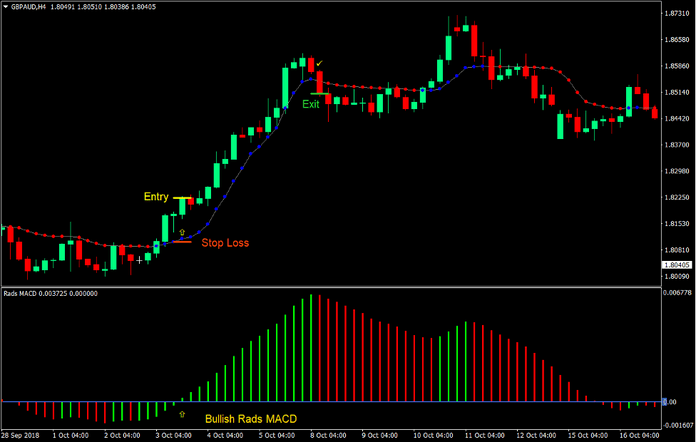

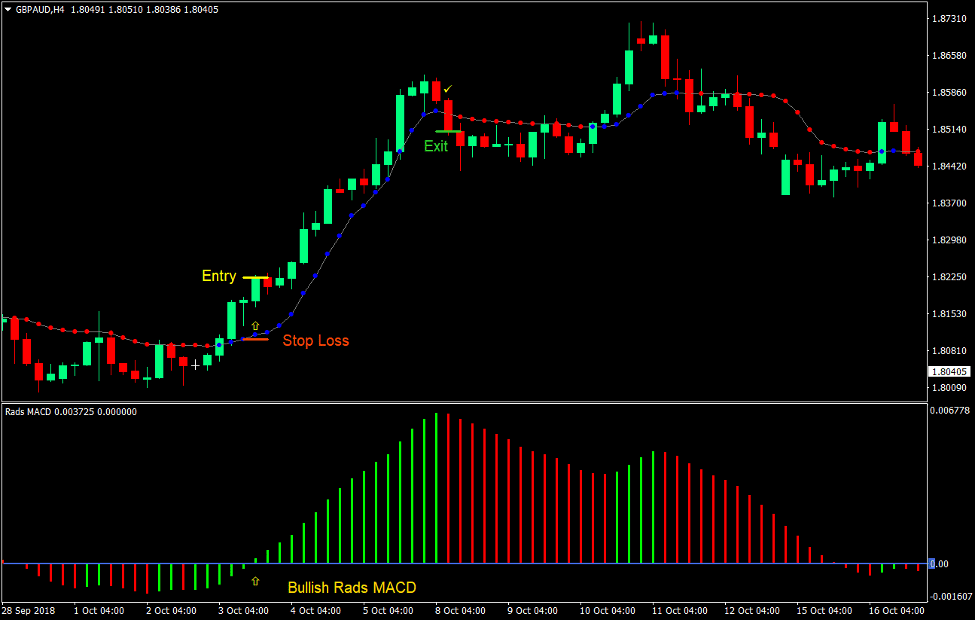

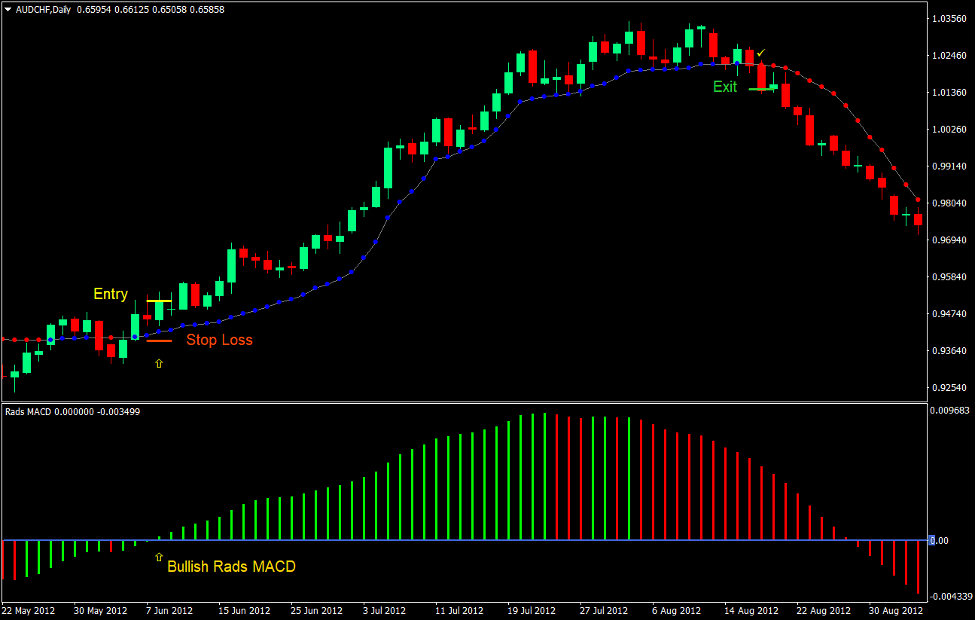

Buy Trade Setup

Entry

- The dots being plotted by the AMA Optimized indicator should change to blue.

- The Rads MACD bars should cross above zero.

- These bullish signals should be closely aligned.

- Enter a buy order on the confirmation of these conditions.

Stop Loss

- Set the stop loss below the AMA Optimized line.

Exit

- Close the trade as soon as the AMA Optimized indicator plots red dot.

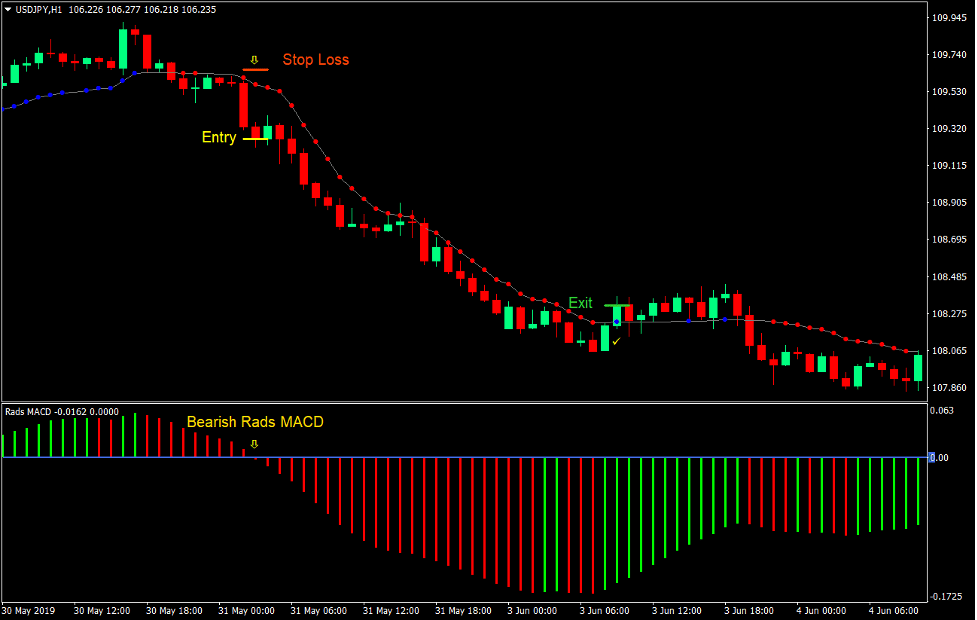

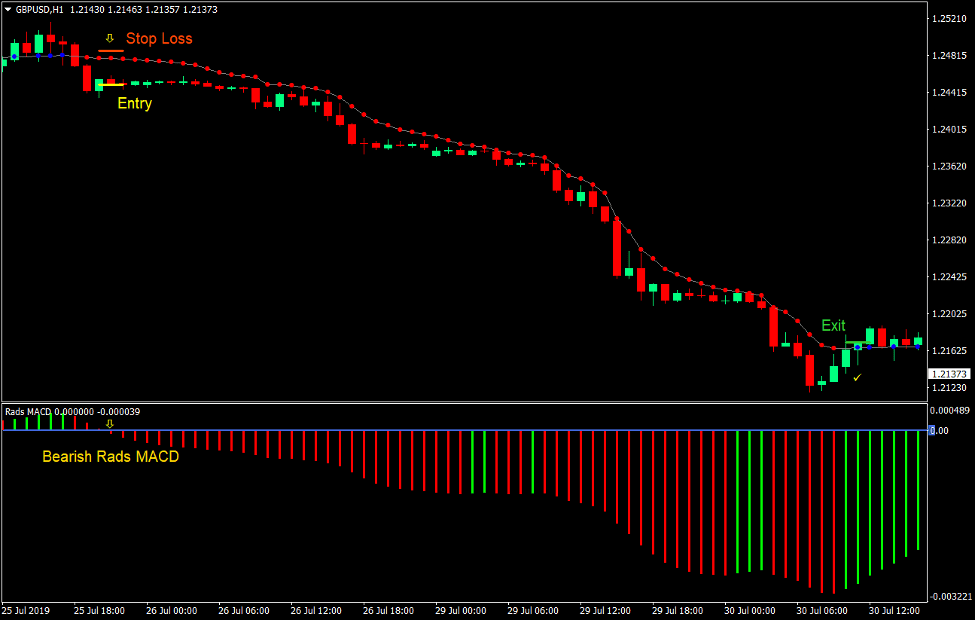

Sell Trade Setup

Entry

- The dots being plotted by the AMA Optimized indicator should change to red.

- The Rads MACD bars should cross below zero.

- These bearish signals should be closely aligned.

- Enter a sell order on the confirmation of these conditions.

Stop Loss

- Set the stop loss above the AMA Optimized line.

Exit

- Close the trade as soon as the AMA Optimized indicator plots blue dot.

Conclusion

This trend reversal strategy is a simple strategy which could be implemented even by beginners. It is easy to follow and easy to execute.

Even with its simplicity, it is still a very effective way to trade the market and capitalize on those huge trending moves.

Combined with some knowledge on price action and taking trades on potential trend reversal zones, this strategy could help traders earn consistent profits.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: