Traders often look for opportunities to make it big in a single trade. At the same time, traders also want to trade in this manner consistently. Trading with high yields mean having high risk-reward ratios. On the other hand, trading with high consistency and accuracy means that the trader is trading with a high probability strategy and as a result has a high win rate.

It is all well and good to be aiming for excellence on both ends. However, it is not usually the case. Often, traders would have to pick one or the other. Traders either go with a high probability strategy or with a high yield strategy.

However, there are ways to increase a trader’s chances of getting those high yielding trades and still maintain a relatively decent win probability.

One of the ways to do this is to make use of confluences coming from complementary technical indicators. Some indicators tend to work really well at identifying trends individually. Some need to be paired with another technical indicator in order to filter out low probability trade setups. However, pairing two high probability technical indicators is a different thing. Although it does not usually follow but pairing two high probability trend-following indicators tend to result in an even higher win probability. That is if the indicators paired are complementary.

Kijun-sen+

Kijun-sen+ is a custom trend following technical indicator which is based on the Ichimoku Kinko Hyo technical indicator.

The Ichimoku Kinko Hyo indicator is a unique indicator because it provides traders a complete overview of market trends, from the short-term trend, mid-term trend, up to the long-term trend. It makes use of average lines that are based on the median of varying price ranges.

Kijun-sen is an integral part of the Ichimoku Kinko Hyo because it represents the mid-term trend, which is one of the main bases for identifying a trend.

Mega Trend

Mega Trend is a custom trend following indicator which is based on a modified moving average. In fact, the Mega Trend indicator is a version of the Hull Moving Average (HMA).

Most moving average lines tend to either be too lagging or too susceptible to false trend indications. HMA tends to decrease the tendency of a moving average line to be susceptible to false signals by way of smoothening out the line. At the same time, it also retains its responsiveness in providing trend reversal signals.

The Mega Trend line plots a moving average line that change color based on the direction of the trend. A red line indicates a bearish trend bias, while a blue line indicates a bullish trend bias.

Moving Average Convergence and Divergence

The MACD or Moving Average Convergence and Divergence is a classic technical indicator which is one of the most popular oscillators.

It is based on the crossing over of two moving average lines. The MACD line is first computed by subtracting a moving average line to another slower acting moving average line. The difference between the two lines is then plotted as histogram bars. Then, a signal line is derived from the MACD bars. The signal line is basically a moving average of the histogram bars.

The MACD can be interpreted based on the crossing over of the MACD bars and the signal line. If the MACD bars are above the signal line, then the momentum is bullish. If the MACD bars are below the signal line, then the momentum is bearish.

It can also be interpreted based on whether the bars or the line is positive or negative. Positive bars and lines indicate a bullish trend bias, while negative bars indicate a bearish trend bias.

Crossovers occurring on overextended bars and lines can indicate a probable mean reversal.

Trading Strategy

Kijun Mega Trend Forex Trading Strategy is a simple trend reversal strategy which is based on the confluence of trend reversal signals coming from the three indicators above.

First, the Kijun-sen+ line should cross over the Mega Trend line.

Then, the Mega Trend line should change color agreeing with the direction of the new trend.

Lastly, the MACD histogram bars should confirm the trend reversal based on the shifting of the bars.

Indicators:

- Kijun-sen+

- Kijun: 12

- Mega trend

- Period: 100

- MACD

- Fast EMA: 17

- Slow EMA: 31

- MACD SMA: 14

Preferred Time Frames: 15-minute, 30-minute, 1-hour and 4-hour charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

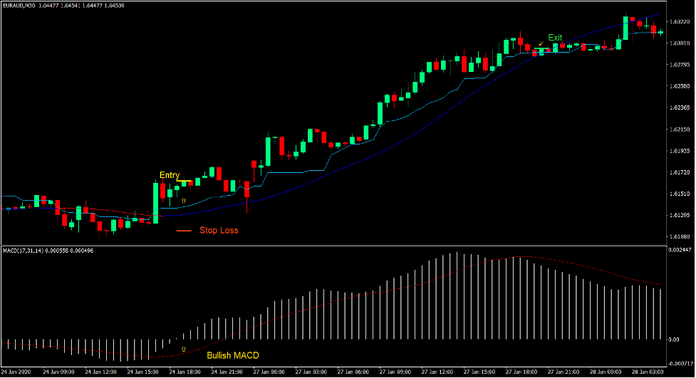

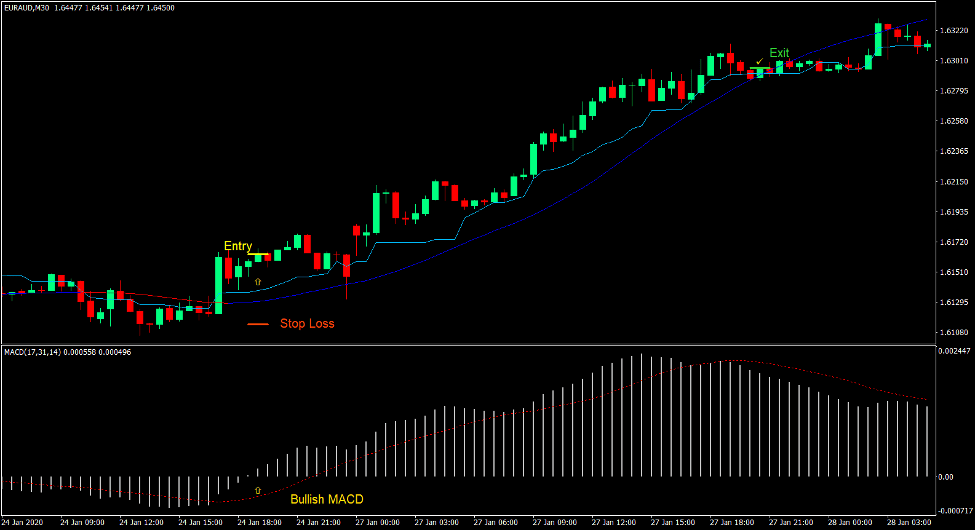

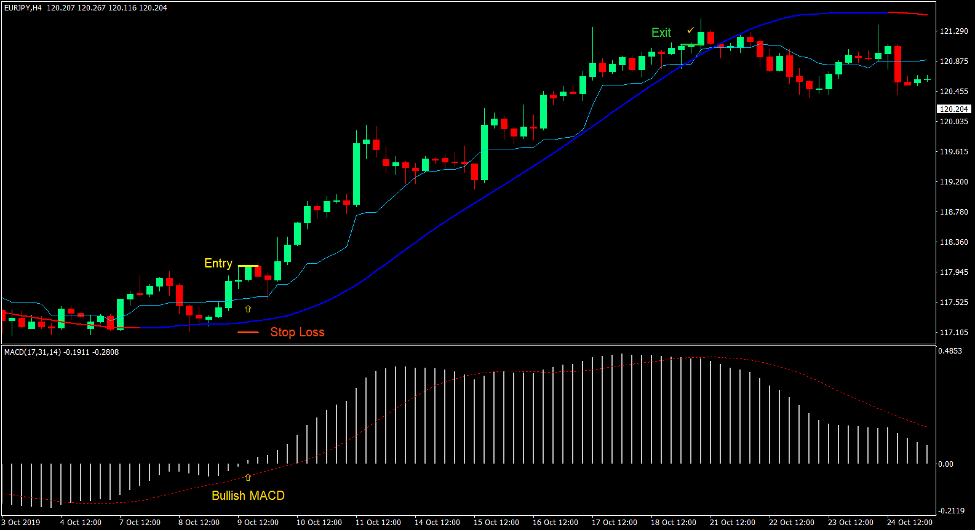

Buy Trade Setup

Entry

- The Kijun-sen+ line should cross above the Mega Trend line.

- The Mega Trend line should change to blue.

- The MACD bars should cross above zero.

- Enter a buy order on the confluence of these conditions.

Stop Loss

- Set the stop loss on a support below the entry.

Exit

- Close the trade as soon as the Kijun-sen+ line crosses below the Mega Trend line.

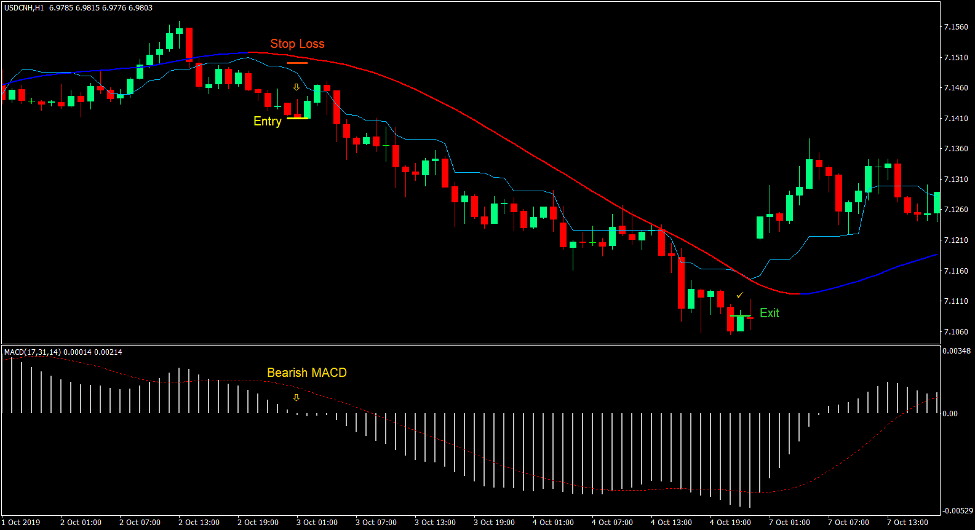

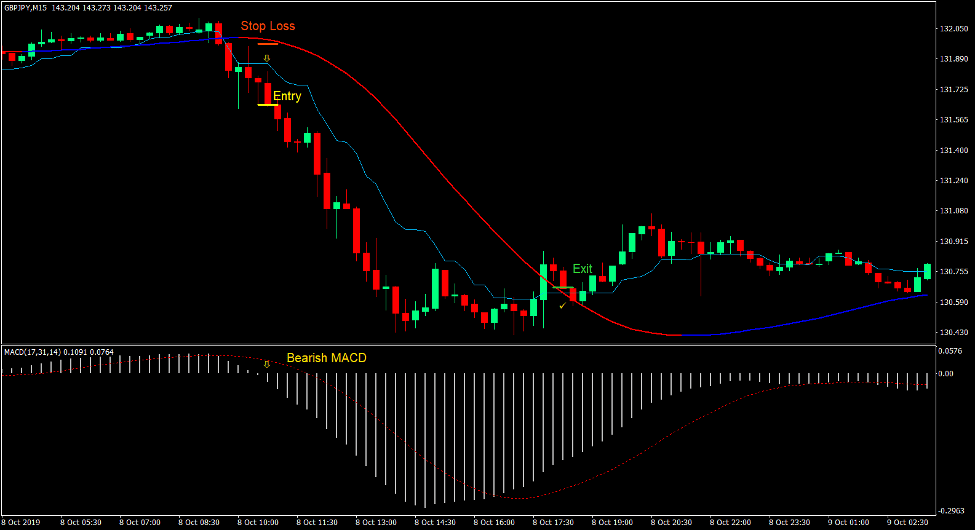

Sell Trade Setup

Entry

- The Kijun-sen+ line should cross below the Mega Trend line.

- The Mega Trend line should change to red.

- The MACD bars should cross below zero.

- Enter a sell order on the confluence of these conditions.

Stop Loss

- Set the stop loss on a resistance above the entry.

Exit

- Close the trade as soon as the Kijun-sen+ line crosses above the Mega Trend line.

Conclusion

This trading strategy tends to produce trade setups with a relatively decent win probability and a decent risk-reward ratio.

This is because the Kijun-sen+ and Mega Trend lines are high probability trend following indicators. Add to it the confirmation of the MACD, and you have a trade setup with an even higher win probability.

However, this strategy is best used only in markets that tend to trend and swing with high peaks and deep troughs. It is also best to take trades that have signals that are relatively close to each other as this often indicates a strong momentum causing the trend reversal.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: