There are two common themes in a trading market – ranging and trending. The market ranges for about 80% of the time and trends for about 20% of the time.

Of the two market conditions, trending markets seem to be the easier route for most traders. There are of course traders who prefer trading range trade setups. However, most new traders would usually want to trade with the trend.

There are many advantages to trading with the trend. For one, momentum is usually behind you when you are trading with the trend. Another advantage would be that there are fewer minor support or resistance levels that a trade should overcome because most of it would have been broken whenever price starts to trend. Lastly, trending markets have a clear direction and patterns could easily be recognized.

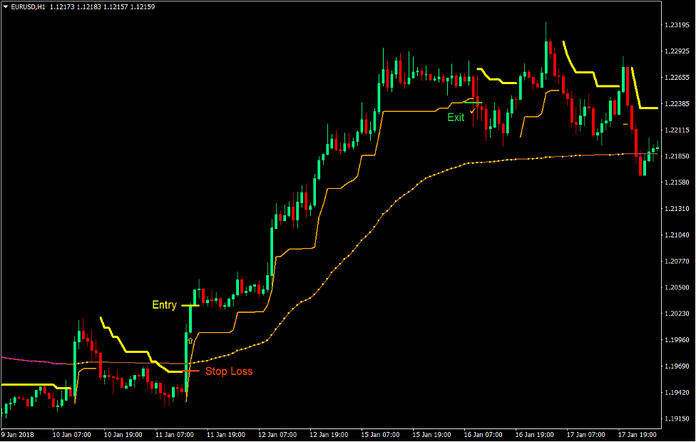

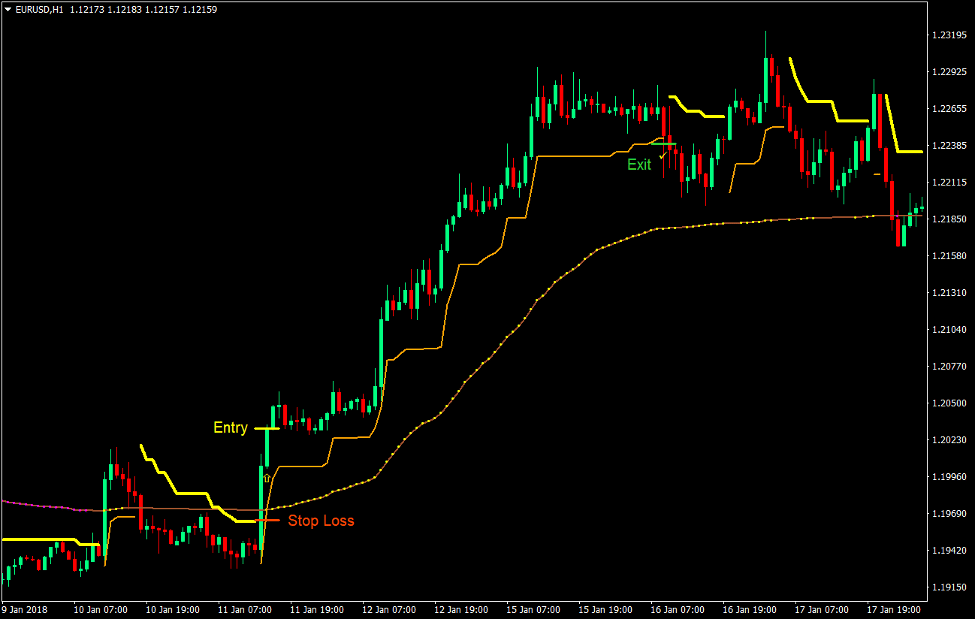

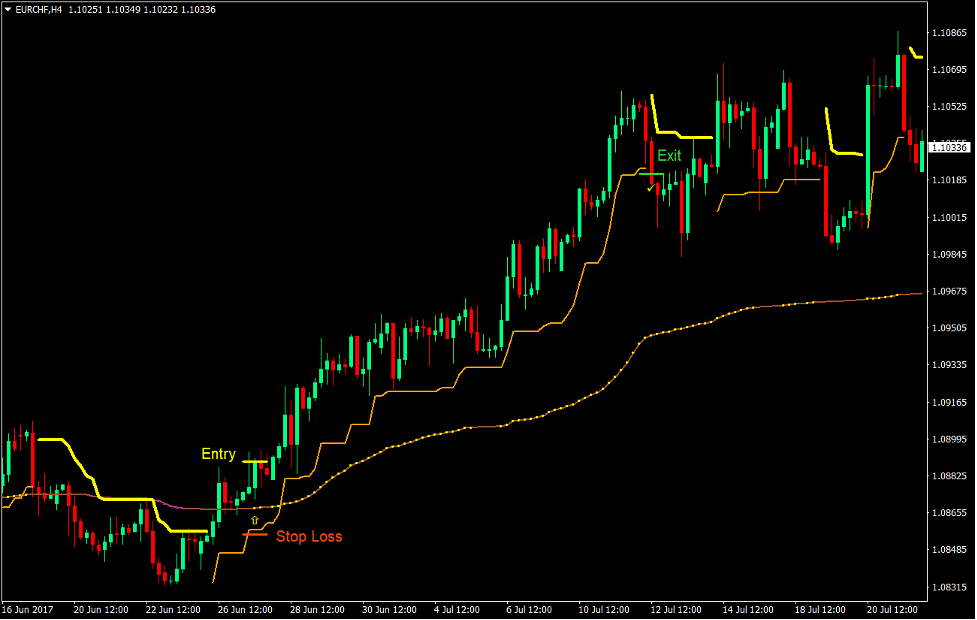

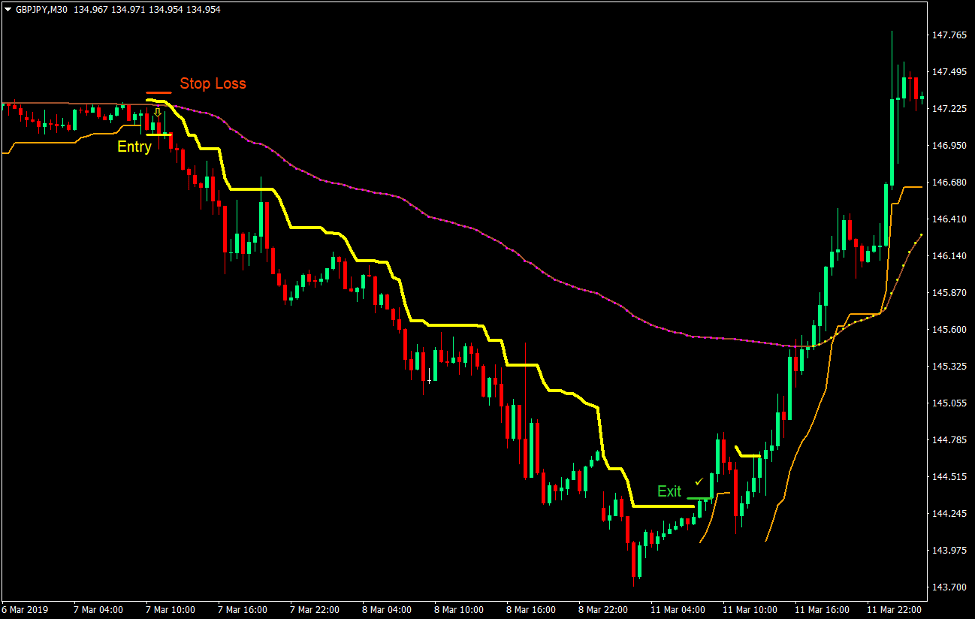

One of the notable patterns that you would notice when trading with the trend is that price would either make higher swing highs and swing lows on an uptrend, or lower swing highs and swing lows on a downtrend. This creates a staircase like pattern that is easy to observe. The question is how do we enter the trade from the bottom of the stairs and exit at the top? On the flip side, when looking at a short trade, how do we sell the market at the top of the stairs and cover the trade at the bottom.

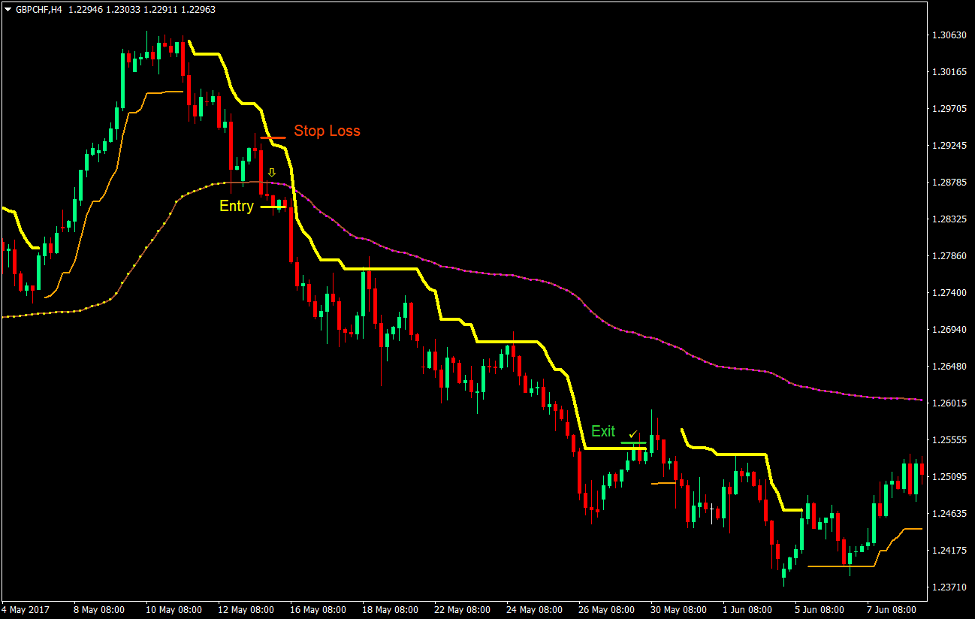

Giant Steps Trend Forex Trading Strategy helps traders identify these staircase-like patterns in order to profit from the trending markets. It also helps traders enter the trade at the beginning of the trend and exit at the end of the trend.

Channel Scalper

Channel Scalper is a trend following technical indicator that helps traders identify trend direction.

This indicator plots a line on the price chart to help traders identify trend direction. The line changes color whenever the indicator detects a shift in trend direction. It also shifts above or below price depending on trend direction.

If the Channel Scalper indicator detects a bullish trend, it will plot an orange line below the price candles. On the other hand, if the indicator detects a bearish trend, it will instead plot a yellow line above price.

The indicator could be used several ways. It could be used as a trend reversal signal indicator, it could also be used as a trend filter indicator, and it could also be used as a stop loss placement indicator.

As a trend signal indicator, the shifting of the line and the changing of its color indicates a possible trend reversal. Traders could use this as an indication of a possible trend reversal setup.

As a trend filter, traders could scalp the market by taking trades only in the direction of the trend based on where the line is in relation to price.

As a stop loss placement indicator, traders could opt to place the stop loss beyond the Channel Scalper line since a breach of this line indicates a possible trend reversal.

Although this indicator is named as a “scalper”, day traders and swing traders could also use it as it is also able to read trend directions on different timeframes.

Var Mov Avg

Var Mov Avg is short for Variable Moving Average.

This indicator is a modified moving average indicator which helps traders identify and follow a big picture trend direction.

It also shares some similarities with the Adaptive Moving Average (AMA) indicator.

This indicator was developed as a moving average that could adjust for market noise such as spikes in volatility. This creates a less reactive type of moving average line, which remains stable even when the market is generating more noise in the form of price spikes.

The indicator is plotted as a line with dots that run along the line. It plots yellow dots to indicate a bullish trend bias, and magenta dots to signify a bearish trend bias.

Trading Strategy

This trading strategy is a simple trend reversal strategy that makes use of the confluence of the Var Mov Avg indicator and the Channel Scalper indicator is a means to time market entry.

The main trend reversal indication of this strategy is the crossover of price and the Var Mov Avg indicator. However, this should not be the only reason that would trigger our trade.

On the Channel Scalper indicator, the line should shift indicating the direction of the trend reversal, which is the crossover of price and the Var Mov Avg indicator.

Then, on the Var Mov Avg indicator, the dots should also change color indicating the trend reversal. A confluence of these factors would be our indication that the market has strong bias to continue its trend reversal action.

If the entry results in a trend, the Channel Scalper indicator would start forming a staircase like pattern in the direction of our trade. We then trail the stop loss behind the Channel Scalper line and keep the trade open until the end of the trend.

Indicators:

- Var_Mov_Avg

- Nslow: 48

- Chanel scalper (default setting)

Preferred Time Frames: 30-minutes, 1-hour and 4-hour charts

Currency Pairs: major, minor and cross FX pairs

Trading Sessions: Tokyo, London and New York sessions

Buy Trade Setup

Entry

- Price should cross above the Var Mov Avg line.

- The Channel Scalper line should shift below price and change to orange.

- The Var Mov Avg line should plot yellow dots on its line.

- Enter a buy order on the confirmation of these conditions.

Stop Loss

- Set the stop loss below the Channel Scalper line.

Exit

- Trail the stop loss a little below the Channel Scalper line until stopped out in profit.

Sell Trade Setup

Entry

- Price should cross below the Var Mov Avg line.

- The Channel Scalper line should shift above price and change to yellow.

- The Var Mov Avg line should plot magenta dots on its line.

- Enter a sell order on the confirmation of these conditions.

Stop Loss

- Set the stop loss above the Channel Scalper line.

Exit

- Trail the stop loss a little above the Channel Scalper line until stopped out in profit.

Conclusion

This trading strategy works well when catching trend reversals. This allows traders to enter a trade at the beginning of a trend and exit the trade near the end of the trend.

It works best in markets that are more likely to reverse. These are markets that have broken a diagonal support or resistance, is bouncing off a supply or demand area, or is coming off a market congestion phase. Reversals that are quite steep coming from an overextended phase also tend to do well.

Trading this strategy in a choppy market environment would not be a good idea as there could be some false signals during such condition.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: