Traders have different ways of identifying trends and trend direction. Some traders identify trend purely based on the trajectory of price action. Some use moving averages. Others use different technical indicators.

Pure price action traders are very unique in identifying trends because most price action traders rely solely on a naked chart. This lack of structure and concrete rules make identifying trends and trend direction very difficult for new aspiring price action traders. However, there are ways to objectively identify trend direction based on price action.

First, let us look into how price action traders identify trend direction. Price action traders identify trends based on price swings. The market is in an uptrend if price swings are making higher swing highs and swing lows. On the other hand, the market is in a downtrend if price swings are making lower swing highs and swing lows.

This method makes identifying trend direction a little bit more concrete. However, this is still very subjective and might still prove to be difficult for new traders.

Here we will look into how the Zig Zag indicator can be used to identify price swings and trend direction, and how the identified price swings can be integrated with Fibonacci retracements to identify high probability entry points.

Zig Zag Indicator

The Zig Zag indicator is a technical indicator which was developed to help traders identify price swings. It identifies swing points on the price chart based on price reversals that are a percentage greater than the preset factors. These factors include depth, deviation and backstep. The indicator then connects these swing points with a line creating a zigzag like structure.

The reversal points identified by the Zig Zag indicator are basically the swing highs and swing lows of price action. Traders can use this information to objectively identify swing points without second guessing themselves and subjectively adjusting what they would consider as a valid swing point.

Traders can use the swing points to identify trend direction. This is based on whether the swing points identified are creating higher or lower swing highs and swing lows.

Traders can also use the swing points as a basis for horizontal supports and resistances, as well as a basis for identifying supply and demand zones.

Fibonacci Retracement Tool

Fibonacci Retracement is a technique in technical trading wherein support and resistance levels are identified based on a percentage of a price swing. These percentages are based on a sequence of ratios, which are called the Fibonacci Ratio.

The Fibonacci Ratio is a sequence of ratios which was discovered by Fibonacci or Leonardo of Pisa as he was observing nature.

Surprisingly the same ratio that he observed in nature can also be applied in our modern-day technical trading analysis. Traders have observed that price do tend to respect the Fibonacci levels as a support or resistance level. The most popular Fibonacci retracement levels are 23.6%, 38.2%, 61.8% and 78.6%, with the level 61.8% being the most popular. In fact, the 61.8% level is popularly called as the golden ratio.

Fibonacci analysis gave rise to the development of the Fibonacci Retracement tool, which is a staple tool in most trading platforms. This tool simply plots the levels as traders connect swing points. This eliminates the hassle of having to manually compute for the levels.

Traders can use these levels as a basis for support or resistance bounces and could be a trading system in itself.

Trading Strategy

Fibonacci Price Swing Trend Forex Trading Strategy is a trend following strategy based on the identification of a trend using price action swing points.

The strategy uses the Zig Zag indicator as a tool to objectively identify the swing points. Trends are identified based on whether price action is plotting higher and higher swing highs and swing lows or lower and lower swing highs and swing lows.

As soon as the trend is identified, we could then connect the swing points in the direction of the trend using the Fibonacci Retracement tool.

Then, we set our pending limit entry orders on the golden ratio, 61.8%. The stop loss is then placed on the 78.6% Fibonacci Ratio level while the take profit target price is set at the prior swing point.

Indicators:

- ZigZag (default setting)

- Fibonacci Retracement Tool

Preferred Time Frames: 1-hour and 4-hour charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

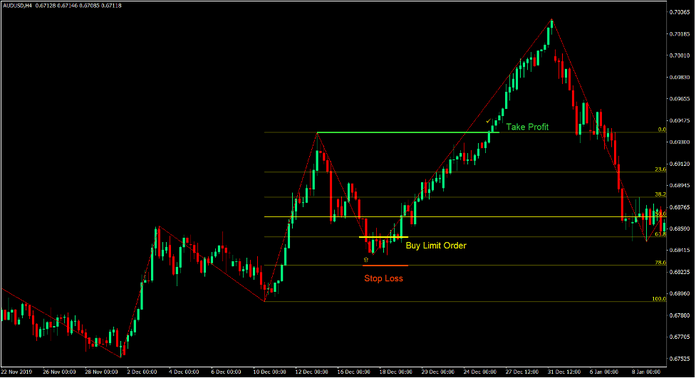

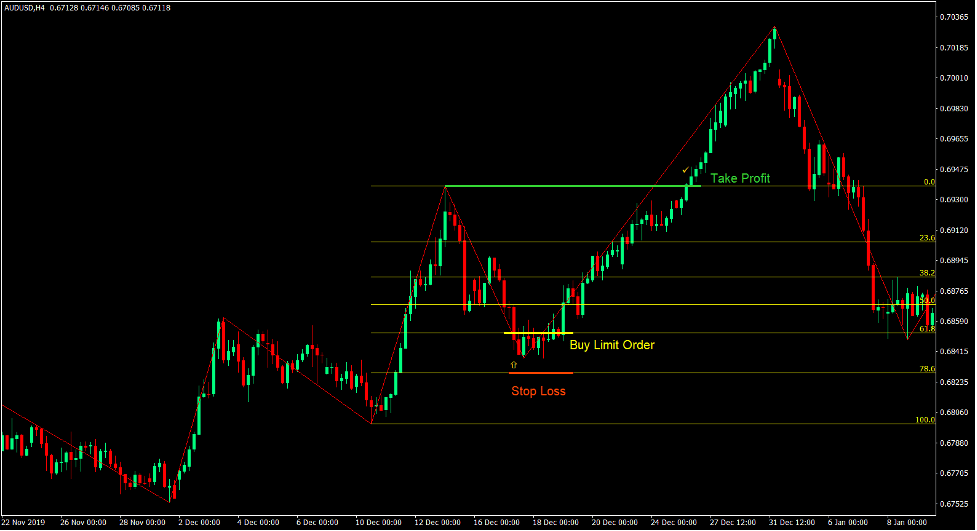

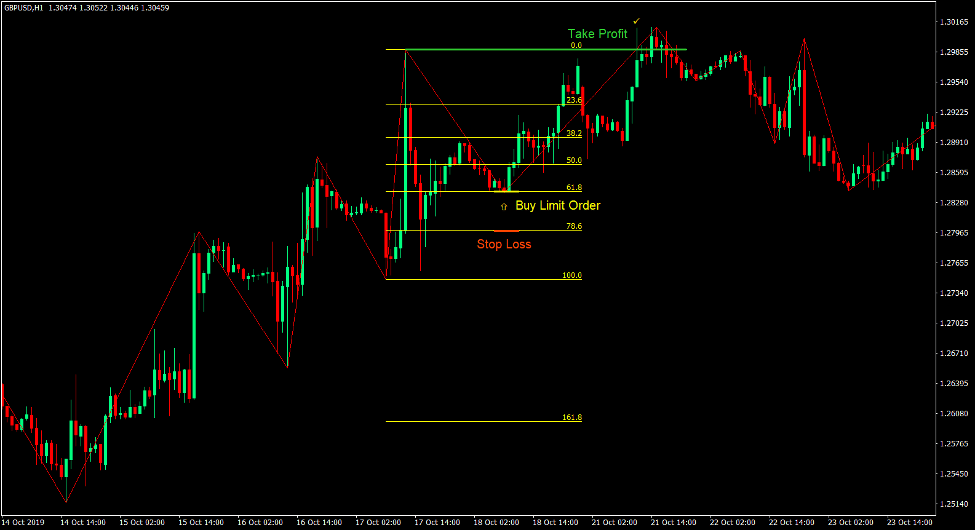

Buy Trade Setup

Entry

- The Zig Zag indicator should identify higher and higher swing highs and swing lows indicating a bullish trending market.

- Use the Fibonacci Retracement tool from toolbar and connect the most recent swing low to the swing high.

- Set a buy limit order on the 61.8% level.

Stop Loss

- Set the stop loss on the 78.6% level.

Exit

- Set the take profit target at the most recent swing high.

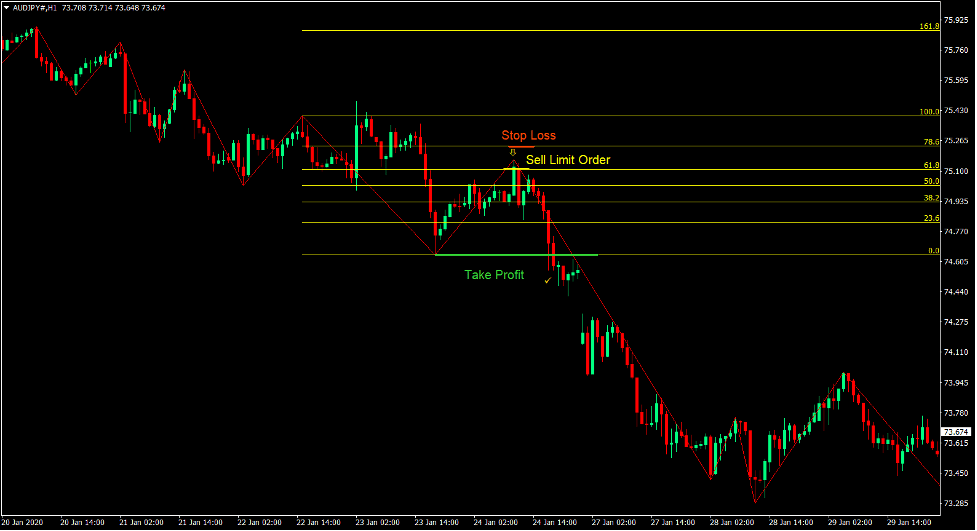

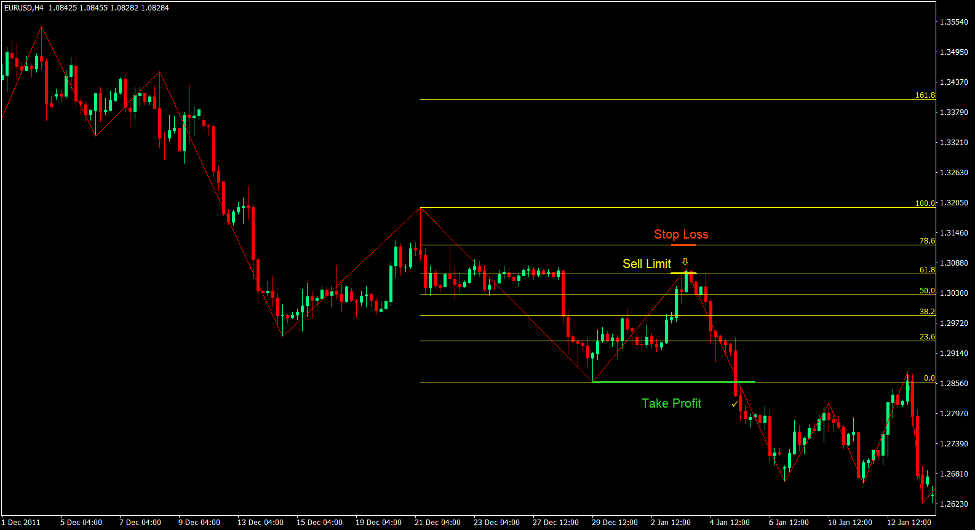

Sell Trade Setup

Entry

- The Zig Zag indicator should identify lower and lower swing highs and swing lows indicating a bearish trending market.

- Use the Fibonacci Retracement tool from toolbar and connect the most recent swing high to the swing low.

- Set a sell limit order on the 61.8% level.

Stop Loss

- Set the stop loss on the 78.6% level.

Exit

- Set the take profit target at the most recent swing low.

Conclusion

This method of trading is a working trading strategy used by many professional traders. Fibonacci analysis is a proven method which many traders use.

However, identifying the swing points is very subjective. Identifying trending markets based on swing points proves to be even more difficult for a new trader.

The use of the Zig Zag indicator helps traders objectively identify the swing points making the strategy more useable by new traders.

This strategy tends to have a very high probability. However, at times price would bounce off the prior levels of the Fibonacci Retracement tool. Sticking to the golden ratio allows us to have more accuracy and a higher risk-reward ratio. However, the number of trades triggered would be lesser.

It is also a viable option to set the stop loss a little beyond the 78.6% level as this level is also a support or resistance level which price could also bounce off from and make a profit.

Traders who could get a feel of trending markets and their swing points using the Zig Zag indicator and the Fibonacci Retracement tool can make use of this strategy to consistently profit from the market.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: