One of the staple techniques that market flow traders use is to trade based on how the market reacts to horizontal support and resistance levels. However, new traders may find it difficult to decipher when the price would bounce off of such levels, let alone identify the correct horizontal support and resistance zones.

This strategy simplifies the support and resistance market flow strategy with the use of technical indicators to help traders objectively identify support and resistance zones, as well as the reversal signals.

Pivot Highs and Pivot Lows as Horizontal Support and Resistance Zones

Price typically oscillates up and down the price chart in a pulsating or wave-like manner. These oscillations create peaks and dips which is commonly known as a swing high and a swing low or pivot highs and pivot lows.

Most traders would describe support and resistance as a line that can connect more than two swing points where the price would bounce off, support being a line that connects more than two pivot lows, and resistance being a line that connects more than two pivot highs. This is the common definition of a support and resistance level. However, support and resistance are not limited to just this.

Support and resistances are points where the price may logically reverse based on prior reversal points on the price chart.

Pivot highs are peaks where the price suddenly reverses. This means that the market saw that the price level was too high. Because of this, it is also always a possibility that price would reverse back down as price reaches these levels in the future. As such, pivot highs can also be a basis for horizontal resistance zones.

Inversely, pivot lows are dips where the price is reversed back up. This also means that the market saw such a price level as too low. This also means that the price could reverse back up as the price reaches this price area in the future. So, pivot lows can also be a basis for horizontal support zones.

Zigzag Pivot Highs and Pivot Lows

Pivot highs and pivot lows are crucial points on the price chart where the price may react. However, identifying pivot highs and pivot lows objectively can be quite difficult for many new traders. Many would second guess themselves when doing so.

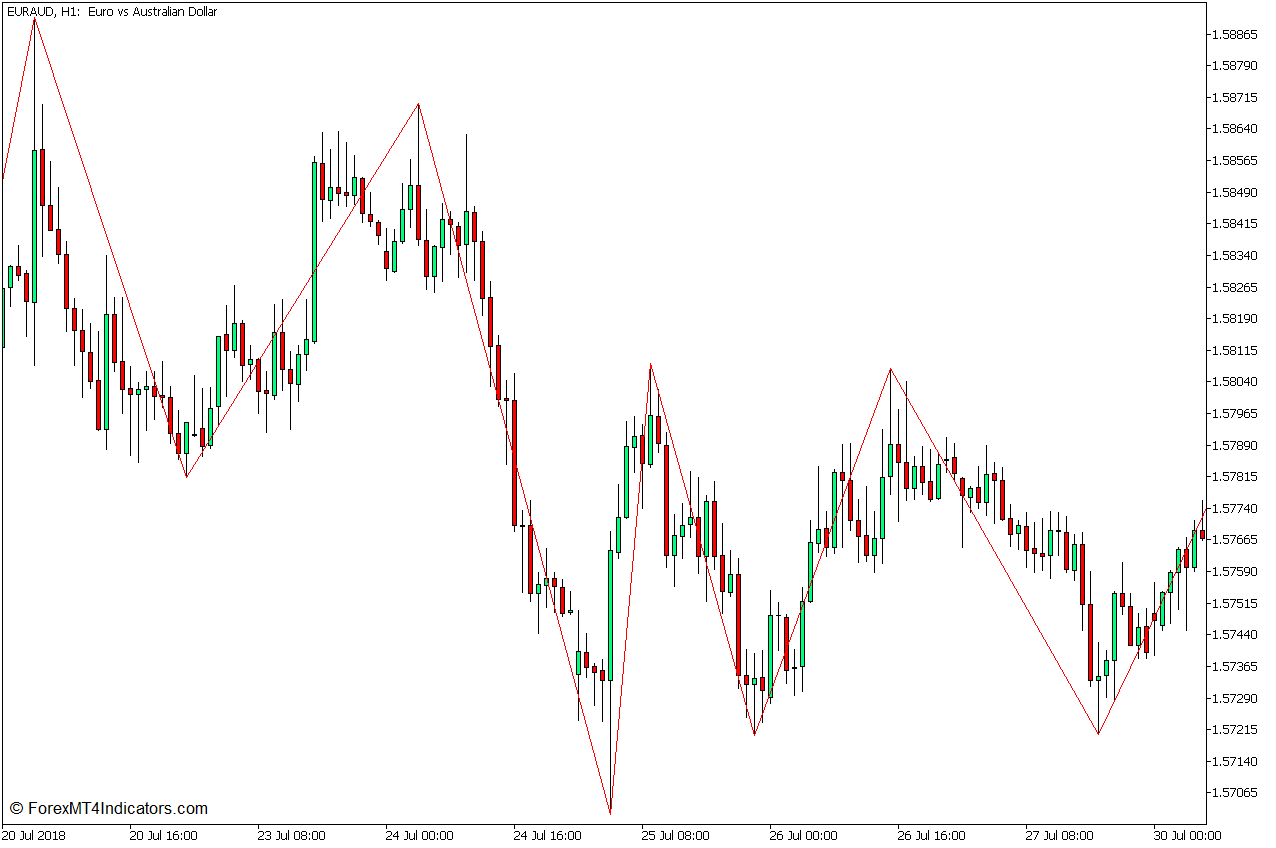

The Zigzag indicator is a technical indicator that we can use to help us identify pivot highs and pivot lows objectively.

The Zigzag indicator identifies points on the price chart where the price is drastically reversed based on a percentage threshold. It then connects these points with a line creating a zigzag-like pattern.

These points can be used as a basis for objectively identifying pivot highs and pivot lows.

Heiken Ashi Candlesticks

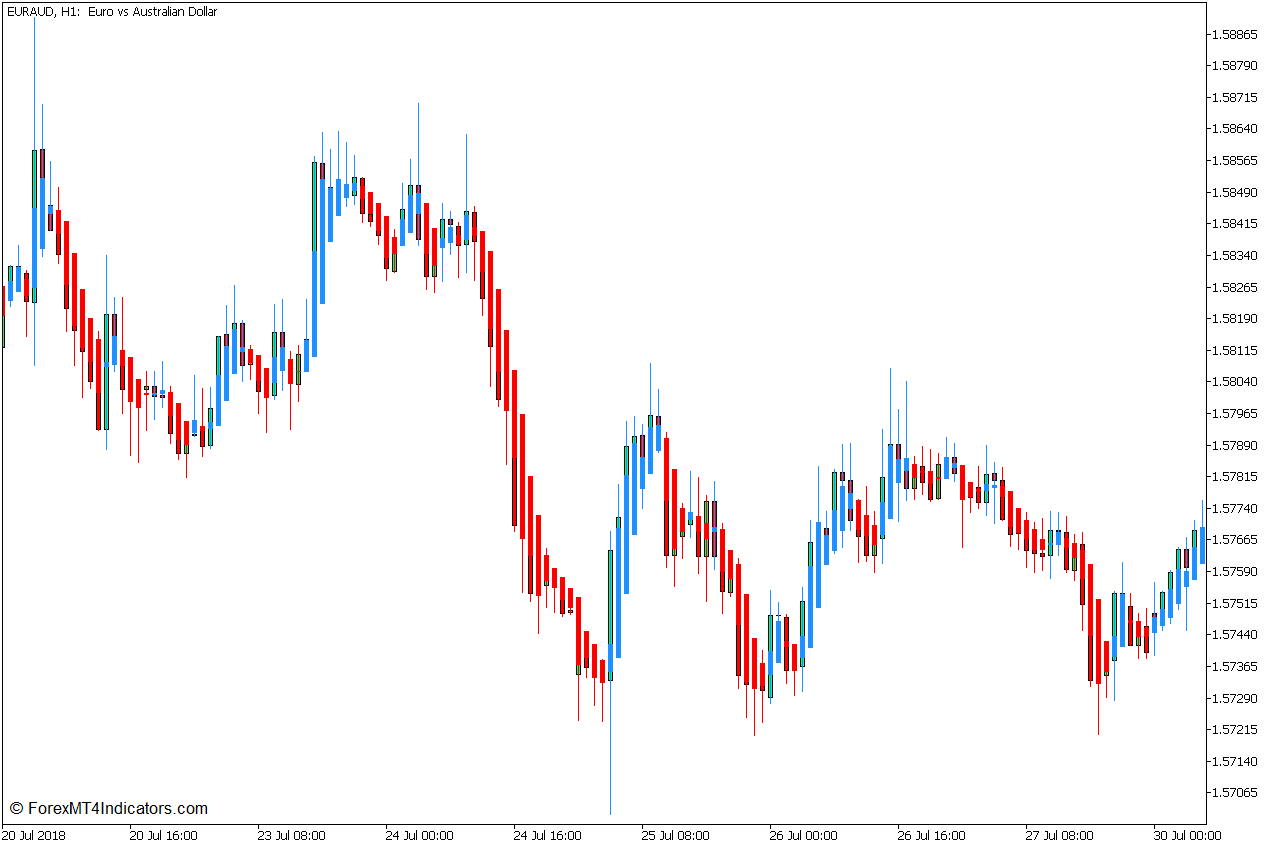

The word “Heiken Ashi” literally means “average bars” when translated from Japanese, and the Heiken Ashi Candlesticks are rightly called as such.

Traditional Japanese candlesticks plot bars that represent the highs and lows through wicks, and the open and close through its body. This information is very useful. However, it can also be quite confusing when the market is very volatile.

The Heiken Ashi Candlesticks smoothen out the traditional Japanese candlesticks by averaging out the body of the candle by modifying the open and close-it plots. This is why it is an “average bar”. This creates bars that could still represent price action based on its wicks but would only change color whenever the direction of the short-term trend has changed.

This version of the Heiken Ashi Candlesticks plots blue bars to represent a bullish momentum, and red bars to represent a bearish momentum.

Moving Average Convergence and Divergence

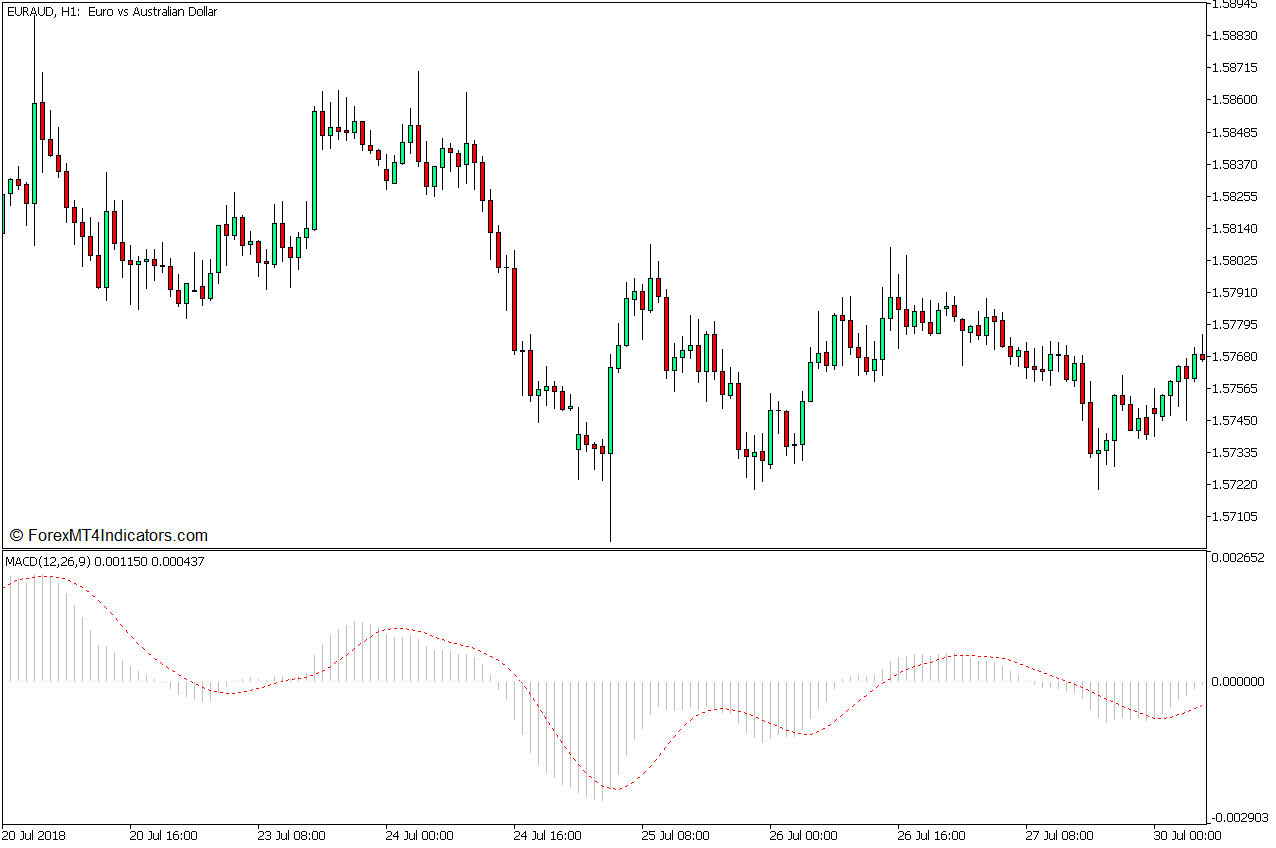

The Moving Average Convergence and Divergence (MACD) is an oscillator type of technical indicator that is based on an underlying crossover of moving average lines.

The MACD computes the difference between two Exponential Moving Average (EMA) lines. The difference is then plotted as MACD bars. Positive bars can indicate a bullish trend bias, while negative bars can indicate a bearish trend bias.

It also plots a dotted line which is a Simple Moving Average (SMA) of the MACD bars. This line serves as a signal line. Momentum direction can be identified based on how the MACD bars and the signal line interact. Momentum is bullish whenever the MACD bars are above the signal line, and bearish whenever the MACD bars are below the signal line. Crossovers between the MACD bars and the signal line could also indicate a momentum reversal.

Trading Strategy Concept

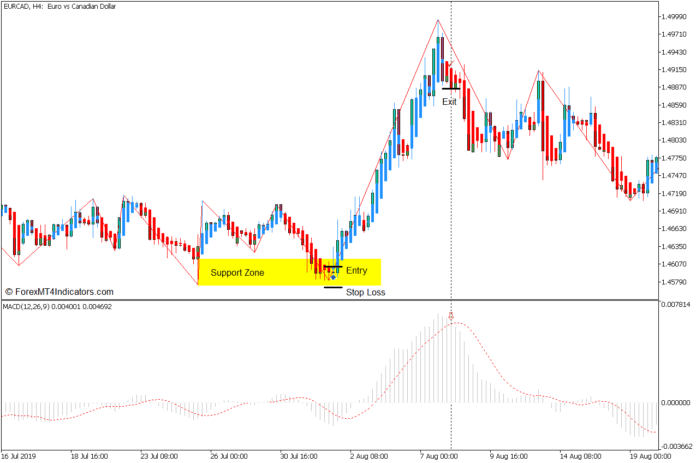

This trading strategy is a market structure-based support and resistance reversal trading strategy that uses the Zigzag Indicator to identify the support and resistance zones based on pivot highs and pivot lows.

The Heiken Ashi Candlesticks are then used as the reversal signals based on the changing of the color of the bars as the price touches the support and resistance zones.

The MACD is used as a trade exit signal based on the crossing over of the MACD bars and the signal line.

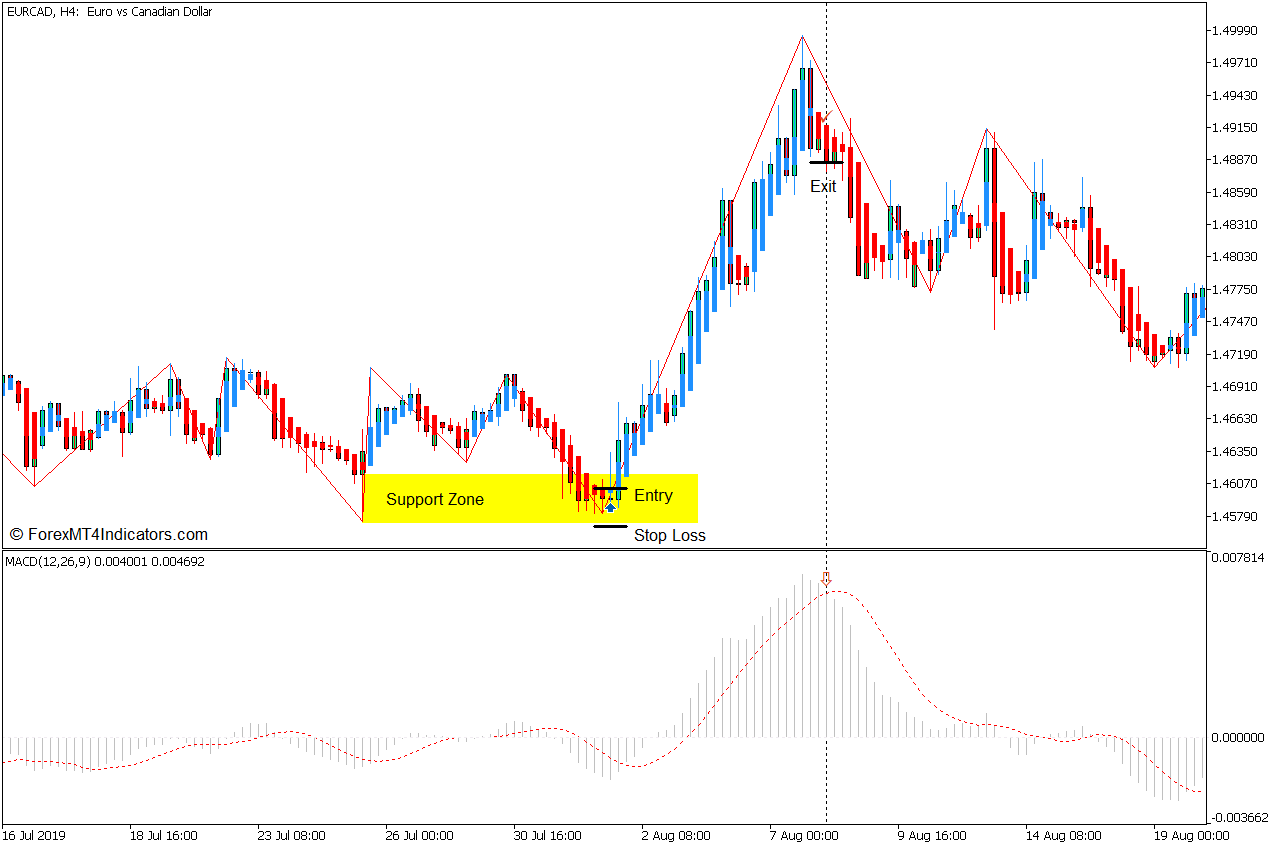

Buy Trade Setup

Entry

- Identify a support zone based on a pivot low as indicated by the Zigzag indicator.

- Wait for the price to touch the area of the support zone.

- Price should reverse as it touches the support zone causing the Heiken Ashi Candlesticks to change to blue.

- Enter a buy order on the confirmation of these conditions.

Stop Loss

- Set the stop loss below the supply zone.

Exit

- Close the trade as soon as the MACD bars cross below the signal line.

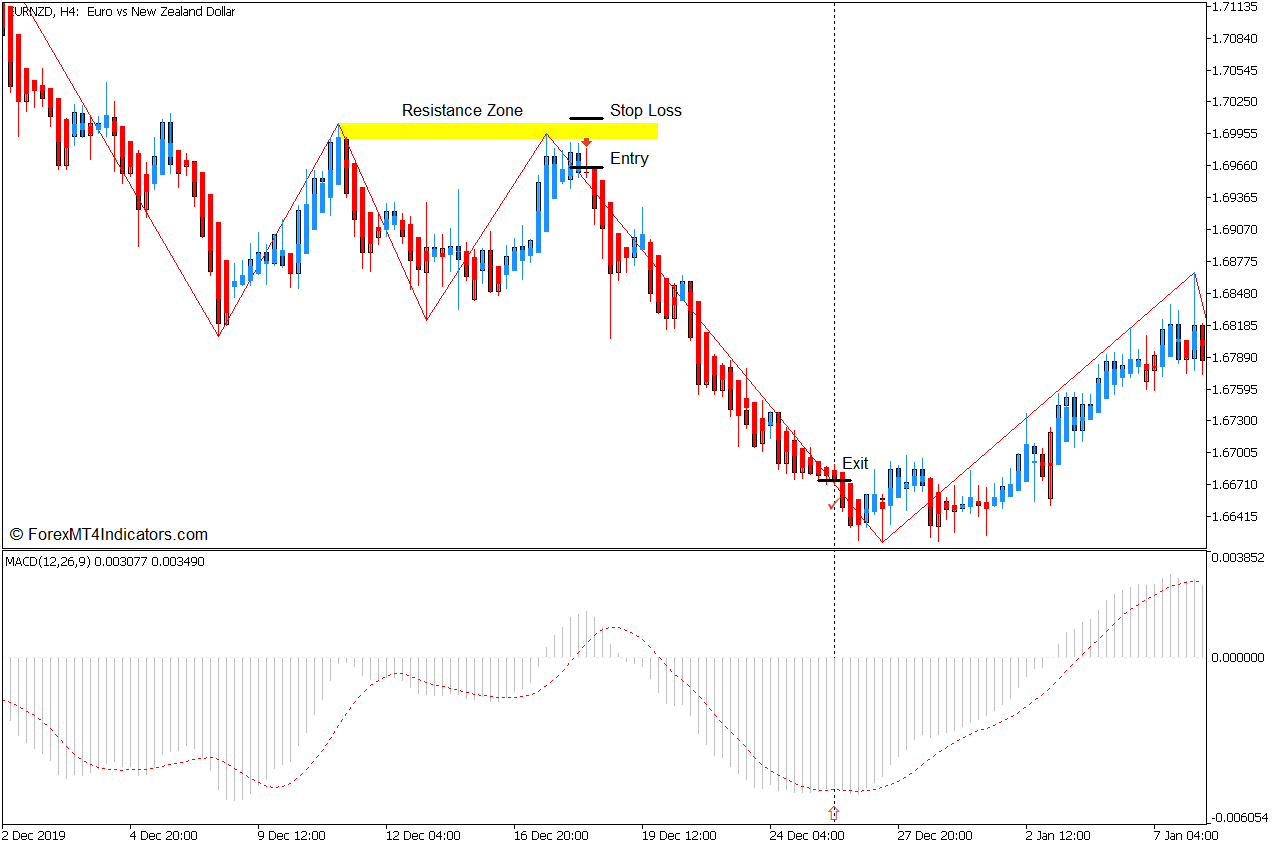

Sell Trade Setup

Entry

- Identify a resistance zone based on a pivot high as indicated by the Zigzag indicator.

- Wait for the price to touch the area of the resistance zone.

- Price should reverse as it touches the resistance zone causing the Heiken Ashi Candlesticks to change to red.

- Enter a sell order on the confirmation of these conditions.

Stop Loss

- Set the stop loss above the resistance zone.

Exit

- Close the trade as soon as the MACD bars cross above the signal line.

Conclusion

Reversals from support and resistance zones are a staple trading strategy among market flow traders. However, it is not always that prices would bounce off these zones.

This strategy gives us a basis to confirm that the price is about to reverse, which is based on the Heiken Ashi Candlesticks. These signals are decent enough because it is not too lagging compared to most trend reversal signals. This gives us decent profits whenever the trade setup starts to trend in the opposite direction.

Recommended MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: