Imagine a tool that whispers valuable insights about the market’s temperament, helping you navigate the ever-changing dynamics of price movements. That, in essence, is the Silence MT5 Indicator. Developed for the MetaTrader 5 platform, this indicator serves a specific purpose: to shed light on market activity. By analyzing price movements, the Silence Indicator unveils two crucial aspects of the market aggressiveness and volatility.

The former reflects the rate of price change, indicating how aggressively prices are moving. Volatility, on the other hand, gauges the extent of price fluctuations within a specific timeframe.

Understanding these two components is essential for any trader. They provide valuable clues about the underlying sentiment of the market, helping you assess whether it’s trending, consolidating, or experiencing a period of heightened volatility.

Understanding The Mechanics Of The Silence Indicator

Now, let’s peek under the hood of the Silence MT5 Indicator and unveil its mechanics. Unlike some indicators that bombard you with complex calculations, the Silence Indicator presents its insights in a user-friendly format.

Aggressiveness and Volatility Lines

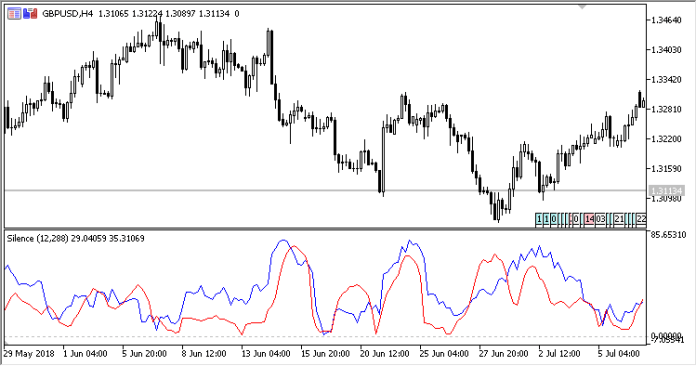

The indicator showcases its analysis through two distinct lines displayed in a separate window. The blue line represents aggressiveness, depicting the rate of price change within the chosen timeframe. A rising blue line signifies an aggressive market, characterized by swift price movements. Conversely, a flat or declining blue line suggests a less aggressive market, with prices fluctuating within a narrower range.

The red line, on the other hand, depicts volatility. It reflects the extent of price fluctuations over the specified period. A high red line indicates a volatile market, where prices are swinging wildly. In contrast, a low red line suggests a calmer market environment with more subdued price movements.

Exploring Calculation Methods

The Silence Indicator uses a specific calculation method to generate these lines. It analyzes price data over a defined period, which you can customize through the indicator’s settings. This period, often referred to as periodicity, determines the timeframe for which the indicator considers price movements.

However, raw price data can sometimes be erratic, making it challenging to discern clear trends. To address this, the Silence Indicator incorporates a technique called Phép nội suy. This process smoothens the indicator lines by filling in the gaps between price data points, providing a clearer visual representation of market activity.

Interpreting The Signals Of The Silence Indicator

Now that we understand how the Silence Indicator displays market activity, let’s decipher what its signals tell us. By analyzing the behavior of the blue and red lines, we can gain valuable insights into the market’s current state and potential future direction.

The Significance Of The Blue Line (Aggressiveness)

A rising blue line indicates an aggressive market, potentially signaling the emergence of a trend. This suggests that prices are moving swiftly in a particular direction, with buyers or sellers dominating the market. However, it’s crucial to remember that aggressiveness alone doesn’t guarantee the direction of the trend.

Decoding The Red Line (Volatility)

The red line, representing volatility, provides complementary information. A high red line signifies a volatile market, where prices are fluctuating significantly. This volatility can be a double-edged sword. While it can present short-term trading opportunities, it also carries increased risk due to the unpredictable nature of price movements. Conversely, a low red line suggests a calmer market, where prices are moving within a narrower range. While this may offer fewer immediate trading opportunities, it can also be a good time to refine your strategies or wait for more decisive signals.

Ưu điểm và Hạn chế

Every tool has its strengths and weaknesses, and the Silence MT5 Indicator is no exception. Let’s delve into the benefits and drawbacks of incorporating this indicator into your trading arsenal.

Dấu hiệu cảnh báo sớm

The Silence Indicator can provide early indications of potential trends by gauging market aggressiveness. A rising blue line, coupled with a confirmation from other technical indicators, could suggest an emerging trend that you can capitalize on.

Đánh giá biến động

The red line, representing volatility, helps you assess the market’s risk profile. This information is crucial for making informed trading decisions, especially for risk-averse traders who might prefer to avoid highly volatile markets.

Phân tích khách quan

Unlike some indicators that rely on subjective interpretations, the Silence Indicator presents its analysis through clear visual signals. This can help remove emotional bias from your trading decisions and promote a more objective approach.

Cách giao dịch với chỉ báo im lặng

Mua vào

- Price action is in an uptrend (consider using additional confirmation like moving averages).

- The aggressiveness line (blue) is rising and above the Volatility line (red).

- Volatility line is flat or trending upwards.

- Entry: Buy near a support level or on a price breakout after the confirmation of the above conditions.

- Chặn đứng tổn thất: Đặt lệnh dừng lỗ bên dưới mức dao động thấp hoặc mức hỗ trợ gần đây.

- Chốt lời: Consider taking profit at a resistance level, aiming for a risk-reward ratio of at least 1:2 (reward is twice the risk).

Nhập cảnh bán

- Price action is in a downtrend (consider using additional confirmation like moving averages).

- The aggressiveness line (blue) is falling below the Volatility line (red).

- Volatility line is flat or trending downwards.

- Entry: Sell near a resistance level or on a price breakdown after the confirmation of the above conditions.

- Chặn đứng tổn thất: Đặt lệnh dừng lỗ trên mức dao động cao hoặc mức kháng cự gần đây.

- Chốt lời: Consider taking profit at a support level, aiming for a risk-reward ratio of at least 1:2 (reward is twice the risk).

Kết luận

Silence MT5 Indicator offers valuable insights into market aggressiveness and volatility, it should be used as a confluence tool alongside price action and other technical indicators. By understanding the interplay between the blue and red lines, traders can gain a better understanding of potential entry and exit points within established trends.

However, remember that no indicator is perfect, and proper risk management practices like stop-loss orders and a sound trading plan are crucial for navigating the ever-changing market landscape.

Nhà môi giới MT5 được đề xuất

XM Broker

- Miễn phí $ 50 Để bắt đầu giao dịch ngay lập tức! (Lợi nhuận có thể rút)

- Tiền thưởng khi gửi tiền lên đến $5,000

- Chương trình khách hàng thân thiết không giới hạn

- Nhà môi giới ngoại hối giành được giải thưởng

- Tiền thưởng độc quyền bổ sung Suốt cả năm

>> Đăng ký tài khoản môi giới XM tại đây <

Nhà môi giới FBS

- Giao dịch 100 tiền thưởng: Miễn phí 100 USD để bắt đầu hành trình giao dịch của bạn!

- Khuyến mãi 100% tiền nạp: Nhân đôi số tiền gửi của bạn lên tới 10,000 USD và giao dịch với số vốn tăng cường.

- Tận dụng tối đa 1: 3000: Tối đa hóa lợi nhuận tiềm năng với một trong những lựa chọn đòn bẩy cao nhất hiện có.

- Giải thưởng 'Nhà môi giới dịch vụ khách hàng tốt nhất châu Á': Được công nhận xuất sắc trong việc hỗ trợ và dịch vụ khách hàng.

- Khuyến mãi theo mùa: Tận hưởng nhiều phần thưởng độc quyền và khuyến mại quanh năm.

>> Đăng ký tài khoản môi giới FBS tại đây <

(Tải xuống chỉ báo MT5 miễn phí)

Nhấp vào đây bên dưới để tải xuống: