Giao dịch chất lượng cao, xác suất cao - đây là điều mà hầu hết các nhà giao dịch mong muốn trong chiến lược giao dịch. Chắc chắn, một số người sẽ muốn các chiến lược giao dịch có thể nhận được càng nhiều giao dịch càng tốt và hy vọng họ sẽ có được những giao dịch mang lại lợi nhuận khổng lồ đó sau một thời gian. Nhưng đối với nhiều nhà giao dịch, việc có được sự nhất quán sẽ tốt hơn là đường cong lợi suất khá thất thường.

Giao dịch kỹ thuật có thể là một trong những cách để giao dịch và kiếm lợi nhuận một cách nhất quán từ thị trường ngoại hối. Điều này là do giao dịch kỹ thuật thường dựa trên quy tắc. Như vậy, các nhà giao dịch có thể duy trì cùng một chiến lược ngày này qua ngày khác, tuần này qua tuần khác và nhất quán với những gì họ đang giao dịch. Tính nhất quán này cho phép quy tắc số lượng lớn có lợi cho họ.

Chìa khóa để thành công trong giao dịch kỹ thuật là sử dụng đúng công cụ, đó là các chỉ báo kỹ thuật. Các chỉ báo kỹ thuật không được tạo ra bằng nhau. Một số chỉ tốt hơn những người khác. Một số tạo ra kết quả tốt trong khi những người khác thì không. Chiến lược giao dịch ngoại hối Ichimoku Cloud Pux CCI sử dụng các chỉ báo kỹ thuật có xác suất cao đã được chứng minh là có hiệu quả theo thời gian.

Ichimoku Kinko Hyo hay Đám mây Ichimoku

Chỉ báo Đám mây Ichimoku là một trong những chỉ báo đã đạt được thành công lớn ngay cả khi chỉ là một chỉ báo độc lập. Trên thực tế, khi được kiểm tra lại, chỉ báo Đám mây Ichimoku cho thấy là một trong những chỉ báo độc lập hoạt động tốt nhất trong số nhiều chỉ báo.

Chỉ báo Đám mây Ichimoku là chỉ báo xu hướng được vẽ trên biểu đồ giá. Nó sử dụng nhiều đường dựa trên các đường trung bình và đường trung bình động đã được sửa đổi. Những đường trung bình và đường trung bình động này đại diện cho một xu hướng nhất định.

Tenkan-sen hay Đường chuyển đổi là một chỉ báo xu hướng ngắn hạn, dựa trên mức trung bình của mức cao nhất và thấp nhất trong 9 kỳ. Kijun-sen hay Đường cơ sở là chỉ báo xu hướng trung hạn được tính là đường trung bình trong 26 kỳ vừa qua. Hai đường này thường được sử dụng làm tín hiệu đảo chiều xu hướng dựa trên sự giao nhau của chúng.

Senkou Span A (Leading Span A) là mức trung bình của Tenkan-sen (Đường chuyển đổi) và Kijun-sen (Đường cơ sở). Đường này thể hiện xu hướng trung hạn chậm hơn. Senkou Span B (Leading Span B) là đường trung tuyến của 52 giai đoạn vừa qua. Hai đường này tạo thành Kumo (Đám mây). Kumo đại diện cho xu hướng dài hạn, dựa trên cách xếp chồng Senkou Spa A và B. Các nhà giao dịch thường sử dụng điều này như một bộ lọc hướng giao dịch. Tuy nhiên, việc hai đường giao nhau cũng cho thấy sự đảo ngược của xu hướng dài hạn.

Khoảng Chikou hoặc Khoảng trễ về cơ bản là hành động giá dịch chuyển sang trái. Đó là một đường được vẽ dựa trên mức đóng của mỗi cây nến và được dịch chuyển 26 tiết trước cây nến hiện tại. Điều này thường được sử dụng để xác định xem thị trường có biến động hay không. Các nhà giao dịch coi thị trường là biến động nếu Chikou Span chạm vào hành động giá, vì các thị trường có xu hướng mạnh thường khiến Chikou Span tụt hậu rất xa so với hành động giá.

Pux CCI

Pux CCI là phiên bản sửa đổi của Chỉ số kênh hàng hóa (CCI) phổ biến. Nó là một chỉ báo động lượng được vẽ dưới dạng một bộ dao động. Nó vẽ biểu đồ và đường để biểu thị hướng xu hướng và chuyển động hành động giá theo bóng.

Đường vàng là đường chuyển động nhanh, cố gắng tạo bóng chuyển động của hành động giá và đại diện cho một xu hướng rất ngắn hạn. Đường này hoạt động khá tốt trong việc di chuyển theo hành động giá, tuy nhiên nó thường tạo ra tín hiệu sai nếu được sử dụng làm chỉ báo độc lập. Tốt nhất chỉ nên sử dụng chỉ báo này nếu nó phù hợp với biểu đồ của chỉ báo này, đây là chỉ báo xu hướng trung và dài hạn của nó.

Các biểu đồ thể hiện chỉ báo trung và dài hạn. Nó được vẽ như một bộ dao động không giới hạn di chuyển xung quanh đường giữa của nó, bằng XNUMX. Biểu đồ dương cho thấy xu hướng thị trường tăng giá trong khi biểu đồ âm cho thấy xu hướng thị trường giảm giá. Tuy nhiên, không phải tất cả các thanh dương hoặc âm đều biểu thị một xu hướng mạnh. Các thị trường không có xu hướng có biểu đồ được sơn màu xanh lam, trong khi thị trường có xu hướng tăng có biểu đồ màu xanh lá cây và thị trường có xu hướng giảm có biểu đồ màu đỏ.

Các nhà giao dịch có thể sử dụng việc chuyển đổi biểu đồ từ dương sang âm hoặc ngược lại làm tín hiệu. Tuy nhiên, các nhà giao dịch bảo thủ thích sử dụng việc thay đổi màu sắc thành xanh lục hoặc đỏ làm tín hiệu vào lệnh có xác suất cao hơn.

Thương mại Chiến lược

Chiến lược giao dịch này dựa trên hai chỉ báo động lượng và theo xu hướng có xác suất cao, đó là chỉ báo Ichimoku Kinko Hyo và Pux CCI. Tín hiệu giao dịch được tạo ra khi có sự hợp lưu dựa trên hai chỉ báo.

Trên chỉ báo Đám mây Ichimoku, hướng giao dịch của giao nhau Kumo và giao nhau Tenkan-sen và Kijun-sen phải hợp lưu.

Mặt khác, Pux CCI cũng phải hợp lưu với chỉ báo Đám mây Ichimoku. Tuy nhiên, tín hiệu giao dịch chỉ được xác nhận khi các thanh biểu đồ có màu xanh lá cây hoặc đỏ, điều này cho thấy thị trường có xu hướng tăng hoặc giảm.

Các chỉ số:

- Ichimoku

- PUX_CCI

Khung thời gian: tốt nhất là biểu đồ 1 giờ, 4 giờ và hàng ngày

Các cặp ngoại tệ: tốt nhất là cặp chính và cặp phụ

Phiên giao dịch: Phiên Tokyo, London và New York

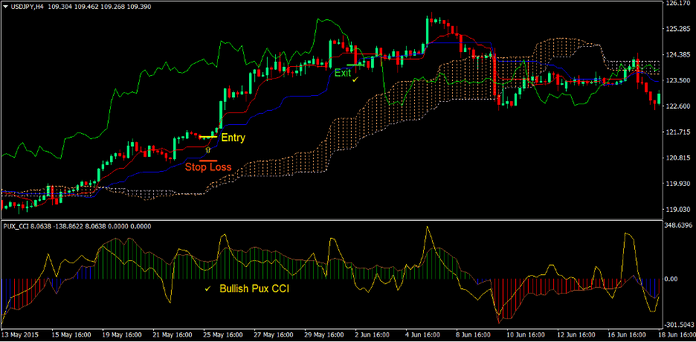

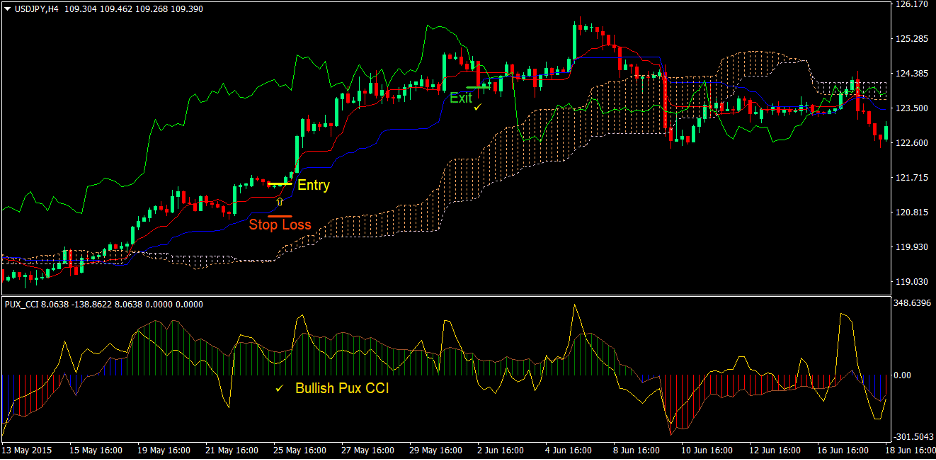

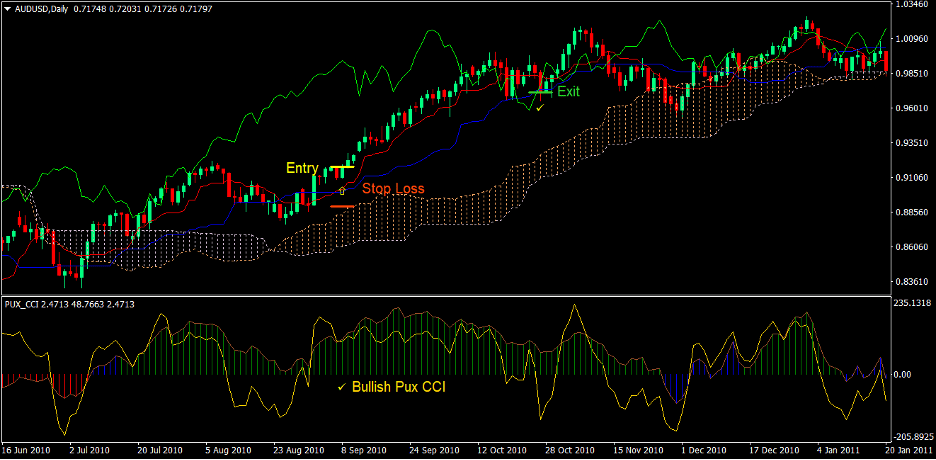

Mua thiết lập giao dịch

lối vào

- Chỉ báo Pux CCI sẽ in biểu đồ màu xanh lá cây cho thấy xu hướng tăng

- Kumo phải có Khoảng thời gian dẫn đầu A phía trên Khoảng thời gian dẫn đầu B cho thấy xu hướng tăng dài hạn

- Tenkan-sen sẽ vượt lên trên Kijun-sen cho thấy xu hướng tăng

- Tham gia giao dịch mua khi hội tụ các điều kiện trên

Stop Loss

- Đặt mức dừng lỗ ở mức hỗ trợ bên dưới mục nhập

Ra

- Đóng giao dịch ngay khi giá đóng cửa dưới Kijun-sen

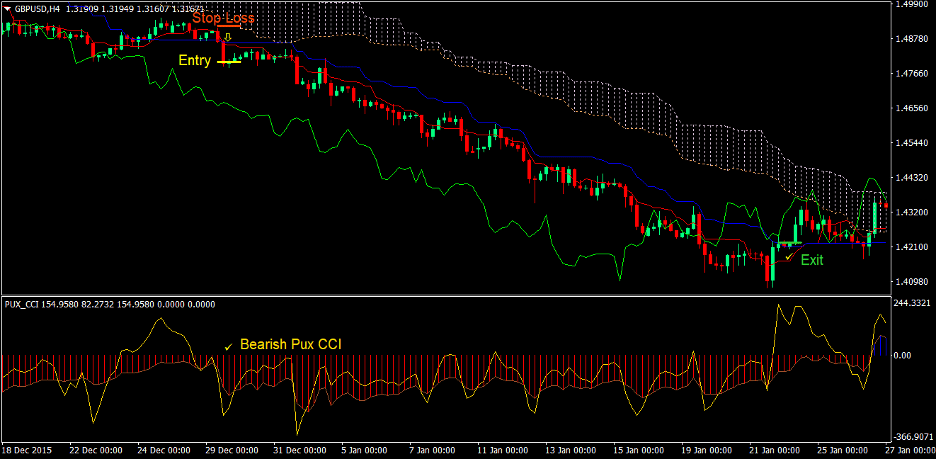

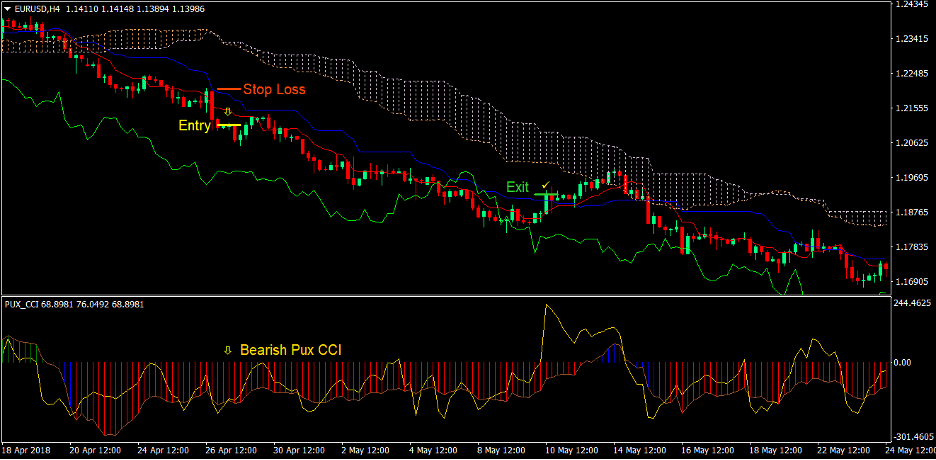

Bán thiết lập giao dịch

lối vào

- Chỉ báo Pux CCI sẽ in biểu đồ màu đỏ cho thấy xu hướng giảm giá

- Kumo phải có Khoảng thời gian dẫn đầu A bên dưới Khoảng thời gian dẫn đầu B cho thấy xu hướng giảm giá dài hạn

- Tenkan-sen sẽ cắt xuống dưới Kijun-sen cho thấy xu hướng giảm

- Tham gia giao dịch bán khi hội tụ các điều kiện trên

Stop Loss

- Đặt mức dừng lỗ ở mức kháng cự phía trên mục nhập

Ra

- Đóng giao dịch ngay khi giá đóng cửa trên Kijun-sen

Kết luận

Chiến lược giao dịch ngoại hối Ichimoku Cloud Pux CCI là một chiến lược dựa trên sự kết hợp của hai chỉ báo xu hướng có xác suất cao là Ichimoku Kinko Hyo và Pux CCI.

Các thiết lập giao dịch này cung cấp tín hiệu vào lệnh điều chỉnh các xu hướng ngắn hạn, trung hạn và dài hạn, cho phép các nhà giao dịch tham gia giao dịch có xác suất cao. Sẽ có lúc việc gia nhập giao dịch muộn hơn một chút, tuy nhiên đây là sự đánh đổi để chúng ta có được hướng xu hướng được xác nhận trong thời gian tới. Điều này lần lượt dẫn đến giao dịch có xác suất cao hơn. Lợi nhuận liên quan đến rủi ro trên mỗi giao dịch có thể không cao bằng, nhưng chúng ta giành chiến thắng thường xuyên hơn các chiến lược giao dịch khác.

Nhà môi giới MT4 được đề xuất

XM Broker

- Miễn phí $ 50 Để bắt đầu giao dịch ngay lập tức! (Lợi nhuận có thể rút)

- Tiền thưởng khi gửi tiền lên đến $5,000

- Chương trình khách hàng thân thiết không giới hạn

- Nhà môi giới ngoại hối giành được giải thưởng

- Tiền thưởng độc quyền bổ sung Suốt cả năm

>> Đăng ký tài khoản môi giới XM tại đây <

Nhà môi giới FBS

- Giao dịch 100 tiền thưởng: Miễn phí 100 USD để bắt đầu hành trình giao dịch của bạn!

- Khuyến mãi 100% tiền nạp: Nhân đôi số tiền gửi của bạn lên tới 10,000 USD và giao dịch với số vốn tăng cường.

- Tận dụng tối đa 1: 3000: Tối đa hóa lợi nhuận tiềm năng với một trong những lựa chọn đòn bẩy cao nhất hiện có.

- Giải thưởng 'Nhà môi giới dịch vụ khách hàng tốt nhất châu Á': Được công nhận xuất sắc trong việc hỗ trợ và dịch vụ khách hàng.

- Khuyến mãi theo mùa: Tận hưởng nhiều phần thưởng độc quyền và khuyến mại quanh năm.

>> Đăng ký tài khoản môi giới FBS tại đây <

Nhấp vào đây bên dưới để tải xuống: