Moving average crossovers are probably one of the simplest trading strategies. It is a trend reversal trading strategy wherein trend reversal signals are based on the crossing over of moving average lines. Moving average crossovers have taken a lot of flack from many losing traders. This is probably because these losing traders blindly followed a moving average crossover strategy without taking into account the context of the market conditions. Some would continue using a moving average crossover strategy even on a choppy range bound market condition. This would naturally cause a string of losses because this is not the context where a trend reversal could occur.

With the right moving average parameters and type, moving average crossovers can actually produce trades which could result in high yields. As long as the signal is not too late and as long as false signals are minimized and avoided, crossover setups could actually work.

This trading strategy is a simple moving average crossover strategy which trades reversal signals which align with the direction of the long-term trend.

Moving Average Crossover Signals

Moving average crossover setups are simple reversal trade setups which are generated whenever a two moving average lines crossover. The direction of the reversal is based on the direction of the crossing over of the faster moving average line.

A bullish trend reversal signal is generated whenever a faster moving average line crosses above the slower moving average line. Inversely, a bullish trend reversal signal is generated whenever the faster moving average line crosses below the slower moving average line.

Moving average crossovers can be excellent trend reversal signals. However, they do not work well when used in a range bound choppy market.

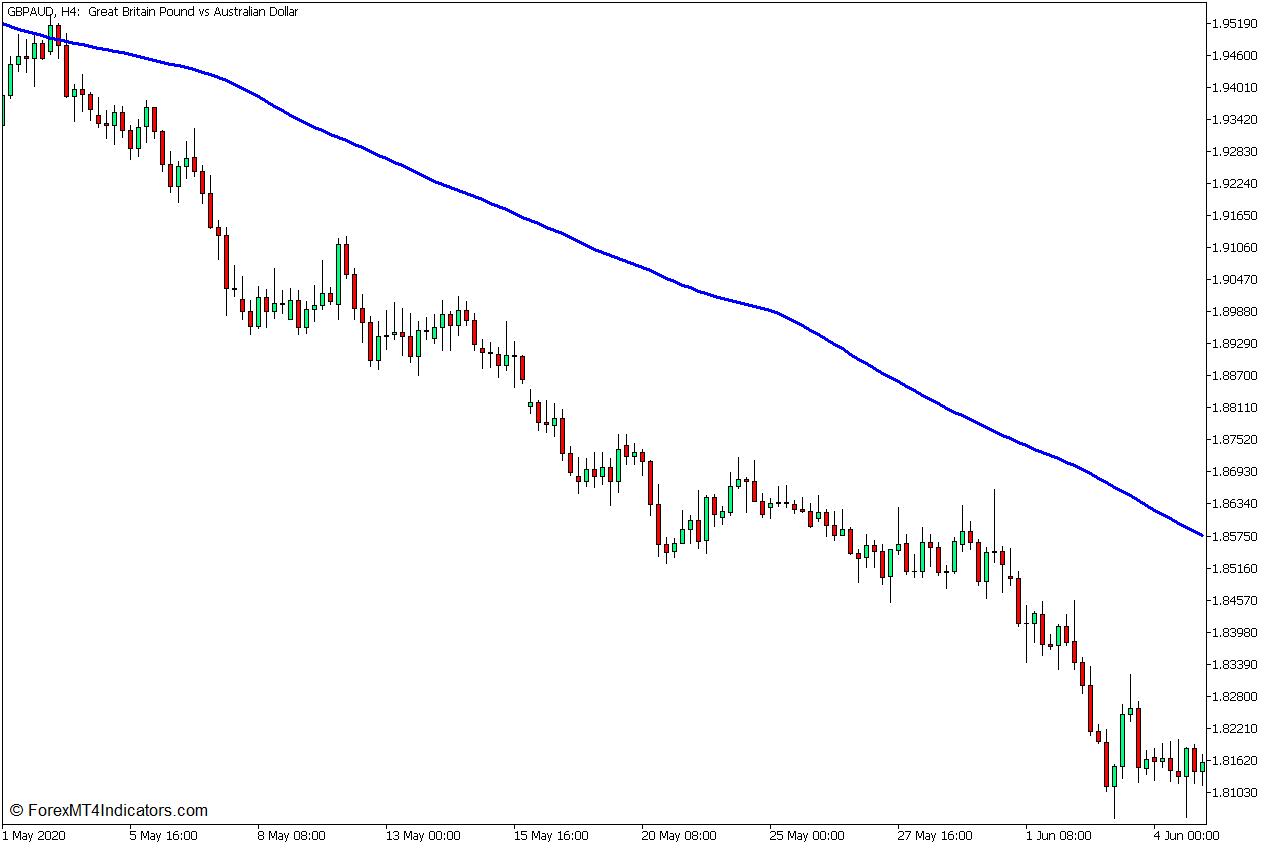

100 SMA as Long-Term Trend Filter

One of the main uses of the moving average line is as a trend direction indicator. Traders can easily identify trend direction based on where price action is in relation to the moving average line and how the moving average slopes.

Price action is generally above a moving average line during an uptrend, and below the moving average during a downtrend. Traders can simply look at where price action generally is in relation to the moving average and know the direction of the trend. Many traders would filter their trades based on trend direction using this method.

The 100-bar Simple Moving Average (SMA) line is a widely used moving average line for identifying long-term trend directions.

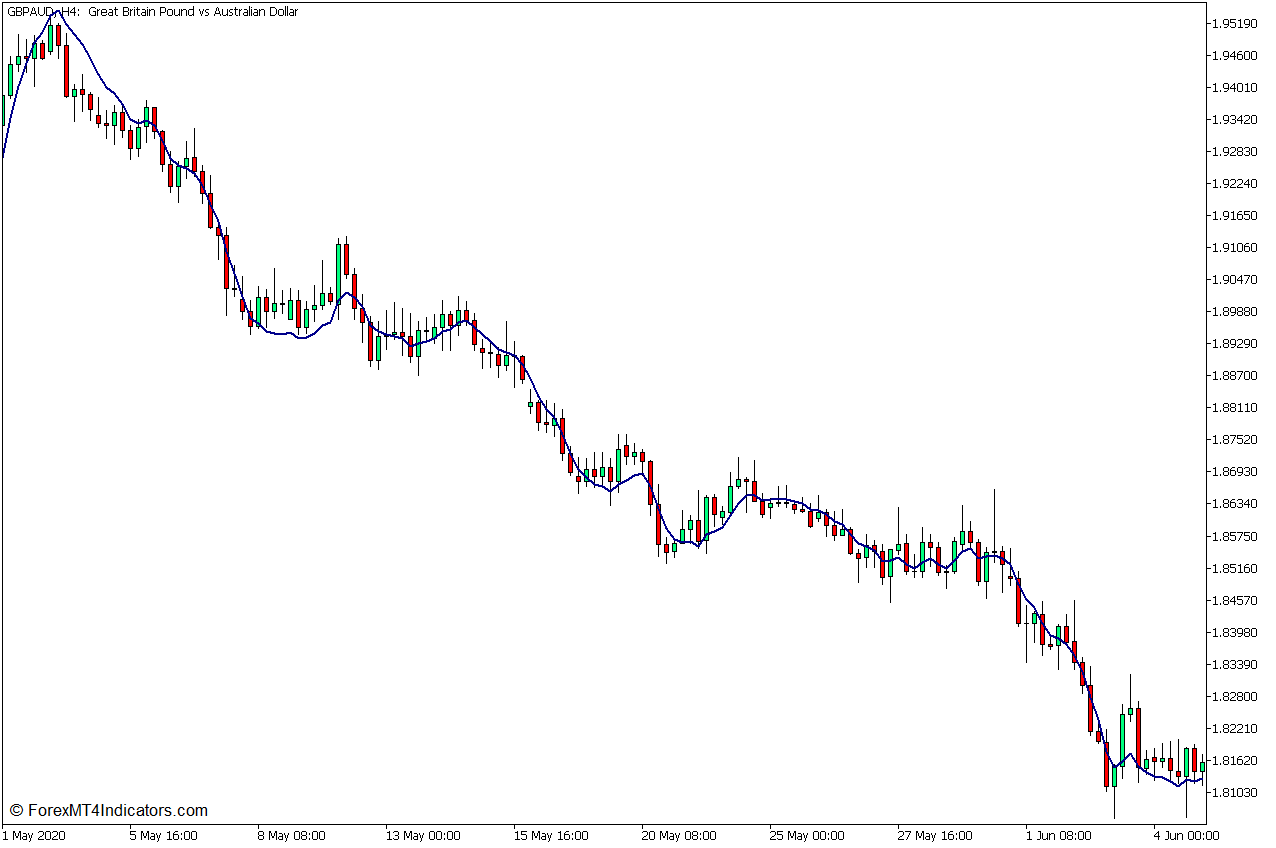

20 EMA as the Signal Line

The 20-bar Exponential Moving Average line is a widely used short-term moving average line. Price action would generally stay above the 20 EMA line during a strong uptrend, and below the 20 EMA line during a strong downtrend.

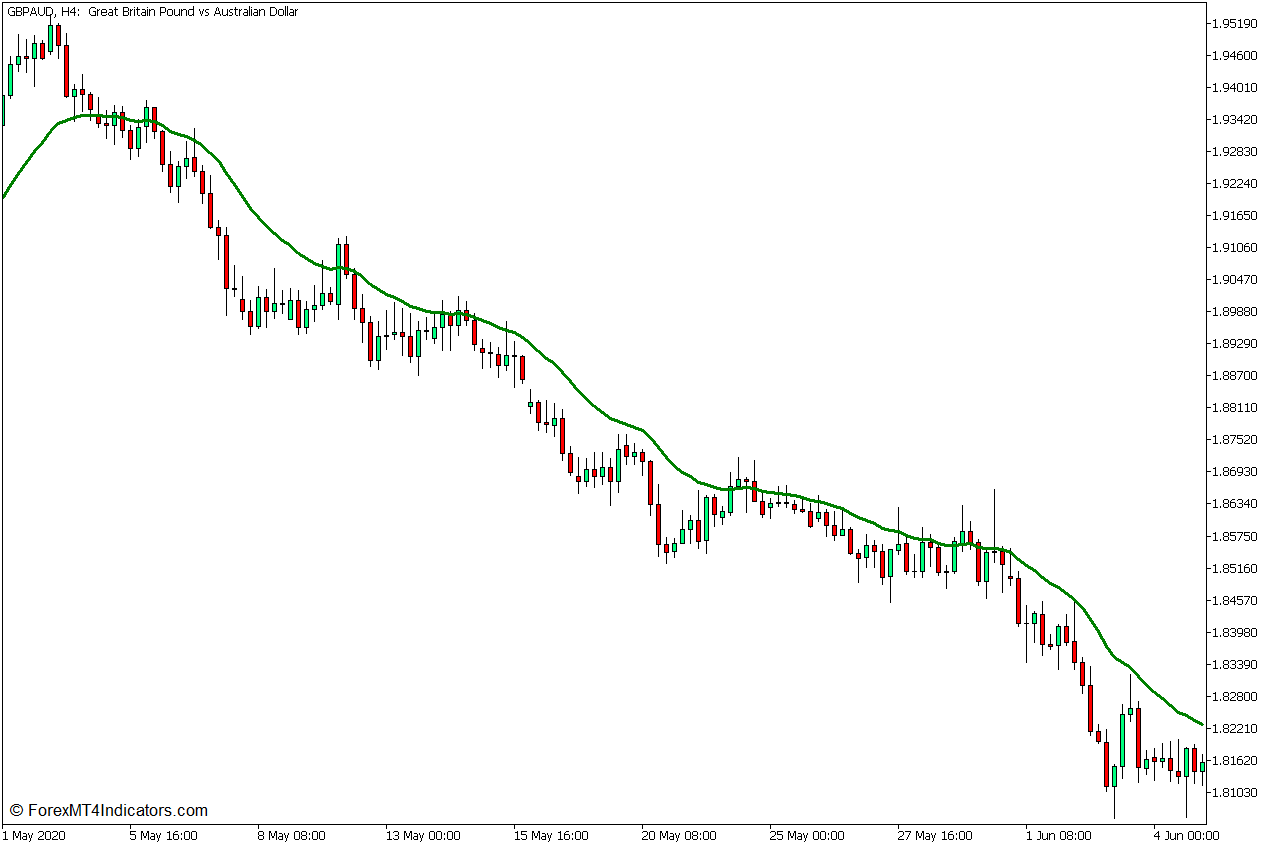

Triple Exponential Moving Average as the Signal

The Triple Exponential Moving Average (TEMA) is a customization of the traditional moving average lines.

Most variations of the moving average line tend to be too lagging. This often causes traders to enter trades too late, which can cause a huge decrease in their potential profits. At times late entries could also cause losses on trades that should otherwise be profitable if they were not late.

The TEMA line mitigates this by providing a line which is very responsive to price movements yet at the same time has smoothening feature which decreases false signals. This is done by putting more emphasis on the most recent price points.

The responsive nature of the TEMA line makes it an ideal entry signal when paired with the right moving average line as a crossover setup.

Trading Strategy Concept

This trading strategy is a simple trend reversal trading strategy which uses moving average crossovers as a basis for identifying potential trend reversals. However, instead of trading any moving average crossover signal that is available, we will only trade crossover signals that are in confluence with the long-term trend direction.

We will use the 100 SMA line to filter out low probability trades that do not go with the long-term trend direction. Only moving average crossover signals that are in confluence with the 100 SMA trend direction are considered valid.

As for our immediate trend reversal signal, we will use the 15-bar TEMA line as a pair to the 20 EMA line for our crossover signal.

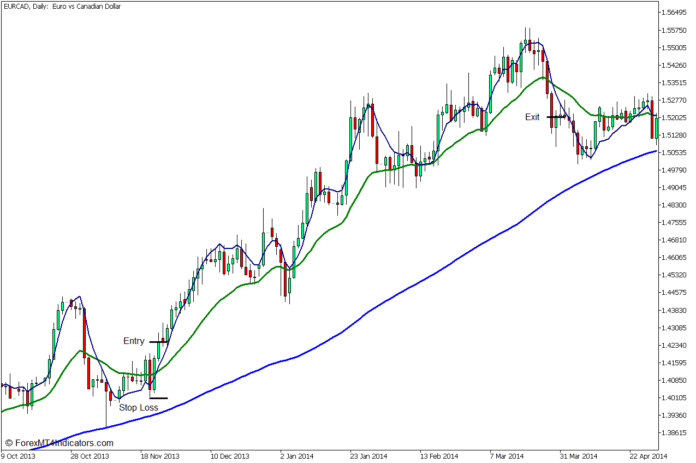

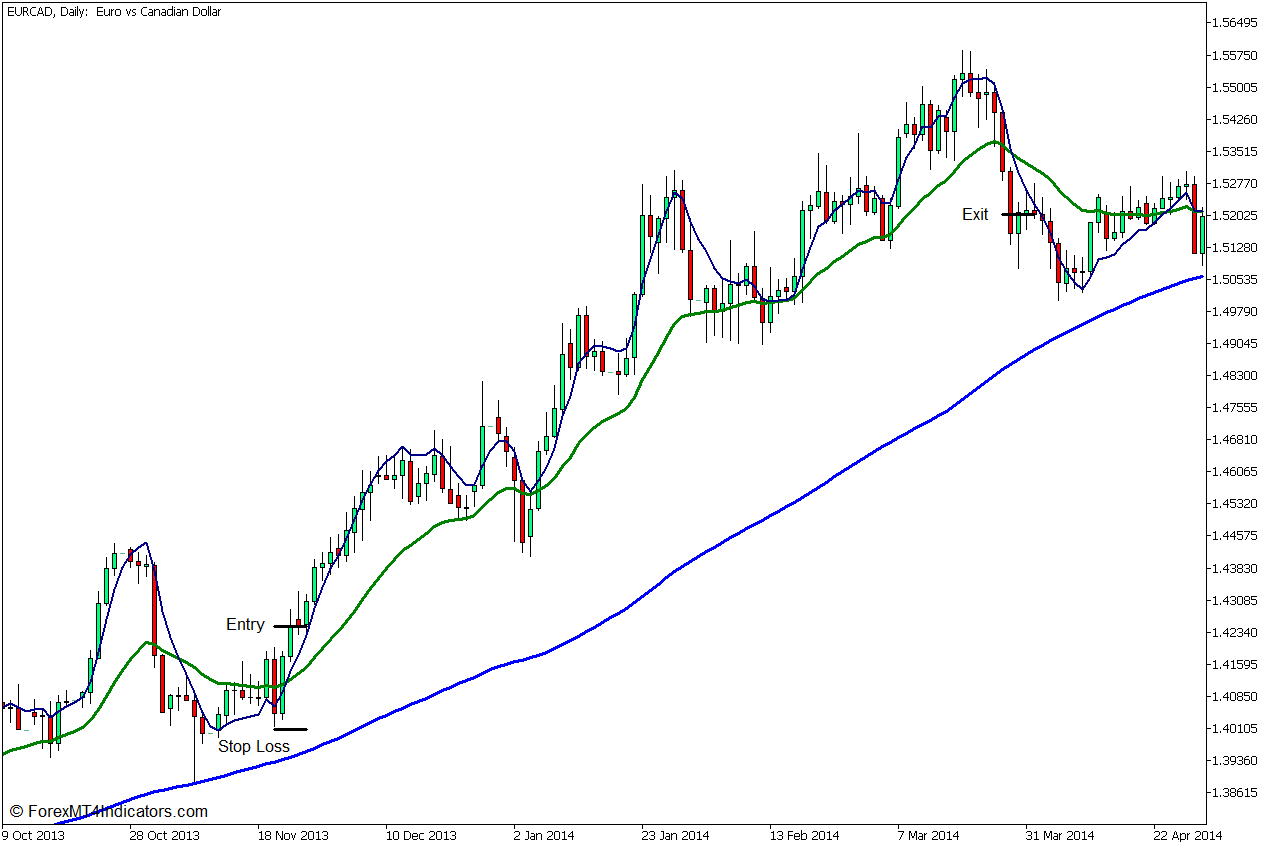

Buy Trade Setup

Entry

- Price action should be above the 100 SMA line.

- The 15 TEMA and 20 EMA line should be above the 100 SMA line.

- Price action should temporarily retrace causing the 15 TEMA line to temporarily cross below the 20 EMA line.

- Enter a buy order as soon as the 15 TEMA line crosses above the 20 EMA line.

Stop Loss

- Set the stop loss on the support below the entry candle.

Exit

- Close the trade as soon as the 15 TEMA line crosses back below the 20 EMA line.

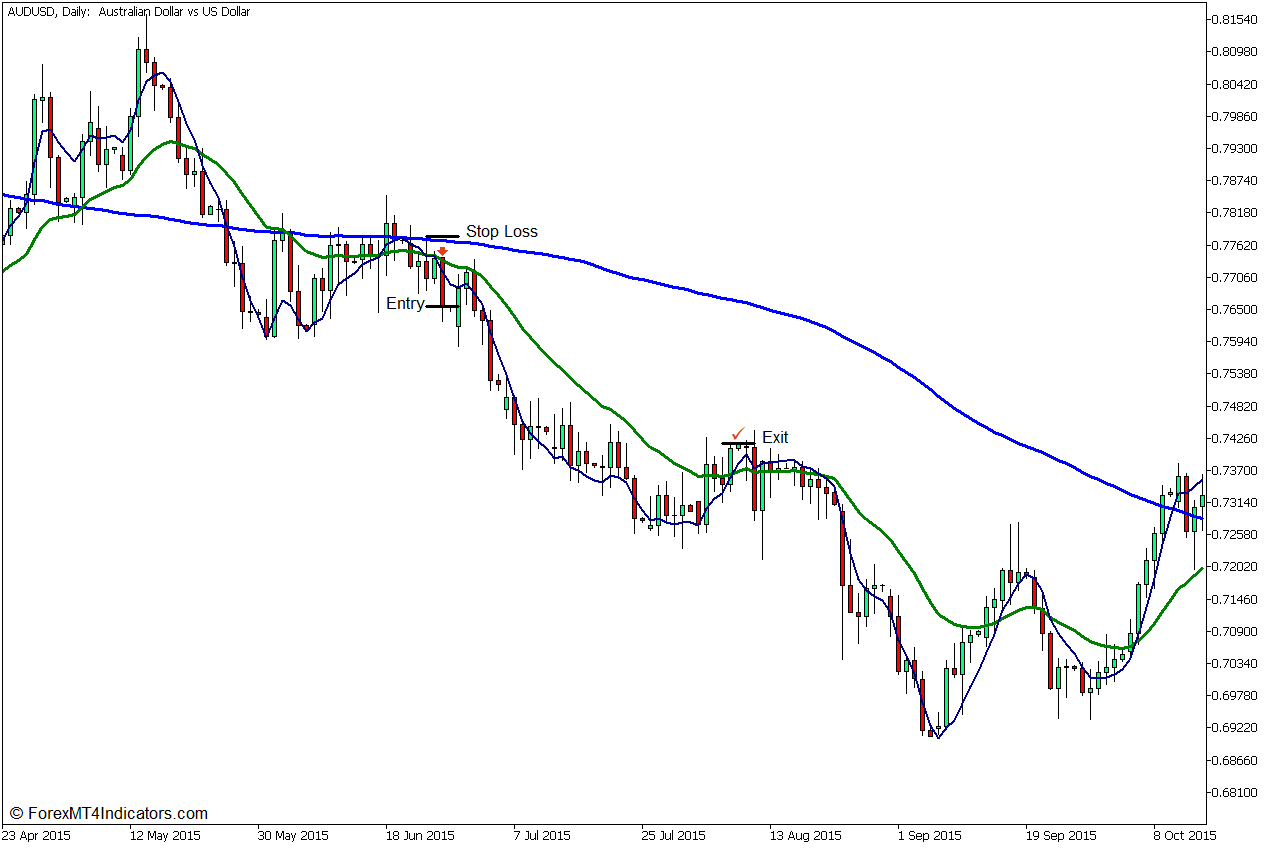

Sell Trade Setup

Entry

- Price action should be below the 100 SMA line.

- The 15 TEMA and 20 EMA line should be below the 100 SMA line.

- Price action should temporarily retrace causing the 15 TEMA line to temporarily cross above the 20 EMA line.

- Enter a sell order as soon as the 15 TEMA line crosses below the 20 EMA line.

Stop Loss

- Set the stop loss on the resistance above the entry candle.

Exit

- Close the trade as soon as the 15 TEMA line crosses back above the 20 EMA line.

Conclusion

As with all moving average line crossover strategies, this strategy is a trend reversal strategy and thus does not work well in a ranging or choppy market. It is best to avoid using any moving average crossover strategy in such a market condition.

However, this type of strategy shines well in a trending market condition especially on the long-term. This works well on long-term trends that develop on the daily charts.

Overextended trends also tend to lose momentum. As such, it is best to use this strategy early on a long-term trend. Avoid trading this strategy when the long-term trend is already overextended and might be due for a reversal.

Recommended MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: