Trend following strategies and mean reversal strategies could be considered as being on opposite sides of the spectrum. Trend following trade setups assume that price would continue its current trending direction. On the other hand, mean reversal setups assume that price is either too high or too low and would be reversing back to the average price.

Many traders choose one type of setup between the two. Astute traders however look for a setup with a common ground, a trade that is aligned with the trend, yet is also either overbought or oversold.

So, how do we merge these two contradicting assumptions?

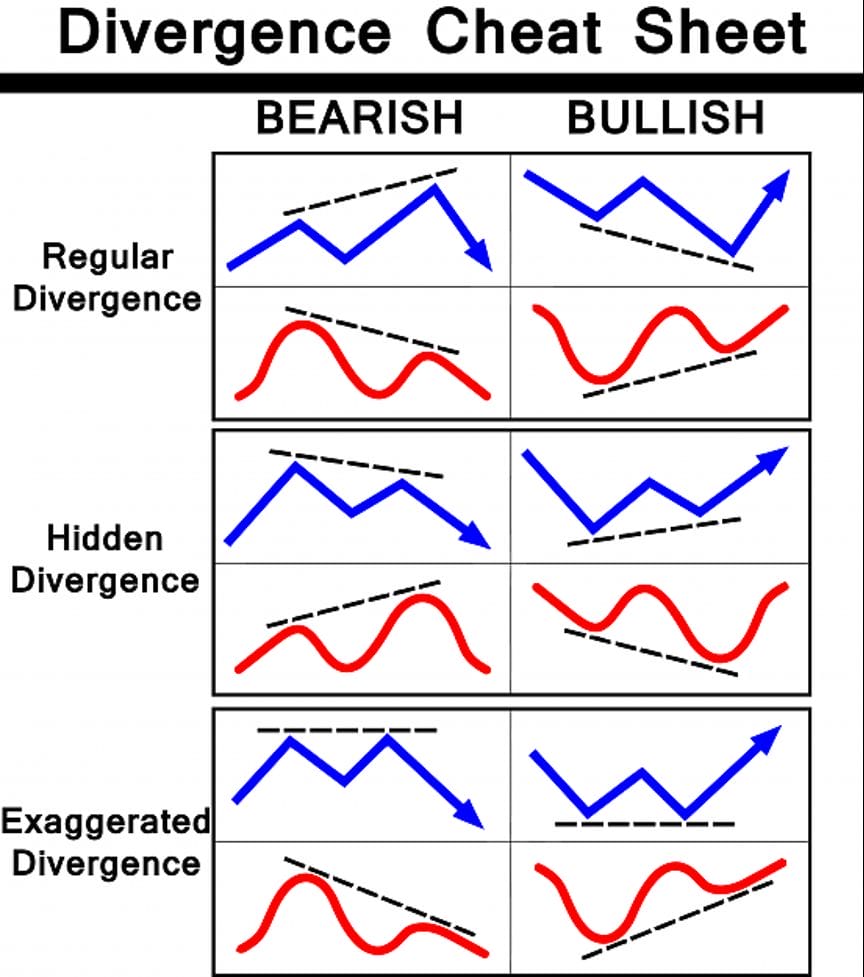

Hidden divergence is a good middle ground between the two. Hidden divergences are trend reversal signals that occur on the shorter-term and is often found during retracements. It is often found on the retracement after a strong push in the direction of a trend. This discrepancy between price action and an oscillating indicator could be indicative of a trend reversal that could occur as a short-term push in the direction of the trend.

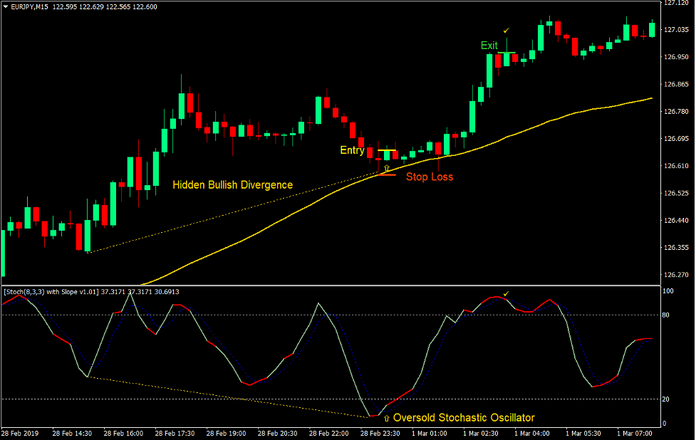

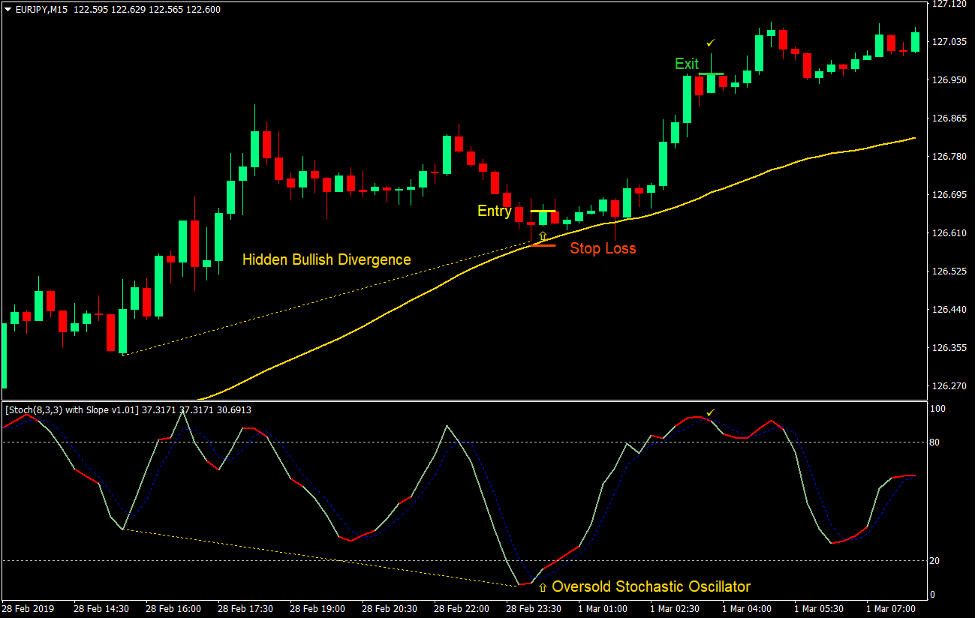

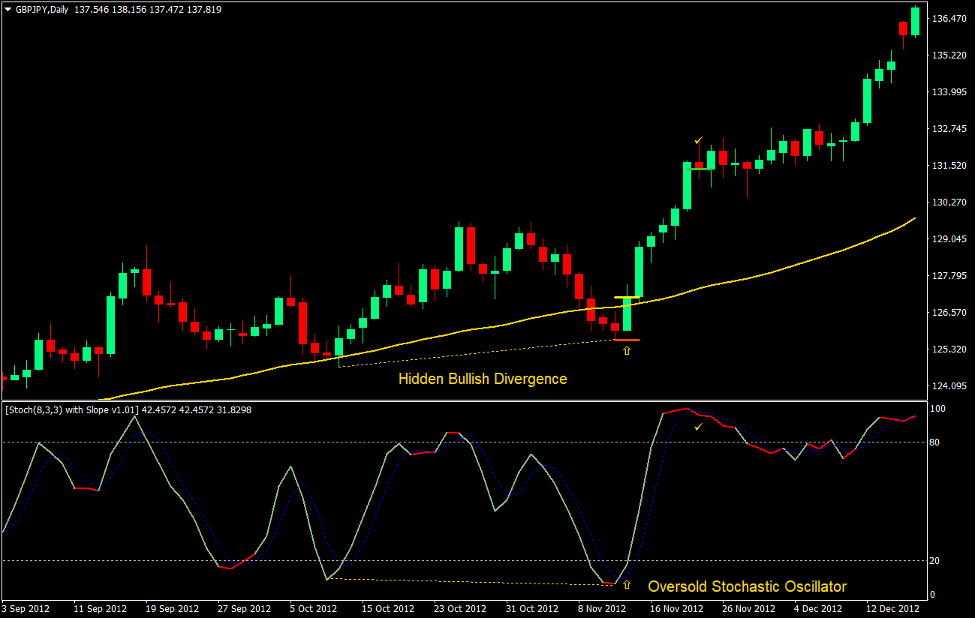

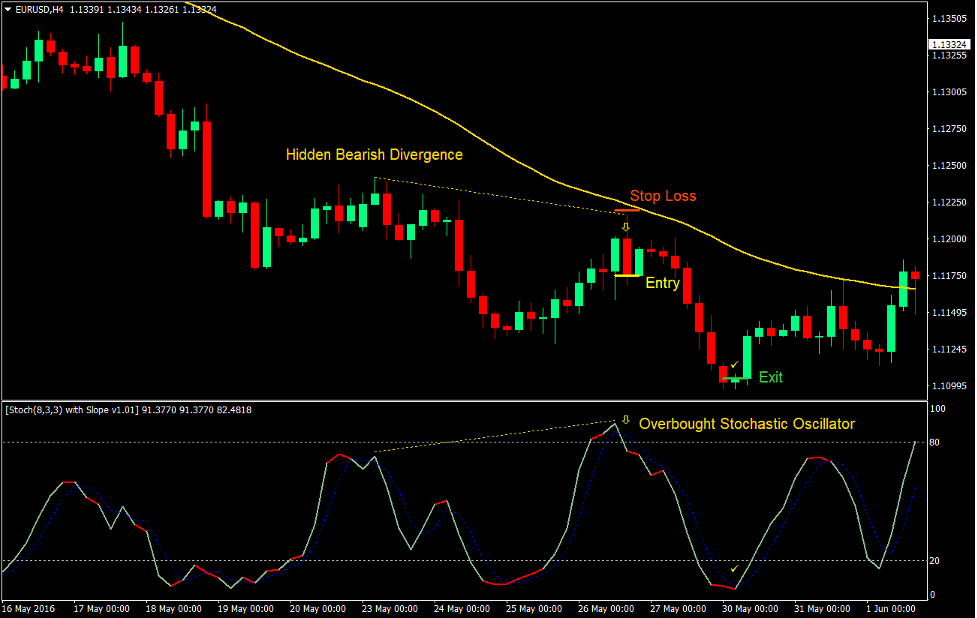

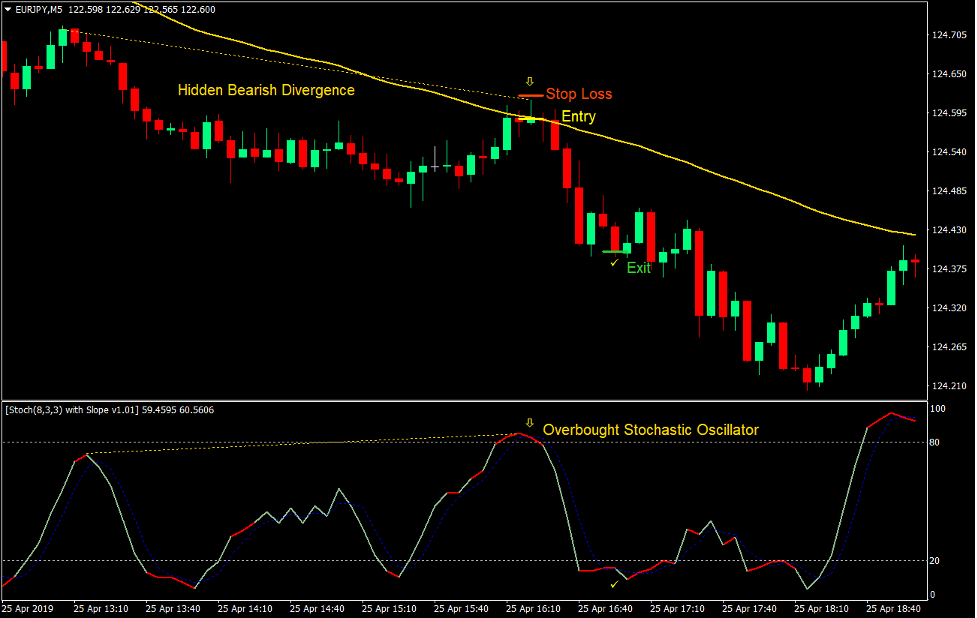

The chart below shows how a hidden divergence would look like.

Stochastic Slope

Stochastic Slope is a custom indicator based on the Stochastic Oscillator. It is basically a Stochastic Oscillator that could indicate whenever price is about to reverse based on the changing of its color.

The Stochastic Oscillator is a technical indicator that compares the current closing price of a candle to a range of its prices over a certain period. It considers the most recent closing price, the lowest and highest price within a period, and the current value of the stochastic indicator.

Stochastic Oscillators are typically used to identify trend direction and overbought or oversold prices.

Trend direction is based on how the two Stochastic Oscillator lines overlap. If the faster line is above the slower line, the market is considered bullish. If the faster line is below the slower line, then the market is considered bearish.

Overbought conditions are identified whenever the Stochastic Oscillator lines are above 80. Oversold conditions on the other hand are indicated whenever the Stochastic Oscillator lines are below 20.

Trading Strategy

This trading strategy combines both mean reversal strategies based on the stochastic oscillator being overbought or oversold and a trend following strategy based on the direction of price action.

To identify the direction of the trend, we would be using the 50-period Simple Moving Average (SMA). Trend direction is based on the direction of the slope of the 50 SMA line. Price action should also be trending in the direction indicated by the 50 SMA line.

Once we identify a trending market, we wait for price to retrace towards the 50 SMA line. This should be accompanied by the Stochastic Oscillator being overbought or oversold, depending on the direction of the trend.

As the stochastic oscillator lines peak, we observe the chart if there are any hidden divergences. If so, then we take the trade in the direction of the trend as soon as the stochastic oscillator lines crossover towards the direction of the trend.

Indicators:

- 50 SMA (Gold)

- Stochastic Slope (default setting)

Preferred Time Frames: 5-minute, 15-minute, 30-minute, 1-hour, 4-hour and daily charts

Currency Pairs: major and minor pairs

Trading Sessions: Tokyo, London and New York sessions

Buy Trade Setup

Entry

- The 50 SMA line should be sloping up.

- Price should be in an uptrend.

- Price should retrace towards the 50 SMA line.

- The Stochastic Oscillator lines should be temporarily oversold.

- A hidden bullish divergence should be observable on the chart.

- Enter a buy order as soon as the faster stochastic oscillator line crosses above the slower stochastic oscillator line.

Stop Loss

- Set the stop loss on the fractal below the entry candle.

Exit

- Close the trade as soon as the stochastic oscillator lines become overbought and crosses over.

Sell Trade Setup

Entry

- The 50 SMA line should be sloping down.

- Price should be in a downtrend.

- Price should retrace towards the 50 SMA line.

- The Stochastic Oscillator lines should be temporarily overbought.

- A hidden bearish divergence should be observable on the chart.

- Enter a sell order as soon as the faster stochastic oscillator line crosses below the slower stochastic oscillator line.

Stop Loss

- Set the stop loss on the fractal above the entry candle.

Exit

- Close the trade as soon as the stochastic oscillator lines become oversold and crosses over.

Conclusion

This strategy works very well on a market that is trending. For best results, traders should observe the chart if the market is clearly trending and if the peaks and troughs of price action coincide with the crossovers on the Stochastic Oscillator.

The crossing over of the stochastic oscillator lines while oversold or overbought is a working strategy as it is. This strategy adds even more factors to filter trades that have lower probability. First, this trading strategy is aligned with the trend. Trading with the trend significantly increases the probability of having a profitable trade. Then it also adds the factor of having a hidden divergence which is a telltale sign of a trend reversal on the short-term after a retracement.

This trading strategy is a robust strategy which, if mastered, could produce consistent profits.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: