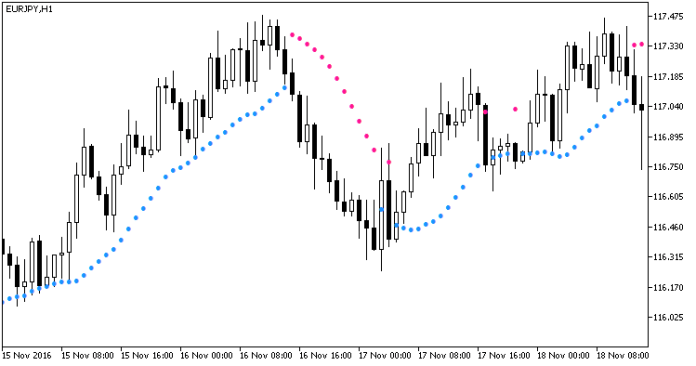

The SSL (Semaphore Signal Level) indicator for MT5 belongs to the category of trend-following indicators. It utilizes two moving averages (MAs) one applied to the price highs and another to the price lows – to create a dynamic channel around the price action. Imagine a visual envelope that adapts to price fluctuations, offering insights into potential trend direction.

Here’s a technical breakdown:

- Two Moving Averages: The SSL employs two simple moving averages (SMAs) with a user-defined period (e.g., 10 periods). One SMA tracks the highs, while the other tracks the lows.

- Dynamic Channel Formation: As prices fluctuate, the moving averages adjust, forming an upper and lower channel around the price. This channel reflects the recent price movement volatility.

The core principle behind the SSL lies in the price’s interaction with these dynamic bands. When the price action breaks above the upper channel (formed by the high SMA), it suggests a potential bullish trend. Conversely, a price break below the lower channel (formed by the low SMA) hints at a possible bearish trend.

Advanced SSL Techniques

Seasoned traders can explore these advanced techniques to enhance their SSL-based strategies:

- Multiple Timeframes: Analyze the SSL on different timeframes (e.g., daily, hourly) to gain a broader perspective on the trend’s strength and potential turning points.

- Customizing Moving Averages: Experiment with different moving average periods to find what suits your trading style and preferred timeframe. Longer periods smooth out price action for identifying longer-term trends, while shorter periods provide more frequent signals for scalping strategies.

- Combining with Other Indicators: Integrate the SSL with other technical indicators like MACD or RSI for additional confirmation on trend strength and potential reversals.

Limitations and Cautions

No indicator is foolproof, and the SSL is no exception. Here are some limitations to keep in mind:

- Lagging Indicator: Like most moving average-based indicators, the SSL is inherently lagging. It reacts to past price movements, and signals might appear after the trend has already begun.

- False Signals: During periods of consolidation or high volatility, the SSL can generate false breakouts above or below the channel, leading to losing trades.

- Over-reliance: Solely relying on the SSL can be detrimental. Always consider broader market sentiment and economic news that can significantly impact price movements.

How to Trade with the SSL MT5 Indicator

Having grasped the SSL’s essence, let’s explore how to translate it into actionable trading strategies:

Identifying Trends

- Bullish Trend: When the price decisively breaks above the upper channel (high SMA), and the channel itself has an upward slope, it signifies a potential buying opportunity. This suggests that the market sentiment leans bullish, and prices are likely to continue their ascent.

- Bearish Trend: Conversely, a price breach below the lower channel (low SMA) accompanied by a downward-sloping channel indicates a potential downtrend. This is a cue for considering sell positions, and anticipating further price declines.

Buy and Sell Entry

- Buy Entry: A conservative approach involves waiting for a price candlestick to close above the upper channel. This confirmation reduces the risk of false breakouts, where prices pierce the channel but quickly reverse direction.

- Sell Entry: Similarly, a prudent approach for short positions involves waiting for a price candlestick to close below the lower channel. This reinforces the downtrend signal and helps avoid premature selling.

Additional Considerations

- Volatility Filter: The SSL works best in trending markets. During periods of high volatility, the channel can become erratic, generating misleading signals. Consider using additional volatility filters (e.g., Average True Range (ATR)) to refine entry points.

- Confirmation with Price Action: While the SSL offers valuable trend insights, it’s crucial to confirm the signals with price action patterns like support and resistance breaks or candlestick reversal patterns.

- Risk Management: Always adhere to sound risk management practices. Employ stop-loss orders to limit potential losses and take-profit orders to secure gains when price targets are met.

Conclusion

The SSL MT5 indicator serves as a stepping stone on your path to becoming a well-rounded forex trader. Remember, success requires dedication, discipline, and a commitment to continuous learning. Embrace the challenges, learn from your experiences, and refine your approach with each trade. As you master technical analysis and develop a sound trading strategy, you’ll be well-equipped to navigate the complexities of the forex market with confidence.

Recommended MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

(Free MT5 Indicators Download)

Click here below to download: