Another type of strategy that traders should have in their arsenal is a momentum type of trading strategy. This is because momentum strategies are simple and effective. In fact, there are traders who hinge their trading careers around trading momentum strategies only, and they are quite successful with it.

Momentum strategies are based on the idea that strong price movements tend to shift the market’s perception of trend direction. People think in a crowd. In most cases, as soon as traders see a momentum shift, many traders tend to follow believing that the trend is indeed shifting. This becomes a self-fulfilling prophecy as traders who are trying to ride the “new” trend push price further in the direction of the momentum candle.

One analogy that I use for momentum is an animal stampede. Animal stampedes start when a small group within a large herd gets startled and starts running from a perceived threat. This alerts others within the herd and other animals would then start to run in the same direction as those who first perceived the threat, even though they have no idea what they are running from. Then, before you know it, an animal stampede has started. The same is true with trading. At first, a small group of the market would perceive price to be too high or too low. It could be either be based on fundamental news releases or just some big banks having large transactions. This strong price movement is then reflected in the price chart as a big solid candle. As this candle is formed, other retail traders would see it and believe that price is starting to move in a certain direction. They might have no idea why the market moved but they see it moving and so they trade in the same direction. Before you know it, momentum has picked up and price starts to rally. Logic would tell you that it is a very bad idea to be standing in front of a stampede. The same is true with trading. It is a very bad idea to be trading against a strong momentum.

Silver Trend Signal

The Silver Trend Signal indicator is a unique trend following indicator. It indicates trend changes based on a confluence of factors programmed within its algorithm. It then prints an arrow indicating the potential trend reversal point.

This indicator is considerably accurate compared to other indicators. It does produce some signals that do not result in trends but most of its signals could result in a profit. This indicator could do great if used in tandem with other indicators and some price action analysis.

SMI Indicator

SMI stands for Stochastic Momentum Index. The SMI is a momentum indicator based on the Stochastic Oscillator. In fact, the SMI is considered a refined version of the Stochastic Oscillator. It allows for broader price movements as compared to the Stochastic Oscillator.

The SMI is also intended to identify momentum reversals as opposed to the Stochastic Oscillator which is often used to identify reversals on overbought and oversold market conditions.

The SMI identifies momentum reversals in a couple of ways. First, it makes use of two stochastic lines which oscillate freely on its own window. These lines tend to crossover whenever there is a trend reversal. These crossovers could be used as entry signals. Another method is to use its midpoint as a signal. Traders could use the lines crossing over from positive to negative or vice versa as a trend reversal signal.

Trading Strategy

This trading strategy provides trade signals based on the confluence of the indicators above in conjunction with a momentum candle.

Momentum candles are often used by price action traders as an indication that price could be reversing or could be continuing strongly in a certain direction. This is because momentum candles indicate that price has moved quite considerably in a short period and most likely with big volume. Momentum candles could be seen in price charts as big long candles that have very little wicks at both ends. This will be one of our main considerations when using this strategy.

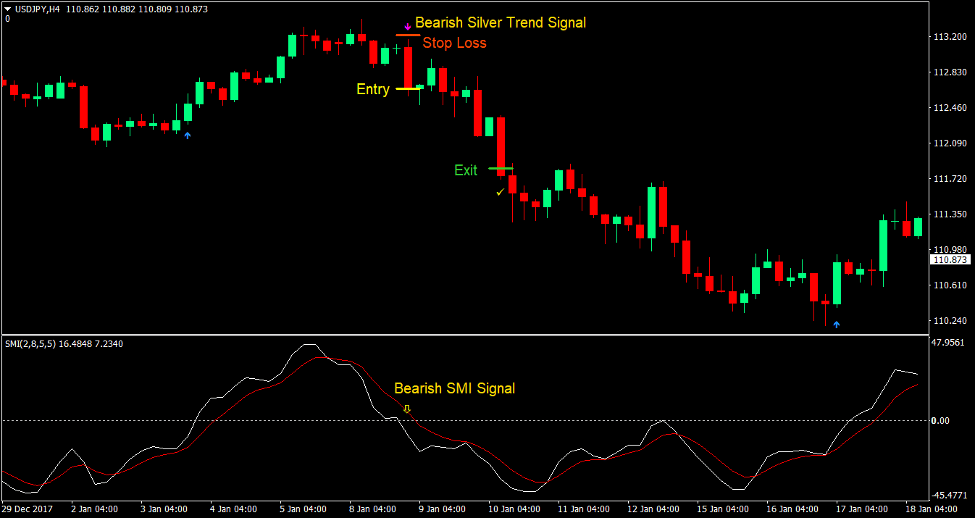

This strategy produces trade signals based on the confluence of the Silver Trend printing an entry signal, the SMI indicator crossing over from positive to negative or vice versa, and a momentum candle appearing at exactly the same time as the confluence of the indicators.

Indicators:

- SilverTrend_Signal_With_Alert_v3

- RISK: 8

- SMI (default settings)

Preferred Time Frames: 15-minute, 30-minute, 1-hour and 4-hour charts

Currency Pairs: major and minor pairs

Trading Session: Tokyo, London and New York

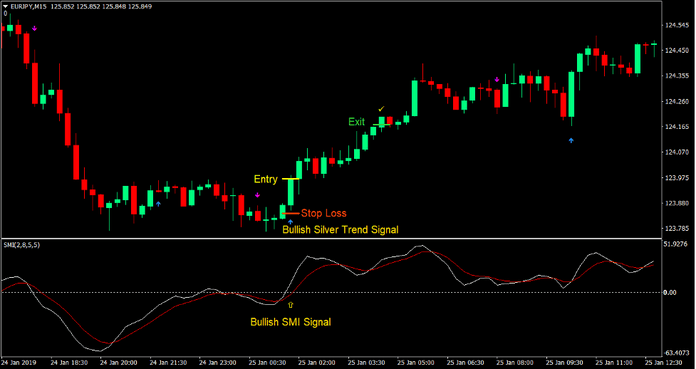

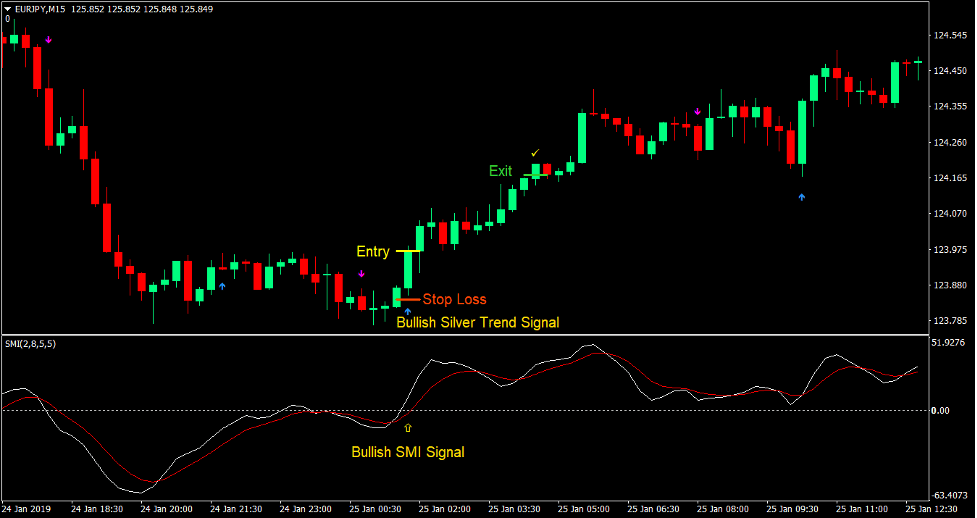

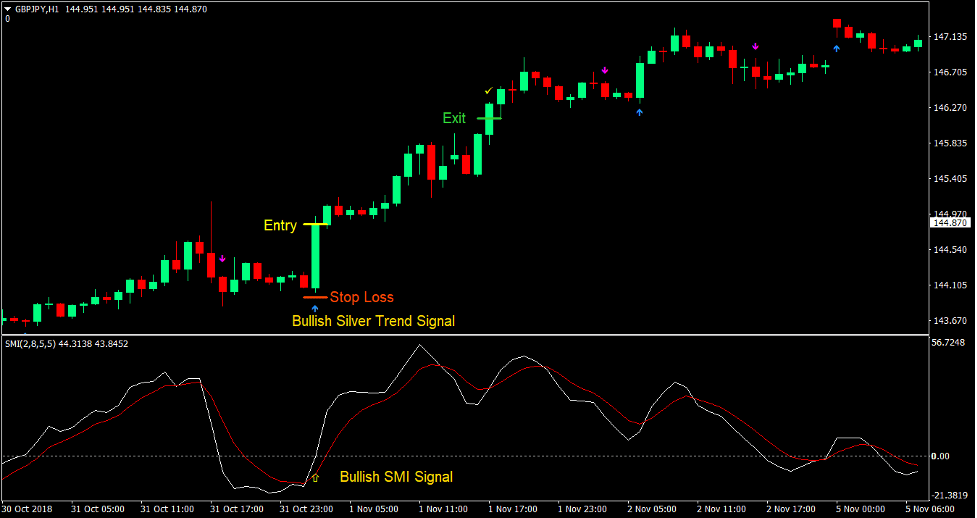

Buy Trade Setup

Entry

- The faster line of the SMI indicator should cross above zero indicating a bullish trend reversal

- The Silver Trend indicator should print an arrow pointing up indicating bullish trend entry signal

- A bullish momentum candle should appear

- These bullish signals should be closely aligned

- Enter a buy order on the confluence of the conditions above

Stop Loss

- Set the stop loss a few pips below the entry candle

Exit

- Set the take profit target at 1.5x the risk on the stop loss

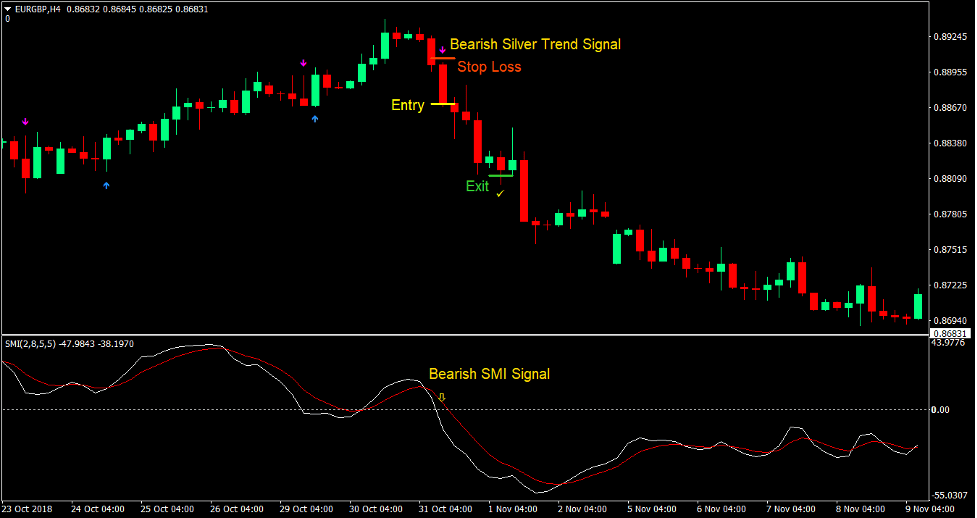

Sell Trade Setup

Entry

- The faster line of the SMI indicator should cross below zero indicating a bearish trend reversal

- The Silver Trend indicator should print an arrow pointing down indicating bearish trend entry signal

- A bearish momentum candle should appear

- These bearish signals should be closely aligned

- Enter a sell order on the confluence of the conditions above

Stop Loss

- Set the stop loss a few pips above the entry candle

Exit

- Set the take profit target at 1.5x the risk on the stop loss

Conclusion

This trading strategy which is based on momentum candles makes use of both price action technical analysis and technical indicators. This provides traders a robust trading strategy that produces high probability trade entries.

Silver Trend Momentum Forex Trading Strategy has a fixed reward-risk ration of 1.5:1. This type of strategy inherently produces a trading edge over the market. The key is to find high probability trade setups that would push price towards the take profit target price rather than the stop loss.

Lastly, it is best to use this strategy in a market that is not prone to whipsaws as some momentum candles may result in “railroad tracks” or “pipe top and bottom” patterns which is the exact opposite signal of what we would want to trade. These patterns typically occur on markets that tend to whipsaw or are very choppy.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: