Trend reversal strategies are a double-edged sword. This is because crossover strategies attempt to catch trades as a prior trend is ending and a new trend is developing. Anticipating when a trend would end is quite difficult. Many professional traders liken it to “catching a falling knife”.

However, even with its perceived degree of difficulty, many traders who have mastered the art of trading trend reversals make a lot of money. This is because a successful trend reversal setup allows traders to squeeze out the most out of a trend. It allows traders to enter the trade as the trend is starting and exit the trade as the trend ends.

Although it is difficult to anticipate a trend reversal, it is not impossible. One of the techniques that traders use when trading trend reversals is by looking for confirmations. There are many ways to confirm a possible trend reversal. One of the most popular way to confirm it is by looking for retest. This means that price action has already broken the previous trend and is retesting the broken support or resistance. Then, after the retest, price action should resume the direction of the new trend. This indicates that price is more likely to continue towards the direction of the new trend.

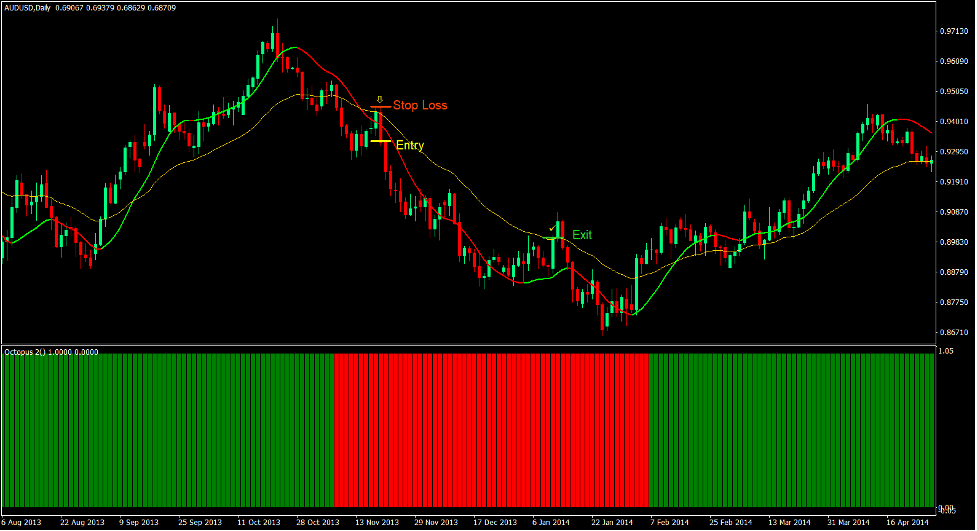

Pyramid Octopus Cross Forex Trading Strategy is a trend reversal strategy based on the crossover of modified moving averages. It also incorporates the retest of the moving averages as moving averages are considered as a dynamic support or resistance line.

OT S RA Signal Line

OT S RA Signal Line is a custom technical indicator based on a modified moving average.

This moving average line changes color depending on the direction of the trend. A lime colored moving average line indicates a bullish trend direction, while a red colored moving average line indicates a bearish trend direction. The changing of the color of the line could be used as an initial indication of a possible trend or momentum reversal.

The OT S RA Signal Line is also very customizable. Traders can choose the number of periods covered by the indicator, the type of moving average line used, and the source of the price data being used.

Octopus 2

Octopus 2 is a directional bias technical indicator. It helps traders objectively identify the directional bias of an underlying currency pair.

This indicator simply plots bars on a separate window. The bars it plots are either green or red. Green bars indicate a bullish directional bias, while red bars indicate a bearish directional bias.

The Octopus 2 indications are based on the shifting of price momentum. If price action causes the indicator to detect a bullish momentum, the indicator will start plotting green bars until it detects the opposite momentum shift. In which case, it will start to plot red bars until momentum reverses again.

Exponential Moving Average

The Exponential Moving Average (EMA) is a type of moving average which places more emphasis on the most recent price movements compared to prior price movements. It is a weighted moving average line which uses exponential averages to plot its line.

Most moving average lines tend to be very lagging. This often causes traders to respond to price movements a bit later than desired. EMA attempts to resolve this problem by making the moving average line more responsive. Placing more emphasis on the most recent price movements make the line more responsive to the most recent price movements. This allows traders to respond to price action more quickly.

Trading Strategy

This trading strategy is a trend reversal strategy based on the crossover of the OT S RA Signal line and a 28-period EMA line.

However, not all crossovers are considered as valid trade setups. Trade setups must also be in confluence with momentum shifts based on the Octopus 2 indicator. This means that the Octopus 2 indicator should also indicate a reversing momentum which coincides with the trend reversal indicated by the crossover of the OT S RA Signal line and the 28 EMA line.

Lastly, even when the above-mentioned conditions are met, traders must still wait for price action to retest the area near the moving average lines, reject the area, then continue the direction of the new trend. If price action confirms the new trend direction, then the trend reversal setup is considered valid.

Indicators:

- 28 EMA

- oT_S_Ra-Signal_Line

- Method: 2

- Octopus_2

Preferred Time Frames: 1-hour, 4-hour and daily charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

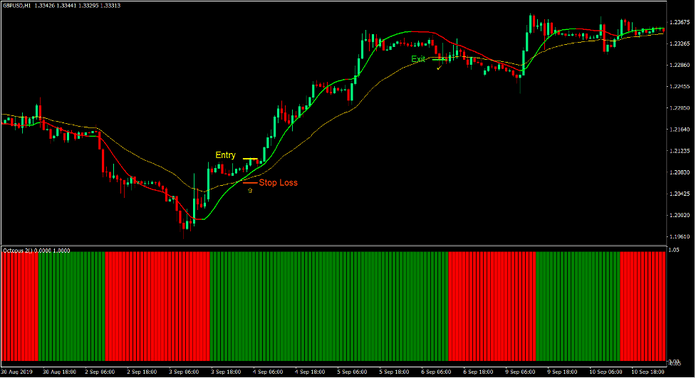

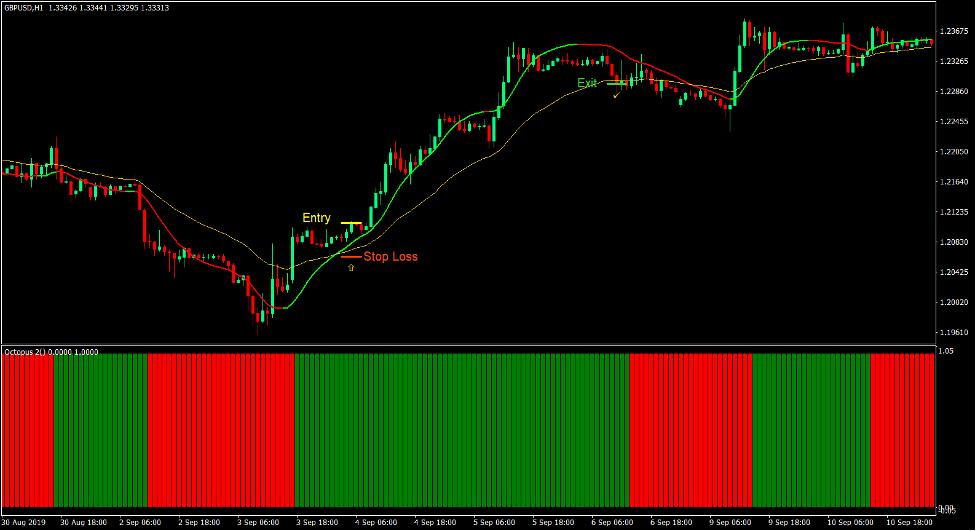

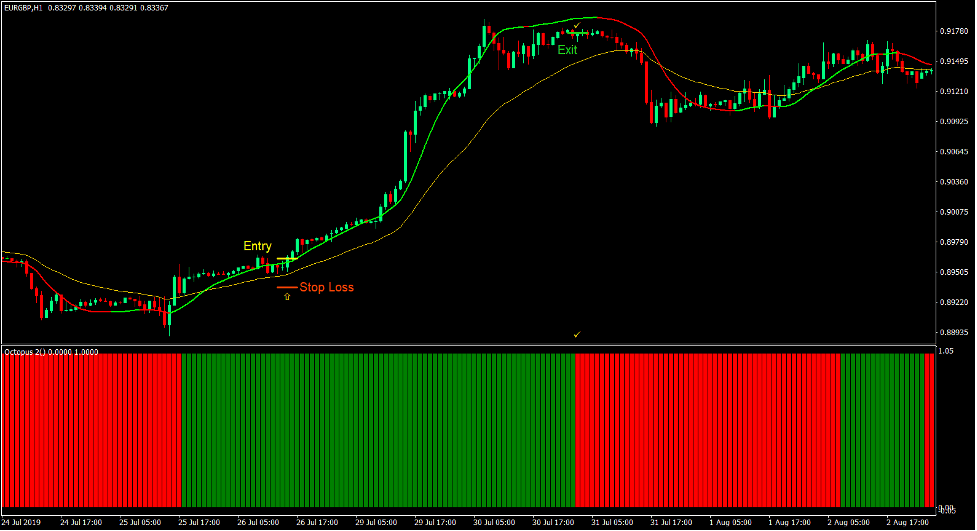

Buy Trade Setup

Entry

- The OT S RA Signal line should cross above the 28 EMA line.

- The Octopus 2 indicator should start printing green bars.

- Price action should retest the area near the moving average lines.

- Price action should reject the area near the moving average lines and continue the bullish direction.

- Enter a buy order on the confirmation of these conditions.

Stop Loss

- Set the stop loss below the moving average lines.

Exit

- Close the trade as soon as price closes below the 28 EMA line.

- Close the trade as soon as the Octopus 2 bars change to red.

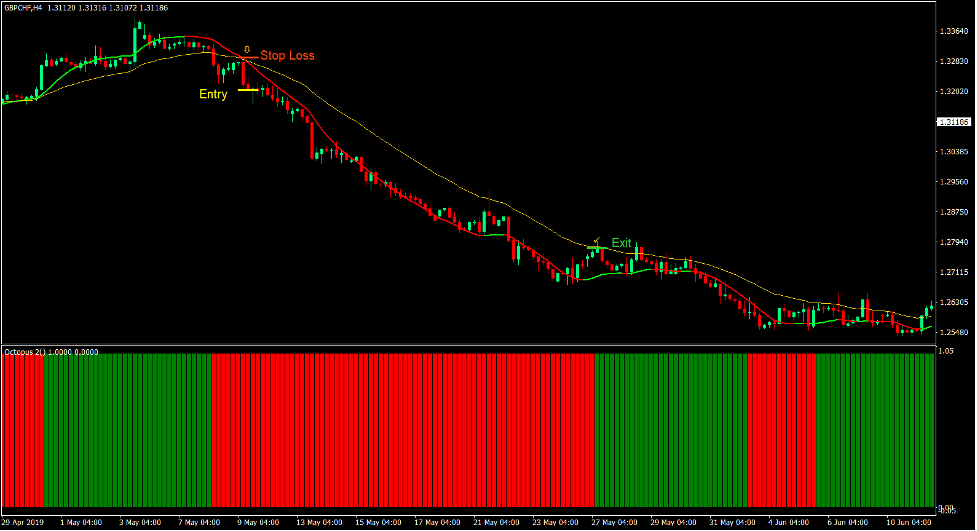

Sell Trade Setup

Entry

- The OT S RA Signal line should cross below the 28 EMA line.

- The Octopus 2 indicator should start printing red bars.

- Price action should retest the area near the moving average lines.

- Price action should reject the area near the moving average lines and continue the bearish direction.

- Enter a sell order on the confirmation of these conditions.

Stop Loss

- Set the stop loss above the moving average lines.

Exit

- Close the trade as soon as price closes above the 28 EMA line.

- Close the trade as soon as the Octopus 2 bars change to green.

Conclusion

This crossover strategy produces good trade setups which many profitable traders use.

Most traders would simply use the crossover of moving average lines as a basis for a trend reversal setup. However, unless the momentum is very strong, traders could often get caught in a whipsaw action specially if the market is very erratic or choppy.

Using the momentum confirmation of the Octopus 2 indicator and the confirmation of the retest of price action significantly increases the likelihood of the fresh trend continuing.

Traders just simply need to manage trades correctly as price moves in their favor.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: