If you would want to profit just like the pros, then it might be a good idea to use the techniques and tools that they use.

One of the techniques that professionals use is price action. Wherever you would go on the internet, you would often hear or read about it. Traders would rave about how learning this one skill revolutionized their trading. This hype does not come for no reason. Price action is very effective and in the right hands it could do wonders. It allows traders to anticipate what the market is about to do and where price might be moving next. This critical information could mean unlimited profits in the right hands.

Another tool that professionals use is the Pivot Points. Institutional traders trading for big banks and hedge funds use this tool. Because many large volume traders use this, the lines on the Pivot Points acting as a support or resistance often becomes a self-fulfilling prophecy. Big traders would often look for bounces off these lines and aim for the next line.

Institutional traders often do position trading. For this reason, they would usually prefer the Weekly Pivot Points over the Daily Pivot Points. However, as day traders, we might do well with the daily pivot.

Pivot Bounce Forex Day Trading Strategy is a strategy that trades on bounces off the daily pivot lines using candlestick patterns to anticipate such reversals.

Pro4x Pivot Lines

Pro4x Pivot Lines is a custom indicator that plots the daily pivots on the price chart.

The Daily Pivot Point (PP) is basically an average of the previous day’s trading. In this setup, the pivot point is plotted as a magenta horizontal line. The Resistance lines (R1, R2 and R3) are plotted above the Daily Pivot Point and are plotted as lime green lines. The Support lines (S1, S2 and S3) are plotted below the Daily Pivot Point and are plotted as red lines. This setup also plots M lines which are spaced in between the Daily Pivot Point, Support and Resistance lines.

These points on the price chart are critical areas. Price would often react to these points as price nears its area. Often, price would bounce off it and travel towards the other lines. At times, these lines could also serve as breakout points, where price could move away from as soon as price breaks beyond these lines.

Trading Strategy

This strategy trades on bounces off the pivot lines. If price is nearing a support line, then price might bounce up. If price is nearing the resistance line, then price could bounce down.

How would we know if price is reacting with the pivot lines? To trade this strategy properly, traders should learn to read candlestick patterns. Traders should look for indications of a reversal right after price touches the pivot lines. As soon as the reversal pattern is confirmed, then we could take the trade and set the take profit target price near the next pivot line or “m” line.

Since this strategy uses the daily pivot points, it is also best to use this strategy on the lower timeframes such as the 5-minute and 15-minute chart. Trades should also be taken as a day trade.

Indicators:

- Pro4x Pivot Lines (default setting)

Preferred Time Frames: 5-minute and 15-minute charts

Currency Pairs: major and minor pairs

Trading Sessions: Tokyo, London and New York sessions

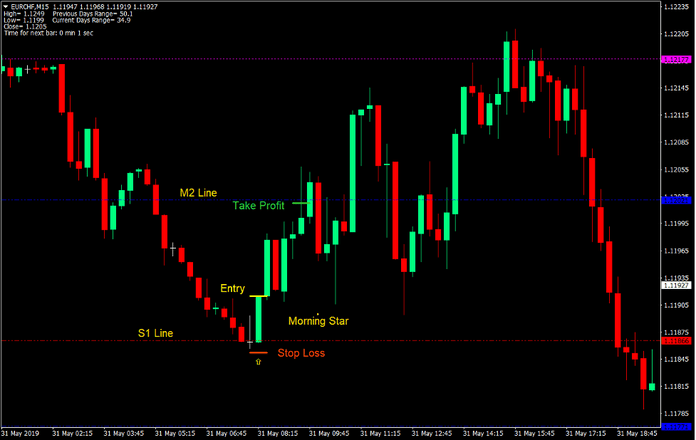

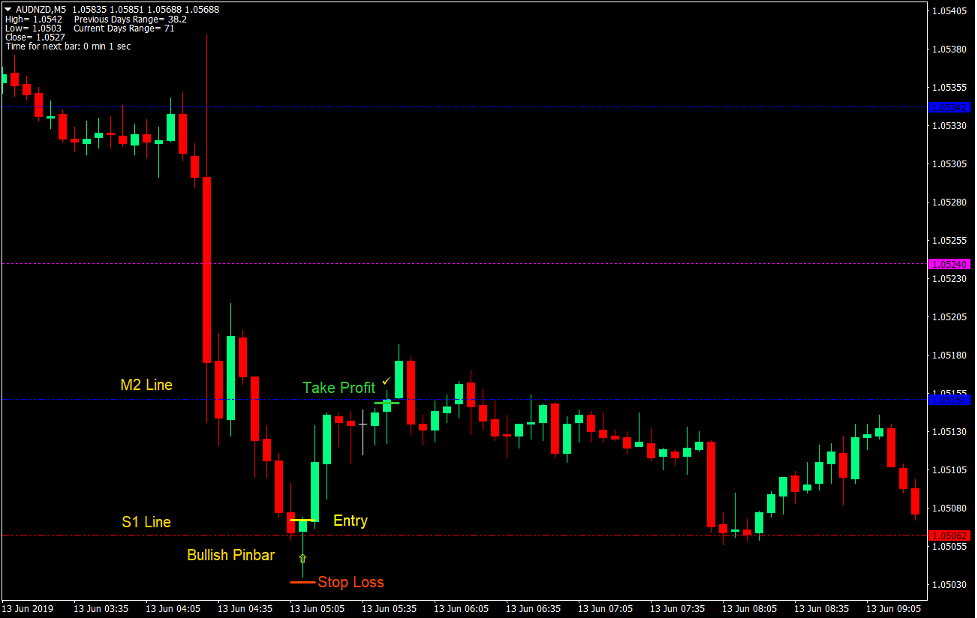

Buy Trade Setup

Entry

- Wait for price to touch a Support line (red).

- Wait for a bullish reversal candlestick pattern to form.

- Enter a buy order as soon as the bullish candlestick pattern is completed.

Stop Loss

- Set the stop loss on the fractal below the entry candle.

Exit

- Set the take profit target a few pips below the next “m” line.

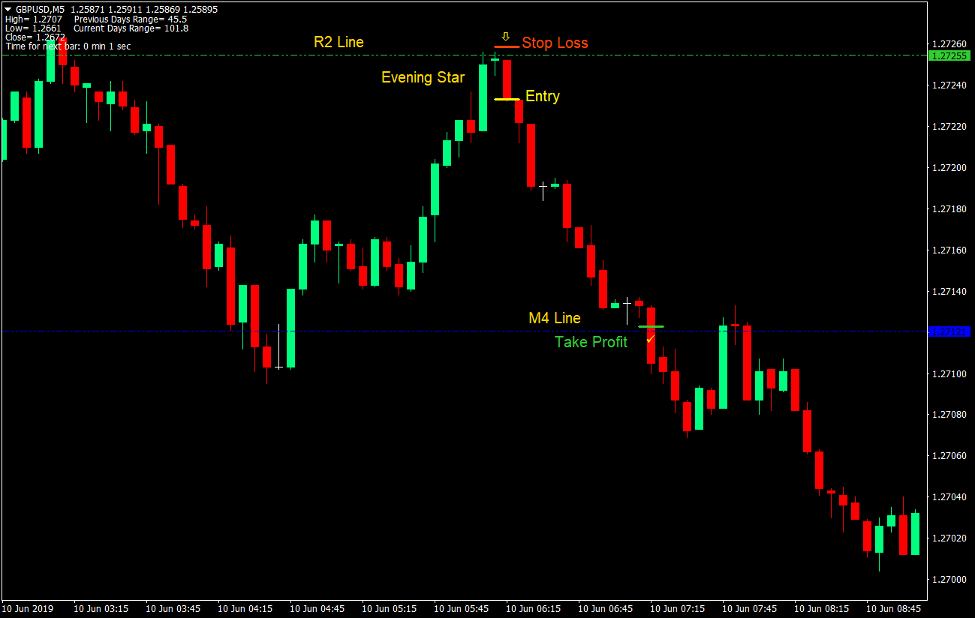

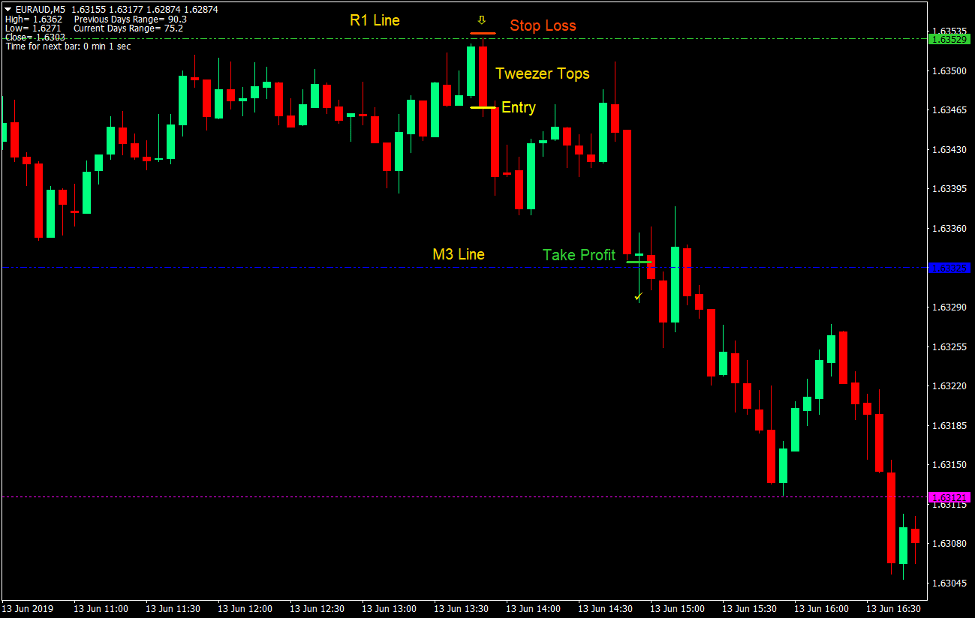

Sell Trade Setup

Entry

- Wait for price to touch a Resistance line (lime green).

- Wait for a bearish reversal candlestick pattern to form.

- Enter a sell order as soon as the bearish candlestick pattern is completed.

Stop Loss

- Set the stop loss on the fractal above the entry candle.

Exit

- Set the take profit target a few pips above the next “m” line.

Conclusion

This method of trading on horizontal support and resistance lines on the lower timeframe is an effective and profitable trading strategy. Some traders prefer to plot their own horizontal lines using the swing points of the most recent price moves.

This trading strategy simplifies the process by marking the daily pivot lines automatically. Daily pivot lines also tend to be more accurate compared to manual plotting of horizontal lines. Plotting your own horizontal lines tend to be subjective, while using the daily pivot is more objective, thus reducing errors.

Still, this strategy requires a lot of practice. Traders should develop the instinct of trading at the right time and in the right direction using price action and candlestick patterns. Traders who develop this skill have a very high potential of making profits from the Forex market.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: