Forex trading is not difficult, but it is not easy. The two phrases within this statement may sound contradicting, but both are true. Forex trading is really not difficult. It is just a matter of identifying patterns which does recur in the market and produces similar results more often than not when traded the same way. Traders need not trade a strategy that is perfect. All they have to do is find a strategy that has an edge.

What makes forex trading difficult is the psyche required as a trader. Forex trading would often cause psychological and emotional highs and lows. This often causes traders to be shaken out of their current strategy or trade plan. It is this discipline to stick to a plan even when a trader is experiencing a drawdown, and the discipline to not chase trades that are outside of a trader’s plan that makes things difficult.

Traders are humans. As humans we have emotional and psychological responses to elation and frustration. Traders who are able to master the discipline needed to be a trader can make a simple strategy with a positive statistical expectancy work. They would not need complex strategies because they do not succumb often to greed and fear.

Oracle Strength Play Forex Trading Strategy is a simple trading strategy that traders could use in a trending market condition. It is a momentum trading strategy based on the strength of a currency pair, which is also aligned with the market trend.

Oracle Move Indicator

The Oracle Move indicator, also known as the 100 Pips Momentum indicator, is a trend following indicator that is based on the short-term trend.

It makes use of a pair of modified moving averages to identify trend direction. These moving averages are characteristically very responsive to price movements yet are also very smooth. This gives traders a pair of moving averages that allows them to respond to market movements quickly, yet do not produce too much false signals coming from market noise.

The faster moving average line of the pair is colored blue, while the slower moving average line is colored red.

Trend directions are identified based on how the moving averages are stacked. If the blue line is above the red line, then the trend is bullish. If the moving average lines are stacked inversely, then the trend is bearish. Crossovers between the two lines indicate a possible trend reversal, which traders may take as an entry signal.

Relative Strength Index

The Relative Strength Index (RSI) is a technical indicator that measures the magnitude of recent price changes based on historical prices. It then normalizes these price movements that oscillate within the range of 0 to 100.

The RSI plots a line that oscillates within the said range. It also typically has markers at level 30, 50 and 70.

The level 50 is generally used to identify the general trend bias of the market. An RSI line that is above 50 indicates a bullish bias, while an RSI line that is below 50 indicates a bearish bias.

The levels 30 and 70 are used to identify oversold and overbought markets. An RSI line that drops below 30 indicates an oversold market, while an RSI line that breaches above 70 indicates an overbought market.

Inversely momentum traders take these signals oppositely. An RSI line that breaches above 70 could indicate a bullish momentum, while an RSI line that drops below 30 indicates a bearish momentum.

Many seasoned traders also add levels 45 and 55 to confirm trend and act as a support or resistance level. An RSI line that is usually above 50 and is supported by level 45 is in a bullish trend, while an RSI line that is below 50 and finds resistance at 55 is in a bearish trend.

Trading Strategy

This trading strategy trades on confluences of a trend reversal signal coming from the Oracle Move indicator and trend confirmation coming from the RSI indicator. At the same time, it also filters out trades that are not inline with the main trend direction.

To identify trend direction, we will be using the 50-period Exponential Moving Average (EMA). Trend direction will be based on the location of price action in relation to the 50 EMA line, as well as the slope of the 50 EMA line.

The trend is then further confirmed with the RSI line. This is based on whether the RSI line is generally staying on one side of the 50 level and finds support on level 45 or resistance on level 55.

As soon as the trend is confirmed, we could then wait for a trade signal in line with the trend.

Signals are based on the crossing over of the Oracle Move lines and the RSI line dropping below 45 or breaching above 55.

Trades are held until the RSI line reverses coming from an overbought or oversold level.

Indicators:

- 100pips Momentum

- 50 EMA

- Relative Strength Index

Preferred Time Frames: 30-minute, 1-hour and 4-hour charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

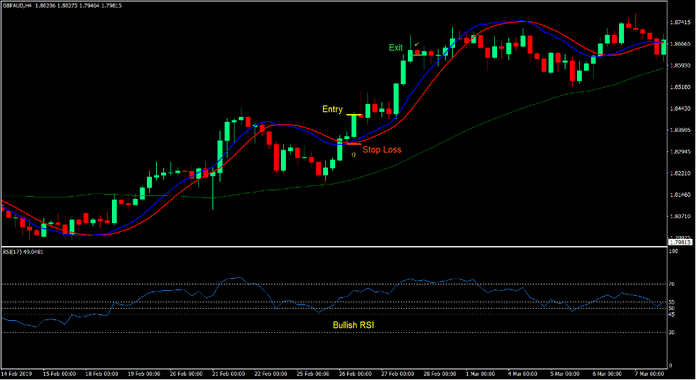

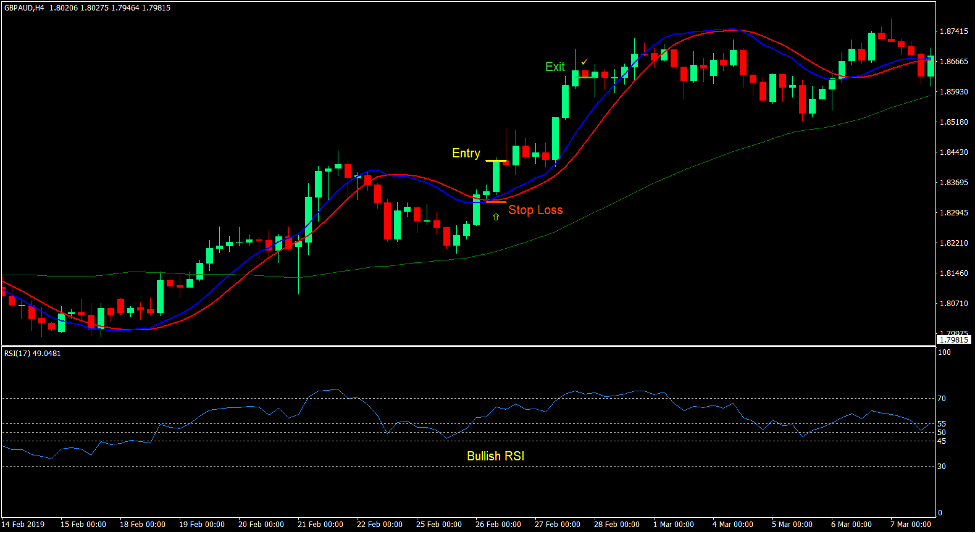

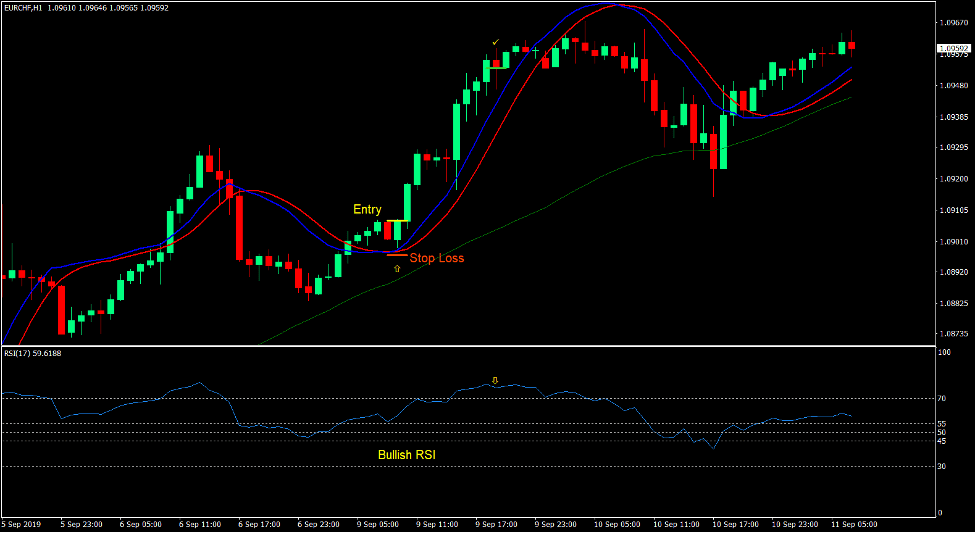

Buy Trade Setup

Entry

- Price action must be above the 50 EMA line.

- The 50 EMA line must be sloping up.

- The RSI line should generally be above 50 and should be supported by level 45.

- The blue line of the Oracle Move indicator should cross above the red line.

- The RSI line should be above 55.

- Enter a buy order upon confirmation of these conditions.

Stop Loss

- Set the stop loss below the Oracle Move lines.

Exit

- Close the trade as soon as the RSI line reverses above 70.

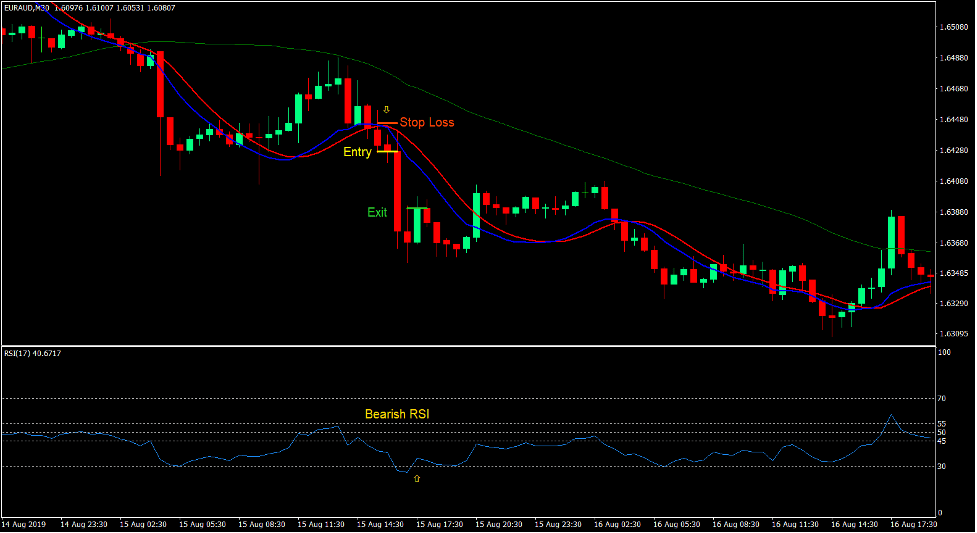

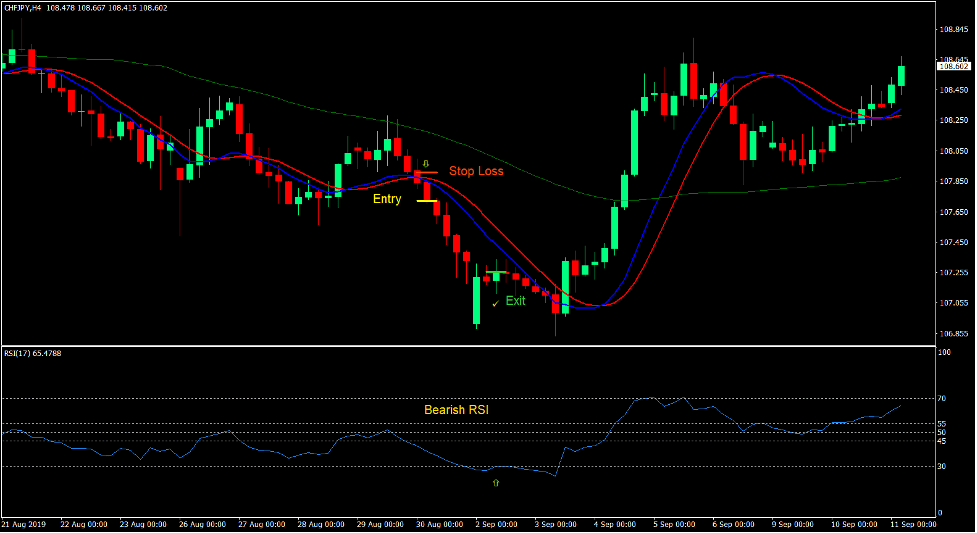

Sell Trade Setup

Entry

- Price action must be below the 50 EMA line.

- The 50 EMA line must be sloping down.

- The RSI line should generally be below 50 and should have resistance at level 55.

- The blue line of the Oracle Move indicator should cross below the red line.

- The RSI line should be below 45.

- Enter a sell order upon confirmation of these conditions.

Stop Loss

- Set the stop loss above the Oracle Move lines.

Exit

- Close the trade as soon as the RSI line reverses below 30.

Conclusion

This trading strategy is a trend following strategy which is based on the trend direction and confirmation of the RSI line and the Oracle Move indicator.

Each of these concepts do work on their own especially when paired with a price action setup. Combining these two indicator concepts together makes the strategy even more robust.

Traders who are able to trade this strategy in a trending market condition with the confirmation of price action and candlesticks formation could profit consistently from the forex markets.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: