Pasaran arah aliran sangat rumit. Dari satu segi, pasaran arah aliran seharusnya merupakan jenis pasaran paling mudah yang boleh didagangkan oleh peniaga. Ini kerana dalam pasaran trending, momentum biasanya menyebelahi anda. Harga cenderung bergerak dalam satu arah umum. Pedagang harus dengan mudah mengetahui arah mana pasaran kemungkinan besar bergerak. Ini memberi mereka jawapan kepada soalan yang hanya mempunyai dua pilihan, iaitu naik atau turun, beli atau jual.

Walau bagaimanapun, ramai peniaga masih gagal walaupun ketika berdagang semasa pasaran trending. Ia biasanya tidak bahawa mereka mendapat arah aliran yang salah kerana kebanyakan peniaga biasanya mendapat yang betul. Walau bagaimanapun, ramai peniaga gagal menjawab soalan kedua dengan betul, iaitu apabila mereka harus mengambil perdagangan. Perdagangan bukan sahaja soal membuat keputusan yang betul untuk membeli atau menjual, ia juga mengenai masa. Walaupun peniaga mendapat arah aliran yang betul, jika perdagangan telah diambil sama ada pada atau berhampiran penghujung aliran, maka perdagangan masih akan mengakibatkan kerugian.

Jadi, bilakah kita harus mengambil perdagangan? Walaupun tidak ada jawapan yang pasti untuk ini, tetapi jalan tengah yang baik akan berada pada titik di mana pasaran telah menjejaki semula, namun ia juga telah menunjukkan tanda-tanda meneruskan arah aliran. Bayangkan melihat carta dan melihat harga semakin meningkat. Anda akan tahu bahawa anda ingin membeli, tetapi anda juga harus menunggu diskaun.

Purata Pergerakan Heiken Ashi

Penunjuk HAMA, yang merupakan singkatan untuk Heiken Ashi Moving Average, ialah penunjuk arah aliran yang merupakan gabungan daripada Heiken Ashi Candlesticks dan purata bergerak.

Heiken Ashi Candlesticks ialah cara baharu carta di mana lilin harga diplot bukan berdasarkan harga buka dan tutup sebenar tetapi berdasarkan pergerakan puratanya. Tinggi dan rendah dikekalkan, membentuk sumbu lilin. Ini membolehkan peniaga mengenal pasti ayunan tinggi dan rendah ayunan dengan berkesan. Walau bagaimanapun, buka dan tutup setiap lilin adalah berdasarkan pergerakan purata harga. Ini mencipta batang lilin yang bertukar warna hanya apabila momentum harga telah beralih.

Purata Pergerakan Heiken Ashi, lebih dikenali sebagai Heiken Ashi Smoothed, ialah variasi Heiken Ashi Candlesticks, yang lebih berkait rapat dengan Purata Pergerakan Eksponen. Ia tidak menyerupai tindakan harga, sebaliknya ia bergerak seperti purata bergerak. Ia juga memplot bar dengan sumbu. Walau bagaimanapun, palang dan sumbu ini tidak mewakili tindakan harga. Bar ini membayangi tindakan harga hampir sama seperti purata bergerak yang baik.

Ia juga bertukar warna hanya apabila arah aliran telah jelas terbalik. Bar biru menunjukkan arah aliran menaik, manakala bar merah menunjukkan arah aliran menurun.

HAMA ialah penunjuk arah aliran yang sangat boleh dipercayai. Ia menunjukkan arah aliran dengan pasti dan cenderung untuk menghasilkan isyarat pembalikan arah aliran yang baik berdasarkan perubahan warna barnya.

Trend ASC

Penunjuk Trend ASC ialah penunjuk momentum tersuai yang lebih kepada penunjuk isyarat pembalikan arah aliran jangka pendek.

Penunjuk Aliran ASC dengan mudah memplot anak panah yang menunjukkan arah pembalikan arah aliran.

Pedagang boleh menggunakan penunjuk ini sebagai pencetus kemasukan pembalikan arah aliran. Pedagang boleh mengesahkan persediaan perdagangan dan memasuki perdagangan berdasarkan anak panah yang diplot oleh penunjuk Arah Aliran ASC, sambil berada dalam pertemuan dengan penunjuk arah aliran jangka panjang yang lain.

Strategi Trading

Heiken Ashi Moving Average ASC Trend Forex Trading Strategy ialah strategi mengikuti aliran mudah yang menggunakan kebolehpercayaan penunjuk HAMA dalam mengenal pasti arah aliran, serta ketepatan penunjuk Trend ASC dalam mengenal pasti isyarat kemasukan berasaskan momentum.

Dalam strategi ini, arah aliran adalah berdasarkan warna bar HAMA, serta hubungannya dengan garis Purata Pergerakan Eksponen (EMA) 50 tempoh. Trend dikenal pasti berdasarkan lokasi bar HAMA berhubung dengan garisan 50 EMA.

Kemudian, sebaik sahaja kami mengenal pasti arah aliran, kami menunggu harga untuk menjejak semula ke arah bar HAMA. Isyarat masuk kemudiannya dikenal pasti berdasarkan anak panah yang diplot oleh penunjuk Trend ASC.

Petunjuk:

- ASCTrend1i

- HAMA_

- 50 EMA

Rangka Masa Pilihan: Carta 15 minit, 30 minit, 1 jam dan 4 jam

Pasangan Mata Wang: Jurusan FX, bawah umur dan salib

Sesi Dagangan: sesi Tokyo, London dan New York

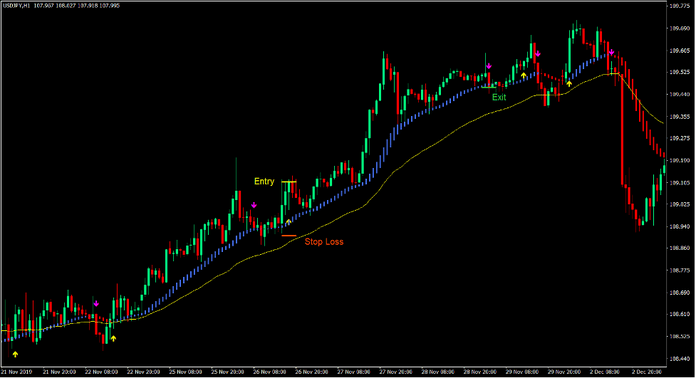

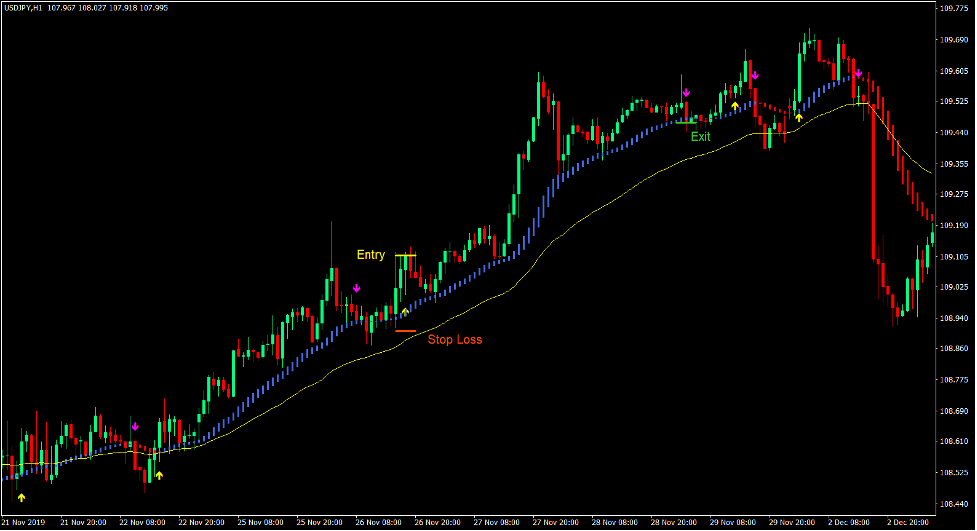

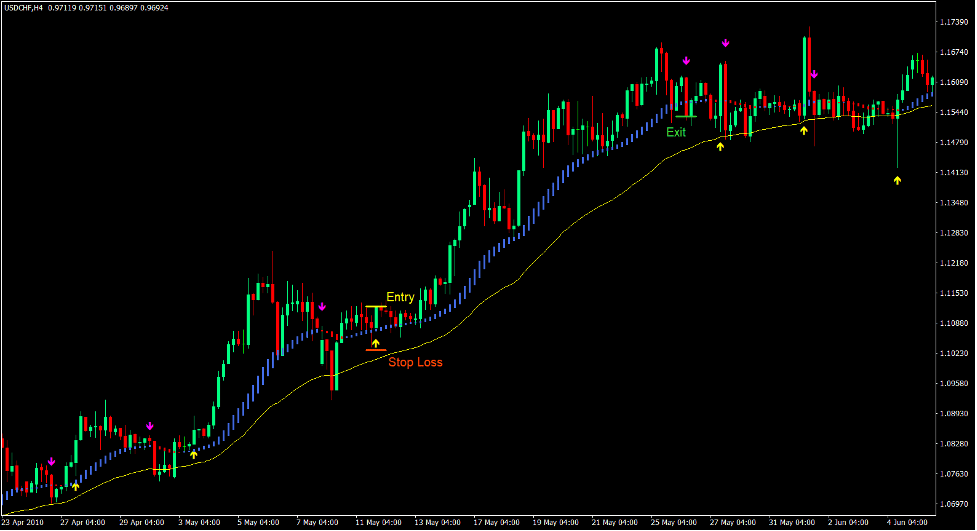

Beli Persediaan Perdagangan

Kemasukan

- Bar HAMA hendaklah berada di atas garisan 50 EMA.

- Bar HAMA mestilah berwarna biru.

- Harga harus menjejak semula ke arah bar HAMA.

- Penunjuk Arah Aliran ASC harus melukis anak panah menghala ke atas.

- Masukkan pesanan beli pada pengesahan syarat ini.

Stop Loss

- Tetapkan stop loss pada sokongan di bawah lilin masuk.

Keluar

- Tutup dagangan sebaik sahaja penunjuk Trend ASC memplot anak panah menunjuk ke bawah.

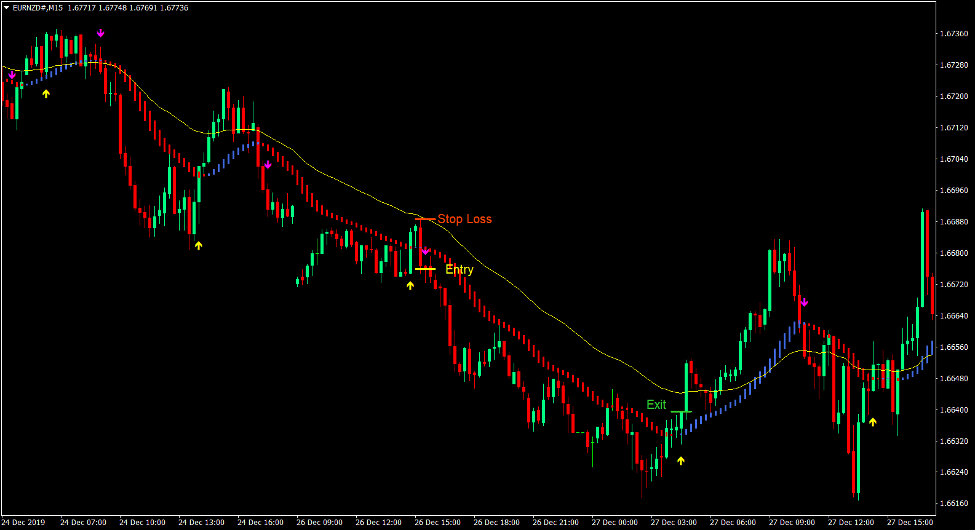

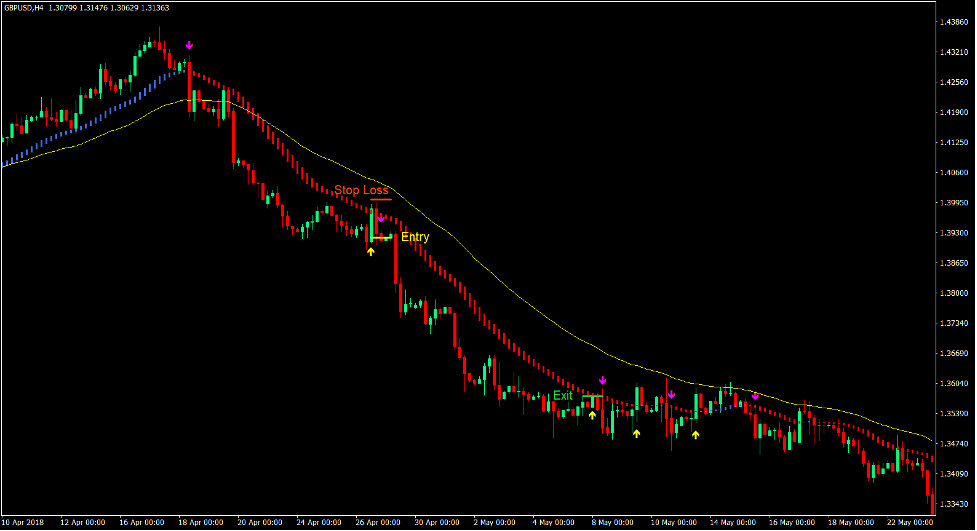

Jual Persediaan Perdagangan

Kemasukan

- Bar HAMA hendaklah berada di bawah garisan 50 EMA.

- Bar HAMA sepatutnya berwarna merah.

- Harga harus menjejak semula ke arah bar HAMA.

- Penunjuk Arah Aliran ASC harus melukis anak panah yang menunjuk ke bawah.

- Masukkan pesanan jual pada pengesahan syarat ini.

Stop Loss

- Tetapkan stop loss pada rintangan di atas lilin masuk.

Keluar

- Tutup dagangan sebaik sahaja penunjuk Trend ASC memplot anak panah menghala ke atas.

Kesimpulan

Strategi dagangan ini adalah strategi berikutan aliran yang sangat baik yang boleh menghasilkan hasil dengan nisbah risiko-ganjaran yang agak tinggi.

Bar HAMA cenderung untuk kekal dengan aliran dan biasanya tidak akan terjejas oleh kenaikan harga yang salah. Ini membolehkan pedagang untuk berdagang dengan lebih lama sehingga tamat trend. Sifat terbuka bagi persediaan perdagangan yang dihasilkan oleh strategi ini membolehkan pedagang memperoleh lebih banyak apabila arah aliran bertahan lebih lama.

Broker MT4 yang disyorkan

Broker XM

- Percuma $ 50 Untuk Mula Berdagang Dengan Segera! (Keuntungan yang boleh dikeluarkan)

- Bonus Deposit sehingga $5,000

- Program Kesetiaan Tanpa Had

- Broker Forex Pemenang Anugerah

- Bonus Eksklusif Tambahan Sepanjang tahun

>> Daftar untuk Akaun Broker XM di sini <

Broker FBS

- Berdagang 100 Bonus: Percuma $100 untuk memulakan perjalanan dagangan anda!

- 100% Bonus Deposit: Gandakan deposit anda sehingga $10,000 dan berdagang dengan modal yang dipertingkatkan.

- Leverage hingga 1: 3000: Memaksimumkan potensi keuntungan dengan salah satu pilihan leveraj tertinggi yang ada.

- Anugerah 'Broker Perkhidmatan Pelanggan Terbaik Asia': Kecemerlangan yang diiktiraf dalam sokongan dan perkhidmatan pelanggan.

- Promosi bermusim: Nikmati pelbagai bonus eksklusif dan tawaran promosi sepanjang tahun.

>> Daftar untuk Akaun Broker FBS di sini <

Klik di sini di bawah untuk memuat turun: