Berdagang dengan arah aliran adalah salah satu prasyarat paling asas untuk strategi perdagangan berkemungkinan tinggi. Walaupun terdapat jenis strategi perdagangan lain yang cenderung menghasilkan persediaan perdagangan kebarangkalian tinggi selain daripada strategi mengikut arah aliran, strategi mengikut arah aliran cenderung menghasilkan persediaan perdagangan kebarangkalian yang sangat tinggi. Ini kerana berdagang dengan arah aliran membayangkan bahawa pedagang berdagang ke arah momentum jangka panjang pasaran. Berdagang ke arah arah aliran meningkatkan kebarangkalian strategi dagangan dengan ketara. Satu-satunya pembolehubah yang tinggal untuk dijawab ialah bila atau di mana untuk mengambil perdagangan.

Walau bagaimanapun, ramai peniaga yang mengikuti trend juga salah mengenal pasti arah aliran. Ini kadangkala kerana sesetengah peniaga hanya menumpukan pada satu aspek arah aliran. Sama ada mereka melihat trend jangka pendek atau trend jangka panjang sahaja.

Satu amalan yang baik ialah mengenal pasti arah aliran jangka panjang dan juga arah aliran jangka pendek terlebih dahulu. Apabila kedua-dua arah aliran ini dijajarkan, menunjuk arah yang sama, arah aliran umum menjadi lebih jelas.

Dalam strategi ini, kita akan melihat bagaimana penunjuk Ichimoku Kinko Hyo boleh digunakan untuk mengenal pasti arah aliran jangka pendek dan jangka panjang.

Ichimoku Kinko Hyo

Penunjuk Ichimoku Kinko Hyo ialah penunjuk teknikal yang unik kerana ia adalah salah satu daripada beberapa trend yang mengikuti penunjuk teknikal yang boleh memberikan pedagang gambaran lengkap tentang apa yang pasaran lakukan. Ia menunjukkan arah aliran berdasarkan siri garisan yang berdasarkan pelbagai median julat harga dalam tempoh tertentu.

Penunjuk Ichimoku Kinko Hyo memplot lima baris.

Tenkan-sen atau garis penukaran, diplot sebagai garis merah, ialah median harga dalam sembilan tempoh yang lalu. Ia mewakili arah aliran jangka pendek.

Kijun-sen atau garis asas, diplot sebagai garis biru, ialah median harga dalam 26 tempoh yang lalu. Ia mewakili arah aliran jangka pertengahan. Bersama-sama dengan garis Tenkan-sen, Kijun-sen boleh digunakan sebagai garis isyarat atau sebagai kawasan dinamik sokongan atau rintangan.

Senkou Span A atau rentang hadapan A, diplot sebagai garis coklat berpasir bertitik, ialah purata Tenkan-sen dan Kijun-sen diplot 26 tempoh di hadapan.

Senkou Span B atau rentang pendahuluan B, diplot sebagai garis thistle bertitik, dikira sebagai median harga dalam 52 tempoh terakhir yang diplotkan 26 tempoh ke hadapan.

Senkou Span A dan Senkou Span B membentuk Kumo atau awan, yang mewakili arah aliran jangka panjang.

Chikou Span atau lagging span ialah harga penutupan tempoh semasa yang diplotkan 26 tempoh kembali. Baris ini boleh digunakan untuk mengenal pasti tindakan harga yang tidak stabil.

Penunjuk Fisher

Penunjuk Fisher ialah penunjuk teknikal tersuai yang menukar data pergerakan harga kepada taburan normal Gaussian. Ini membolehkan peniaga mengenal pasti keterlaluan harga dan secara proaktif mengenal pasti pembalikan arah aliran yang datang daripada keterlaluan harga tersebut. Pedagang boleh dengan lebih mudah mengenal pasti titik pembalikan dalam carta harga apabila digunakan sebagai alat dagangan teknikal.

Penunjuk ini ialah jenis penunjuk pengayun yang memplot bar histogram di sekeliling mediannya, sifar. Bar limau positif menunjukkan momentum kenaikan harga, manakala bar merah negatif menunjukkan momentum menurun.

Penunjuk ini boleh digunakan sebagai isyarat masuk berbalik berdasarkan peralihan bar dengan syarat ia bertembung dengan penunjuk teknikal lain yang juga mengenal pasti arah aliran.

Strategi Trading

Fisher Ichimoku Trend Forex Trading Strategy ialah strategi mengikut arah aliran yang bergantung pada konsep dagangan ke arah arah aliran, yang menjajarkan kedua-dua arah aliran jangka panjang dan arah aliran jangka pendek.

Aliran jangka panjang dan jangka pendek dikenal pasti menggunakan penunjuk Ichimoku Kinko Hyo. Dalam persediaan ini, kami tidak akan menggunakan Chikou Span. Aliran jangka panjang dikenal pasti berdasarkan cara garisan Kumo disusun. Sebaliknya, arah aliran jangka pendek dikenal pasti berdasarkan bagaimana garis Tenkan-sen dan Kijun-sen disusun.

Kawasan berhampiran garisan Tenkan-sen dan Kijun-sen juga bertindak sebagai kawasan dinamik sokongan atau rintangan di mana harga boleh melantun.

Sebaik sahaja kedua-dua arah aliran jangka panjang dan jangka pendek bersetuju, kita boleh mula menunggu tindakan harga untuk menjejak semula ke arah kawasan berhampiran garisan Tenkan-sen dan Kijun-sen. Tindakan harga sepatutnya menunjukkan tanda-tanda penolakan harga dari kawasan tersebut. Lantunan kemudiannya disahkan berdasarkan bar penunjuk Fisher yang beralih daripada positif kepada negatif atau sebaliknya.

Petunjuk:

- Ichimoku Kinko Hyo

- Warna Span Chikou: Tiada

- Fisher

Rangka Masa Pilihan: Carta 15 minit, 30 minit, 1 jam dan 4 jam

Pasangan Mata Wang: Jurusan FX, bawah umur dan salib

Sesi Dagangan: sesi Tokyo, London dan New York

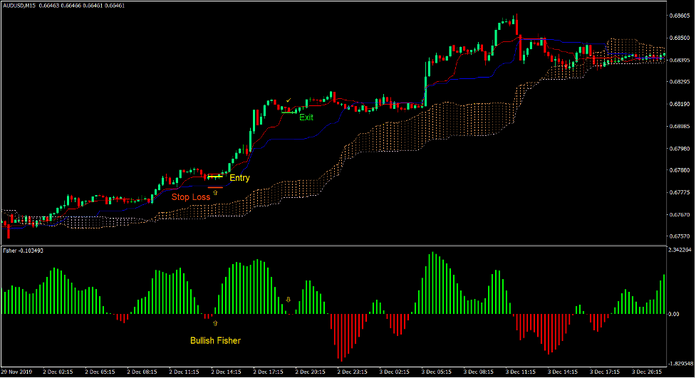

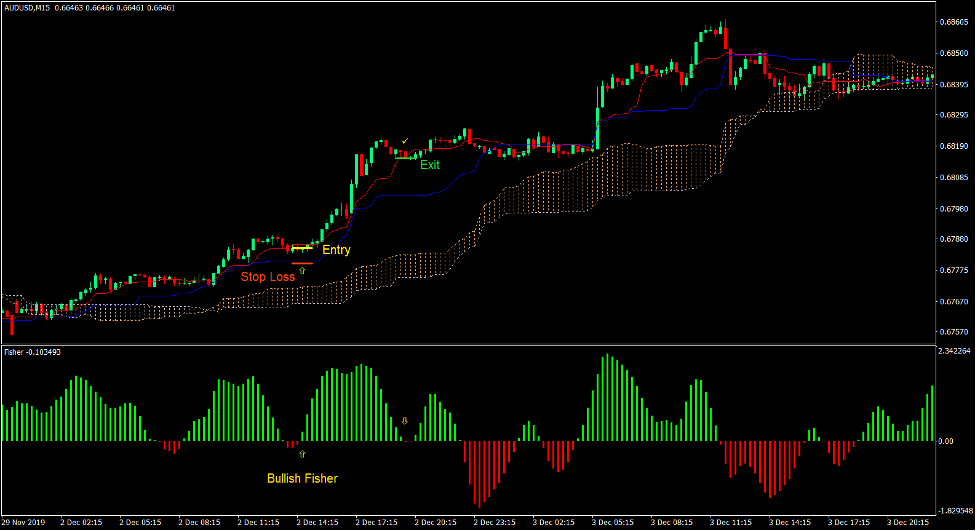

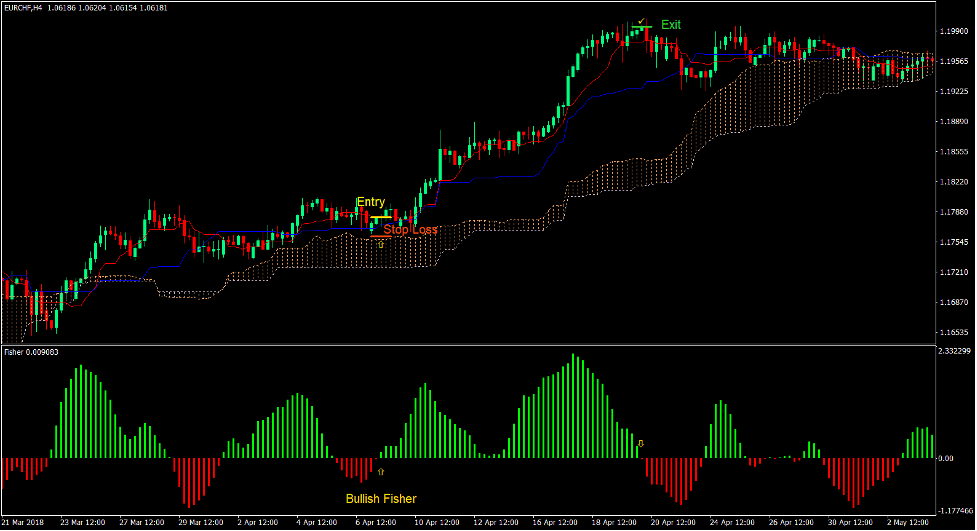

Beli Persediaan Perdagangan

Kemasukan

- Senkou Span A sepatutnya berada di atas Senkou Span B.

- Garisan Tenkan-sen sepatutnya berada di atas garisan Kijun-sen.

- Harga sepatutnya menjejak semula ke arah kawasan berhampiran laluan Tenkan-sen dan Kijun-sen.

- Masukkan pesanan beli sebaik sahaja bar Fisher beralih kepada positif.

Stop Loss

- Tetapkan stop loss pada sokongan di bawah lilin masuk.

- Tetapkan stop loss di bawah garisan Kijun-sen.

Keluar

- Tutup dagangan sebaik sahaja bar Fisher beralih kepada negatif.

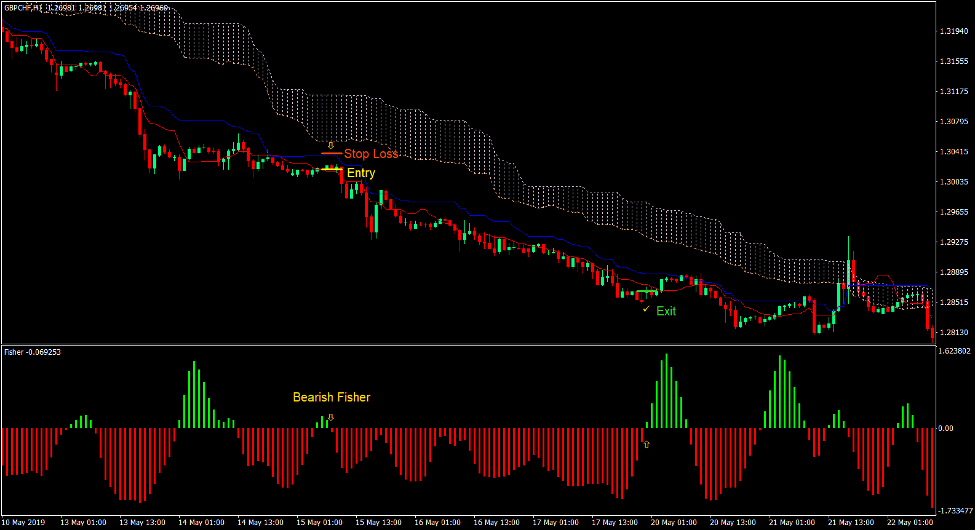

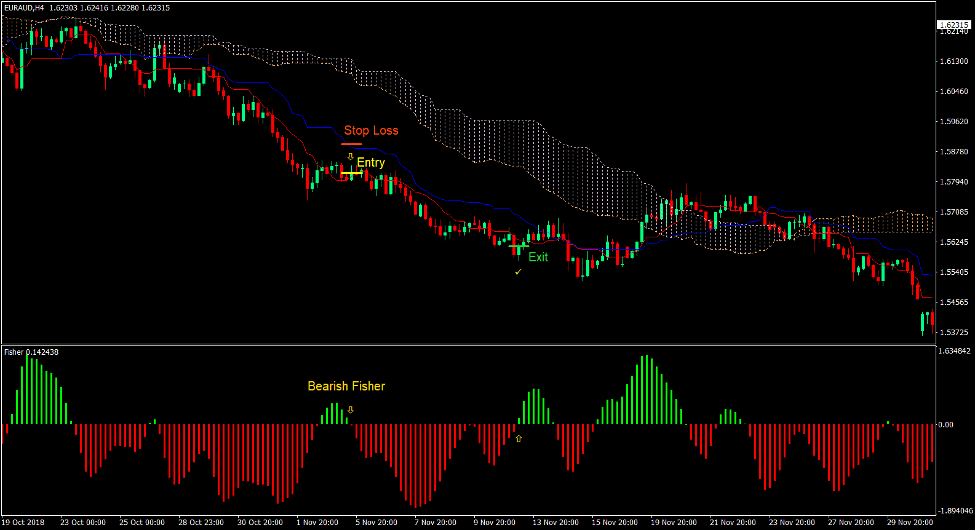

Jual Persediaan Perdagangan

Kemasukan

- Senkou Span A sepatutnya berada di bawah Senkou Span B.

- Garisan Tenkan-sen sepatutnya berada di bawah garisan Kijun-sen.

- Harga sepatutnya menjejak semula ke arah kawasan berhampiran laluan Tenkan-sen dan Kijun-sen.

- Masukkan pesanan jual sebaik sahaja bar Fisher beralih kepada negatif.

Stop Loss

- Tetapkan stop loss pada rintangan di atas lilin masuk.

- Tetapkan henti rugi di atas garisan Kijun-sen.

Keluar

- Tutup dagangan sebaik sahaja bar Fisher beralih kepada positif.

Kesimpulan

Strategi dagangan ini ialah strategi berikutan aliran asas yang menggunakan sistem penunjuk Ichimoku Kinko Hyo.

Ini adalah salah satu cara untuk berdagang sistem Ichimoku Kinko Hyo. Cara lain adalah dengan menggunakan silang antara garisan Tenkan-sen dan Kijun-sen. Walau bagaimanapun, isyarat ini tidak selalu berlaku apabila arah aliran adalah kuat. Daripada menunggu crossover, pedagang boleh menggunakannya sebagai kawasan sokongan atau rintangan dinamik dan menggunakan penunjuk lain sebagai isyarat masuk. Dalam kes ini, kami menggunakan penunjuk Fisher yang berfungsi dengan baik dengan penunjuk Ichimoku Kinko Hyo.

Broker MT4 yang disyorkan

Broker XM

- Percuma $ 50 Untuk Mula Berdagang Dengan Segera! (Keuntungan yang boleh dikeluarkan)

- Bonus Deposit sehingga $5,000

- Program Kesetiaan Tanpa Had

- Broker Forex Pemenang Anugerah

- Bonus Eksklusif Tambahan Sepanjang tahun

>> Daftar untuk Akaun Broker XM di sini <

Broker FBS

- Berdagang 100 Bonus: Percuma $100 untuk memulakan perjalanan dagangan anda!

- 100% Bonus Deposit: Gandakan deposit anda sehingga $10,000 dan berdagang dengan modal yang dipertingkatkan.

- Leverage hingga 1: 3000: Memaksimumkan potensi keuntungan dengan salah satu pilihan leveraj tertinggi yang ada.

- Anugerah 'Broker Perkhidmatan Pelanggan Terbaik Asia': Kecemerlangan yang diiktiraf dalam sokongan dan perkhidmatan pelanggan.

- Promosi bermusim: Nikmati pelbagai bonus eksklusif dan tawaran promosi sepanjang tahun.

>> Daftar untuk Akaun Broker FBS di sini <

Klik di sini di bawah untuk memuat turun: