Most traders have an even or slightly lower expectation of being accurate. Many traders even have a win rate ratio that is below 1:1. However, there are also traders who seem to make no mistake. These traders could easily pinpoint where they would want price to retrace and predict with certainty where or when price has reversed. These traders are those who are in the “flow”. Trading seems automatic for them and it seems that they do not need to think much in order to gain much from the market.

How are these traders able to accomplish having this level of accuracy? How are these traders able to trade with the flow of the market as if it was just like breathing?

It is because these traders have the clarity to see what the market is doing. They could easily identify trends, reversals, zones or whatnot.

Different traders have different sources of clarity. Many traders use price action, support and resistances or trading patterns. Others use technical indicators such as moving averages or oscillators. It does not matter what a trader uses as long as it gives traders clarity, as long as it allows them to see what the market is doing.

Mega Trend Momentum Forex Trading Strategy is a strategy that provides clear visual indications of where the market is going. With one glance of a trending market, traders would easily identify which direction the market is going, where the market has reversed, and what are the signals that price was about to reverse.

Mega Trend Indicator

Mega Trend indicator is a custom indicator that helps traders identify the trend direction. It is a trend following indicator based on a modified moving average.

The Mega Trend indicator plots a moving average line on the price chart, which moves smoothly along with price. It is less susceptible to price spikes and clearly shows the direction of the trend or the bias of the market based on the slope of its moving average line.

It also indicates the direction of the trend based on the color of its moving average line. If it detects a market that is trending up, then it would paint the moving average line blue. If it detects a market that is trending down, then it would paint its moving average line red.

The Mega Trend indicator could be used either as a confirmation or filter for trend direction or as a trend reversal entry signal.

As a trend direction bias filter or confirmation, traders could simply filter out trades that are going against the flow of the trend based on the indication of the Mega Trend indicator and take trade signals that are moving with the trend. This implies that there is another entry signal that is being used in conjunction with the Mega Trend indicator.

As a trend reversal entry signal, traders could use the changing of the color of the moving average line as an indication of a probable trend reversal.

Heiken Ashi Candlesticks

Heiken Ashi Candlesticks is a technical indicator which identifies the direction of the short-term trend. It is plotted much like a Japanese candlestick. However it has some differences that make it more useful in identifying short-term momentum or trend.

Heiken Ashi basically means “average bars” in Japanese. This is because Heiken Ashi candlesticks are plotted based on the average of the high, low and close of the candle. It then paints the color of the bar based on how it perceives the direction of the trend.

In this setup, bullish bars are painted spring green, while bearish bars are painted red.

Trading Strategy

This trading strategy is a trend following strategy based on strong momentum. It makes use of the Heiken Ashi Candlesticks and the Mega Trend indicator to identify probable trade setups that traders could take.

The Mega Trend indicator will be used as a trend filter. Traders will identify a trending market based on a Mega Trend indicator with a steep slope. The steeper the slope, the strong the momentum of the trend. It would also be good to identify trend based on price action by looking at the swing highs and swing lows of price.

As soon as we identify a currency pair that is trending strongly, we then wait for price to retrace or contract. This will cause the Heiken Ashi Candlesticks’ color to temporarily reverse. Then, as soon as the color of the Heiken Ashi Candlesticks resume the direction of the main trend, we could then place a stop entry order on the high or low of the candle. Momentum is confirmed if the next candle would hit the stop entry order. Price should move in the direction of the trend.

Indicators:

- Heiken Ashi

- Mega trend

Preferred Time Frames: 5-minute, 15-minute, 30-minute and 1-hour charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

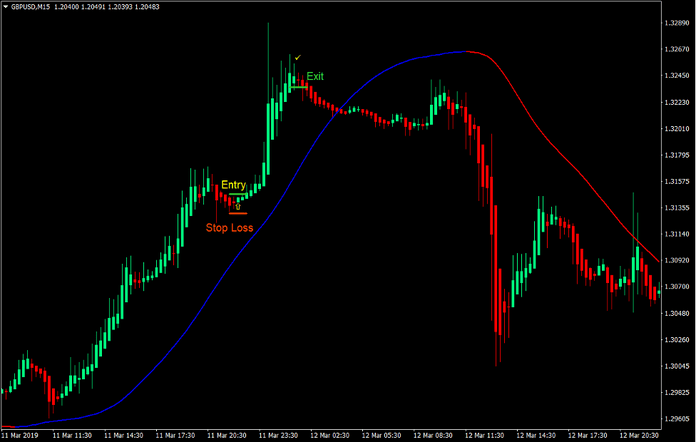

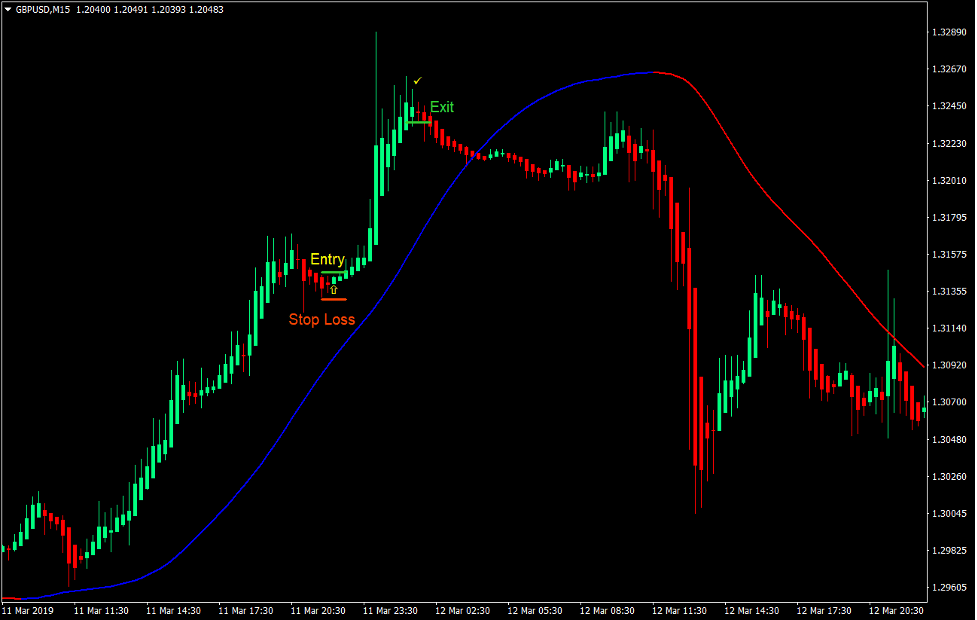

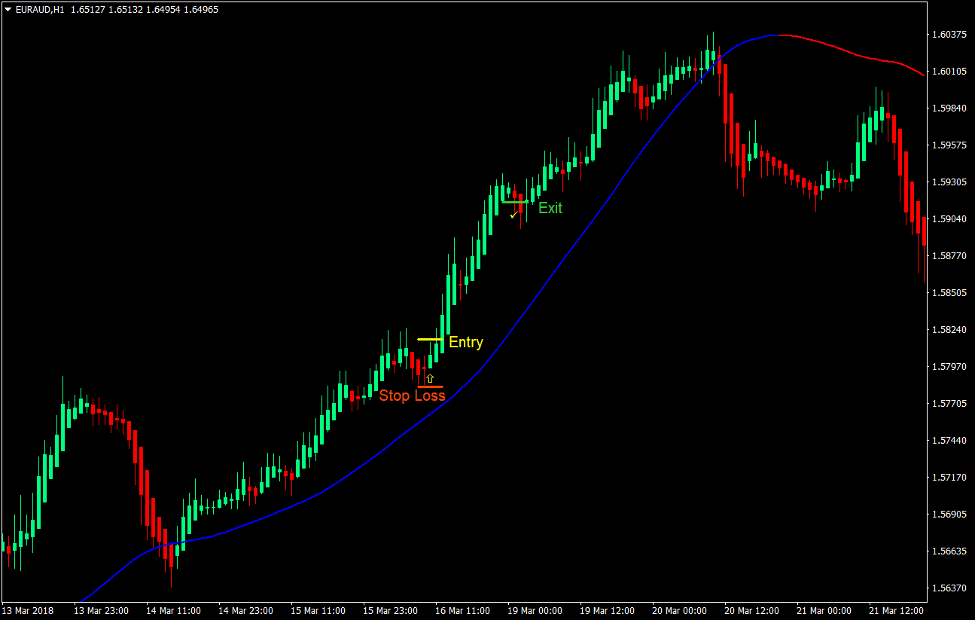

Buy Trade Setup

Entry

- The Mega Trend line should be color blue and should be sloping up.

- Price action must be forming higher swing highs and swing lows.

- Price should retrace causing the Heiken Ashi Candlesticks to become temporarily red.

- Enter a buy order as soon as the Heiken Ashi Candlesticks change to spring green.

Stop Loss

- Set the stop loss below the low of the last two candles.

Exit

- Trail the stop loss 2 candles behind until stopped out in profit.

- Close the trade as soon as the Heiken Ashi Candlesticks change to red.

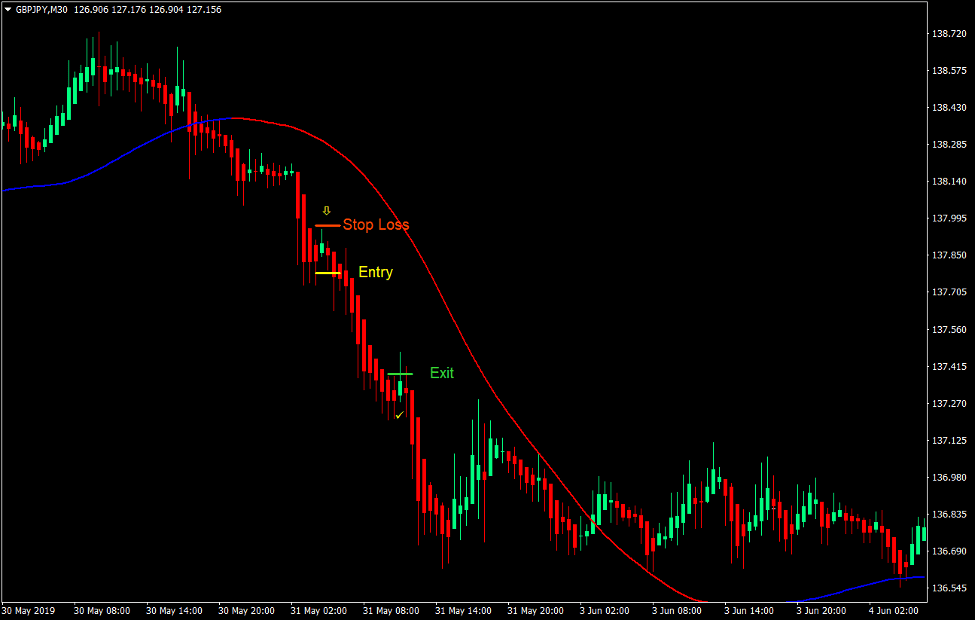

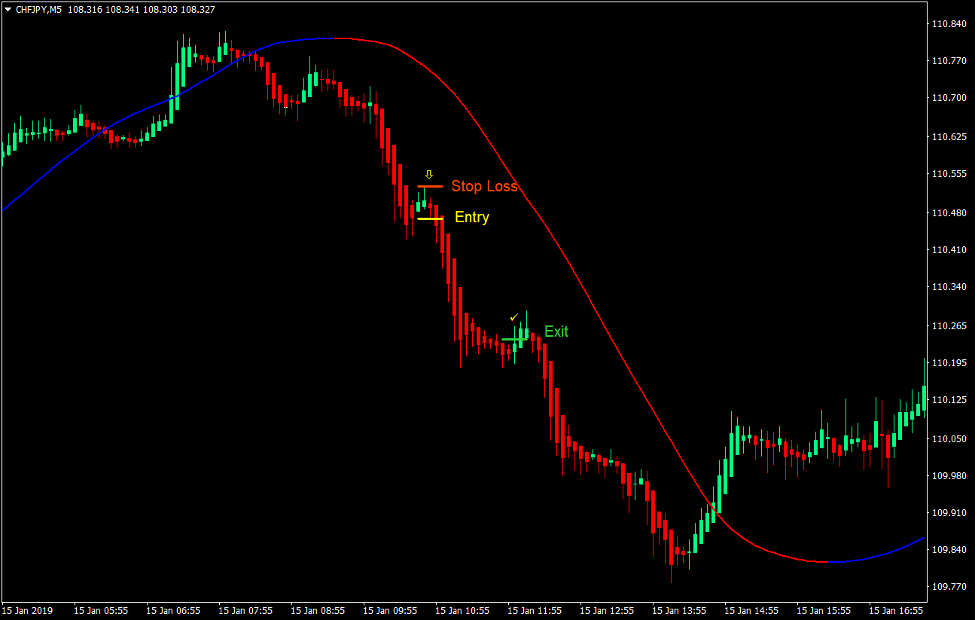

Sell Trade Setup

Entry

- The Mega Trend line should be color red and should be sloping down.

- Price action must be forming lower swing highs and swing lows.

- Price should retrace causing the Heiken Ashi Candlesticks to become temporarily spring green.

- Enter a sell order as soon as the Heiken Ashi Candlesticks change to red.

Stop Loss

- Set the stop loss above the high of the last two candles.

Exit

- Trail the stop loss 2 candles behind until stopped out in profit.

- Close the trade as soon as the Heiken Ashi Candlesticks change to spring green.

Conclusion

This trading strategy works extremely well in markets that have a very strong trend. Trends that could be considered as a momentum breakout would do well with this trading strategy.

Because this strategy uses the high and low of the Heiken Ashi Candlesticks’ reversals, it tends to confirm the trend reversal and often results in a strong momentum going towards the direction of the trend.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: