Reversal trading strategies are typically high-yield yield low-probability trade setups. This is because trades are often made against an established trend or momentum. Seasoned reversal traders seek confluences of reversal signals as these reversal trades often have a higher probability of resulting in a profitable trade.

This trading strategy is a simple reversal trading strategy that trades on a confluence of divergences and a highly reliable reversal candlestick pattern. To do this, we will be using a MACD Divergence indicator that would allow us to easily identify possible reversal setups based on divergences between price action and the MACD, as well as a Pin Bar Detector to simplify the process of identifying pin bar patterns.

Divergences as Reversal Signals

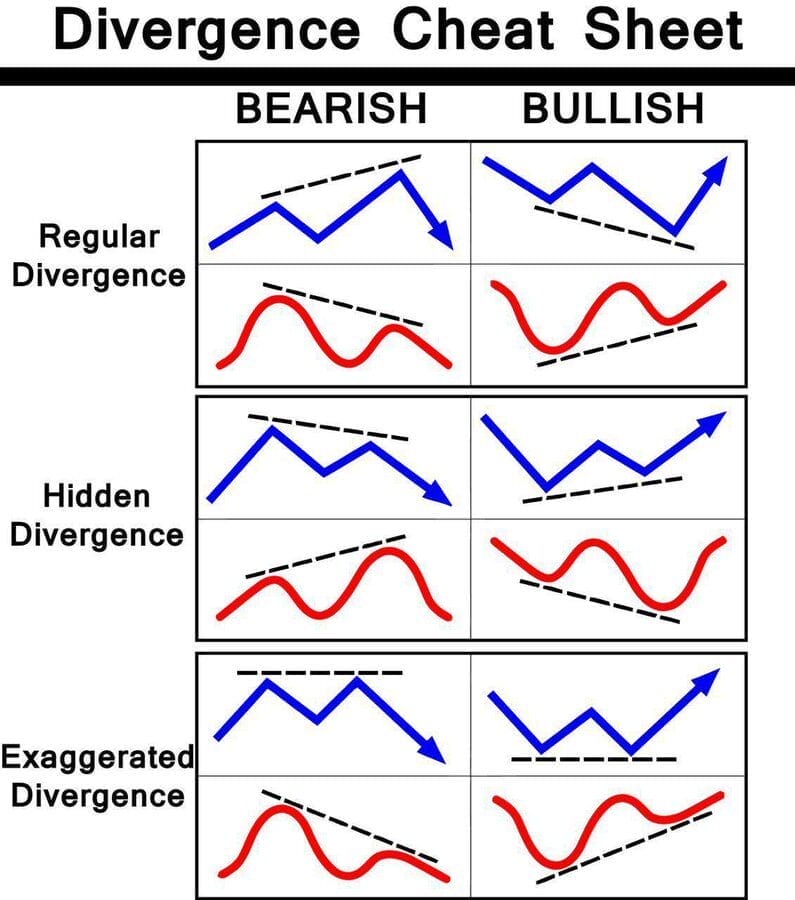

Divergences are highly reliable reversal signals that many professional traders use. But before we dive into what divergences are, it is important that we first understand how price typically moves and how it correlates with oscillators.

Price action typically oscillates up and down the price chart with seemingly no clear pattern. However, if you observe it closely, you will notice that it often moves in a cycle of rallies and drops with varying intensities. The rallies form the swing highs or pivot highs, while the drops form the swing lows or pivot lows.

Oscillators are technical indicators that indicate momentum or trend with the use of lines or bars that oscillate within a range or around a midline. These oscillations typically shadow the movements of price action since it is based on the movements of price. As such, oscillators also form peaks and dips which would usually correlate with the swing highs and swing lows on price action. The height or depth of the peaks and dips on the oscillators would also usually correlate with the intensity or momentum of the swing highs and swing lows.

However, there are also scenarios wherein the height or depth of the peaks or dips on the oscillator would drastically vary from the height or depth of the swing highs or swing lows on price action. These are what we call divergences. These divergence patterns are strong indications of a probable reversal.

MACD Divergence Indicator

The classic Moving Average Convergence and Divergence (MACD) indicator is a widely used momentum oscillator used by many traders. It is an oscillator that is based on the difference between two Exponential Moving Average (EMA) lines and a signal line derived from the difference between the two EMA lines.

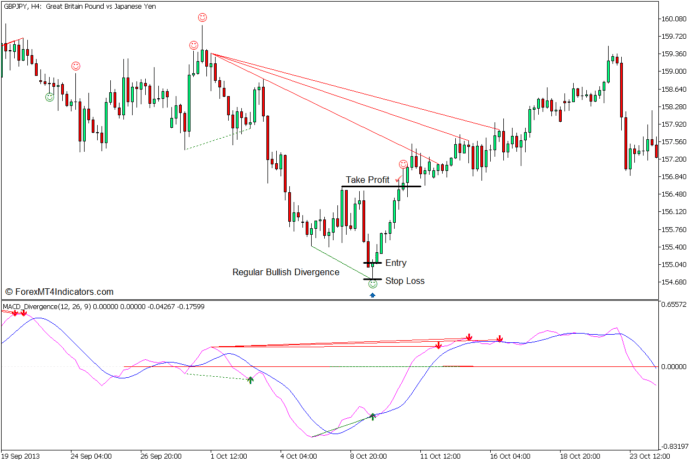

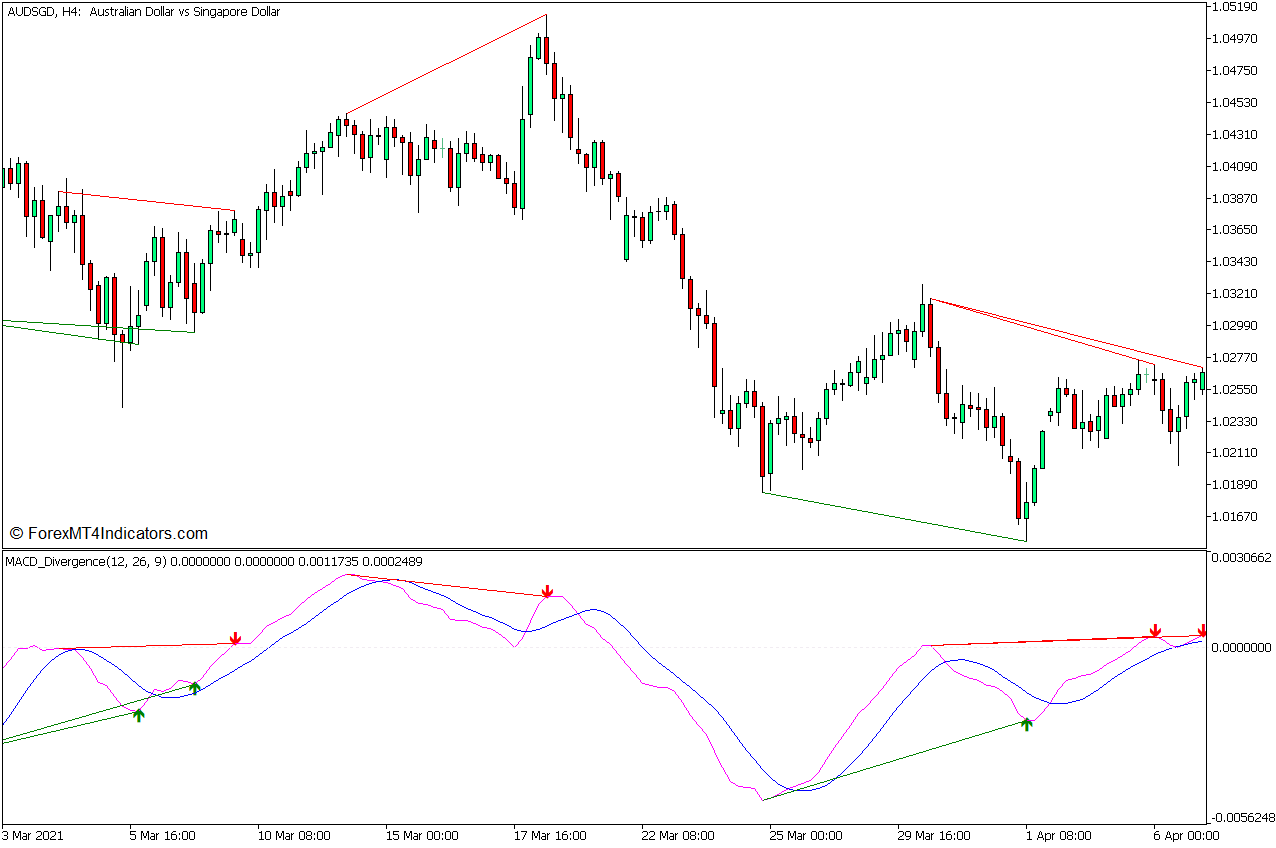

The MACD Divergence indicator is a modified version of the MACD, which modifies the parameters within the indicator to allow for a more responsive yet reliable signal. As the name suggests, it also automatically identifies divergences between price action and the MACD.

This indicator plots an oscillator line representing the MACD line and a signal line based on the MACD line. Positive lines generally indicate a bullish trend, while negative lines indicate a bearish trend. MACD lines above the signal line indicate a bullish momentum, while MACD lines below the signal line indicate a bearish momentum.

This indicator also identifies divergences by plotting lines below price action and the oscillator to indicate a bullish divergence, and lines above the oscillator and price action to indicate a bearish divergence. It also plots arrows whenever the bars crossover the signal line after a divergence confirming the reversal signal.

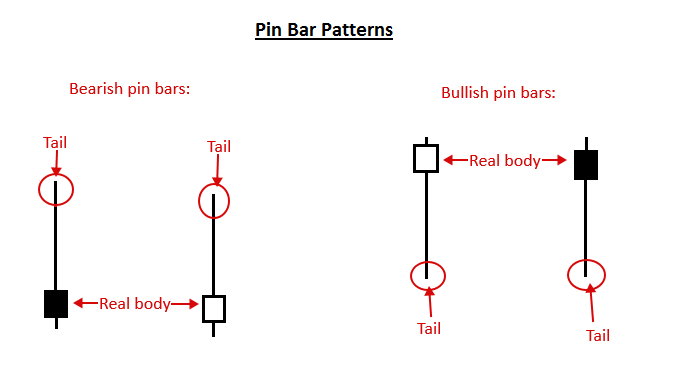

Pin Bar Patterns as Price Rejection

The Pin Bar pattern is probably one of the most effective and reliable reversal candlestick patterns. This is because this pattern tells us that the market has quickly reversed against a prior momentum.

Bullish pin bar patterns have a short body on top and a long wick at the bottom. Inversely, bearish pin bar patterns have a short body at the bottom and a long wick on top. This signifies how the market has quickly rejected a price level and reversed against a prior momentum.

Pin Bar Detector

The Pin Bar Detector is a reversal signal indicator that is based on pin bar patterns. As the name suggests, this indicator automatically identifies and indicates pin bar patterns.

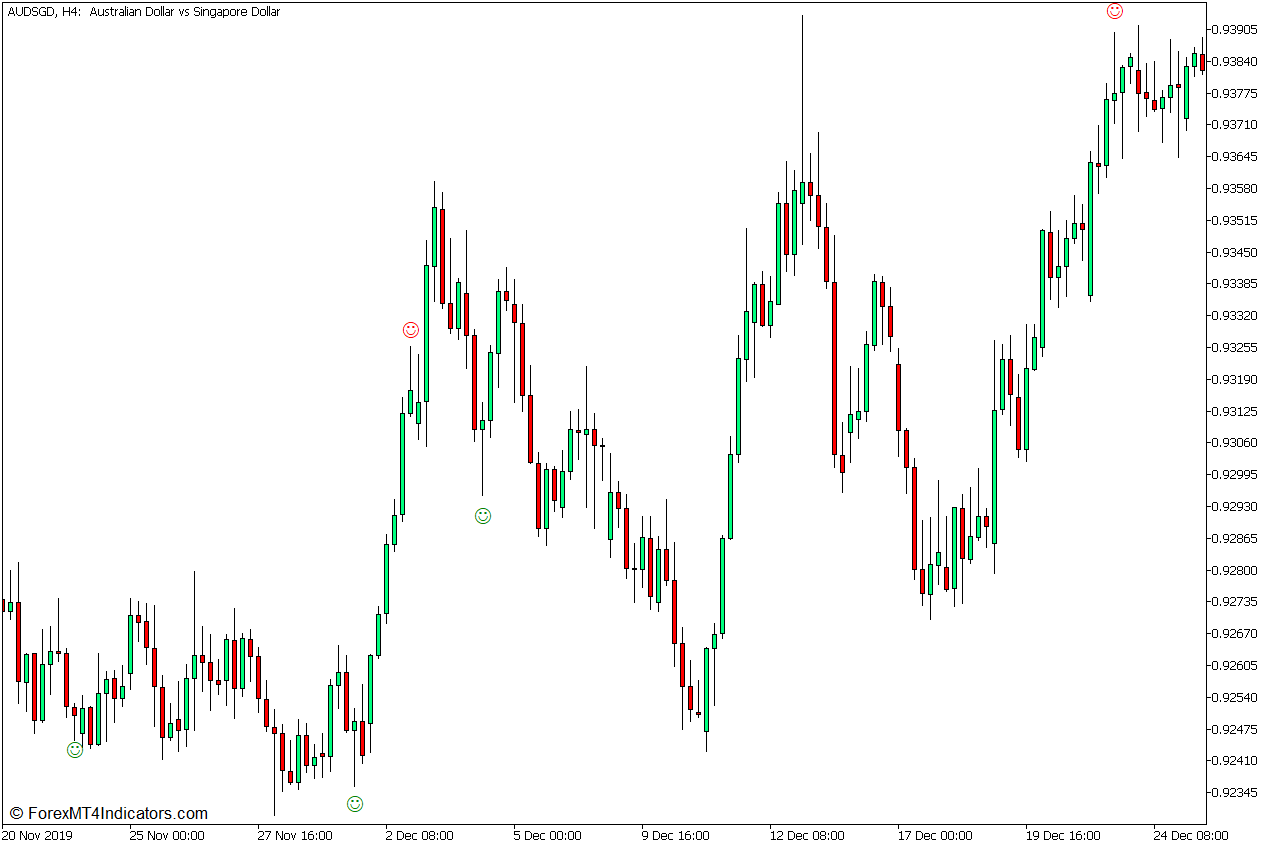

On this template, the Pin Bar Detector plots a green smiley below a candle which it identifies as a bullish pin bar pattern. It also plots a red smiley above a candle which it identifies as a bearish pin bar pattern.

Trading Strategy Concept

This trading strategy is a reversal trading strategy based on divergences between price action and the MACD with the confluence of a known reversal pattern, which is the pin bar pattern.

The MACD Divergence Indicator is used to help traders easily identify potential MACD divergence setups, while the Pin Bar Detector is used to easily identify pin bar patterns.

Trade signals are considered whenever there is a confluence between the two signals. However, it should also be visually confirmed by the trader if the divergence and pin bar patterns are valid.

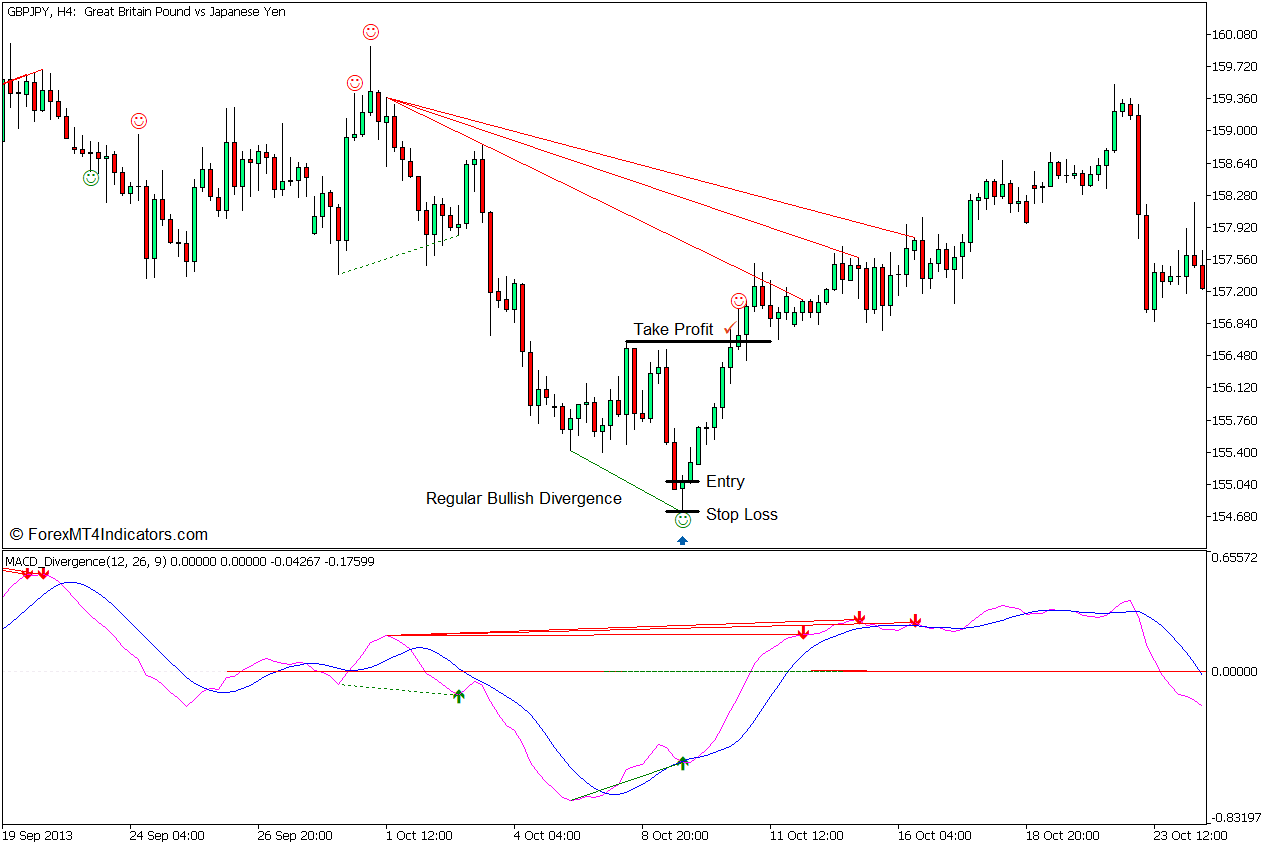

Buy Trade Setup

Entry

- The MACD Divergence indicator should identify a bullish divergence pattern and plot a line below the price action and the MACD line.

- Enter a buy order if the signal is in confluence with a bullish pin bar pattern identified by the Pin Bar Detector.

Stop Loss

- Set the stop loss below the entry candle.

Exit

- Set the take profit on the next resistance level based on a swing high.

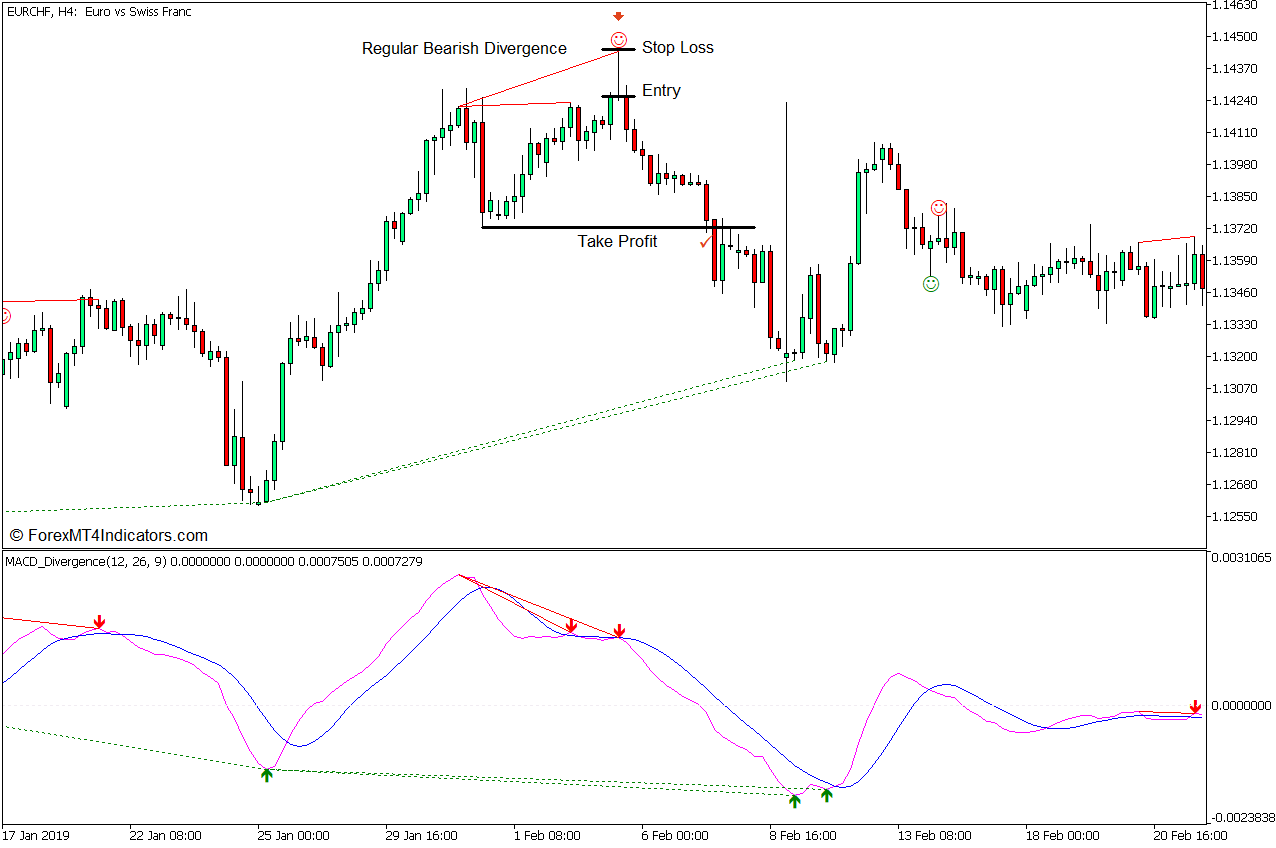

Sell Trade Setup

Entry

- The MACD Divergence indicator should identify a bearish divergence pattern and plot a line above price action and the MACD line.

- Enter a sell order if the signal is in confluence with a bearish pin bar pattern identified by the Pin Bar Detector.

Stop Loss

- Set the stop loss above the entry candle.

Exit

- Set the take profit on the next support level based on a swing low.

Conclusion

MACD Divergences are used by seasoned reversal traders to make a profit from the forex market. However, new traders may find it difficult to identify divergences. This strategy simplifies the process by using indicators to identify potential patterns.

This reversal trading strategy can produce reversal trade setups with very high potential yields yet also have a relatively high accuracy compared to other reversal setups. When done right, traders can be consistently profitable over the long run while using this as a strategy.

Recommended MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: