モメンタムブレイクアウトは、トレーダーが良い取引機会を見つけることができる主要な取引条件です. これは、モメンタムのブレイクアウトが価格を一方向に動かす傾向があり、多くの場合トレンドになる可能性があるためです.

モメンタム取引は、トレーダーがトレンドの強さに基づいて取引可能な商品を売買する技術的な取引手法です。 基本的に、モメンタム戦略を取引するトレーダーは、価格変動の背後にある強い力で取引しています。 これらの強い価格変動は、多くの場合、価格が同じ方向に移動する原因となり、多くの場合、トレンド市場になる可能性があります.

取引以外の勢いは、質量と速度の結果です。 取引では、量と価格によって短期間に移動した距離に基づいて、質量と速度を識別できます。

強いモメンタムを識別する XNUMX つの方法は、モメンタム ローソク足を観察することです。 モメンタム キャンドルは、芯がほとんどまたはまったくない、長くてコクのあるキャンドルです。 これは、ローソク足の期間内に価格が一方向に移動したことを示しています。 これは、多くの場合、そのローソク足内での大量取引を伴います。

この戦略では、勢いを確認するためにいくつかのテクニカル指標の使用を検討します。

動的価格チャネル

動的価格チャネルは、Average True Range (ATR) に基づくカスタム チャネル タイプのインジケーターです。

ATR は、基本的に、所定の期間内の価格ろうそくの平均範囲です。

ダイナミック プライス チャネルでは、トレンド、ボラティリティ、モメンタム、および平均反転を特定するために、ATR と移動平均が組み込まれています。

動的価格チャネルは、移動平均線をメイン ラインとしてプロットし、黄色の破線で表します。 この線は、単純移動平均 (SMA)、指数移動平均 (EMA)、または平滑移動平均 (SMMA) のいずれかです。 トレーダーは、インジケーターのパラメーター タブでオプションを選択できます。

すると、移動平均線からXNUMX本線が放射状に伸びます。 上にXNUMXつ、下にXNUMXつ。 これらの線は、ATR の係数に基づいて、移動平均線である中央の線から離れてプロットされます。

この指標は、ボラティリティ指標として使用できます。 トレーダーは、中央線から離れたバンドの収縮と拡大に基づいてボラティリティを識別できます。

また、中央線がどのように傾いているか、および特定の線がトレンドの方向に動的なサポートまたはレジスタンスとして機能するかどうかに基づいて、トレンドの方向を識別するために使用することもできます.

また、外側のバンドに対する価格の反応に基づいて、買われ過ぎまたは売られ過ぎの市場を示すこともできます。 価格行動が外側のバンドで価格拒否の兆候を示している場合、市場は買われ過ぎまたは売られ過ぎの可能性があります。 これらの条件は、平均反転の素数です。

一方、同じ外側の線を使用して、強い運動量を決定できます。 価格行動が外側の線に対して強いモメンタムのブレイクアウトの兆候を示している場合、市場は強いモメンタムを獲得しており、トレンドにつながる可能性があります.

相対力指数

相対力指数 (RSI) は、インジケーターのオシレーター ファミリーの一部である汎用性の高いテクニカル インジケーターです。 トレンド、モメンタム、買われ過ぎまたは売られ過ぎの価格条件を判断するために使用できます。

RSI は、0 から 100 の範囲内で振動する線をプロットします。通常、中央線であるレベル 50 にもマーカーがあります。 RSI ラインが 50 を超える場合、市場バイアスは強気であり、RSI ラインが 50 を下回る場合、市場バイアスは弱気です。

レベル 30 と 70 にもマーカーがあります。30 を下回る RSI ラインは売られ過ぎの状態を示し、70 を超える RSI ラインは買われ過ぎの状態を示す可能性があります。 どちらの条件も、平均反転の素数です。

ただし、モメンタム トレーダーは、70 を超える突破を強気のモメンタムの兆候と見なし、30 を下回ると弱気のモメンタムの兆候と見なすこともあります。 RSIラインがこれらのレベルを超えたときに、価格行動がどのように反応するかが問題です.

トレーダーは、トレンド市場の指標をサポートするために、レベル 45 と 55 も追加します。 レベル 45 は強気トレンド市場でサポート レベルとして機能し、レベル 55 は弱気トレンド市場でレジスタンスとして機能します。

取引戦略

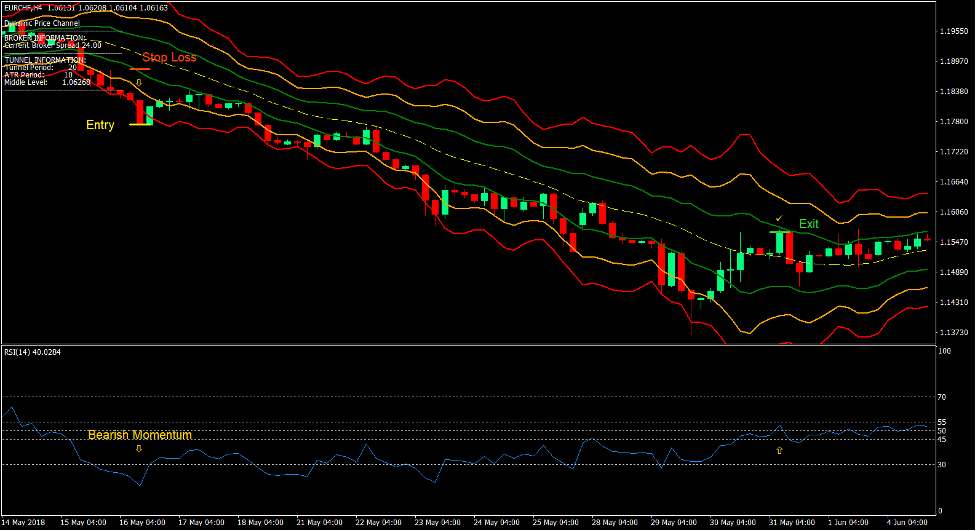

Dynamic Channel Momentum Breakout Forex Trading Strategyは、Dynamic Price ChannelインジケーターからのモメンタムブレイクアウトシグナルとRSIの間の合流点で取引するモメンタムブレイクアウト戦略です.

ダイナミック プライス チャネルでは、ダイナミック プライス チャネルの外側の線を超える強いモメンタム ローソク足に基づいて、モメンタムが識別されます。 これは、中央の黄色の線の上下にある赤い線で表されます。

RSI では、強気の勢いの場合は 70 を超え、弱気の勢いの場合は 30 を下回る RSI ラインに基づいて、勢いが確認されます。

XNUMX つのモメンタム シグナルの合流点は、高い確率でトレンドになるモメンタム シグナルになる傾向があります。

インジケータ:

- 動的価格チャネル

- 相対力指数

優先時間枠: 1時間および4時間チャート

通貨ペア: FXメジャー、マイナー、クロス

取引セッション: 東京、ロンドン、ニューヨークのセッション

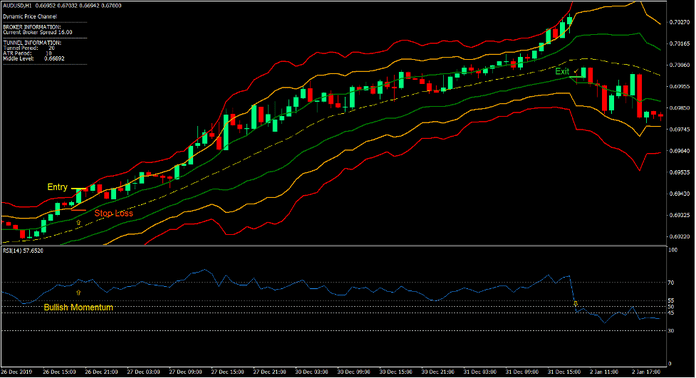

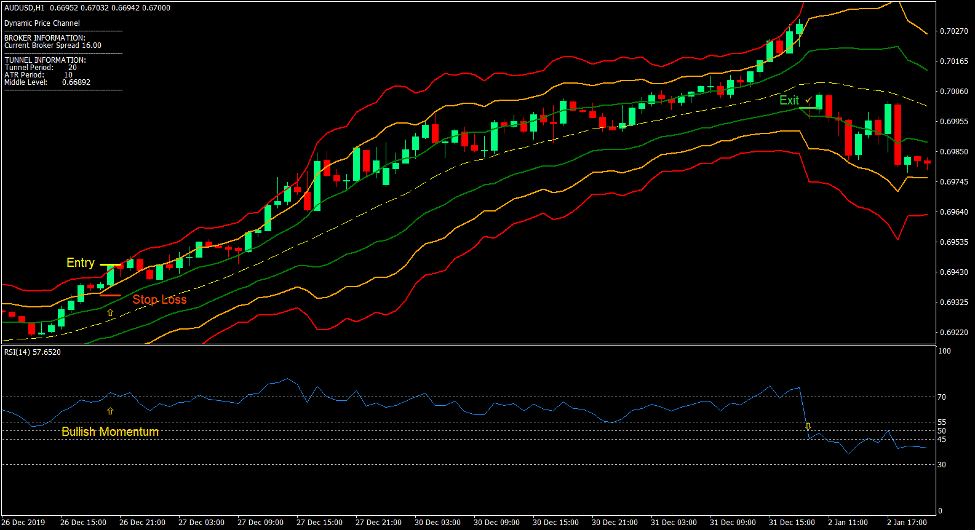

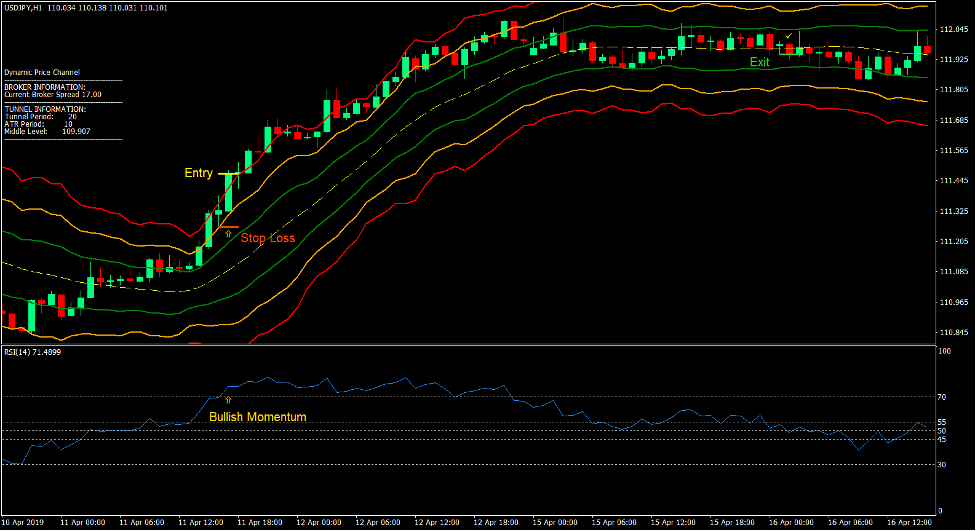

トレードセットアップを購入する

入門

- 強気の勢いのろうそくは、動的価格チャネルの上部の赤い線を突破する必要があります.

- RSIラインは70を超えるはずです。

- 両方のシグナルが合流したら、買い注文を入力します。

ストップロス

- エントリーキャンドルの少し下のサポートレベルにストップロスを設定します.

出口

- RSI ラインが 50 を下回ったらすぐに取引を終了します。

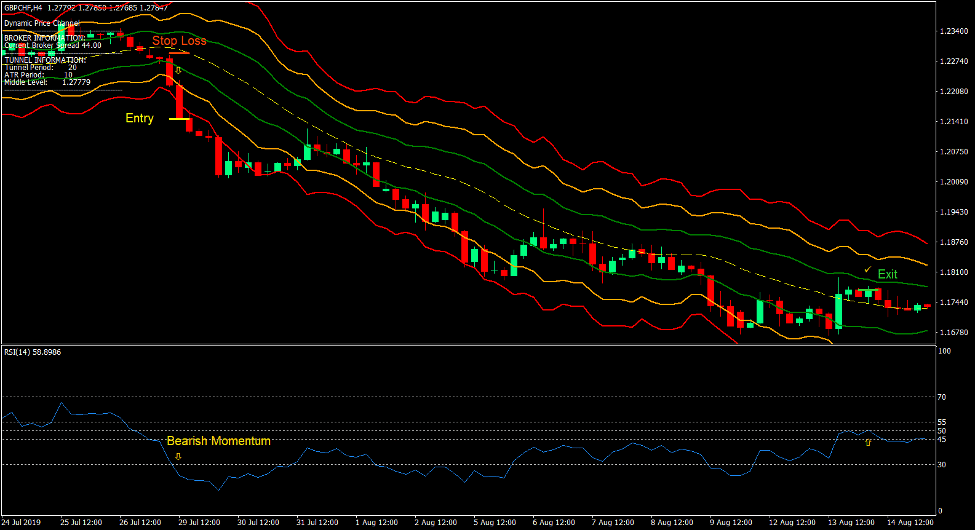

トレードセットアップを売る

入門

- 弱気のモメンタム キャンドルは、ダイナミック プライス チャネルの下側の赤い線を下回ります。

- RSIラインは30を下回るはずです。

- 両方のシグナルの合流点で売り注文を入力します。

ストップロス

- エントリーキャンドルの少し上の抵抗レベルにストップロスを設定します.

出口

- RSI ラインが 50 を超えるとすぐに取引を終了します。

まとめ

このモメンタム ブレイクアウト戦略は、XNUMX つの高品質のモメンタム シグナルに基づくモメンタム トレード セットアップを生成します。

さまざまなパラメーターを使用し、複数の時間枠からの合流点でこの方法を使用して取引する多くのプロのトレーダーがいます。 ただし、スタンドアロンのモメンタム シグナルとして、この戦略はすでに高品質の取引設定を生み出す可能性があります。

これらの取引セットアップは、ブレイクアウトがタイトな市場の混雑から来たときはいつでもうまく機能する傾向があることに注意することも重要です.

トレーダーは、複数の時間枠が合流する全体的なモメンタム戦略の一部として、この戦略を練習できます。

おすすめのMT4ブローカー

XMブローカー

- 無料$ 50 すぐに取引を開始するには! (出金可能利益)

- までのデポジットボーナス $5,000

- 無制限のロイヤルティプログラム

- 受賞歴のある外国為替ブローカー

- 追加の独占ボーナス 年間を通じて

>> ここからXMブローカーアカウントにサインアップしてください<

FBSブローカー

- トレード100ボーナス: 100 ドルを無料で取引の旅を始めましょう!

- 100%の入金ボーナス: 入金額を最大 $10,000 まで XNUMX 倍にし、強化された資本で取引します。

- 1まで活用する:3000: 利用可能な最高のレバレッジ オプションの 1 つで潜在的な利益を最大化します。

- 「アジアのベストカスタマーサービスブローカー」賞: カスタマーサポートとサービスの優秀性が認められています。

- 季節のプロモーション: 一年中、さまざまな限定ボーナスやプロモーション特典をお楽しみいただけます。

>> ここからFBSブローカーアカウントにサインアップしてください<

ダウンロードするには、以下をクリックしてください。